Published on March 31, 2023 by Rajnish Kumar Sinha

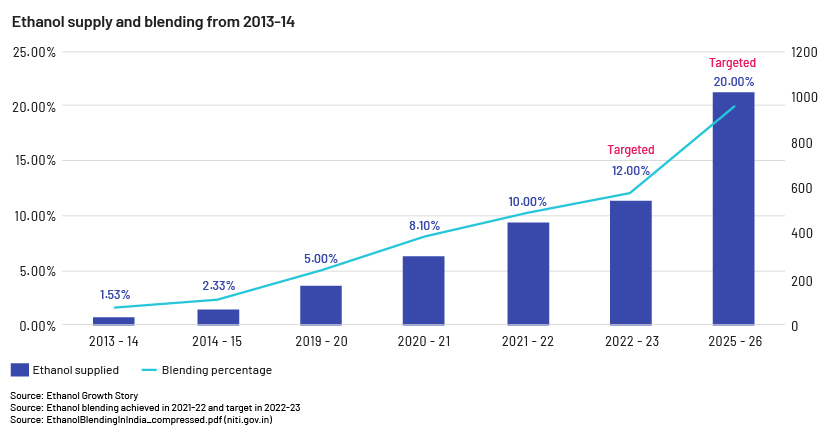

India’s economy is seeing robust growth, and like any growing economy, needs to have a healthy supply of energy to ensure its growth engine maintains its momentum. The country does not have an abundance of fossil fuels; as a result, it has to import almost 85% of its requirement to maintain the pace of economic growth. Together with economic growth targets, countries aim to reduce emissions. Emissions from transport account for 14% of India’s energy-related emissions. Due to growth and an increasing number of vehicles, this sector is projected to account for more emissions than other sector. One of the options adopted to offset emissions is blending ethanol with petrol. India has come a long way since it started this process in 2001. It reached 10% ethanol blending in June 2022 and is on the path to reach 20% by 2025 (a target set to be achieved by 2030). This required significant policy changes and effort on numerous levels, with a few more challenges yet to be overcome.

The journey so far

India started ethanol blending in 2001 as a pilot project to address environmental pollution and boost farmers’ earnings. The ethanol used for the blending was that generated as a by-product in sugar production. The government started selling petrol blended with 5% ethanol in nine states and four Union Territories (UTs) in 2003. Its success led to the government deciding to extend the programme to 11 more states by end of 2006.

In 2013-14, the government made a number of policy changes such as the following to ensure the program was successful, as results were mixed, with only 0.5-1.5% blended versus the planned 5%:

-

Re-introduced an administered price mechanism for procurement of ethanol under the Ethanol Blending Programme (EBP)

-

Amended the IDR Act in 2016 to clarify the roles of state and central governments in ethanol supply

-

Launched the Interest Subvention Scheme to increase ethanol production capacity

-

Allowed B molasses, sugarcane juice, sugar, sugar syrup and damaged food grains to be used in ethanol production

-

Extended the EBP to all of India except the Andaman Nicobar and Lakshadweep Islands

-

Subsequently allowed the use of surplus rice available with FCI (Food Corporation of India) for ethanol production

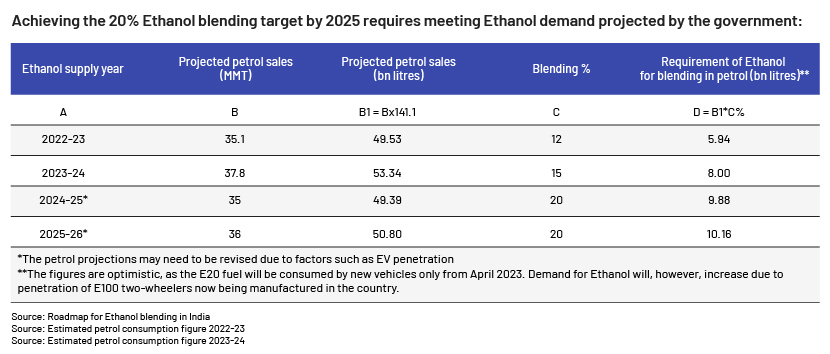

These measures were successful, and India achieved its blending target in 2022. The government targets 12% blending in 2022-23:

The next steps

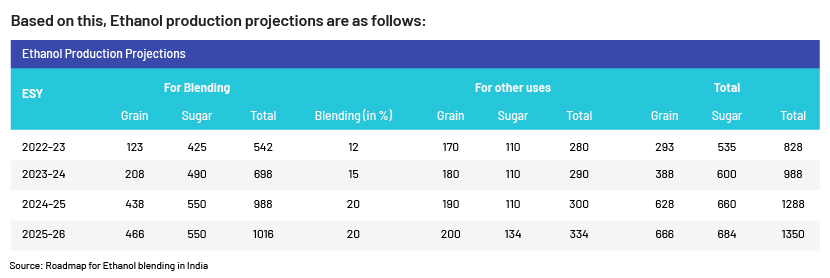

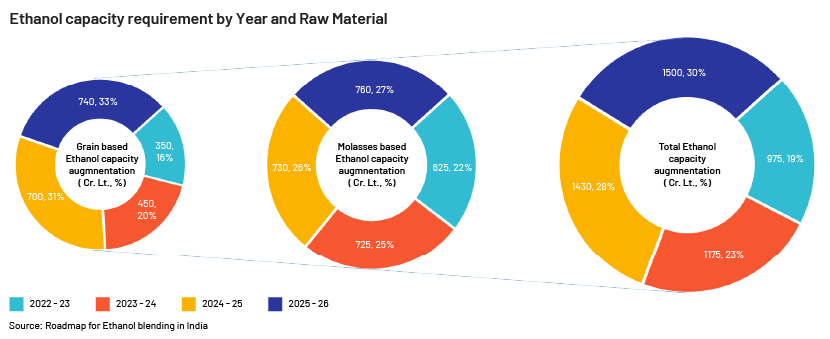

To ensure ethanol supply achieves the E20 blending target, the government has announced the following measures to increase ethanol production:

-

Interest Subvention Schemes for molasses-based distilleries

-

The DFPD (Department of Food and Public Distribution) approved 368 projects for setting up new distilleries/expanding existing distilleries

-

The DFPD announced a modified Interest Subvention Scheme on 14 January 2021 for setting up new grain-based distilleries/expanding existing grain-based distilleries using other 1G (First Generation) feedstock to produce ethanol

-

Introduced the concept of tripartite agreements between mills/distilleries, banks and OMCs (Oil Marketing Companies), to help mills/distilleries obtain loans for ethanol projects

-

Molasses-based distilleries have also been offered interest subvention, to convert both food grains and molasses into ethanol

According to the roadmap, ethanol supply will come mainly from 1G ethanol using feedstock such as molasses C and B, sugarcane juice, sugar and extra grain.

Recent developments

-

Petrol blended with 20% ethanol starts retailing in 11 states/UTs Petrol blended with 20% ethanol was rolled out on 6 February 2023 at selected petrol pumps in 11 states and UTs as part of a programme to increase use of biofuels to cut emissions and dependence on foreign exchange-draining imports

-

The budget provides sugar co-operatives relief of USD 1.2 bn, to ensure farmers are compensated and sugar mills are encouraged to work towards augmenting ethanol production capacity (1 INR = 0.012 USD)

-

The government proposes USD 3.6 bn “capital support” to oil refiners-cum-fuel retailers in 2023-24 for building low-carbon infrastructure, including for ethanol blending. (1 INR= 0.012 USD)

-

The Ministry of Road Transport and Highways will be approaching the Ministry of Petroleum and Natural Gas to firm up a policy on biofuel ethanol-dispensing stations in the country, according to Union Minister Nitin Gadkari.

Although all policy measures are in place and OMCs and the government are working to achieve their target, certain concerns need to be addressed:

-

Ethanol supply is to come mainly from 1G sources, e.g., sugarcane and grain. Using sugarcane and grain to produce ethanol raises questions on the use of land required to feed humans; in addition, these are water-intensive crops. Reducing water levels and land available for producing food for humans in an effort to reduce pollution is a concern.

-

Although the government has announced ethanol blending to be implemented in all states, not all states have the same ethanol production capacity, and ethanol availability will require interstate movement; this be a concern, considering the many states have yet to comply with the amendments to the IDR Act.

-

Vehicles can use ethanol blending of 10%, but modifications are required to ensure smooth function when using E20. New vehicles that can use E20 will be manufacture, but this will entail high replacement cost.

-

Proper storage facilities would be required to ensure continued supply of E20 fuel; retail outlets would also need to be revamped.

To address these concerns, measures such as concentrating more on 2G ethanol production than on 1G ethanol production could be taken and targets set. The central and state governments would need to work together to achieve the targets and agree to comply with the IDR Act. Consumer awareness of the need for E20 fuel-compatible vehicles would have to be increased and incentives offered to attract them. Launching an E20 fuel, E20 fuel-compatible vehicles and infrastructure for dispensing the fuel would be critical to achieving the target.

How Acuity Knowledge Partner can help

We are the preferred partner for energy solutions. With a talented pool of experts, we cater to companies engaged in the oil and gas, and power sectors, providing in-depth research, analysis, investment decision making and strategy. Our solutions range from conventional oil and gas/power solutions to solution related to alternative sources of energy.

Sources:

-

Maruti engines to be E20 capable by April 2023; E85 flex fuel engine in the works | Autocar India

-

India achieved 10% ethanol blending target ahead of schedule: PM –The Hindu

-

Petrol doped with 20 pc ethanol starts retailing in 11 states/UTs | Deccan Herald

-

Union Budget 2023-24 – Sugar co-operatives get Rs 10000 crore relief in budget – Telegraph India

-

Rs 30k crore ‘support’ to let oil companies cushion losses – Times of India (indiatimes.com)

-

Govt to firm up policy on ethanol pumps soon: Gadkari | Mint (livemint.com)

-

India’s ethanol distillation capacity to double by 2025 | Mint (livemint.com)

Tags:

What's your view?

About the Author

Rajnish has more than 14 years of experience in Energy industry. It includes Oil & Gas field experience to working on various strategic and management research projects. Apart from Conventional Oil & Gas industry his expertise also includes Alternative Fuels and Power sector. He holds an MBA degree in Oil & Gas Management from University of Petroleum and Energy Studies (UPES) and Applied Finance Certification from IIM-Calcutta.

Like the way we think?

Next time we post something new, we'll send it to your inbox