Published on May 23, 2023 by Karan Arora and Parushi Kalra

Sustainability, ESG and green financing were the trends in 2022, as evidenced by the unprecedented deal numbers. Ageing demographics and the “energy transition” are likely to have a significant impact on the global infrastructure sector in 2023. Investments in 2022 were driven by inflationary pressures; we expect these pressures to continue this year.

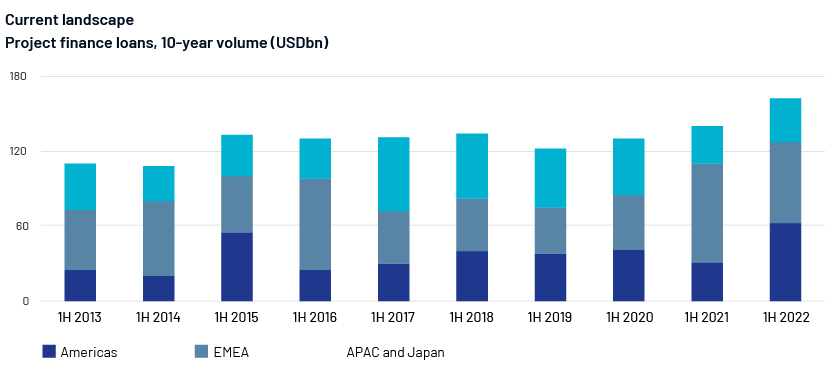

In terms of global project financing activity, North America had a busy first half in 2022, with the value of projects increasing by 133% to USD53.8bn from USD23.1bn in 1H 2021; volumes were similar. The telecommunication sector saw a boom in 1H 2022 with a sharp c.154% increase in project finance loans over 1H 2021.

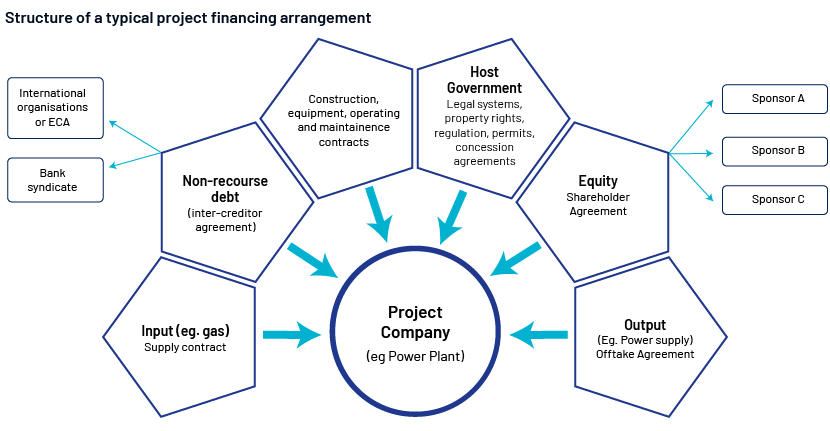

What is project finance?

Project finance is a financing method that involves funding the development of a specific project, typically with the goal of maximising the economic and social benefits of the project. Project finance has increased in popularity in recent years as a method of financing large-scale infrastructure projects, as it enables investors to share the risks and rewards of the project with the sponsors. It also creates value by funding cost reduction, providing financial flexibility, maximising leverage ratios, providing risk management and reducing corporate taxes amid market volatility.

Project finance loans in the Americas in the first six months of 2022 totalled USD62.5bn from 150 deals, a 90% increase from the same period in 2021. EMEA project finance loans totalled USD64.7bn from 142 deals in the first six months of 2022, a 21% decrease in proceeds compared to the same period in 2021. Project financing for APAC and Japan in the first half of 2022 reached USD35.1bn from 89 deals, up 19% from the same period in the previous year.

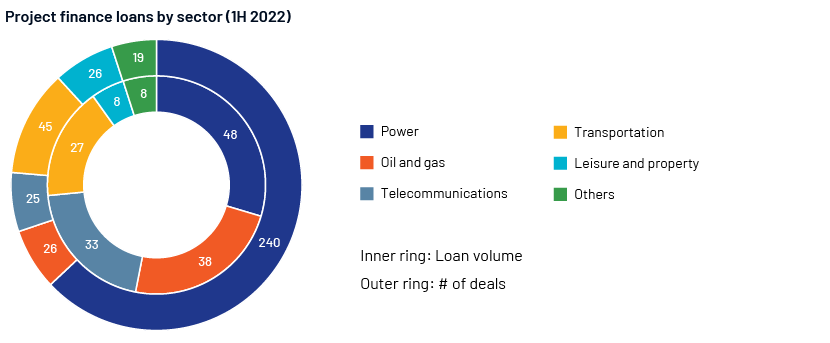

Global project finance loans in the power sector amounted to USD48bn, with 240 deals in the first half of 2022, 17% lower than in 2021. Oil and gas sector loans contributed USD38bn, with 26 deals in total in 1H 2022, 36% more than in 2021. Telecommunications sector loans increased by a sharp 154% from 2021, amounting to USD33bn. The mining sector also showed an increase, of 167% from 2021, with loans amounting to USD4.6bn.

Deals in 1H 2022:

The top three deals in the first half of 2022 related to the oil and gas, telecommunications, and transport sectors, respectively. The largest was Venture Global Plaquemines, with a USD9.5bn project in the US; the second largest was Open Fiber SpA, with a USD8.1bn project in Italy and the third largest was NewYorkTransportationDevCorp, with a USD6.6bn project in the US.

Forces driving project finance:

-

Project finance services help address the infrastructure funding gap and the urgent requirement globally for good infrastructure The availability of potable water, private and public spaces, sanitisation, electricity and other crucial resources would depend on new and upgraded infrastructure, necessitating annual expenditure on global infrastructure of USD3.9tn.

-

The 2008 financial crisis led to PPPs becoming more common. Governments want to make the most of limited public resources, but the number of developing nations has increased over the past 20 years. More than 134 developing nations employ PPPs, accounting for 15-20% of total infrastructure investment.

-

The World Bank Group assists developing nations by enhancing access to infrastructure and basic services through PPPs to promote development and combat poverty. Its PPP portfolio has expanded since FY02 and now includes several hundred capacity development, investment and guarantee projects worth several billions of dollars.

-

Escalating oil prices in the Middle East enabled the region to recover from the financial crisis. Project financing in the Middle East increased by 18% in value to USD32.7bn in 2010. Saudi Arabia alone provided project funding worth USD25.9bn. The United Arab Emirates created several PPP statutes in response to the anticipated boom in PPP schemes, significantly increasing the use of PPP models there.

Risks and challenges:

The pandemic resulted in temporary disruptions to demand and operations, ultimately leading to revenue losses for PPPs. There were delays in construction schedules because of the shortage of supplies. S&P Global says that with a BB+ rating in the initial stages and a BBB rating in the operational phases, the default rates for rated project finance structures are because of exposure to input or output, followed by technology risk and counterparty risk. Infrastructure objectives must be met with low-carbon, climate-smart infrastructure, but there is a yearly financing gap of trillions of dollars. Through 2030, the Asian Development Bank (ADB) projects that approximately USD1.7tn will need to be invested annually in infrastructure throughout Asia. The difference between availability and demand for infrastructure capital is growing.

Outlook

Trends in 2023:

-

Net zero economy: There is an increasing need for renewable-energy sources because of worries about climate change and the requirement to minimise reliance on fossil fuels. According to the International Energy Agency (IEA), a net zero economy requires fossil fuels to constitute only 22% of the world's energy mix by 2050. In 2023, we expect a 58GW increase in the market for wind and solar energy in Europe and a 32GW increase in the US. This is almost equivalent to investments of USD73.87bn in Europe and USD35bn in the US.

-

Carbon capture and storage (CCS) technologies: CCS technologies would continue to advance in 2023 as more businesses commit to going carbon-free. From January through the middle of September 2022, 61 new CCS projects were announced globally. Active or planned commercial CCS capacity will increase by 44% to 244m tons annually (Mtpa) by 2023. Three projects – two in China and one in Australia – are expected to start up in 2023, increasing the operational capacity by 2.3 Mtpa to 44.9 Mtpa overall.

-

ESG: The global market for green, social, sustainable and sustainability-linked bonds (GSSSB) in 2022 fell short of the 2021 highs. As rising interest rates slow in 2023, global bond issuance would grow slightly. GSSSB issuance would increase to between USD900bn and USD1tn in 2023 from roughly USD850bn in 2022 as the asset class takes advantage of numerous attempts to close the financing gap for climate change. ESG-driven investing will reach USD1tn by 2030, according to the chairman of BlackRock's iShares.

Major developments shaping the future:

-

Green hydrogen: Technologies using green hydrogen are advancing globally. Around USD15tn of investment is expected to be needed annually in 25 years’ time. Electrolyser capacity will increase by 115 gigawatts by 2030, 73% of which will be in Europe.

-

Batteries: The battery business will likely be significantly impacted by the US Inflation Reduction Act (IRA), particularly by the new clean vehicle tax credit. More batteries need to be built for a long-term energy shift. As a result, battery demand will likely increase significantly in 2023. The IEA estimates global installed battery capacity to expand 10-16 times by 2030. In this event, we expect battery storage to increase to 48GW in 2023. To reduce dependence on Russian gas, the EU plans to increase renewable-energy generation capacity to 1,236GW by 2030.

-

Renewables: The IRA has supported the US renewable-energy sector, including support for new technologies and easy transfer of tax credits. The Energy Transition Accelerator Financing (ETAF) platform has secured commitments of USD900m from four agencies to deploy about 1.5GW of renewable energy projects by 2030. Investment in the US renewable energy market is expected to reach USD11bn by 2031. The combined wind and solar market is expected to grow by 58GW in Europe, and by 32GW in the US in 2023. Financing for onshore and offshore wind projects will overtake solar financing by 2023, according to JP Morgan. The outlook for the cost of capital is USD20-21bn in tax participation funding for renewable projects in 2023.

-

Infrastructure: Global airlines, US leisure, US hotel and timeshare, and APAC airports are expected to continue to gain from solid recoveries as demand for travel increases, according to Fitch's 2023 projection. It expects around 6.3bn people to be living in metropolitan areas by 2050, up from 3.9bn at present. Infrastructure investments in Asia would need to total about USD1.7tn yearly until 2030, according to the Asian Development Bank (ADB). The transition from a brown to a green economy is supported by the UN's Sustainable Development Goals (SDGs). The financial cost of achieving the SDGs is estimated at USD5-7tn annually through 2030, with emerging economies bearing roughly half of this expenditure.

Sources:

-

https://www.dentons.com/~/media/6a199894417f4877adea73a76caac1a5.ashx ,

-

Energy outlook 2023: From power to utilities to renewables | Bundle | ING Think

-

Global landscape of renewable energy finance 2023 (azureedge.net)

-

Project Finance | 2023 Trade Finance Global Export Finance Hub

Tags:

What's your view?

About the Authors

Karan has been working with Acuity’s investment banking team since 2018. He has over 10 years of work experience in the financial services industry with domain expertise in financial research, modeling and business valuation. At acuity, he has experience of closely working with partners / directors of boutique advisory clients, advising them on modelling, valuations, and M&A projects. He also supported various clients on asset/project finance modelling assignments across power generation, renewable energy and infrastructure sectors. Karan is a CFA charterholder from CFA Institute, USA and holds a master’s in business administration from IIPM, Delhi and a Bachelor of Commerce from University of Delhi.

Parushi joined Acuity in September’22 and has over 7 years of experience in reviewing, validating, and developing project finance models. She has hands-on experience in independently structuring models in discussion with onshore clients across diverse sectors such as power generation, renewable energy, and infrastructure sectors. Parushi is a Chartered Accountant from ICAI and Bachelor of Commerce from Rajasthan University.

Like the way we think?

Next time we post something new, we'll send it to your inbox