Published on November 17, 2022 by Pranay Pradeep Bharambe

Introduction

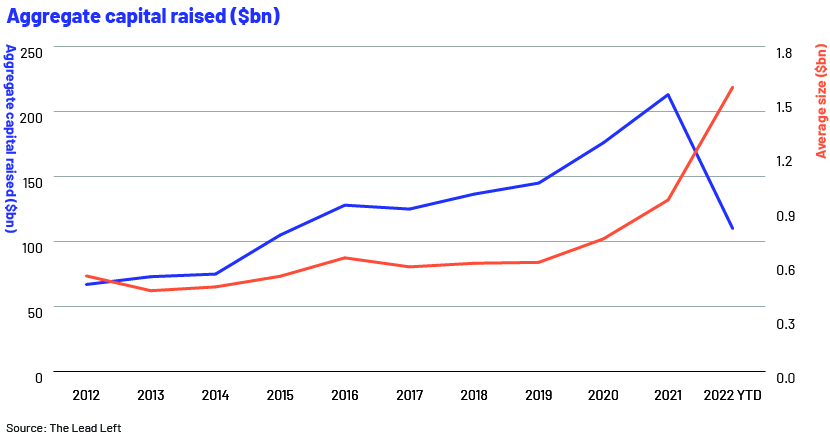

Private debt, which refers to loans not provided by banks or public markets, spiked amid the pandemic on the back of government support for extensive credit guarantees, liberal lending programmes and repayment moratoriums. Global private debt jumped to USD1.6tn by mid-2022, a 66% increase from 2021 and more than double the amount in 2020. Continued growth in private debt is driven by investors’ search for higher yield and recent stock market volatility. For borrowers, private debt offers more flexibility. For instance, private lenders often have liberal loan underwriting standards, characterised by increased EBITDA addbacks, and lenient or no covenant structures.

The spike in overall leverage of borrowers due to private debt should not be underestimated. While monetary easing by regulators may be necessary to support vulnerable households and firms, given the uncertain economic recovery, it could bolster leverage and elevate the risk to future economic activity, as such households and firms are more exposed to adverse shocks. Economic recovery is further impeded by the Russia-Ukraine war; this is compounding the risks by intensifying inflationary pressures and undermining the recovery in many economies. Despite these risks, investors still favour private debt due to its floating rates and shorter duration than traditional fixed-rate loans. Private debt is well positioned to report a CAGR of 17.4% from 2022 to 2026, and become the second-largest private capital asset class in 2023, according to the 2022 Preqin Global Private Debt Report.

We list below potential risks that investors, borrowers and regulators should not lose sight of:

1.Inflation and interest-rate risk

Private debt is typically structured as floating-rate notes; returns have, therefore, historically tracked rising interest rates, hedging against inflation. Although rising interest rates benefit investors, they require borrowers to service higher debt payments. Given that private debt is more concentrated in middle-market borrowers and speculative-grade companies (averaging USD30m in EBITDA), their ability to service debt in an inflationary environment remains circumspect. In 2022, the Federal Reserve enacted its third 0.75 percentage-point interest-rate hike, taking its benchmark rate to a range of 3-3.25%; the market has already started pricing in a peak of about 4.6% in the Federal funds rate. With interest rates expected to rise, defaults in private debt are likely to increase if borrowers cannot service incremental costs, either by passing costs to customers or absorbing them amid slowing economic growth.

2.ESG implementation risk:

ESG factors are rapidly influencing the financial sector, and the private debt market is no exception. In 2021, ESG-linked credit issuance in Europe increased by 39.8% y/y to EUR923m, and nearly 87.1% of fundraising is forecast to be driven by ESG considerations by 2025. Despite the increased need to incorporate ESG considerations in private debt markets, there remain challenges due to a lack of data. The difficulty in data accessibility is because only a few private companies publish sustainability reports, or have the capability and resources required to assess their ESG parameters. Hence, ESG integration in the private debt market is not standardised and requires proactive engagement.

3.Illiquidity risk:

Private debt poses illiquidity risk, as it is not traded in the secondary market. Consequently, there is limited market discovery, and lenders often approach the market willing to hold the debt to maturity. Therefore, it is common to see higher yields for these investments than for similarly rated public debt to compensate for illiquidity.

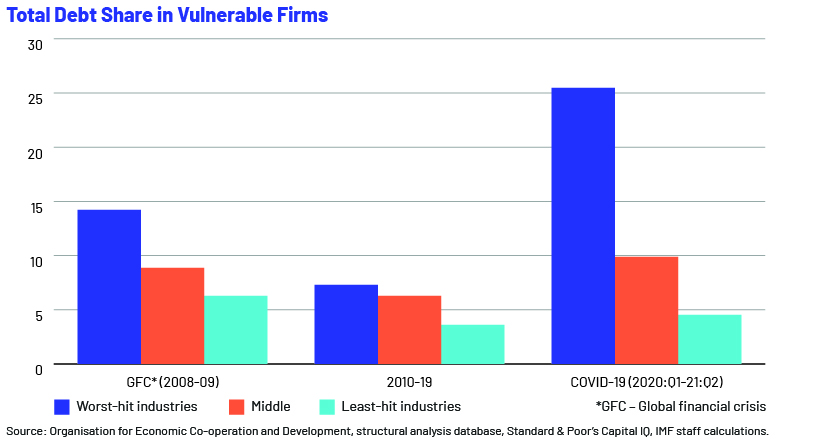

4.Slow economic growth:

As economies recover and inflation accelerates, policymakers of many countries are tightening monetary policy. This could cause large and potentially long-lasting disruptions to households and firms with weak financial positions. The decision to rapidly tighten monetary policy becomes crucial in countries affected severely by the pandemic, as default from riskier sectors could spill over to the rest of the economy. The IMF has indicated that elevated levels of leverage could slow economic recovery by a cumulative 0.9% of GDP in developed nations and 1.3% in emerging markets, on average, over the next three years. Recovery is expected to be much slower in economies where indebtedness is more prominent in low-income households and vulnerable firms, government support is limited and monetary policy is tight.

How risks associated with private debt can be mitigated

Regulators could mitigate risks associated with private debt in the following ways:

1.Increasing transparency:

Regulators should aim to enhance the transparency of borrowers’ financial statements and private lenders’ underwriting processes by mandating effective supervision, standardised practices for asset-quality reporting and implementing ESG considerations. Consensus could be reached in setting a minimum mandatory standard of data disclosure.

2.Implementing effective insolvency and restructuring processes:

Regulators should enhance restructuring and insolvency mechanisms, so that proceeds from the liquidation of vulnerable, non-viable firms can be reallocated towards more productive firms. Similarly, if higher household debt poses a threat to economic recovery, the government could consider restructuring aid to route funds to vulnerable households most likely to service the debt.

3.Timing policymakers’ actions:

The central banks of many economies have embarked on monetary tightening in 2022 to curb financial stability risks stemming from mounting leverage and rising inflation; however, the timing of deployment is more crucial where the pace of recovery is slow. An exit from liquidity support could eventually lead to more default by sectors still recovering from the crisis (for example, tourism, hospitality and contact-intensive services) and by households that are returning to normal. Thus, policymakers face a trade-off between supporting growth in the short term by injecting funds and containing downside risk.

How Acuity Knowledge Partners can help

Our Lending Services vertical helps financial institutions assess credit risk and formulate underwriting processes, and provides tools to manage risk on an ongoing basis. We have nearly two decades of experience in offering bespoke support to global clients in the private debt space through a wide range of solutions including portfolio surveillance and insights on managing risk during systematic shock. We keep an eye on macroeconomic factors affecting markets and provide end-to-end support, customised to client requirements. This has helped our clients streamline operations, speed up decision making and ensure better portfolio management.

Sources:

-

https://www.imf.org/en/Publications/WEO/Issues/2022/04/19/world-economic-outlook-april

-

https://elfainvestors.com/wp-content/uploads/2021/Challenges-and-Private-Debt-Survey.pdf

-

https://pitchbook.com/news/articles/private-debt-market-institutional-investors-pandemic

-

https://www.spglobal.com/en/research-insights/featured/private-debt

Tags:

What's your view?

About the Author

Pranay has over 8 years of experience in working with leading global organizations in the banking and commercial lending domains. At Acuity Knowledge Partners, he is part of a large portfolio underwriting team covering diverse sectors for a mid-size US bank. His expertise spans credit analysis, financial modelling, fixed income analysis and leveraged lending. Pranay is CFA Charterholder and holds an MBA from Cardiff Business School, UK.

Like the way we think?

Next time we post something new, we'll send it to your inbox