Published on April 16, 2025 by Sachintha Wijayatunga

Introduction

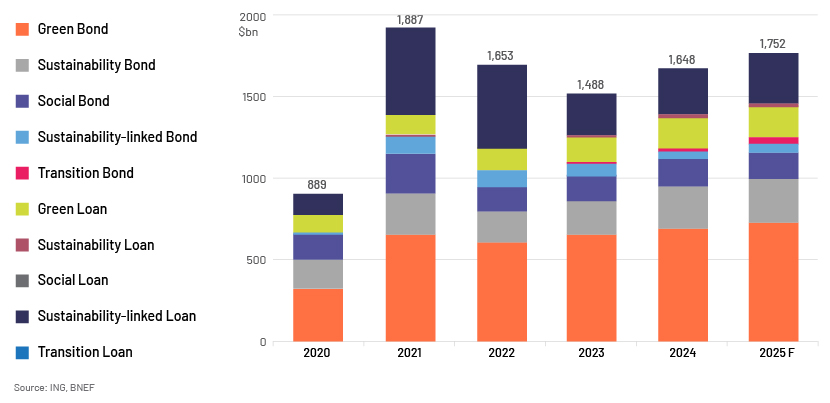

Increasing climate-related incidents across the globe have proven the importance of incorporating environmental, social and governance (ESG) considerations, with corporates and the financial services sector strongly advocating this. A number of banking and financial services products have, therefore, been created under the overarching objective of ensuring a sustainable planet. The sustainable finance market was worth USD1.657tn in 2024, recording growth of 11% y/y. There are several sub-products on offer, as illustrated below, and the outlook for 2025 is positive, with estimated y/y growth of 6% to USD1.752tn.

Sustainability-linked loans (SLLs) are one type of product under the umbrella of sustainable finance that aim to facilitate and support sustainable economic activity, and a key banking product in climate transition financing. SLLs are where the interest margins or credit spreads of a loan are linked to the borrower’s performance against pre-agreed sustainability performance targets (SPTs). S&P Global predicted an increase in SLLs, as a margin adjustment on a drawn term loan increases the issuer’s responsibility for meeting its SPTs. SLL growth is expected to be driven by refinancing of deals closed in 2021/22 and conducive regulatory developments in Europe through the EU’s Corporate Sustainability Reporting Directive (CSRD), which has mandated ESG disclosures for nearly 50,000 companies commencing from 2025.

Operational considerations for SLLs

Under SLLs, we see several KPIs or SPTs being defined in loan facility agreements. If the given targets are achieved by the borrower, the bank commits to reducing the interest rate margin/spread of the facility.

Establishing and monitoring appropriate and impactful SPTs that are also measurable and achievable is a complex task that requires domain expertise. There is also the challenge of ensuring that these targets are aligned with a company’s broader strategic objectives, where greenwashing risk arises when the SPTs do not align with corporate goals. Greenwashing refers to the practice of overstating sustainability claims, resulting in distrust in the system and closing up funding options for the overall ESG objective.

Therefore, how SLLs are operationalised is very important. In this regard, the Loan Market Association (LMA) introduced Sustainability-Linked Loan Principles (SLLPs) in 2023. Subsequently, an extension to these were introduced in the form of the LMA’s SLL Model Provisions, defining “Calculation methodologies”, “Sustainability amendment events” and “External reviewers”. According to the LMA,

-

A calculation methodology refers to the method used to assess a borrower's, parent's and/or group's performance against each KPI.

-

Sustainability amendment events help set parameters when the SLL structure cannot be used in relation to a particular loan during servicing due to material events such as asset disposals or M&A. If amendments cannot be agreed by a deadline, the lenders could declassify the loan as no longer being sustainability-linked (a declassification event).

-

An external reviewer is an independent, internationally recognised professional services firm, environmental consultancy firm or rating agency that is regularly engaged in the application and monitoring of ESG standards and ESG calculation methodologies.

The EU Omnibus Package (officially known as the Omnibus Simplification Package) is a legislative proposal introduced by the European Commission to simplify EU laws on sustainability reporting, due diligence and trade. It aims to make sustainability reporting more accessible and efficient, unlocking opportunities for corporates to be eligible for SLLs.

From a financial statement preparation standpoint, robust mechanisms are being adopted for reporting specific climate-related disclosures aligning with the IFRS Standard 2 (S2) issued by the International Sustainability Standards Board (ISSB). This would aid financial institutions, as there will be a standardised methodology for reporting that would help in extracting data.

Impact on a bank’s loan operations function

As explained above, the sustainable finance ecosystem is developing and will likely lead to an increased number of loans being approved under the sustainability-linked loans(SLLs) subset. The Loan Facility Agreement for sustainability loans previously specified only the end use of funds, but with recent developments, financing agreements will have new focus areas, under SLLs:

-

SPTs will be defined

-

Information covenants to be met will be defined

-

Methodology for assessing the targets will be defined

-

Margin changes that will be granted on the successful achievement of targets will be defined

Based on the level of achievement of target, margins will be adjusted on loan-management systems. These tasks will fall within the purview of the loan operations team, who will peruse the disclosures and make the margin adjustments. The loan operations team would also need to facilitate compliance with regulatory reporting requirements under this segment.

Conclusion

The outlook for sustainable financing and the SLL subset is positive, considering that the ecosystem for this banking product is being formalised and simplified. From a lender’s perspective, it calls not only for efficient monitoring and processing of sustainability disclosures but also for communicating the challenges they face and contributing to the continued development of this ecosystem. Domain expertise is also required to make assessments effective in mitigating greenwashing.

How Acuity Knowledge Partners can help

Acuity Knowledge Partners support the loan operations value chain from initial document review, pre-closing review, loan booking and in-life servicing to managing monitoring of margins against targets achieved. We also provide support with regulatory reporting and data integration. As a centralised hub undertaking this task, we are able to provide insights gained from the process, helping clients become strong advocates.

Sources:

-

Commission proposes to cut red tape and simplify business environment – European Commission

-

EU and UK approaches to Greenwashing Enforcement in the Financial Market: A Comparison

-

https://pulitzercenter.org/stories/how-mega-polluters-take-advantage-billions-green-loans

-

Morgan Stanley, Citi, Bank of America Join Others in Exiting Net Zero Banking Alliance – ESG News

-

Sustainable Insight ESG Regulations and Reporting Standards Tracker – January 2025 Highlights

What's your view?

About the Author

Sachintha has over 9 years of experience in Banking & Finance, Risk Management & Credit Analysis. At Acuity, he is a part of the Lending Services team servicing a large European bank on ESG work. He pursued his MBA from the Post Graduate Institute of Management (PIM), University of Sri Jayewardenepura and is an Associate Member of Chartered Institute of Management Accountants, UK

Like the way we think?

Next time we post something new, we'll send it to your inbox