Published on March 28, 2025 by Rabin Thakur

Environmental, social and governance (ESG) factors have increasingly become integral to investment decisions in private markets ESG trends. Our Private-Markets Survey 2024 suggests that more than 90% of private-markets investors consider ESG-related risks in their investment decisions. In fact, 46% of the respondents reported having a comprehensive process in place to identify and mitigate ESG risks.

With greater regulatory pressures and a competitive market looking to generate shared value, Private markets ESG trends are likely to continue to be a core differentiator among private investors. It would, therefore, be interesting to note some of the Private markets ESG trends that private-markets investors should be aware of and align themselves with, to derive the maximum value.

How ESG Regulations Are Driving Private Markets Sustainability in 2025

The Sustainable Finance Disclosure Regulation (SFDR) gave a major push to private investors, especially those in the European Union (EU), to consider ESG and sustainability matters in their decision-making and report on key ESG parameters. The recent Corporate Sustainability Reporting Directive (CSRD) is expected to increase regulatory pressure in the EU, with more than 50,000 companies required to report under this framework.[1]

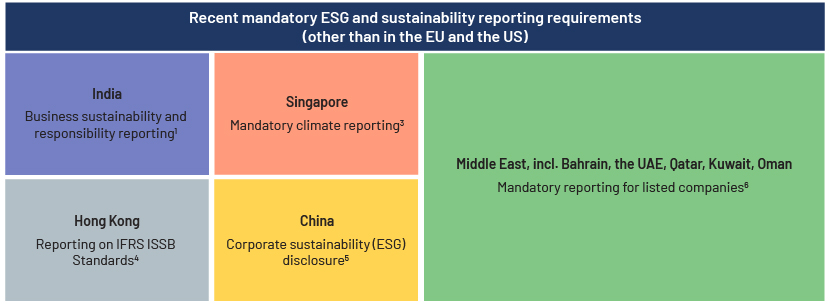

The US Securities and Exchange Commission (SEC) has also proposed rules, making it mandatory for listed companies to make climate-related disclosures.[7] The private markets should be on the lookout for such disclosure mandates. Countries in Asia Pacific, including India, Hong Kong, Singapore and China and many countries in the Middle East have seen similar mandates in recent years.

While this has resulted in a major push among private investors to identify ESG-related topics and integrate them into their investment decisions, the year ahead will likely see more being done strategically. Private markets would be looking to gain a strategic advantage by working on ESG considerations, which, until now, were more of a regulatory requirement.

How Anti-Greenwashing Rules Impact Private Markets

The developed markets of the EU, the UK and the US are adopting measures aimed at tightening regulations on greenwashing.[8] With the EU’s SFDR in its third year, the UK’s Sustainability Disclosure Requirements (SDR) keeping impact investments separate and the US’s Name Rule (addressing false claims misleading investors), greenwashing practices are likely to diminish sooner rather than later.

Rise of impact/green funds aligned with Sustainable Development Goals (SDGs)

Impact funds have increased significantly in the past five years. Private equity impact funds have grown by 219% since 2015, aligned with the goals outlined in the UN SDGs, with most tied to three goals: SDG 2: Zero Hunger; SDG 3: Good Health and Well-Being; and SDG 9: Industry, Innovation and Infrastructure.

There are 712 private equity impact managers, and approximately 50% of these have funds open to new investments, according to a private equity impact report published in January 2025. The data suggests significant growth potential in impact funds in 2025.[9]

Senior positions being filled with personnel dedicated to working on ESG and sustainability

ESG considerations have traditionally been handled by a business’s health, safety and environment (HSE) function. With more visibility on the ESG performance of businesses and their increased accountability in terms of sustainability, ESG considerations have now risen to become a major topic for discussion among the top ranks of an organisation.

The UK leads the way in terms of ESG considerations being discussed in the boardroom, according to a recent survey conducted by a global consulting firm. One-third of the businesses surveyed had a chief sustainability officer, with the position also being filled from within the UK. Interestingly, the UK still lagged countries such as France, the US and India in terms of establishing these positions.[10]

Our Private-Markets Survey 2024 shows that 87% of the respondents have personnel dedicated to managing day-to-day ESG-related affairs while 79% have an ESG committee in place, an increase from 78% and 66%, respectively, in the previous year. We assume that private-markets firms including private equity, asset managers and secondaries expect to hire senior and dedicated ESG personnel to manage their performance on core topics of responsibility, impact and sustainability.

Outsourcing ESG Operations: A Cost-Effective Strategy

ESG-related exercises are spread across the lifecycle of an investment. Due diligence, ESG analysis, risk profile, ratings, etc. are the typical tasks on the pre-deal side, while on the post-deal side, exercises relating to ESG engagement, data collection from portfolio companies, monitoring and reporting are the most significant.

The biggest challenges that private-markets face in carrying out ESG work are the lack of proper data-collection methodology and then processing the data for performing the required analysis, a key concern among Private markets ESG trends in 2025. The complexity increases due to a lack of trained ESG resources amid the tighter regulations globally. Keeping up with Private markets ESG trends is essential for firms looking to navigate these regulatory challenges effectively. The result is an ever-increasing burden of ESG compliance, associated with ever-increasing costs of training and retaining skilled ESG professionals.

In this scenario, private-market participants envision outsourcing routine services, which ensures substantial cost saving as outsourcing providers offer specialised services in domains such as sustainability, ESG, green financing and impact investing.

How Acuity Knowledge Partners can help

We are the leading provider of ESG research services to the private markets. Our capabilities are developed around both front- and back-end support functions within the ESG domain. We provide specialised services relating to enhanced due diligence, risk analysis, data collection, data cleaning and aggregation, analysis and reporting and have hands-on experience in supporting clients throughout their regulatory reporting journey. We have supported clients on either side of the maturity continuum to set up ESG solutions.

Source

[2] ESG Reporting Mandate in India

[3] SGX Sustainability Reporting

[4] ESG Today: Hong Kong Sustainability Reporting

[5] China Briefing

[6] Convene ESG: State of ESG reporting in the Middle East

[9] Phenix Capital Private Equity Impact Report 2025

[10] PwC: UK firms turning to CSOs

What's your view?

About the Author

At Acuity, Rabin is overseeing multiple ESG engagements which includes research, analysis and reporting assignments for clients in the US and Europe. Overall, Rabin holds an experience of ~11 years which is spread across various areas of client management and interface within the domain of ESG and Sustainability. Rabin holds a post-graduate diploma in Sustainable Management from Indian Institute of Management, Lucknow

Like the way we think?

Next time we post something new, we'll send it to your inbox