Published on September 19, 2023 by Mansi Chauhan

The pharmaceutical sector has grown in recent years, with the pandemic putting it in the spotlight. The rapid development and distribution of vaccines changed the way it functions, and there is increased focus on personalised medicine and a rise in investment in biologics. Companies are remodelling their product portfolios to cater to this new market and its demands.

Portfolio remodelling, also known as portfolio optimisation or restructuring, is a strategic process that pharma companies undertake to ensure their product portfolios align with their business objectives, market dynamics and emerging healthcare needs. In this context, it’s crucial for companies to use tools such as portfolio risk analyticsto assess and mitigate risks when aligning their product portfolios with the dynamic market demands.

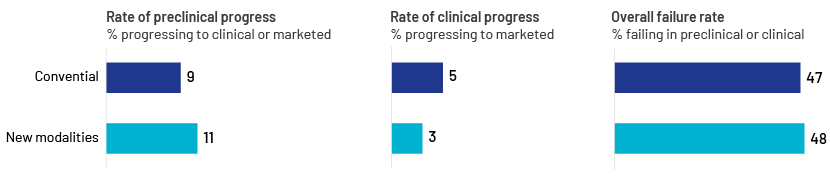

Traditional pharma platforms such as small-molecule treatments and monoclonal antibodies are now well established in healthcare. Companies have remodelled their portfolios in the past two decades by focusing on new developments such as gene and cell therapies and RNA medications. Four of the six most popular biopharmaceutical products are expected to be developed by using innovative approaches depending on the emerging needs of the healthcare sector by end-2023. This is expected to be the case for all six leading products by 2028.

Source: New Drug Modalities 2023, BCG Industry Report

Challenges pharma companies are likely to face in portfolio remodelling:

-

Heavy R&D investment

-

Addressing safety concerns of emerging technologies and therapeutic areas

-

Developing operational and manufacturing capabilities that differ from traditional capabilities

-

Developing proper pricing and reimbursement channels to cover drug development costs

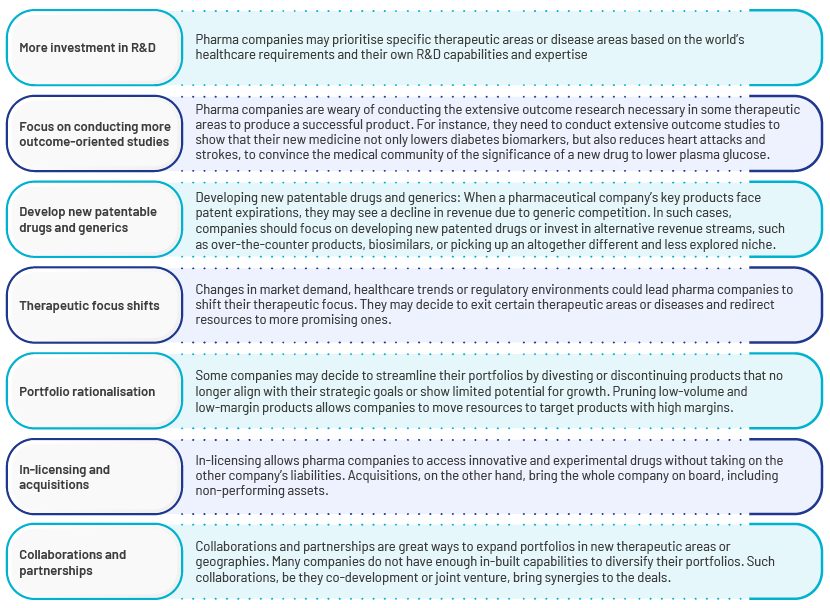

Common approaches pharma companies could include in portfolio-remodelling strategies:

Considering all these factors, pharma companies are trying to align with the changing environment to keep up with market dynamics. Until recently, the conventional illness categories of cardiovascular and metabolic disorders, neurosciences, arthritis, respiratory disorders, anti-infectives and oncology were pharma companies' key areas of interest in R&D. Their current portfolios, however, are very different. With the changing needs of the healthcare sector, most of these companies' pipelines are concentrated on immunology/inflammation, vaccines, biosimilars, rare diseases and internal medicine (mostly for non-alcoholic steatohepatitis, or NASH). Major therapeutic advancements including immunotherapy and cell and gene therapy have become a significant area of investment for practically all big pharma companies in the past 10 years.

Examples of portfolio remodelling

Companies such as AbbVie, Bristol-Myers Squibb and Takeda have taken steps to improve their pharma portfolios in recent years by focusing on novel therapeutic areas and treatment models such as gene therapy. Bayer, GlaxoSmithKline (GSK), Johnson & Johnson, Novartis and Pfizer have sold certain businesses such as consumer health, generics and animal health.

-

AstraZeneca has a diverse portfolio in oncology. In 2017, AstraZeneca and Merck established a strategic oncology collaboration. AstraZeneca is also working with Daiichi Sankyo to license its antibody-drug conjugate. AstraZeneca has partnered with innovative biotech companies to broaden its R&D efforts across oncology therapeutic discovery.

-

Novartis announced its strategic shift to become a pure-play innovative medicines company. Through its novel access approaches and technology, it now focuses on high-value innovative medicines. Its remodelling journey started with the divesture of the consumer health joint venture in 2018; it subsequently spun off Alcon, exited from Roche in 2021 and spun off Sandoz in 2022.

-

Pfizer plans to divest its 32% stake in consumer health business Haleon as it focuses on reducing debt linked to its USD43bn acquisition of Seagen and boosting returns to shareholders.

-

Sanofi made a targeted acquisition when it purchased Tidal Therapeutics, a biotech company with a focus on mRNA therapy.

-

Johnson & Johnson announced plans to separate its consumer health enterprise into a publicly traded company in November 2021.

-

Merck & Co. and Seattle Genetics made a similar move for their antibody-drug conjugate.

The main reason for portfolio remodelling is the realisation that each of these units requires different skills to operate them. It is strongly believed that these divested companies will be able to stand separately and be better equipped to win in their respective markets, and the prescription drug business will be able to pursue targeted innovation through R&D, partnerships and transactions.

Case study – The importance of change in portfolio in emerging therapeutic areas

1. Rare diseases

Rare diseases are a new field that has gained focus. The overarching objective is to develop a significant portfolio in particular therapeutic fields and establish credibility with a specified audience.

A rare disease is one that affects a small population but is recognised as a worldwide public health issue. Governments across the world are becoming more and more interested in the academic study of rare diseases and funding their treatment. Despite the increase in government regulations and social awareness, conducting clinical trials for uncommon diseases remains challenging.

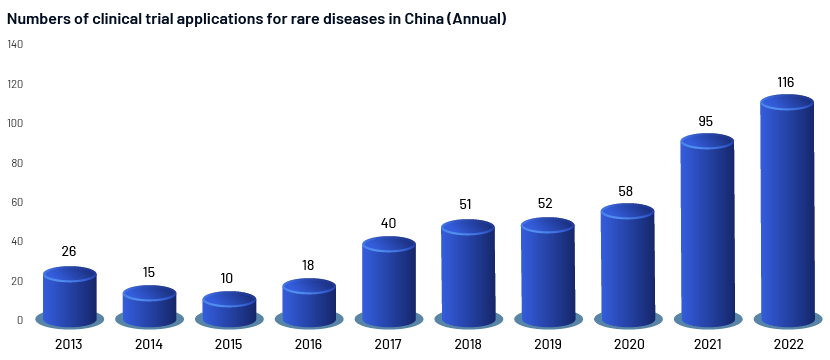

A total of 481 rare disease clinical trial applications were submitted from 2013 to 2022, representing a compound annual growth rate (CAGR) of 28.2%. The number of rare disease clinical trial registrations has increased steadily since 2015. In 2016, the number of rare disease clinical trial submissions increased by 80% from 2015. This may be related to China's introduction of a faster process for rare disease clinical trials and approval of infant drugs in 2015. Orphan drug filings in 2017 increased by 122% compared to 2016, consistent with the overall trend of investigational new drug (IND) filings. Rare disease clinical trial registrations increased by 63.8% in 2021 compared to 2020, and in 2022, by 22% compared to 2021. It could be argued that the 2020 coronavirus pandemic had little impact on clinical trials for rare diseases in China. Although it cannot be ignored that the annual growth trend of rare disease clinical trials is in line with the general trend of development of clinical trials in China, the CAGR is still lower than the average (32%).

However, compared to those for wide therapeutic areas, rare illness medication programmes have several advantages:

-

Access to patient advocacy groups that helps drive recruitment for clinical studies and raise awareness of the new medicine in the community

-

Clinical trials that require significantly fewer patients than necessary for programmes in major therapeutic areas such as cardiovascular diseases and diabetes

-

A more open-minded view on the part of regulatory agencies of the drug's risk-benefit profile

-

The potential for very favourable pricing

-

A higher likelihood of clinical success

Given these benefits, it is difficult to imagine that rare diseases would not consume a larger share of biopharma R&D funding in the future.

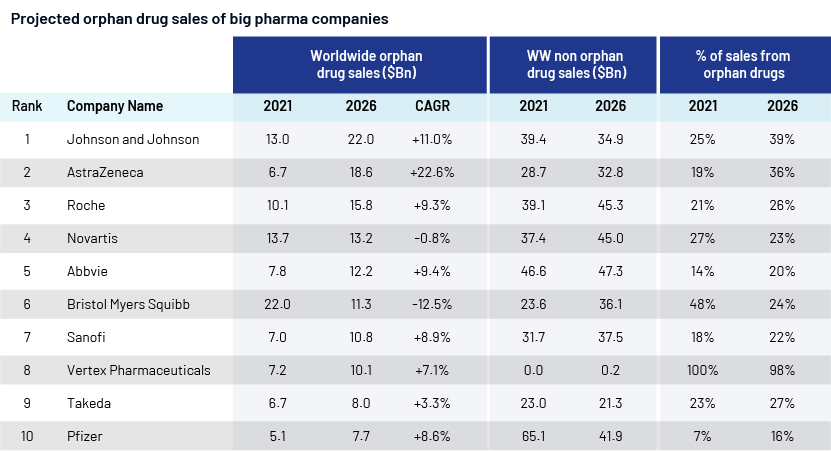

2. Orphan drugs

Big pharma companies have now started to focus on orphan drugs, too. Orphan drugs are no longer niche. Despite growth in orphan drugs, almost 7,000 rare diseases remain underserved. The pharma R&D pipeline is filled with chimeric antigen receptor T-cell (CAR-T) therapies, gene therapies and focused cancer medications, several of which have been designated as orphan drugs. Total projected sales for the top 10 orphan drugs in the pipeline by 2026 exceeds USD42bn.

According to Evaluate Pharma’s’ analysis,

-

In 2026, major pharma companies will financially support 8 of the top 10 most popular drugs for rare diseases – 9 if we include Novartis's rights outside the US to Incyte's Jakafi.

-

Vertex will be the sole biotechnology company in the top 10 as a result of AstraZeneca's acquisition of Alexion for USD39bn in 2021.

Apart from increasing focus on rare diseases and orphan drugs and other emerging modalities, pharma companies are also shifting their focus to other areas such as the following:

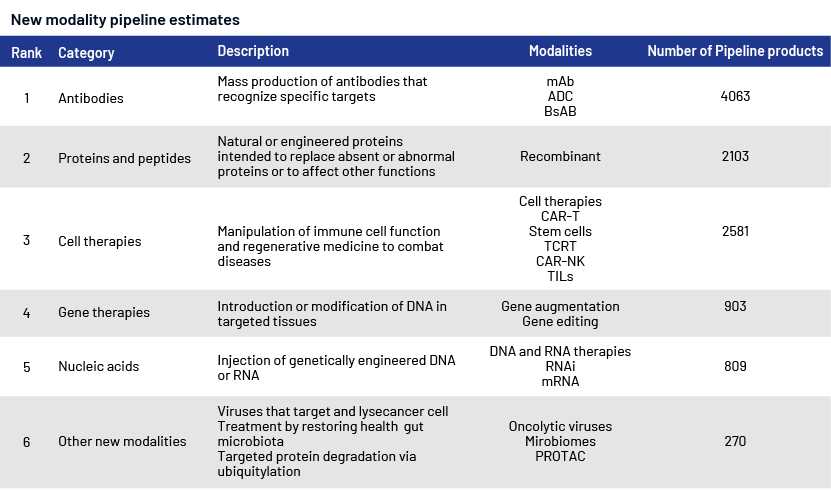

1. Antibodies: Companies are using antibodies as potential areas of growth for different types of medications, including antibody-drug conjugates (ADCs), which facilitate the targeted delivery of small-molecule chemotherapy drugs, and bispecific antibodies (BsAbs), which are able to target two antigens. This sector is attracting substantial investment interest, as evidenced by Pfizer's planned USD43bn purchase of Seagen for its ADC.

2. Immune cell therapies: Cell-based immune therapies have been used to treat different types of cancer since the FDA sanctioned the initial CAR-T therapy in 2017.

-

Efforts are ongoing to develop cell therapies for endocrine, musculoskeletal and dermatological disorders. These novel approaches are designed to enhance the effectiveness of previous cell therapies by addressing their limitations. For instance, T-cell receptor therapy (TCR-T), in contrast to CAR-T, is able to identify both intracellular and cell-surface antigens, which may lead to greater success in treating solid tumours.

3. Proteins and peptides: This area consists of enzymatic proteins, vaccines and target areas such as endocrine, immunology and haematology. This category includes glucagon-like peptide-1 agonists, targeting incretin hormone action.

4. Other nascent modalities include oncolytic viruses, microbiomes and proteolysis-targeting chimera (PROTAC).

New modalities

Note: ADC = Antibody-drug conjugate, BsAB = Bispecific antibody, CAR-NK = Chimeric antigen receptor-transduced natural killer cell, CAR-T = Chimeric antigen receptor T cell, mAb = Monoclonal antibody, PROTAC = Proteolysis targeting chimera, TCRT = T-cell receptor therapy, TIL = Tumour-infiltrating lymphocyte

Source: Evaluate Pharma

Areas pharma companies could focus on to enhance their portfolio-remodelling journey

1. Building differentiated capabilities: Key sector capabilities (distributed trials, machine learning, etc.) help drive pharma companies’ business in a differentiated way. Companies that make perfect use of these skills would have a competitive advantage.

2. Focus on IT and cloud investments: Pharma companies are investing heavily in internal resource planning systems (ERP), artificial intelligence (AI), automation and cloud. Now is the time to leverage these investments and improve the front-end patient experience to increase customer satisfaction, while improving operational efficiency.

3. Focus on areas other than oncology and rare diseases: Diseases such as AADC deficiency have a limited patient pool; therefore, the market does not have many competitors currently. By identifying such areas, pharma companies could have a first-mover advantage in the market.

4. Identifying new mechanisms of action: With increased R&D, new treatment areas can be identified for existing and traditional therapeutic areas, or novel treatments can be identified in which multiple therapeutic effects can be combined in a single treatment.

-

Oncolytic virus therapy is a good example; it not only kills tumour cells, but also blocks angiogenesis and activates innate immunity against tumours.

Conclusion

Successful remodelling depends on strategy formulation and effective execution.

Product pipelines are longer in the pharma sector than in many other sectors, and any change in portfolio would have a significant impact on the organisation and the sector. Thus, timely and apt formulation and execution of strategy become vital. Once the strategy is formulated, change management becomes a priority. A structured approach to manage the collective impact of the remodelling is essential. Ineffective management of stakeholder expectations would result in adverse effects.

Measuring the impact of remodelling is essential. Any course correction required should be implemented in a timely manner to minimise the long-term negative effects on the company.

Innovative methods are generating new ideas on how medications could function. One or more of these ideas may emerge as a game changer, transforming the available treatment options for a specific disease area. Remodelling portfolios by understanding the needs of the future would help pharma companies gain a competitive advantage. However, big pharma companies are in different stages of progress, each with its own level of uncertainty in R&D, ability to address unmet needs and timeline for potential commercialisation. It is crucial that they outline a tailored plan that aligns with their distinct portfolios and abilities, efficiently managing the advantages and disadvantages while optimising the allocation of resources to maximise the potential worth of a differentiated portfolio that addresses the needs of society, even if the patient pool for that disease is negligible.

How Acuity Knowledge Partners can help

We are a leading provider of high-value research, analytics and business intelligence services to life sciences, biopharma, medtech and healthcare consulting firms. Our offerings include Portfolio Analytics and Reporting, alongside bespoke research support on market entry and due diligence, portfolio management, licensing and acquisition, go-to-market strategy, opportunity assessment, regulatory landscaping, product launch analysis, market access and therapy area assessment, indication prioritisation, market research and forecasting, pipeline analysis and benchmarking and competitive intelligence

Sources:

-

https://info.evaluate.com/rs/607-YGS-364/images/WorldPreviewReport_Final_2021.pdf

-

https://info.evaluate.com/rs/607-YGS-364/images/Evaluate%20Orphan%20Drug%20Report.pdf

-

https://www.astrazeneca.com/content/dam/az/r-and-d/pdf/turning-science-into-medicine.pdf

-

https://www.novartis.com/news/media-releases/novartis-unveils-new-focused-strategy-

What's your view?

About the Author

Mansi brings about 3+ years of research and strategic insights experience in the healthcare and life sciences sector. She has experience in both primary and secondary market research. In her most recent role, she has been working on healthcare projects that include deep-dive market research studies, competitive analysis, benchmarking, competitive landscaping, go-to-market strategies, partner scouting and delivering final solutions to the client. Prior to joining Acuity Knowledge Partners, Mansi worked in a direct client-supporting role in primary market research.

Like the way we think?

Next time we post something new, we'll send it to your inbox