Published on February 13, 2025 by Vyas Pandey

Globally, banking is the single-largest profit-generating industry and is the key measure for economic growth. Banks’ portfolios are growing due to solid merger and acquisition (M&A) activity and increased consumer demand. However, with global uncertainties and tighter regulations, banks are now stressing more on enhanced portfolio monitoring. Portfolio monitoring is a key activity with which banks can manage risk and make informed decisions in a competitive market. It helps obtain insight on cash flow and the overall stability of loan portfolios, enabling determination of portfolio health. This is a key activity for any bank to identify and manage diversification of the loan portfolio as per the risk appetite of the bank and bank’s financial stability.

Market outlook

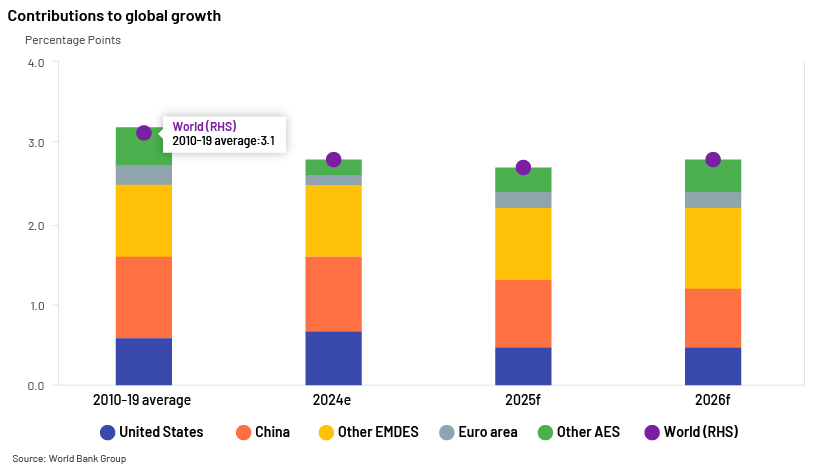

Despite uncertainties, the global economy grew at an estimated 2.7% in 2024. Global GDP growth is expected to continue to grow steadily, by c.2.7% in the coming years, although still below that during the decade before the pandemic.

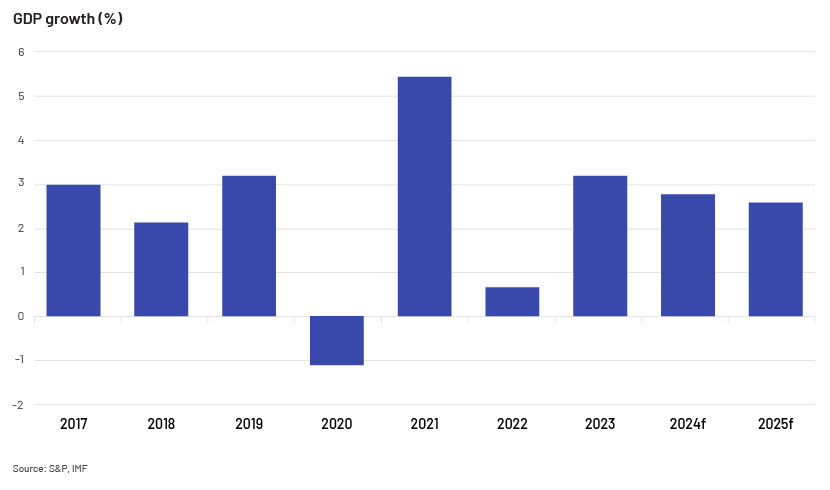

The US economy is estimated to have grown 2.8% in 2024, mainly due to strong consumer spending and overall job growth. US GDP grew 3.1% in 3Q 2024 due to an increase in consumer spending, which accounted for 2.5% of this 3.1% growth in total real GDP. The labour market also saw payroll gains in December 2024. Overall job growth was 2.2m in 2024, with an average gain of 186,000 jobs a month.

The US market is expected to grow moderately in the coming years. The IMF expects US GDP to grow 2.7% in 2025 due to strong underlying demand and supportive financial conditions.

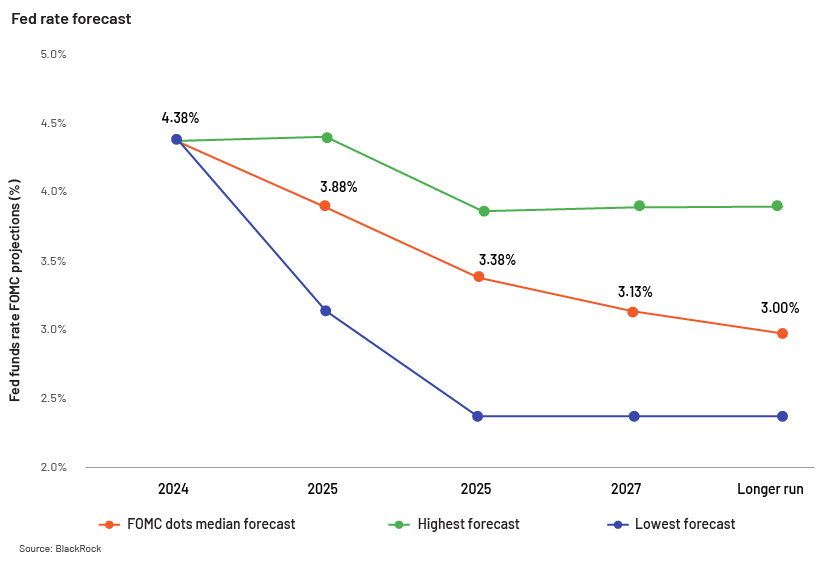

While US inflation has cooled from the high in 2022, it is still above the Federal Reserve’s (Fed’s) target of 2%. With the implementation of President Trump’s proposed policies, inflation is expected to be higher in the near term, and the Fed is expected to reduce its policy rate more gradually.

The proposed tariffs would help sectors such as metals and mining, as companies in such sectors tend to be higher on the cost curve, and tariffs could help them compete with imports. Chemical manufacturers could also benefit from the move. However, the technology sector and, to some extent, the power and utilities sector could be affected adversely, as they import semiconductors and electrical components from China.

The Fed rate will reduce to 4% in 2025 and then pause, according to BlackRock. The Fed is expected to observe inflation and labour-market data before deciding on further cuts. Long-term rates are expected to be in the 2.4-3.9% range.

Business environment: loan outlook

Demand for loans is expected to improve as rates drop. Although we expect consumer demand to be slow due to financial pressures, corporate borrowing is likely to grow, with an uptick in debt issuance and M&A due to a stable political regime and an improved macroeconomic environment. Loan demand was limited due to the prolonged effects of the pandemic. In addition, companies used federal stimulus funds to pay down debt and avoided taking on new credit. However, positive economic activity, declining loan rates and strong employment data will likely lead to growth in loan demand.

We believe bankers are optimistic about an improvement in the operating environment in 2025, leading to higher annual loan growth. Large- and mid-cap banks are expected to post a median 5.4% in loan growth. Small financial institutions are expected to increase their loan portfolios by 5.8%.

Bank portfolios

Based on the new regulations, banks will now have to look at their portfolios more stringently. They were previously able to take decisions on a loan-by-loan basis to achieve the most optimal capital allocation; however, they would now have to assess the impact of new loans at the portfolio level and plan to optimise their balance sheets to meet requirements of the regulatory framework. For example, the integration of climate risk-related factors into credit decisions would enable risk to be structured, priced and managed both at the loan level and the portfolio level.

Why portfolio monitoring is important

Banks are focusing on portfolio monitoring due to tighter regulations, market volatility and economic uncertainty. Based on regulatory changes, they would need to review their portfolios and devise strategies for optimising risk and return. In addition, changes in the rates cycle and market volatility are increasing credit risk, further triggering the need for portfolio review.

Below are some of the key elements of portfolio monitoring:

-

Risk management: Regulatory bodies have increased scrutiny of financial institutions after the 2008 financial crisis. Portfolio monitoring plays a crucial role in ensuring compliance with these regulations by providing a clear view of the risk profile and performance of a bank's loan assets. Regular monitoring helps identify potential problem loans early, enabling banks to take corrective action and maintain regulatory compliance.

-

Borrower management: Effective portfolio monitoring plays a vital role in enhancing customer relationships. By closely monitoring loan performance, banks can identify opportunities to offer tailored financial solutions to their clients. For example, a customer with a consistently strong payment history could be offered better interest rates or additional credit products. This proactive approach helps build trust and loyalty, ultimately leading to higher customer retention rates.

-

Regulatory requirements: Regulatory frameworks in the banking sector are stringent and change regularly. Inadequate monitoring can result in non-compliance, leading to legal repercussions and penalties.

-

Liquidity management: Banks need to monitor portfolios regularly, as this helps respond swiftly to any market volatility and control financial loss. It helps banks adapt investment strategies to changing market conditions.

-

Identifying cross-selling opportunities: Regular portfolio monitoring helps obtain insight on borrower behaviour to identify cross-selling and upselling opportunities.

Challenges banks face in portfolio-monitoring tasks

-

Cost management: There is increased pressure on banks to keep costs under control. Many are thinking of ways in which to allocate spending to generate additional savings and preserve profitability.

-

Growing loan books: With policy rates falling, the significant refinancing achieved in 2024 and healthy growth projected across sectors, we expect a favourable fundamental credit environment in 2025. Thus, we expect loan books to grow; banks would, therefore, need to invest more time in monitoring loans.

-

Seasonality: Banks’ loan-monitoring activity spikes when borrowers file annual/quarterly reports. Since banks have to complete loan reviews after the release of these financials by the deadlines specified by the regulator, it becomes difficult for banks to manage peak loads at annual/interim review.

-

Right skillset: Banks are finding it increasingly difficult to find and retain resources able to handle banking activities such as portfolio monitoring due to the skill gap and the high cost of talent.

How Acuity Knowledge Partners can help

We take complete ownership of the portfolio-monitoring function so bankers can focus on high-value/client-relationship activities; this leads to improved operational efficiencies and better financial performance.

In the current market scenario, commercial banks and financial institutions face a number of challenges at the different stages of the loan lifecycle:

-

Meeting deadlines for quotations

-

Value creation

-

Cost savings

-

Increased volume

-

Portfolio monitoring

Globally, lending institutions are partnering with offshoring vendors that offer solutions designed to address these questions

Sources

What's your view?

About the Author

Vyas Pandey has over 18 years of experience in working with leading global banks & financial institutions and PE firms. He has led various client engagements focusing on investment banking and commercial lending domain. He has managed teams supporting global banks across first line of defense and second line of defense. He has expertise in a broad range of banking work products covering valuations, business research, investment research, credit analysis, portfolio monitoring, and underwriting. Vyas holds an MBA with majors in Finance and a B Sc. in Math.

Like the way we think?

Next time we post something new, we'll send it to your inbox