Published on August 14, 2020 by Anshul Kulshrestha

The COVID-19 pandemic continues to have profound and far-reaching impacts across the spectrum of financial markets, including the private-equity (PE) secondary market. While industry participants engage in damage assessment, there is still significant uncertainty about the full impact of the COVID-19 virus. We believe that as precursors to the current pandemic, past major market corrections (also referred to as “black swan” events) can actually provide insight on how the secondary markets may react given the current market dynamics. This understanding, in conjunction with an analysis of evolving paradigms in a post-COVID-19 world, would augur well for a discerning market participant.

Historically, market downturns have affected the secondary markets in the near term by lowering transaction volumes, slowing the pace of realisations and distributions, and putting downward pressure on pricing. As demonstrated during the global financial crisis (GFC), once volatility subsides and stability is restored, secondary markets, including secondary funds of funds, have generally rebounded from market downturns with strong volume and have offered attractive opportunities for investors with available investment capital.However, even though the current pandemic situation is continually evolving, with no definitive end in sight, the markets are not just waiting to ride the storm.

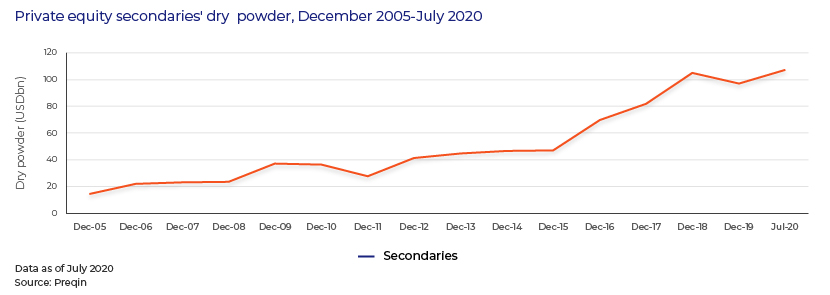

Unprecedented levels of dry powder

First things first. Despite the annus horribilis of 2020, the secondary players have historically high levels of dry powder – committed, but uninvested capital – ready for deployment. And they will look to take advantage of larger-than-average discounts to net asset value to lock in above-average appreciation. Whether we end up witnessing a V-shaped or U-shaped recovery, many buyers will likely be eager to get transactions done prior to the rebound, given the ephemeral nature of secondaries.

It would seem that a plethora of industry participants are waiting eagerly to consummately deploy their dry powder in the interests of limited partners (LPs). The current economic downturn bodes well for capital providers. This is because in such a scenario, liquidity becomes incredibly valuable, and the provider of that liquidity stands to earn a premium return.

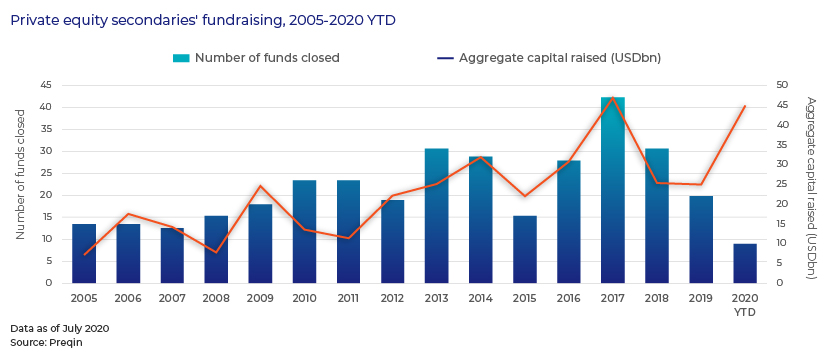

Active secondaries market

Secondaries strategies are experiencing an increase in investor interest. The aggregate capital raised in 2020 YTD (USD45bn) has already exceeded 2019 levels (USD22.4bn), although, as expected, the average months to final close in 2020 YTD (16) have increased vis-à-vis 2019 (11). As seen during previous steep market corrections, forced sellers,

those whose alternative asset allocation has grown too big due to the fall in public markets (known as the denominator effect) and those with cash flow issues would come to market with "a more realistic understanding of pricing expectations" and those deals will get done. However, the volume of deals being closed has been relatively muted. Discussions continue. But it would not be completely accurate to describe the investors as “sitting on the fence”. The nature of opportunities available remains diverse and the number abundant.

Deepening of bid-ask spreads

Secondary activity has slowed on account of a widening of bid-ask spreads between buyers and sellers. There is a lack of definitive assessment of the pandemic impact, but naysayers are fuelling speculations of further portfolio write-downs and market volatility. The consensus is that once “the dust settles”, volumes will rebound in the latter half of the year. We have seen this during the GFC, which caused secondary volumes to drop by 50% in 2009 but subsequently rebound in 2010 to pre-crisis levels.

Unlike in the public markets where bid-ask spreads are available on a real-time basis, bids in a secondaries market are typically based on general partner (GP)-reported values for the underlying private companies. Cut to July 2020, these valuations are only beginning to factor in the real impact of the pandemic situation. In subsequent quarters from now, as the GPs adjust their NAVs to factor in the deltas in the top line, bottom line and indebtedness in the performance in their portfolio companies, true valuations will start to manifest and the bids and asks quotations would move towards convergence. However, until a clearer picture emerges, the bid-ask spreads would remain out of sync

Milking painful vintages and tail-end assets

A recent study by eFront attempted to predict the impact of the COVID-19 pandemic on returns generated by various PE vintages. It found that funds raised from 2016 to 2018 and those that began investing closer to the 2009 financial crisis (vintages 2007-10) could suffer the most in terms of a reduction in NAV. The 2016-18 pressure point comes from the fact that these funds should be close to being fully invested but have not benefited much from the conducive exit environment that existed before the pandemic struck. Similarly, funds stuck with tail-end assets or those at the end of their term are running short of time before investors start demanding liquidity.

Both these vintage buckets should further make a compelling investment proposition to secondaries investors looking to avoid the negative bit of the J-curve.

In conclusion, crisis or not, secondaries, as an investing strategy, have continued to generate interest and growth. The banking system is more stable now than in 2008-09, and the public markets have shown more resilience. Investors expect deal flow to return to pre-pandemic levels more quickly this time around. However, investors need to be aware of the challenges and dynamics of this fast-evolving market and carefully analyse each potential sourced opportunity. At Acuity Knowledge Partners, our dedicated intellectual capital provides plug-and-play solutions across the deal lifecycle to quickly value private company portfolios, run complex bid calculations, firm up investment decisions and assist in due diligence, diversification, hedging, rebalancing and continuous monitoring.

Sources:

1. Resilient Returns: Navigating PE in ESG and post COVID-19 world by INSEAD’s Global Private Equity Initiative

4. The Growth of Private Equity Secondaries – Neuberger Berman webminar of June 18, 2020

5. S&P Market intelligence

Tags:

What's your view?

About the Author

Anshul Kulshrestha joined Acuity Knowledge Partners in 2012 and has been a part of the firm’s Private Equity and Consulting Vertical since. His current role involves managing multiple PE and fund-of-funds clients.

He has extensive experience across a broad range of private equity and hedge fund services, including fundraising pitchbook, investment due diligence, investment memorandums, fund cash flow modeling, portfolio monitoring and fund revaluation modeling.

Anshul holds Post Graduate in Business Management with a specialization in Finance and Marketing from Institute of Management Technology, Ghaziabad

Comments

15-Aug-2020 11:54:09 am

Very interesting article. Would love to hear more from this gentleman.

Like the way we think?

Next time we post something new, we'll send it to your inbox