Published on January 31, 2024 by Karthikeyan G

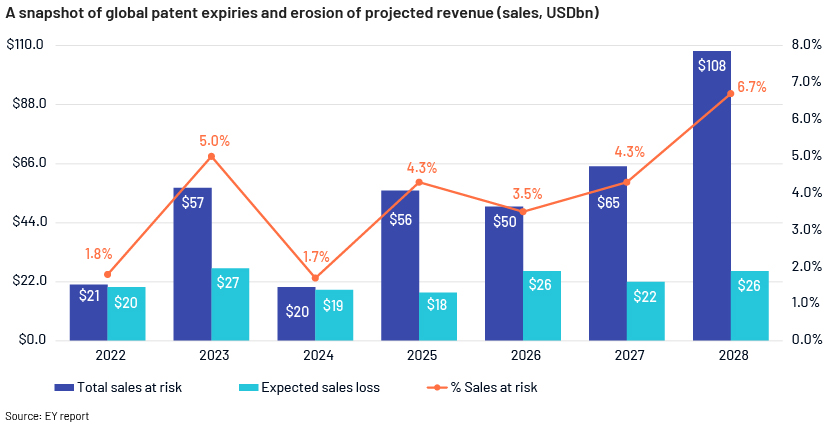

Pharma companies hold the exclusive rights to manufacture and market the drugs by way of patent protection, only for a specific period during which the drugs will not have competition from other drug manufacturers. After the expiry of the patents, other pharmaceutical companies can manufacture the same drug with similar drug composition (called as generics). Revenues of the drug manufacturer will drop significantly post patent expiration as the market share for the drug will be taken away by the generics and this is called as Patent cliff.

Companies can research and create a robust product pipeline to safeguard themselves from getting trapped in the situation of patent cliff but they still fall prey and depend on M&A or partnerships such as licensing agreements. Few companies have created the pipeline that can safeguard themselves in this situation to some extent but still have to lose a major portion of their revenues to its generics from the competition.

A few instances / examples of the impact of Patent cliff

Eliquis and Revlimid by Bristol Myers are estimated to lose over 80% of their revenues between 2025 and 2030 which is around $11.5bn and $3.9bn respectively. Nine products of Amgen to face patent expiry between 2021 and 2030 of which Prolia / Xgeva and Otezla contributes 41% of the company’s estimated 2025 total revenue. Pfizer to lose exclusivity of eleven drugs by 2030 of which BMS-shared Eliquis and Ibrance are the major contributors with 23% of Pfizer’s 2025 estimated revenue with both drugs anticipated to lose 77% in revenue by 2030 or $6.1 bn and $4.8bn, respectively.

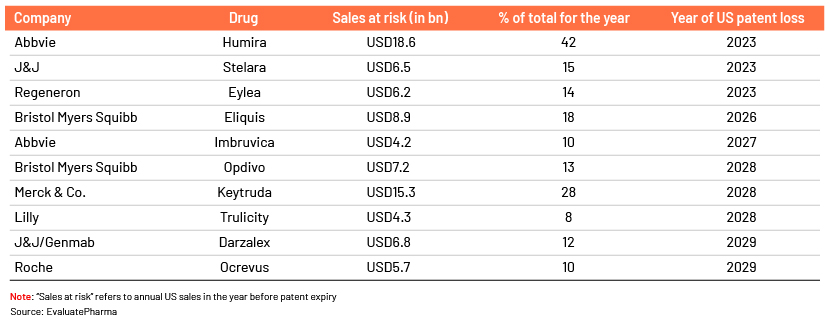

Sales at risk is the drug’s annual revenue in the year prior to loss of exclusivity and expected loss is the difference between sales at risk number and the sales in the first year of sales after expiry, as highlighted by companies for historic expiries or computed by Evaluate Pharma’s consensus.

Summary of Blockbuster drugs approaching expiry:

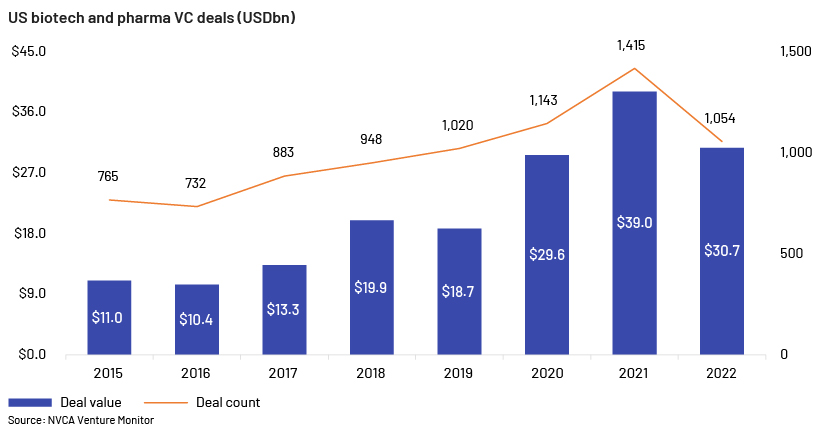

M&A is the fallback option for smaller firms to bridge capital gap created by macro-economic environment

The year 2022 saw a 54% decline in the availability of capital to the healthcare sector compared to the levels of capital raise in 2020 & 2021. $54.6bn raised in 2022 was the lowest annual investment in an industry since 2016. In 2022, debt financing declined 10% because of rise in interest rates, but 63% drop in capital raised through follow-on offering and 93% drop in IPOs suggest that smaller companies are struggling to access capital to reach their next value-generating inflection point.

Investment by venture capital firm declined significantly in 2023 as they reserved the available cash to fund the existing portfolio company’s operations. This is partly because hedge funds withdrew from the market to focus on the venture funding rounds that takes place before an IPO. Since there is no help from hedge funds to back the series B or C rounds, series A-focused VC’s are forced to make series B and C funding to retain their series A investments working till R&D programs reach a point where they are ready for an acquisition or IPO. This in turn reduces the financing option for new companies to raise funds through venture capital firms.

Companies are now focusing to cut down on the cost by way of workforce reduction and offloading non-core areas to have the necessary capital to fund the operations. Few companies do not have the necessary capital to fund the operation and have reached to a position to close their R&D programs or their operations completely due to lack of new funding, partners or buyers. When the availability of funds for biotech companies are difficult to source, companies can only look at M&A as the fallback option to continue their operations. In this kind of situation, it may become difficult for the firms to dictate terms in M&A.

Smaller firms can have a say on the valuations in M&A

In 1H ’23, some of the larger deals have been kept on hold due to regulatory scrutiny because of which dealmakers are looking at a transformative deal. Big Pharma companies are focused on acquiring large number of small & medium-sized companies, which makes the smaller firms more attractive leading to a better valuation. Smaller biotech firms that are in the oncology and immunology space are expected to be on the focus with high growth, along with other therapeutics area targeting central nervous system and cardiovascular diseases.

There are a few transactions where smaller firms on the outset seems to have dictated terms in the transaction where Novo Nordisk acquired Forma for a premium of 49.3% as Forma had a pipeline focused on hemoglobinopathies therapeutics area; Merck acquired Imago for a premium of 107.0% only for Bomedemstat product that Imago owned along with additional pipeline candidates that are still in the discovery phase; UCB acquired Zogenix for a premium of 66% in order to expand their pipeline in the rare forms of epilepsy which Zogenix was already working on; Alcon acquired Aerie Pharmaceuticals for a premium of 37.0% in order to strengthen the ophthalmic pharmaceutical space along with the R&D capabilities; and GSK acquired Bellus Health for a premium of 103% as it provides access to the drug camlipixant, a highly selective P2X3 antagonist that is currently in the phase 3 development for the first-line treatment of adult patients with RCC.

These examples prove that the acquiror will be ready to pay a higher premium in case the smaller firms (targets) have unique product candidates irrespective of the stage / phase of the product, if the target is into any specific sector of focus that the acquiror is seeking to acquire. Release of compelling data for the product would be an added advantage for the smaller firms to dictate the financial terms in the transaction.

2022 - Mid-2023 M&A Corporate Deals with premiums and Rationale* ($ in millions)

| Date | Buyer | Target | Deal Value | Premium | Rationale |

| Apr 30, 2023 | Astellas Pharma | Iveric bio | 5,900 | 64% | Acquisition advances Astellas' primary focus on Blindness & Regeneration area |

| Apr 18, 2023 | GSK | Bellus | 2,000 | 103% | To strengthen specialty medicines and respiratory pipeline with camlipixant, a highly selective P2X3 antagonist and potential best-in-class treatment for refractory chronic cough |

| Apr 17, 2023 | Merck | Prometheus | 10,800 | 75.4% | To grow presence in immunology and add diversity to the overall portfolio |

| Mar 13, 2023 | Pfizer | Seagen | 43,000 | 32.7% | Proposed combination enhances Pfizer’s position as a leading company in Oncology |

| Jan 09, 2023 | AstraZeneca | CinCor Pharma | 1,300 | 121% | Acquisition to bolster AstraZeneca’s cardiorenal pipeline by adding CinCor’s baxdrostat (CIN-107), an aldosterone synthase inhibitor (ASI) for blood pressure lowering in treatment-resistant hypertension |

| Nov 19, 2022 | Merck & Co. | Imago | 1,350 | 107.0% | To advance its portfolio with Imago's lead drug Bomedemstat (LSD1inhibitor), used for Thrombocythemia, Myelofibrosis, & Polycythemia vera and 2 discovery stage drug candidates |

| Sep 1, 2022 | Novo Nordisk | Forma | 1,100 | 49.3% | To accelerate its scientific presence and pipeline in hemoglobinopathies |

| Aug 22, 2022 | Alcon | Aerie Pharmaceuticals | 930 | 37.0% | To enhance its ophthalmic pharmaceutical space and pharmaceutical R&D capabilities |

| Aug 8, 2022 | Pfizer | Global Blood | 5,400 | 7.3% | Lead products Oxbryta, Inclacumab and GBT021601 to enhance its portfolio in rare hematology |

| Aug 4, 2022 | Amgen | ChemoCentryx | 3,700 | 116.0% | Acquisition to strengthen the position of the company in inflammation and nephrology with the addition of Tavneos and Avacopan products, along with 3 early-stage drug candidates |

| Jun 3, 2022 | Bristol Mayers Squibb | Turning Point | 4,100 | 122.0% | To further broaden BMS's oncology pipeline with Repotrectinib, Elzovantinib, TPX-0046, TPX-4589 and TPX-0131 |

| May 10, 2022 | Pfizer | Biohaven | 12,900 | 78.6% | Enhance Pfizer's neurologic product portfolio with Rimegepant and Zavegepant for Migraine and five preclinical CGRP assets |

| Apr 13, 2022 | GSK | Sierra Oncology | 1,900 | 39.0% | Sierra Oncology’s differentiated momelotinib has the potential to address the critical unmet medical needs of myelofibrosis patients with anaemia |

| Jan 19, 2022 | UCB | Zogenix | 1,900 | 66.0% | Expand UCB's product pipeline for specific or rare forms of Epilepsy |

(*) Only added deals where premium is publicly available

Conclusion

Small or mid-size healthcare companies that have a proven science or released compelling data or technology platform that support the drug development need more funds to further their studies. With the lack of availability of funds in the market for the biotech firms, smaller healthcare firms seek to partner with larger pharma’s to advance their programs or to test their technologies.

Big Pharma companies would be majorly interested in acquiring the product / company than the licensing deals as they would not have to pay royalty for the products. This can act as a factor for smaller firms to dictate the valuation multiples in the current situation depending on the difference in the profit between the licensing and acquisition deal.

Acuity can help

We are a leading provider of high-value research, analytics and business intelligence services to life sciences, bio-pharma, medtech and healthcare investment banks.

We provide bespoke research support on market entry and due diligence, portfolio management, licensing and acquisition, go-to-market strategy, opportunity assessment, regulatory landscaping, product launch analysis, market access and therapy area assessment, indication prioritization, market research and forecasting, pipeline analysis and benchmarking & competitive intelligence.

Sources:

-

Venture Capital Musical Chairs, Pfizer’s Financing Strategy and Boehringer on Being The Early Bird

-

Dealmaking Gives Biotechs Needed Financial Relief, But Deal Terms Are Under Pressure

-

Venture Monitor (Page 25)

-

Global M&A Trends in Health Industries: 2023 Mid-Year Update

-

Alcon to Acquire Aerie Pharmaceuticals, Inc., Enhancing its Ophthalmic Pharmaceutical Portfolio

-

PREM14A 1 d359803dprem14a.htm PREM14A (Page 56)

Tags:

What's your view?

About the Author

Karthikeyan has over 6 years of experience in the Investment Banking division with over 2.5 years of experience specifically focusing on Healthcare sector. He holds an MBA from Sri Sathya Sai Institute of Higher Learning.

Like the way we think?

Next time we post something new, we'll send it to your inbox