Published on June 4, 2020 by Sanyam Bhatia

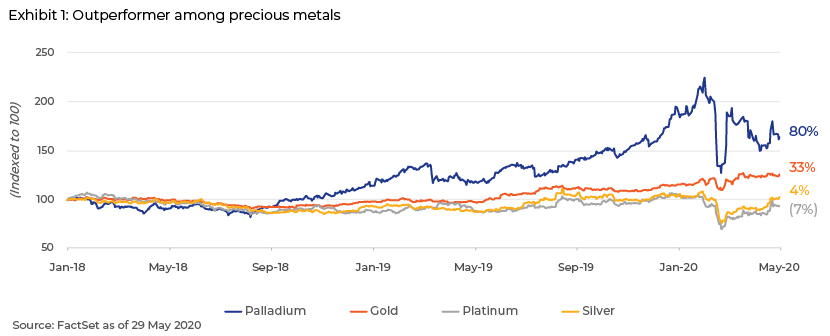

The platinum group metals (PGM) are a group of six elements valued for their range of use in industrial, medical, jewellery and electronics applications. Palladium, a silver-white metal, has excellent catalytic properties due to its unique ability to absorb hydrogen. The metal currently trades at USD1,935/oz and is the most expensive of the four major precious metals – gold, silver, palladium and platinum; it has outperformed even during these testing times.

Source: FactSet

Palladium, primarily extracted as a by-product (c.90%) from operations focused on other base metals such as platinum, nickel and copper, is mined mostly in Russia and South Africa (75-80% combined), followed by Canada and the US. Russia produced 86MT in 2019, followed by South Africa at 80MT, as per Statista data.

Stellar performance in the past

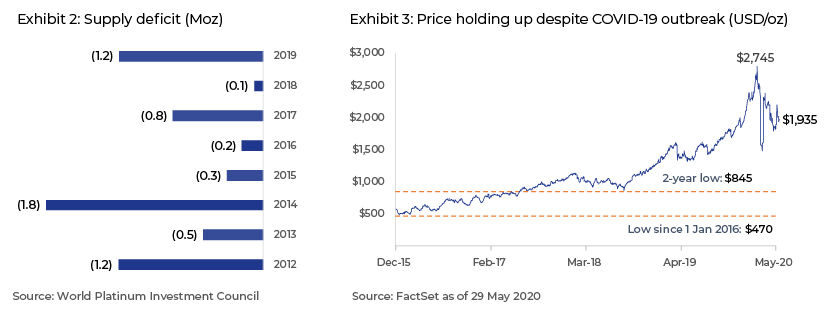

Most (80-85%) of the metal produced ends up in catalytic converters in vehicles to reduce the harmful effects of pollutants in the exhaust system. The price of palladium has increased in the past eight years, primarily because of the supply deficit (Exhibit 2), a catalyst for the metal’s performance. The price jumped 340% from the beginning of 2016 to end-2019 (Exhibit 3), and jumped nearly 52% in 2019 alone.

It touched an all-time high of USD2,745/oz on 27 February 2020 due to a dust explosion at Anglo American Platinum's (Amplats’s) Waterval smelter, termed a force majeure event, leading to supply disruption and even wider palladium market deficit forecasts for 2020.

Government regulations on pollution control

Governments globally are tightening emission-control regulations. Earlier this year, China’s new emissions standards (the China 6 standards) kicked in, requiring vehicles to contain 30% more palladium. Europe, too, has introduced more stringent rules (such as the Euro 6d legislation) that, along with a demand shift from diesel to gasoline vehicles, have increased demand for the metal, leading to an increase in its price despite the reduction in auto production in most markets.

Market response to supply deficit

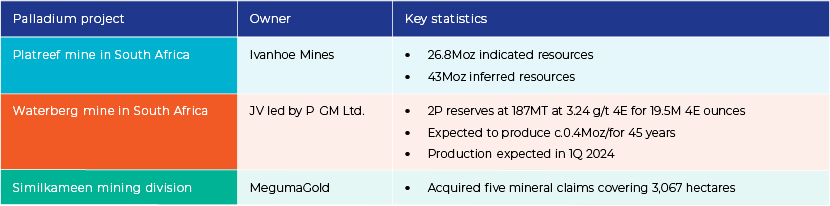

Most of the world’s palladium is produced by Russia-based Norilsk Nickel (c.39% of global production in 2019). Seeing the potential opportunity, many miners have planned to invest in new projects.

The current crisis may pose challenges, and it would, therefore, be important to review project implementation once the global lockdowns are lifted.

Impact of COVID-19

The automobile industry, the largest user of palladium, has been affected badly, with production and vehicle sales coming to a halt. China reported a 42% sales decline in 1Q 2020, as per data from the China Association of Automobile Manufacturers, and local governments are offering cash subsidies to revive demand. New passenger car registrations dropped by 76% y/y in the EU in April 2020, as per the European Automobile manufacturing Association.

Palladium had a good start to the year, even reaching an all-time high in February, but this swiftly faded with the COVID-19 outbreak. The price fell sharply in mid-March, but has since made a classic U-shaped recovery due to the lockdowns in/restrictions imposed on Russia and South Africa, further tightening supply.

On 21 April 2020, IHS Markit lowered its forecast for global light vehicle sales for 2020. It expects a decline of 22% in the wake of the pandemic, with a decline of c.27% and c.25% in the US and Europe, respectively. Sales in Mainland China are expected to drop c.16%.

Possibility amid volatility

The industry is contemplating substituting palladium with platinum in gasoline vehicles, but the system would need to be redesigned first. An economic benefit is certain, but a few reasons are slowing its advancement:

-

The cost of palladium is just a fraction of the total cost of the vehicle

-

The costs involved in reengineering

-

Concerns about not meeting emissions regulations and “real-world” standards

-

Focus shifting towards electrification

BASF announced on 10 March 2020 that it had developed a new petrol engine that uses only 20-50% of palladium currently being used in vehicles; however, its deployment in the “real world” is likely still a few months away, as it would require extensive testing to ensure driving standards are met

Outlook

IHS Markit expects global light vehicle production to decline by c.21% in 2020. Russia's Norilsk Nickel revised its outlook in March 2020 in the wake of COVID-19 and expects a less severe palladium deficit. As per a UBS report published on 15 April 2020, a 20% decline in global sales could lead to a palladium surplus this year.

However, the supply disruptions in South Africa due to power outages and restricted production at Amplats are likely to partially offset the decline in demand. The global lockdown will also affect the supply side. Moreover, the upcoming projects and the technology, that would replace the use of metal, are not expected to be operational anytime soon.

The market is, therefore, expected to be in supply deficit in 2020, although less than previously forecast

At end-March 2020, BMO Capital expected the platinum and palladium markets to be volatile and the price of palladium to average USD2,313/oz in 2020. Forecasting movement in metal prices is difficult at present due to the uncertainties surrounding COVID-19, but a recovery is expected by the end of 2020 or early 2021, and this recovery would decide whether the prices reach new highs; we currently believe this is highly unlikely.

At Acuity Knowledge Partners, we extensively track industry trends and offer research and analytics support to investment banks and advisory firms globally. We also offer technology-enabled solutions across the investment banking spectrum – including M&A, capital markets, and restructuring and debt advisory services – across sectors, including the metals and mining, oil and gas, industrial and retail sectors. We have an extensive pool of resources with in-depth knowledge and expertise in the metals and mining space. For more details on our investment banking services, click here.

Sources:

Norilsk Nickel

Reuters

S&P

Statista

Press releases

What's your view?

About the Author

Sanyam Bhatia has over 11 years of work experience in Investment Banking and Restructuring & Debt Advisory. During his tenure, he has assisted various investment banks globally and worked across a number of sectors including Aviation, Industrials, Metals & Mining and TMT. His area of expertise includes financial modeling, industry research, and client engagement. Sanyam holds a Master of Business Administration (Finance) from ICFAI Business School (IBS), Dehradun, and a Bachelor of Commerce from Punjab University, Chandigarh.

Like the way we think?

Next time we post something new, we'll send it to your inbox