Published on October 5, 2023 by Ambarish Srivastava

Private equity and venture capital (PE&VC) firms face strong headwinds in the form of rising interest rates that have reduced both early- and late-stage valuations of portfolio companies and negatively impacted market sentiment and confidence[1].

Challenges due to volatile valuations are mounting amid environmental challenges.

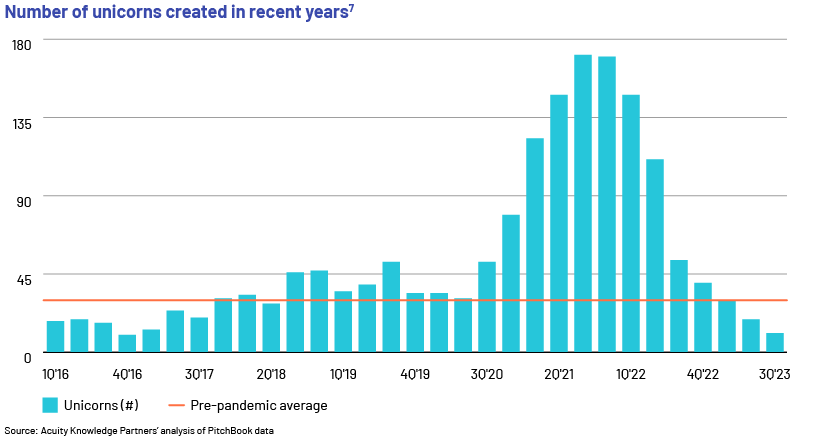

Unicorn formation weakening

After the excitement in 2020 and 2021, the second half of 2022 was not promising for funds and portfolios, and the situation is the same so far in 2023. The number of new unicorns has declined steadily since mid-2022, with many portfolio firms, including unicorns, facing down rounds[2], [3] (and likely to face more[4]). A number of unicorns have also lost their unicorn status[5]. At the start of 2023, the number of unicorns created quarterly reached the pre-pandemic average[6], but it has now fallen below this average.

Startups faced difficulty in 2022. Of the 1,686 unicorns created since 2016, 18 have filed for bankruptcy and 24 have lost their unicorn status[8].

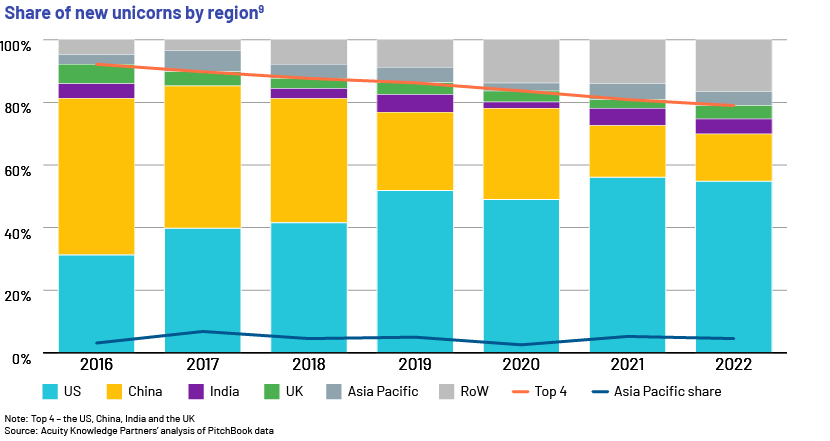

Rest of Asia is creating unicorns faster than China

The top four countries creating unicorns are the US, China, India and the UK. However, their share has declined, mainly due to the steep decline in China, where the share of global unicorns fell to c.15% in 2022 from c.30% in 2020, while Asia Pacific (primarily Southeast Asian nations) created more, doubling its share to 4.5% from 2.6% during the period, while the US’s share increased to 55% from 49% and India’s to 5% from 2%. Despite the decline in China, the US and China continue to dominate the creation of unicorns.

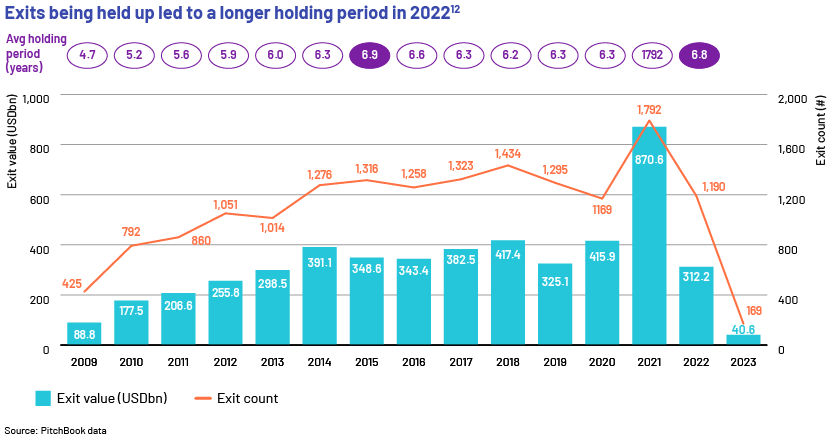

Drop in the number of PE exits could result in an asset pileup

Rising interest rates also result in a decline in deals and, in turn, a pileup of a significant volume of investments. Deal volume has declined significantly in North America[10]. US PE alone is heading towards USD360bn in investment being held up in the next 12 years, according to PitchBook Data[11].

However, certain markets are seeing a slight recovery. PE&VC exits in India stood at USD2.4bn in July 2023, the highest in 11 months, according to E&Y[13]. In 2Q 2023, Europe saw a 42% increase in exits over 1Q 2023[14]. Nevertheless, we believe it is too early to forecast a complete recovery; the improved performance in India was due to large deals, and the higher exits in Europe were due to strategic sales[15], [16].

PE&VC firms are looking to the East to raise funds

As deals declined in Greater China in 2022, PE funds established operations in India and Japan[17], [18]. While the pandemic accounted for most of the decline, managers are also more cautious. For example, the head of Goldman Sachs’s PE business in Asia revealed they were not raising funds from the US but other markets such as the Middle East, China, Korea and Japan[19].

Amid this funding winter in the West, many US-based general partners (GPs) are looking to Asia Pacific to raise funds[20], and a number of companies have entered into partnerships with these GPs. For example, Asia Heritage, a Singapore-based funds of funds investor, is assisting US-based Bonaccord Capital Partners to expand reach of its North American and European managers in Asia[21]. Northleaf Capital Partners has opened an office in Tokyo to capture Asia Pacific investor base[22]. This is a win-win situation, as managers obtain new sources of funding while high-net-worth individuals (HNWIs) in Asia find alternative investments in the West.

Recent regulatory tightening targets transparency and channelising investments

Regulators have been steadily tightening regulations governing the PE&VC sector in recent years. Recent regulation by the SEC[23] aims to prohibit disclosure of preferential terms, requiring investor consent before engaging in a range of activities. The SEC is also seeking to increase reporting. The rules are likely to improve transparency and increase competition in the private funds sector, according to SEC Chair Gary Gensler[24]. The US Federal Trade Commission has proposed that PE firms disclose the names of their limited partners (LPs) in regulatory filings[25].

In China, “venture capitalists would be encouraged to make technology-focused investments in early-stage smaller companies” according to new regulations, effective 1 September 2023.[26] The China Securities Regulatory Commission (CSRC) believes “the new regulations may facilitate high-quality technology development in the country”[27]. China is also working on its 2025 Made in China policy that seeks to make the country a technology powerhouse[28]. “The new regulations state that the PE sector should promote technological innovation”, according to China Daily[29] .

Summary

The challenges of 2022 have accelerated in 2023, significantly denting valuations and leading to challenges relating to structure and confidence, down rounds and a number of companies losing unicorn status. The regulatory authorities remain vigilant and are bringing more private-market activity under their purview. In this dynamic environment, professionals need to keep abreast of sentiment in the sector.

How Acuity Knowledge Partners can help

We are one of the largest private-market professional support practices for global PE funds. We support professionals with a wide range of support such as target identification, deal evaluation, sector and market scans and back- and middle-office support. We also assess sentiment in the sector through our annual private-market surveys.

Sources

-

[1]https://pitchbook.com/news/articles/europe-q2-2023-venture-capital-valuation-trends

-

[2] https://pitchbook.com/news/articles/europe-q2-2023-venture-capital-valuation-trends

-

[3] https://businessday.ng/technology/article/global-interest-in-high-valuation-startups-dampens/

-

[4] https://www.lexology.com/library/detail.aspx?g=f633c2ac-10be-416a-9085-857e79a3b73b

-

[5] https://pitchbook.com/news/articles/unicorn-startups-list-trends

-

[6] Private equity and venture capital trends 2023 | Acuity Knowledge Partners (acuitykp.com)

-

[7] https://pitchbook.com/news/articles/unicorn-startups-list-trends

-

[8] Based on Acuity Knowledge Partners’ analysis of PitchBook Data research obtained in September 2023 (https://pitchbook.com/news/articles/unicorn-startups-list-trends )

-

[9] https://pitchbook.com/news/articles/unicorn-startups-list-trends

-

[10] https://pitchbook.com/news/articles/private-equity-exits-2023-liquidity

-

[11] https://pitchbook.com/news/reports/q2-2023-pitchbook-analyst-note-pe-exit-timelines-and-the-impending-maturity-wall.

-

[12] https://pitchbook.com/news/reports/q2-2023-pitchbook-analyst-note-pe-exit-timelines-and-the-impending-maturity-wall

-

[13] https://www.ey.com/en_in/news/2023/08/pe-vc-exits-in-july-2023-at-a-11-month-high-at-us-dollor-two-point-four

-

[15] https://www.ey.com/en_in/news/2023/08/pe-vc-exits-in-july-2023-at-a-11-month-high-at-us-dollor-two-point-four-

-

[17] https://www.business-standard.com/world-news/pe-funds-moving-away-from-china-to-india-japan-amid-geopolitical-tensions-123061600859_1.html

-

[18] https://www.theinformation.com/articles/before-sequoia-split-a-100-billion-american-cash-spigot-to-chinese-vcs-ran-dry

-

[19] https://www.ft.com/content/9ff6d864-e5c1-4889-bc56-3d375849fcdb

-

[20] https://finance.yahoo.com/news/north-american-gps-look-east-050000246.html

-

[21] https://finance.yahoo.com/news/north-american-gps-look-east-050000246.html

-

[22] https://finance.yahoo.com/news/north-american-gps-look-east-050000246.html

-

[23] https://carta.com/blog/sec-proposed-rules-private-funds/

-

[24] https://www.reuters.com/legal/government/us-private-funds-industry-sues-securities-regulator-over-new-rules-2023-09-01/

-

[25] https://pitchbook.com/news/articles/ftc-may-require-pe-funds-to-disclose-lps

-

[26] https://global.chinadaily.com.cn/a/202307/10/WS64ab7bb4a310bf8a75d6e3c4.html

-

[27] https://global.chinadaily.com.cn/a/202307/10/WS64ab7bb4a310bf8a75d6e3c4.html

-

[28] https://www.dw.com/en/china-fears-eu-foreign-investment-strategy-at-a-crossroads/a-63546979

-

[29] https://www.chinadaily.com.cn/a/202307/11/WS64aca597a31035260b815a5a.html

Tags:

What's your view?

About the Author

Ambarish has about 17 years of experience in business research, analysis and consulting. He is engaged in leading deep-dive strategic projects, due-diligence support, issue-focused trend analysis and similar assignments for our Private Markets clients. His previous experience includes tenures with startups, the Big Four and consulting organisations, where he focused on industry studies, price forecasting, company analysis, macroeconomic studies and other strategic engagements.

Like the way we think?

Next time we post something new, we'll send it to your inbox