Published on September 1, 2022 by Akshay Bhatia

-

The US Federal Reserve (Fed) continues to hike rates as inflation seems far from cooling off (8.5% in July) and labour data suggests more resilient domestic demand as the unemployment rate falls to 3.5%

-

Credit spreads blew out in 1H 2022 (US HY OAS widened from 3.05% in January to 5.87% in June); the recent tightening in OAS (4.37% in August) was due to lower-than-expected recession fears

-

Following one of the worst first halves for the fixed income markets in near 40 years, the outlook for fixed income and credit remains good, given the flight to safety

This blog highlights opportunities in the credit markets, such as a focus on quality (investment grade vs high yield), improving duration, floating-rate securities and screening distressed opportunities.

Monetary tightening – a soft landing or recession

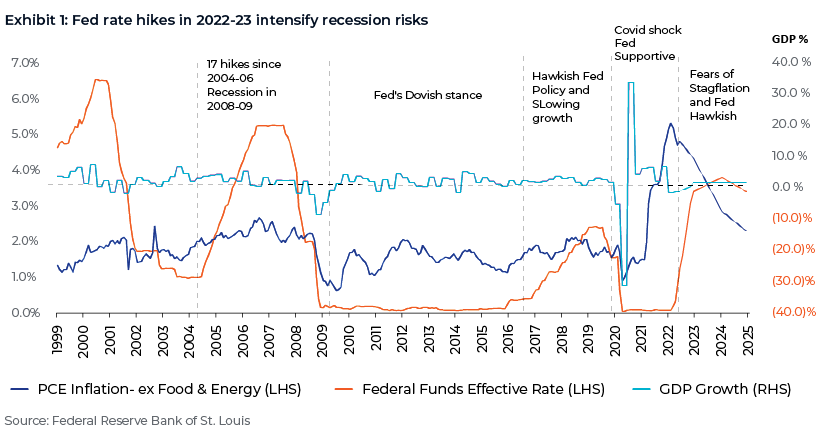

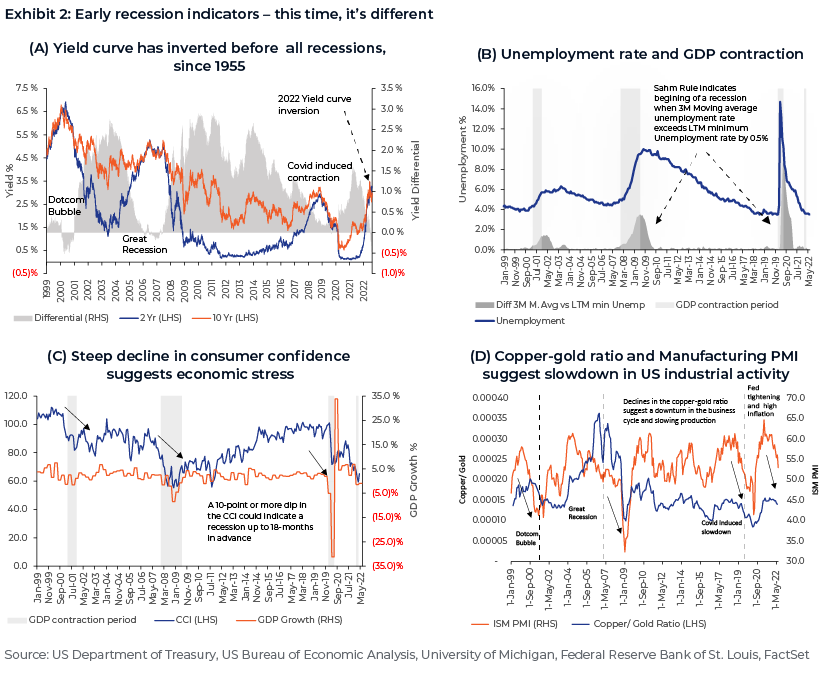

As the Fed continues to hike interest rates, pushing the Fed funds rate to 2.25-2.50% at 27 July 2022 meeting, investors now see a greater risk of recession. A 40-year-high inflation rate of 8.5% in July and increasing lending rates could cool consumer demand, the Fed believes. However, certain economic indicators are pointing to a higher probability of recession. The most-watched signal, the yield curve, inverted in July and August 2022, indicating increased probability of recession. Furthermore, the most recent reading of the Consumer Confidence Index was at an 18-month low, with other indicators such as a falling manufacturing PMI and copper/gold ratio signalling weakening industrial demand.

Fixed-income opportunities

None of the above indicators suggest a straightforward effect on recession, explaining, in part, the volatility as a result of uncertainty among market participants. In the current hyperinflationary environment, the decades-old 60:40 portfolio mix for equities and bonds, may not generate adequate real returns. In fact, this has been one of the worst-performing strategies year to date in August 2022, generating negative 10.6% returns.

Capital preservation and high-quality credit are the preferred strategies at times of volatility

-

Moving up the capital structure for better collateral packages with higher exposure to first lien securities. Fitch Ratings suggests historical 1L term loan recoveries have been strong, with 52% of claims obtaining ultimate recoveries of 91-100%. However, this need to be assessed cautiously, considering covenants and collateral packages, as there have been instances when junior debt has been exchanged by priming existing priority liens, transferring assets outside the restricted group and reclassifying significant guarantors as non-guarantors.

-

Floating-rate securities such as leveraged loans and floating-rate notes can act as natural hedges to rising rates. Not surprisingly, leveraged loans have outperformed other asset class year to date in August 2022, with total returns of negative 0.94%, compared to negative5% each for high-yield bonds and Treasuries. However US high-yield bond funds received inflow of USD4.8bn in July, the first monthly inflow in 2022, with fund managers also increasing their investments in junk bonds to take advantage of widening yield spreads.

-

Distressed credits grew 67.0% y/y in the week ended 19 July 2022, with 8bn worth of USD corporate bonds and loans in the Americas trading at distressed levels, the most since January 2021. Investors could look for these distressed credits, in line with their sector preferences and risk appetite, but they need to carefully evaluate a company’s valuation and recoveries.

-

Municipals bonds rebounded in July and the S&P Municipal Bond Index returned 2.59%, bringing the year-to-date total return to negative 6.02%. With most US states well positioned due to record fiscal-year 2022 revenue, accumulated reserves and federal aid, investors could evaluate municipal bonds amid higher yields and strong credit.

-

Investment-grade (IG) securities. IG bond prices fell to their lowest since 2008 and the US IG bond index price was at USD93.5 in May 2022, against a fair value to USD100.0, due to rising rates and market volatility. Investors could consider IG credits trading at significant discounts to par with strong fundamentals.

How Acuity Knowledge Partners can help

The macroeconomic environment has become more volatile as global central banks globally move away from easy monetary policy not only by raising interest rates, but also by reducing liquidity in market by reducing their balance sheets.

Given this background, the capital markets have been under pressure recently, and fundamental credit analysis has increased in importance, not only to ensure capital preservation, but also to capitalise on opportunities. We have been supporting asset managers and sell-side firms for over 20 years, providing them with scalable and customised solutions. Our credit research support has helped clients enhance coverage and free up onshore bandwidth to focus on more-value-add tasks.

What's your view?

About the Author

Akshay has over nine years of experience in credit research, with expertise in US high-yield and distressed corporates. He currently supports a US-based investment manager, with a focus on distressed and deeply distressed securities. Akshay provides investment recommendations and commentaries on credits through periodic review and keeping a track of developments. He is a Chartered Accountant (equivalent to US CPA).

Like the way we think?

Next time we post something new, we'll send it to your inbox