Published on June 7, 2022 by Archana Kanojia

The year 2019 was definitely a year of locks and downs. While the global economies were put under lock to halt the spread of the virus, economic activity went down due to the pandemic-induced restrictions. Private equity suffered a setback for a while, but having learnt from past events (such as the global recession of 2008-09), it was able to recover fast to pre-pandemic fundraising levels. This confidence was identified in our landmark survey, which shows that private equity and venture capital (PE&VC) professionals are very enthusiastic about fundraising in 2022.

Fundraising is expected to remain strong in 2022, continuing the trend of rising fundraising in recent years, driven by expectations of low interest rates and the business support ecosystem

– Acuity’s 2022 PE&VC survey

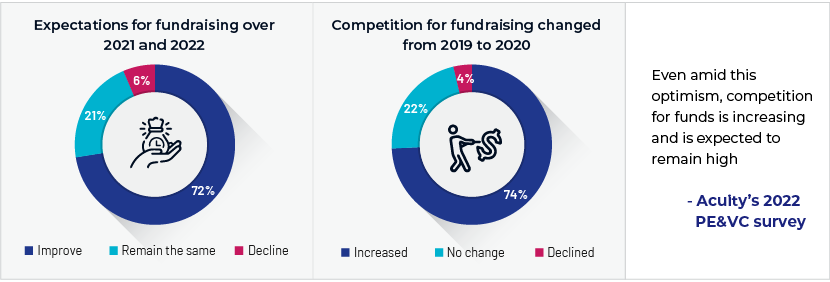

As markets open up and economic activity picks up pace, expansion of the private equity market in terms of fundraising and investments will likely be gradual and in line with positive market sentiment. Our survey results highlight this optimism.

“Despite a large number (74%) of respondents experiencing increasing competition for raising funds recently, almost the same number (72%) still believe fundraising should improve in 2022”

Performance of private equity verticals

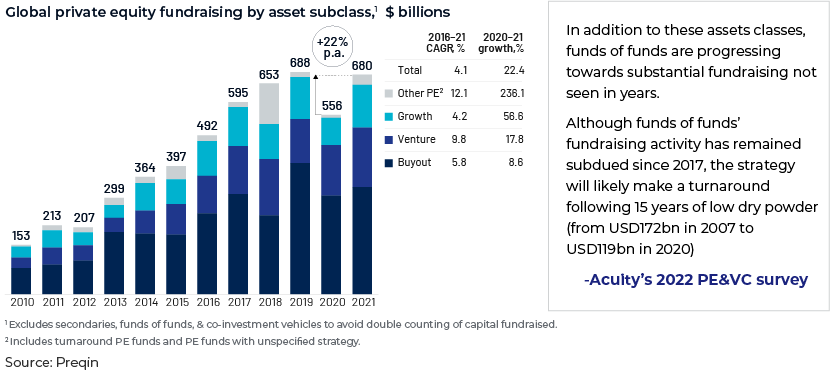

Private equity remained the highest-performing market class among peers such as real estate, natural gas, infrastructure and private debt. It recorded AuM of USD9.8tn in 1H 2021 (33% more than for all of 2020), and fundraising reached USD680bn[1] in 2021, as many deals put on hold due to the pandemic were concluded. Buyout deals surpassed venture and growth deals and recorded a fundraising volume of USD331bn.

Buyouts (80%) and funds of funds (90%) are the most positive about an increase in fundraising

– Acuity’s 2022 PE&VC survey

On the other hand, private equity asset classes across verticals such as buyouts and growth showed an improvement in 2021 from the 2020 slump and were back to the previous trend of high growth.

One hundred and four growth equity funds closed in 2021[2], clocking a deal value of USD74.2bn and recording growth of 30% and 44% in terms of transactions and deal value, respectively. This was fuelled by increasing capital investment in health and technology companies. Considering that the pandemic led to a wave of digitalisation across global economies, the trend of technology-based investments is likely to continue in 2022.

-

Permira, a UK-based buyout firm, closed its second growth equity fund in December 2021 at USD4bn, surpassing its target of USD2.5bn

-

Tiger Global Management, a US-based investment firm, closed its growth fund in March 2022 at USD11bn

If there is a deal out there, private equity is sure making its way towards it. With USD3.4tn of dry powder at its disposal, we believe fundraising is sure to increase.

The road ahead

With markets adjusting and economic activity returning to pre-pandemic levels, the private equity space is very likely to conclude the deals put on hold. The result could be a further increase in private equity fundraising.

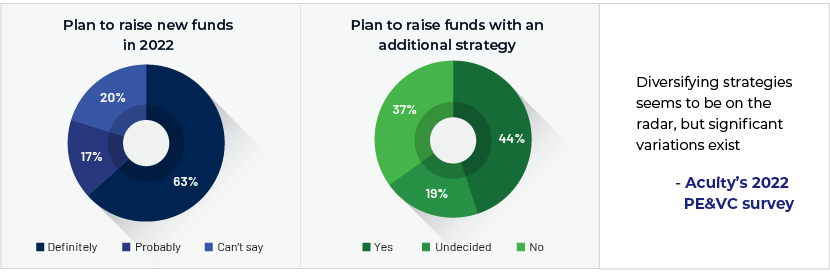

Fundraising is expected to increase in 2022, with two-thirds of the respondents planning to raise new funds while another 17% think they may

Acuity’s 2022 PE&VC survey

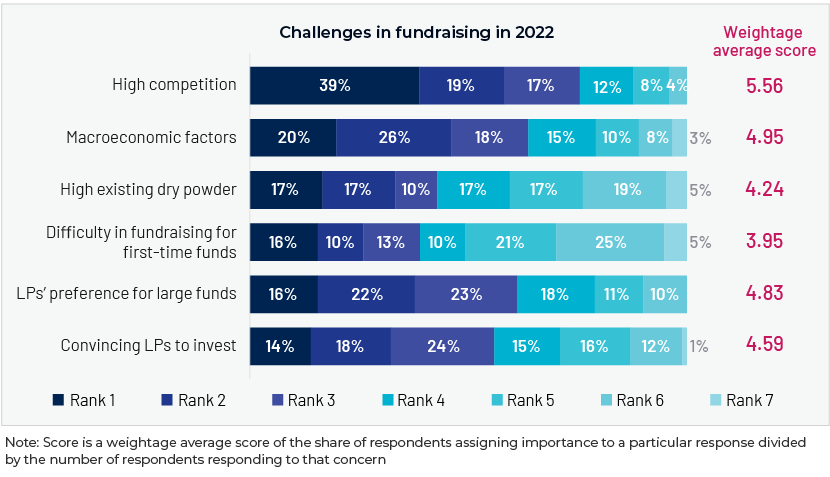

The trend of increasing fundraising has its own challenges.

Pandemic-related travel restrictions and the current political and regulatory climate are also impacting fundraising. At times, firms face challenges due to their internal structures, e.g., niche mandates, investment strategies and resources available for marketing efforts. Firms’ performance and valuation could also hinder fundraising – Acuity’s 2022 PE&VC survey

How Acuity Knowledge Partners can help

We have more than two decades of experience in offering fundraising support to global clients. Our services range from market mapping and target screening to pre-sales support, with our teams of subject-matter experts working as an extension of the client team.

Sources:

https://www.eisneramper.com/private-equity-ea-0222/

https://www.bain.com/insights/topics/global-private-equity-report/

https://www.eisneramper.com/private-equity-ea-0222/

https://www.bain.com/insights/topics/global-private-equity-report/

What's your view?

About the Author

Archana Kanojia started her career with Acuity Knowledge Partners in 2010. She currently provides oversight to various teams assisting client business development teams’ in proposals drafting, managing proposal content, lead generation and consultant databases. Previously, she provided oversight to teams that assisted clients to set up fund databases for private equity funds of funds, analyzing private equity (PE) firms and their funds from an investment standpoint, and also extended investment support to PE firms through industry studies, information memoranda and similar activities.

Archana holds a Post Graduate in Business Management with a specialization in Finance and Marketing from New Delhi Institute of Management, Delhi. She..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox