Published on June 24, 2022 by Richa Prakash

Scope of the international trade finance market:

The international trade finance market has changed significantly after the pandemic. Its value is expected to grow at a CAGR of 5.4%, from USD7.6tn in 2020 to USD11.0tn by 2027 (source: valuates.com). However, the natural growth trajectory of the space may result in these numbers being reached before 2027. Banks are responsive to market demands and would adapt in order to maintain their competitive advantage in pace with new demands. Leaders of banking operations who can scale up existing processes and address challenges would be able to protect and grow their banks’ revenue streams and maintain their lead.

Major challenges banks face in trade finance operations and solutions:

Artificial intelligence (AI) is replacing human functions, but implementing AI could consume years of a company’s budget allocated for growth, making it less agile in an open ecosystem. However, the following challenges require immediate and cost-effective resolution:

1.Talent requirements and the talent crunch

Delivering quality service is imperative for maintaining long-term client relationships and increasing the client base, but this requires subject-matter experts (SMEs) who are either difficult to source or too expensive. Retaining SMEs is another difficulty, either due to intense industry competition or the retirement of experienced staff. The entire process – from sourcing to deploying new talent – requires time, aggravating the difficulty faced when transaction volumes increase.

A better solution may be to reach out to an offshore partner with SMEs who can deliver quality service, freeing up clients’ experienced staff to focus on new growth areas.

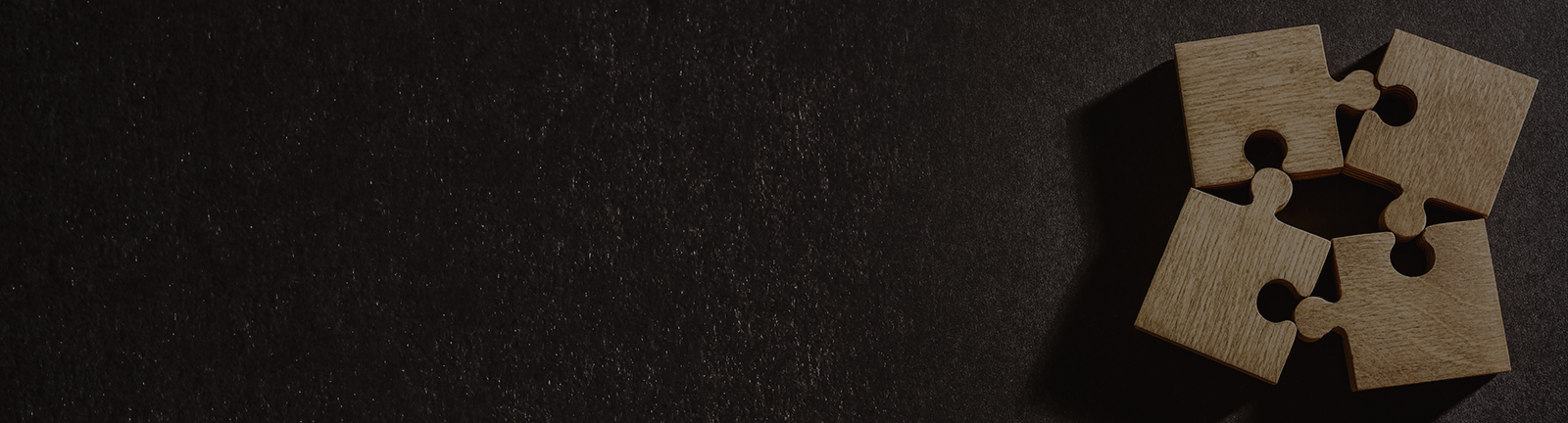

2.Efficient transaction management

Restructuring the transaction process by eliminating redundant activities and segregating nested tasks makes the process more defined, efficient and robust.

Implementing new processes or changes without rigorous testing may go wrong, but this could be avoided by consulting professionals who have worked closely with a number of clients in the industry and a number of methodologies and who can tailor best practices to make existing processes more efficient.

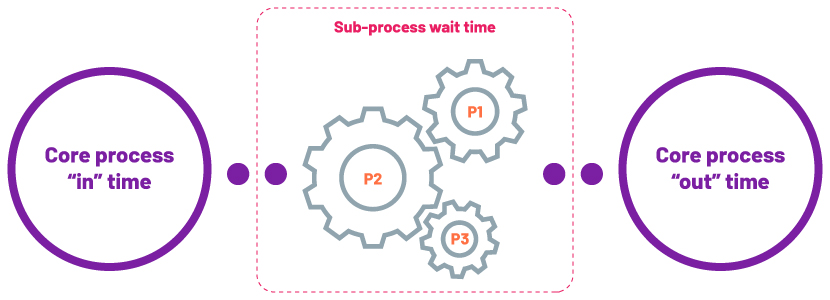

3.Evaluating capacity to execute transactions and restructuring resource deployment

Capturing new business translates into higher volumes that require more manpower. Capacity needs to be assessed to see whether the new functions can be handled with available resources or whether restructuring is required. Increasing manpower rapidly could divert the focus from quality to quantity and compromise quality delivery.

A hybrid approach is beneficial and logical in such situations. Matured processes could be sub- contracted, freeing up resources to service new business. Such restructuring would ensure continuity of quality standards.

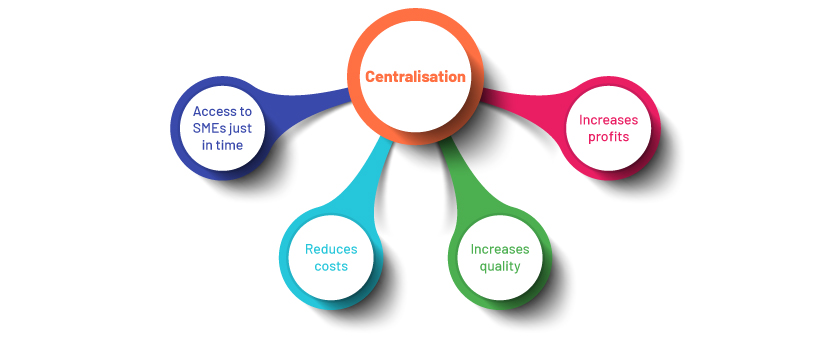

4.Increased competition and high implementation costs

Global banks that use in-house solutions to manage cost and competition tend to incur additional expenses if their processes are decentralised, because SMEs are required to be placed permanently in decentralised locations and a just-in-time approach may not work.

Centralising the process could have a positive impact on cost, quality and delivery, and reduce technical challenges.

5.Risk distribution, appetite and compliance

New developments in the international trade finance market have increased risks due to AML directives, sanctions and stricter regulations. Compliance regulatory bodies have zero tolerance in these areas, increasing the challenges. More investment is required for stringent sanctions screening, failing which the business could be shut down or incur heavy fines, damaging its reputation.

Mitigating such risks by developing a reliable compliance process is vital. It is also important that the process does not hinder transaction flow and is not affected by prevailing uncertainty.

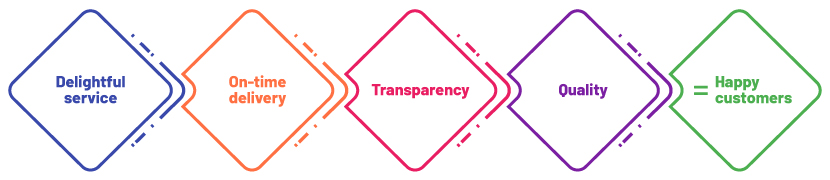

6.Satisfying customer demand and addressing queries

Happy customers are key to survival, and error-free service and timely delivery are critical in the trade finance space. The tools used are complex, and their functions may not be understood by a novice, whose queries would need to be addressed on priority if client stickiness is to be maintained.

These solutions have proved to be extremely cost-effective when certain functions are outsourced to service providers. Partnering with an experienced consulting firm that provides overall leadership and SMEs ensures an efficient transition is achieved.

How Acuity Knowledge Partners can help

We have extensive experience in working in the industry and believe in delivering only the best quality. We embrace transformation and provide an improved customer offering to help you grow while mitigating operational risk and delivering efficiencies. We list below some of the benefits we offer:

-

Competitive edge due to our global presence

-

Access to low-cost skilled labour and SMEs

-

Resource management including hiring, training and retaining staff

-

Well-equipped offices and technology

-

Tailor-made process restructuring for improved efficiency and process simplification

- Quality and timely delivery while boosting productivity with strict adherence to deadlines

-

Data confidentiality

-

Easy project management

-

Dedicated experts able to handle several transaction processes

References:

Trade Finance Market Size & Share, Growth, Report, 2021-2027 (valuates.com)

Top 10 Banking Industry Challenges — And How You Can Overcome Them

Tags:

What's your view?

About the Author

Richa has pursued B.Tech(IT) from Bharati Vidyapeeth, Pune and MBA(Finance) from Institute of Marketing and Management, Delhi. She is a CDCS certified with around 11 years of rich experience in international trade finance, customer service & relationship management. She has a rich experience of various trade process and platforms migrations along with several process automations in trade finance operations.

Like the way we think?

Next time we post something new, we'll send it to your inbox