Published on November 30, 2021 by Gursharan Singh

Private debt or private credit comes in many forms (senior debt, direct lending, mezzanine debt, distressed debt) but is mostly extended as loans to private companies. Historically, banks have been the main source of finance as have the “debt desks” of private equity firms to some extent.

Emergence of private debt

Private debt emerged as an “established” asset class in its own right after the Global Financial Crisis (GFC) of 2008 as credit managers jumped in to fill the vacuum created by traditional banks due to tightened banking regulations or what the banks perceived as “riskier” loans. Institutional investors seeking diversification and yield enhancement beyond traditional listed fixed income also fuelled growth of the private debt space.

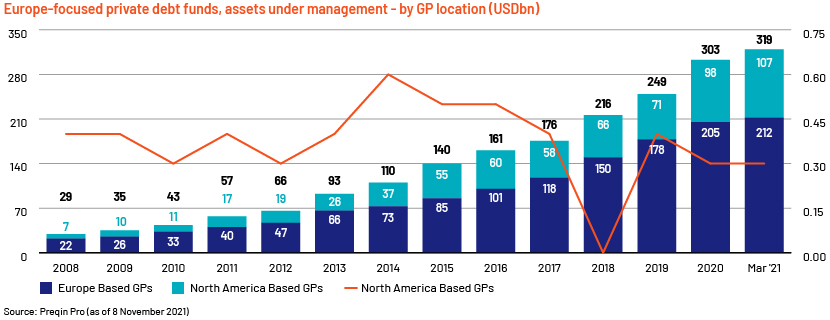

Since the GFC, growth of Europe’s private debt market has been nothing short of phenomenal, with assets under management increasing to USD320bn as of March 2021 from USD30bn in 2009, growing at a CAGR of c.21.4%. Of the assets currently managed, Europe-based GPs administer nearly two-thirds, while their North American counterparts manage almost one-third.

Pandemic impact on Europe’s private debt market

The alternative space was not spared by the pandemic. All asset classes saw their activities – from fundraising to deal making – being suspended. Whether credit managers, investors or bankers, all were concerned about late-cycle conditions in the private debt space – from underlying economic conditions to interest payment defaults. Emerging risks associated with demand-supply imbalances, tightening spreads, earnings adjustments and rising leverage took centre stage.

Banks and large asset managers played a pivotal at the height of the COVID-19 crisis, preventing what could have been a financial and liquidity crisis. In Europe, measures such as guaranteed loans, evolving credit lines and granting covenant holidays helped mid- and lower-market companies to weather the storm. The ECB’s TLTRO scheme has further supported banks by easing the burden on their balance sheets as they continue to refinance guaranteed loans.

However, we believe banks’ refinancing regimes may not be sufficient to cover mid- to lower-market companies’ financing needs, and banks remain hesitant to lend beyond the support packages stipulated. This has resulted in a number of opportunities for credit managers to meet the additional liquidity needs.

Post-pandemic opportunities and concerns

John F Kennedy said in his 1959 speech, “When written in Chinese, the word crisis is composed of two characters – one represents danger and one represents opportunity.”

In the aftermath of the GFC, banks retrenched completely from the market, and credit managers and investors capitalised on the opportunities and enjoyed greater returns. We note that in Europe’s private debt space, direct-lending funds provided more stable returns than other private debt strategies; vintage funds of 2011-17 maintained a median net IRR of 7.6-8.8%, higher than in other fixed-income markets. The 5% standard deviation of the net IRR is also the lowest of any private debt strategy (source: Preqin Pro).

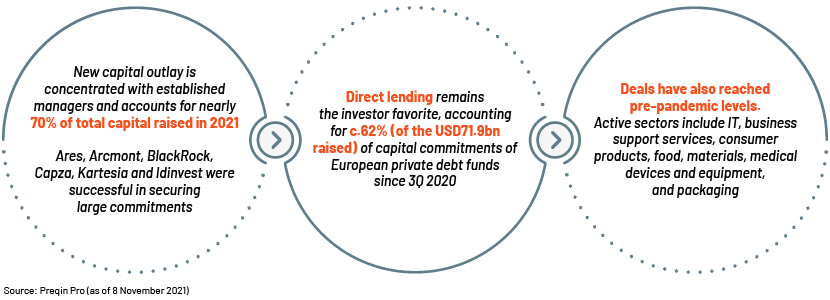

Similar reports were generated amid the pandemic: private debt funds (predominantly direct-lending funds) proved more resilient than other asset classes, including high-yield and leveraged-loan markets. Fundraising and deal activity has now rebounded to pre-pandemic levels.

Deal activity in the region is set to increase, according to the latest survey by Proskauer, with more than two-thirds of UK-/EU-based managers (33 respondents) expected to deploy capital in the UK, Spain, France, the Benelux area and the Nordics over the next 12 months.

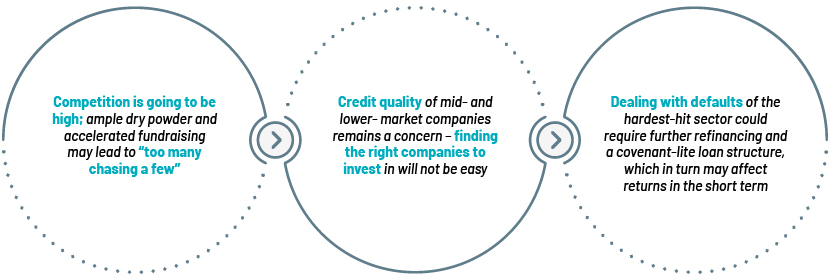

Despite the similarity, investors/managers should bear in mind that the GFC and the pandemic are different in nature. During the GFC, banks were not in good shape and the private debt space was relatively small and new; today, the banking system is more agile (it has injected trillions of dollars’ worth of stimulus) and the private debt space has grown considerably. Post-pandemic opportunities, therefore, are unlikely to come as easy as they did after the GFC.

Outlook: Positive

In the short to medium term, the outlook for European private debt products remains positive. The dislocation caused by the pandemic, especially in the lower and mid-market, has proved to be nothing but a blessing in disguise for credit managers/investors. There still are a number of high-quality companies that need money to grow and return to normalcy. But given that the landscape of the private debt space has changed completely, in that it has become more stable and developed, we believe post-pandemic vintages may not be as good as the post-GFC ones, but that a practical and prudent approach to finding the right companies will eventually pay off well. Selectivity should remain the same as it was before the pandemic. Fundamental and financial analysis and thorough due diligence would be key to better understanding a target company’s business model and drivers.

How Acuity Knowledge Partners can help

Our private debt/credit support vertical offers a number of services to private debt/credit middle and back offices, ranging from deal origination and target screening to portfolio monitoring services. We also help private credit managers with live deal support including due diligence, relative valuation, and scenario and bond yield analysis.

Sources:

Preqin Pro

Proskauer Releases Private Credit Market Survey for 2021

Web articles:

https://www.spglobal.com/en/research-insights/featured/private-debt

Tags:

What's your view?

About the Author

Gursharan has over 10+ years of experience working on variety of research including industry deep dives, trend analysis, market mapping and competitive benchmarking. He has been associated with Acuity Knowledge Partners since Jun 2015 and currently works closely with the fund launch and product team of private equity firm across various asset classes, primarily assisting them in understanding fundraising landscape, addressing consultant queries, identifying perceived peers, providing insights on alternative strategy, deals analysis, performance and fee benchmarking and LPs mandates.

He has an MBA with specialization in finance from Indian Institute of Finance, Delhi and has done his graduation in B.com from SGTB Khalsa College, University of Delhi

Like the way we think?

Next time we post something new, we'll send it to your inbox