Published on January 5, 2023 by Ambarish Srivastava

Since the global financial crisis, the private equity and venture capital (PE&VC) sector has enjoyed two major tailwinds: (1) easy money and (2) global peace. Easy money stemmed from abysmally low interest rates. Geopolitics was largely supportive as strategic differences of key trading partners were kept to rhetoric and were not a serious impediment to trade. Even the two decades of conflict (e.g., Afghanistan and Iraq) remained localised. However, easy money and global peace have been disrupted in 2022, and the effects will likely be felt in 2023 as well.

These observable challenges would alter the way we conduct business in 2023 and have the potential to impact the landscape after next year. Any change in the business climate would impact the investment landscape. In the private-asset sector, exits may see an immediate impact. Investment evaluation may become more conservative, resembling pre-pandemic evaluations.

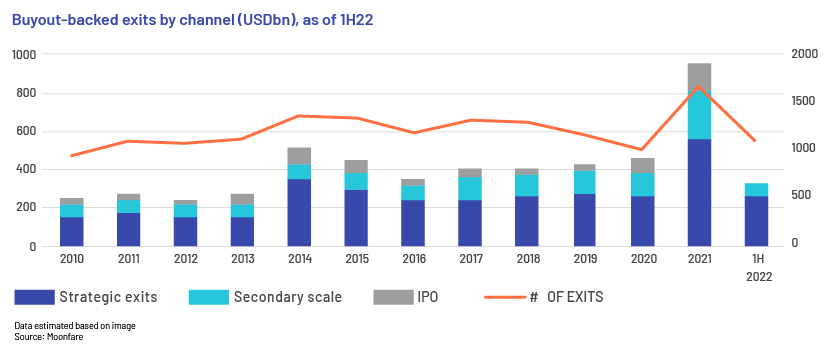

Exits may face a challenge, but strategic sales seem stable for now

Exits via strategic sales, driven by business needs, are likely to be slower than the abnormal level in 2021 but steadier as in pre-pandemic years. Sponsor-to-sponsor exits seemed to be less affected in 1Q22, but as the year progressed, secondary sales began being strained, too.

Sponsor-to-sponsor sales had decreased as of September 2022, according to Bain & Company, while IPOs were miniscule. The IPO market was nearly non-existent; US companies have raised only USD4.3bn via IPO in 2022 versus USD102bn in 2021 as the markets became bearish. Last year saw significant SPAC activity; together with IPOs, these were 28% less than buyout-backed exit values in 2021, up from 23% in 2020. A lot would depend on how markets move in 2023. As of end-2022, they are showing a comeback.

SPACs are cooler now than before

SPAC tailwinds are absent as investors are getting jittery. Renowned SPAC mughals have faced challenges in 2022. Chamath Palihapitiya returned USD1.6bn to investors in October 2022 as he could not obtain suitable merger targets within deadlines, and Bill Ackman, after raising USD4bn in the biggest-ever SPAC, folded the deal in July. SPACs are not as successful as they were last year – there were 78 SPACs in the first nine months of 2022 compared to 444 in the same period of 2021.

SPACs lose their shine due to rising interest rates and a slowdown in IPO; interest rates are likely to remain elevated in 2023, at least until supply shock-driven inflation persists. Hence, SPACs are expected to remain sluggish.

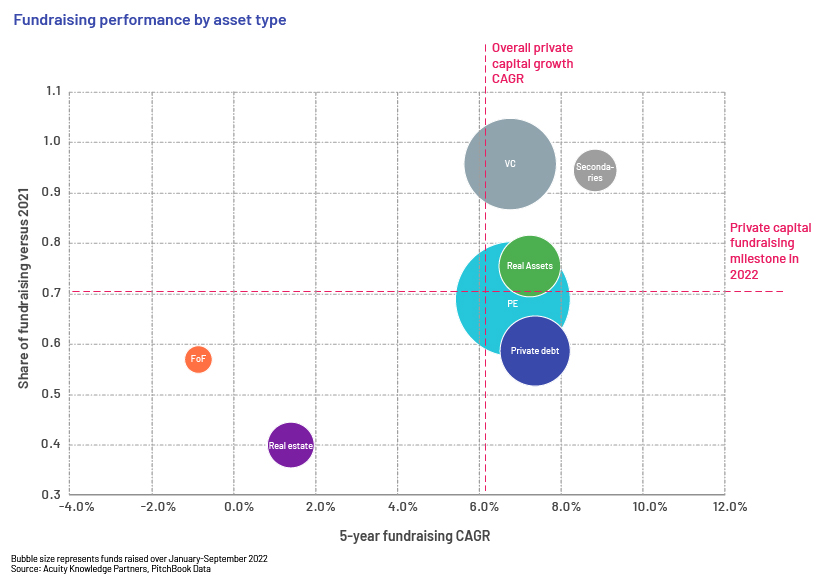

Fundraising has weakened in the latter part of 2022, but not for all kinds of funds

Weak PE fundraising was widely reported in 2022. PE raised only 69% of the funds raised in 2021 (75% of the funds raised in 2020). However, this was not the case for all private capital segments. For one thing, most observations are based on 2021, an astonishingly optimistic year. However, VC and secondaries are close to their 2021 fundraising levels, and may surpass these. Real estate and funds of funds seem to be struggling, although funds of funds have a smaller impact on overall fundraising.

Funds raised by real assets are 75% of funds raised in 2021 and 95% of funds raised in 2020; it is safe to say, therefore, that fundraising is at appropriate levels, although suppressed from levels in 2021.

However, we also have to look at other means of investment – for investors as well as those seeking capital. Banks have fallen out of favour since the global financial crisis due to a number of reasons. While some money is likely to go to “safer” instruments, PE is likely to remain strong in the saddle. Interest rates may be adjusted amid concern of a recession. Federal Reserve Chair Jerome Powell has indicated that the pace of rate increase may decline.

Investment in tech may face more scrutiny

Tech, the darling amid the pandemic, looks like a cousin of the dot-com bubble. Easy money inspired risk taking, channelling substantial investment into tech ventures, particularly fintech. Tech startups or “unicorns” were created, with less discussion on business viability and cashflow. As the funding environment contracts, investors are likely to get more bargaining power. Fintech unicorns are the most affected of unicorns.

N Chandrasekaran, chairman of large Indian conglomerate Tata Sons, advises looking at steady cashflow rather than chasing valuations, indicating the need for pragmatism in valuation assessments. However, fear could be stronger than pragmatism. Pär-Jörgen Pärson, partner at VC firm Northzone, believes large unicorns may be heading towards spectacular collapse. If this materialises, it would be history repeating itself, after the “irrational exuberance” of the dot-com bubble in 2001 and the real estate crisis of the 2000s. This would necessitate stricter due diligence.

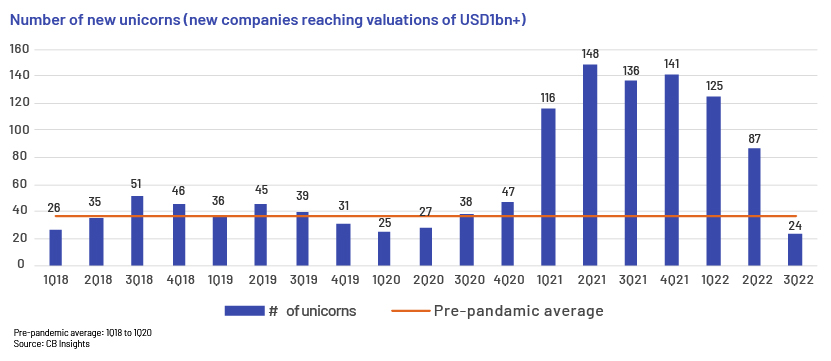

Unicorns declining to normalise the exuberance

Unicorns are very much in existence, but their valuations are more reasonable than in 2021. Yes, there is talk of spectacular failures, but it should be noted that investments in other avenues were restricted during the pandemic-related lockdowns. A lot of easy, low-cost money was channelled into businesses “active” amid lockdown, primarily those in the digital space. Hence, valuations in such pockets skyrocketed regardless of their viability. In terms of sound investment targets, we note that asset managers found identifying suitable targets with realistic valuations difficult in 2020-21.

Tracxn data shows that the number of unicorn events is still above the long-term average. CB Insight quarterly data reveals that 1Q22 was as optimistic as 2021; however, numbers dropped in 3Q, although they were still in line with the long-term quarterly average.

This may augur well for the sector in the long term as the focus of evaluation shifts to generating revenue and profitability-driven and viable business from speculating on scalability and expansion. There are already adjustments to valuation, as evidenced recently with Stripe (payment firm), Klarna (Swedish buy-now-pay-later firm), Instacart (delivery startup) and BlockFi (cryptocurrency). In addition to these known names, 81 US companies have seen a decline in funding in 2022.

A strengthening dollar is also driving a decline in unicorns outside the US, as these unicorns are valued in their local currencies, which are then converted to dollar values.

Summary

We believe the challenges that have emerged during the latter part of 2022 will continue through 2023. However, looking at 2022-23 without the pandemic as reference, 2023 may see PE activity returning to pre-pandemic levels. We, therefore, need to keep close watch of macroeconomic events.

How Acuity Knowledge Partners can help

We have worked with PE firms for two decades, helping them navigate both financial crises and investing exuberance. Our pool of analysts is well placed to assist PE clients weather economic cycles.

Source

-

https://pitchbook.com/news/articles/pe-ipo-mergers-buyout-trends

-

https://www.moonfare.com/blog/private-equity-exits-why-investors-should-look-beyond-the-

-

https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/pe-exit-

-

https://www.reuters.com/business/dreaded-down-rounds-shave-billions-off-startup-valuations-

-

https://www.moonfare.com/blog/private-equity-exits-why-investors-should-look-beyond-the-

-

https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/spac-

-

https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/spac-

-

https://www.moneycontrol.com/news/world/jerome-powell-signals-downshift-likely-more-hikes-

-

https://www.cbinsights.com/research/unicorn-company-slowdown/

-

https://economictimes.indiatimes.com/news/company/corporate-trends/focus-on-steady-cash-

-

https://www.cbinsights.com/research/unicorn-company-slowdown/

-

https://www.cbinsights.com/research/unicorn-startup-market-map/

-

https://inc42.com/buzz/funding-winter-indias-unicorn-boom-slows-

-

https://www.reuters.com/business/dreaded-down-rounds-shave-billions-off-startup-valuations

Tags:

What's your view?

About the Author

Ambarish has about 17 years of experience in business research, analysis and consulting. He is engaged in leading deep-dive strategic projects, due-diligence support, issue-focused trend analysis and similar assignments for our Private Markets clients. His previous experience includes tenures with startups, the Big Four and consulting organisations, where he focused on industry studies, price forecasting, company analysis, macroeconomic studies and other strategic engagements.

Like the way we think?

Next time we post something new, we'll send it to your inbox