Published on July 30, 2024 by Prasanna Kumar

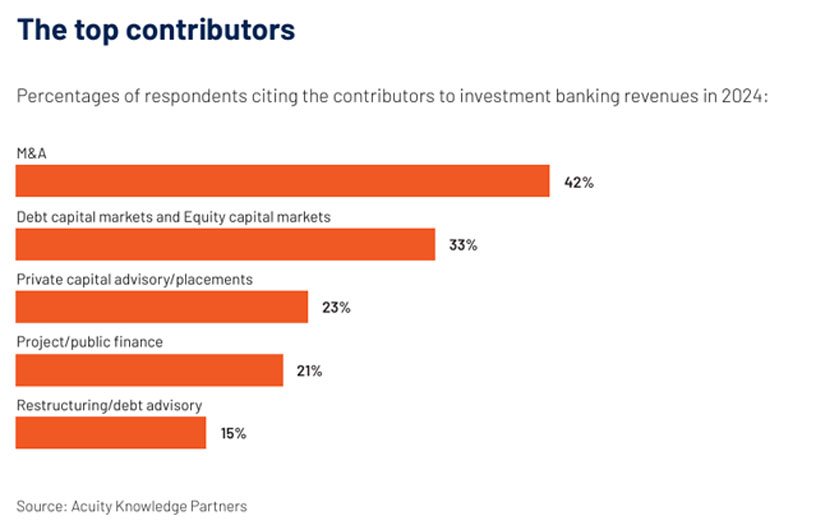

M&A is expected to be the #1 contributor to overall revenue, followed by debt capital markets and equity capital markets

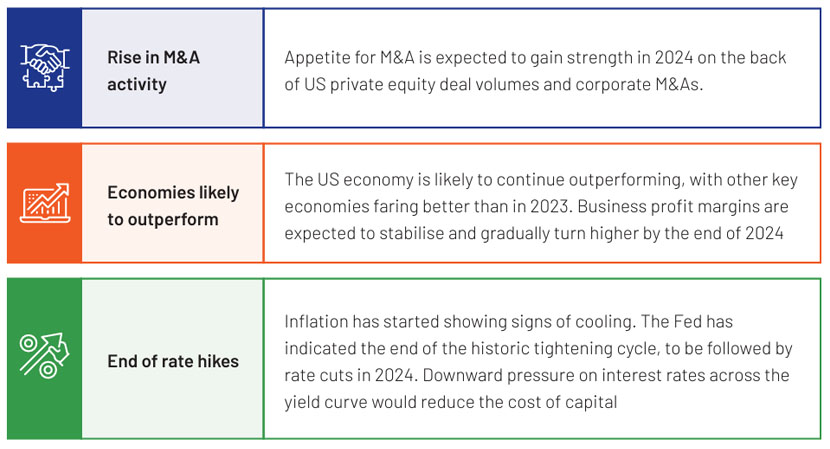

The global economy is expected to overcome most of the uncertainties that weighed heavily in 2023. The deal-making landscape is, therefore, expected to bounce back in 2024.

Companies in the major economies had to accept higher-for-longer interest rates in 2023. However, US and European investment banks expect their advisory and underwriting businesses to recover in 2024. M&A and capital-market activity have been trending upwards since 3Q 2023, and debt capital markets have seen a recovery in activity, sparking optimism in investment banking and advisory businesses for 2024. An EY study of the M&A outlook for 2024 indicates that deals are largely anticipated to return to pre- pandemic levels, with the number of deals in 2024 only about 2% below the average number of deals in 2017-19.

Consequently, investment banking revenue is expected to rebound. Revenue was below long-term averages for a seventh consecutive quarter in 3Q 2023. Previous downturns typically lasted no longer than eight quarters. Supporting this trend, many US mid-market investment banks such as Lazard, Piper Sandler, Houlihan Lokey, Raymond James and Moelis reported revenue growth in 4Q, after a consistent decline over a number of quarters.

While market uncertainty and volatility resulted in subdued M&A activity in 2023, the expected decline in the cost of capital would lead to the creation of more attractive valuation scenarios. This bodes well, with better profit margins expected for businesses across sectors, eventually driving the deal pipeline in 2024.

Factors expected to steer M&A activity

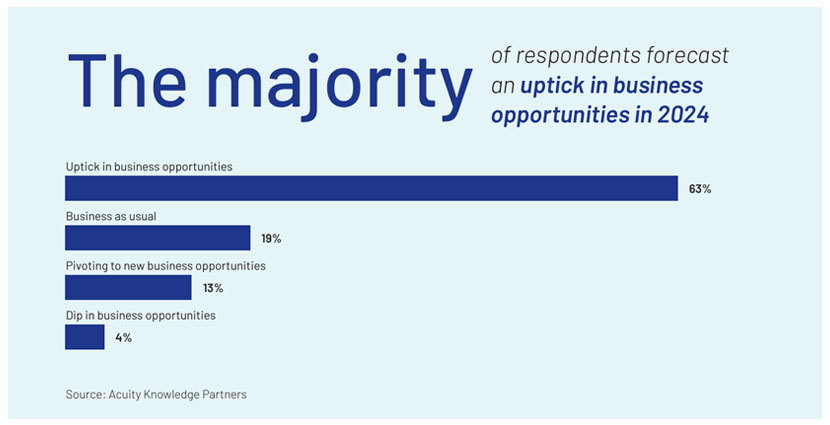

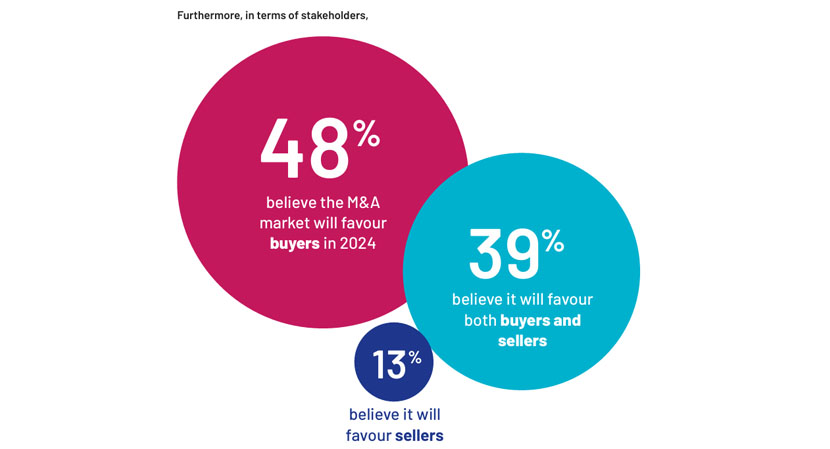

Percentages of respondents citing the contributors to investment banking revenues in 2024: While market uncertainty and volatility resulted in subdued M&A activity in 2023, the expected decline in the cost of capital would lead to the creation of more attractive valuation scenarios. This bodes well, with better profit margins expected for businesses across sectors, eventually driving the deal pipeline in 2024.

Uptick in financial sponsor-driven deal activities A record high level of USD1.9tn of stacked dry powder is ready to be deployed. Additionally, a large inventory of private equity-owned assets also needs to be monetised. Time to close the valuation gap Selected M&A market segments have been picking up since late 2023. As observed historically, M&A markets tend to bounce back after two years of being quiet, reflecting the buildup of supply and demand for assets. This is well supported by the expected narrowing of the “valuation expectation gap” in 2024.

Other major factors or contributors:

» Greater opportunities for cross-border transactions with European companies being open to the US markets and Asian companies seeking new prospect.

» Opportunity to enter businesses at the current higher cost of capital would eventually translate into higher profitability at the time of exit, when interest rates decline

» Corporate earnings and balance sheets are strong and present opportunities for an optimal M&A environment

» Activist investor campaigns have picked up and has opened up new deal-making opportunities

Debt capital markets’ performance to remain strong in 2024

Although they faced a challenging environment, debt capital markets performed well in 2023, and the momentum is expected to continue. The global volume of convertible bond offerings doubled in 2023 vs 2022. More than USD200bn of convertible debt is set to mature from 2024 to 2026, indicating a need for refinancing.

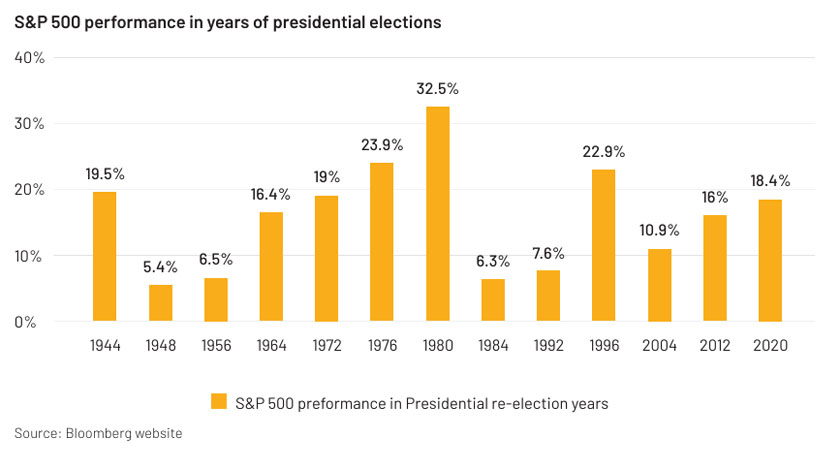

There are also opportunities for re-pricing subinvestment-grade offerings and US investment grade offerings; these amount to close to USD1.5tn of issuance in 2024. For equity markets, the catalysts are higher retail fund flows and the expected end of the Fed’s rate hikes. The US presidential elections are also expected to play an important role for equity capital markets.

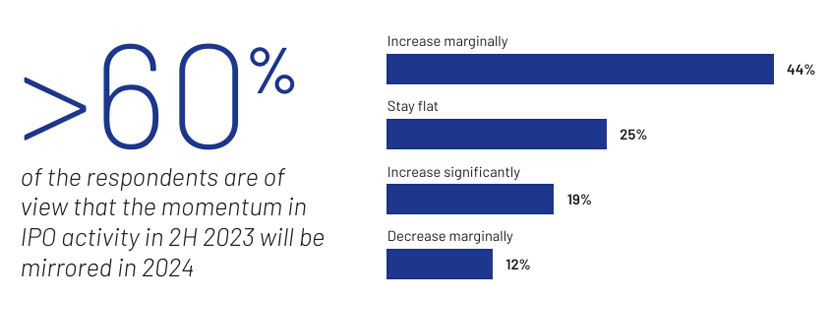

The primary market is expected to invigorate Equity Capital Markets (ECM) bounce back IPO activity to gain momentum in 2024, after an uneventful 2023 In 2023, IPO proceeds were down 33% y/y. The interest rate cuts expected in 2024 are likely to attract investors back to IPOs. Private companies have recently accelerated their IPO processes.

Tags:

What's your view?

About the Author

Prasanna Kumar has over 16 years of experience in global capital markets –Investment Banking and Investment Research. His responsibilities include managing one of the IB engagements and relationship, coordinating with staffers and bankers on new initiatives and services, soliciting feedback, working with teams to identify and improve efficiencies and productivity, training team members on complex and value-added analysis, and implementing industry best practices in the Acuity team for IB Analytics.

Prior to taking up the dedicated role with the account in 2014, Prasanna was working as part of Projects and Transition team gained experience in business development and equity research (financial modeling, report writing, relative..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox