Published on February 5, 2025 by Anjana Viswanathan

Executive summary

The USD4.2tn US municipal (muni) bond market has been instrumental in the development of about 75% of US infrastructure, according to the National League of Cities. About 80% of municipal bond issuance over the years has been by the state and local governments to finance schools, water and sewer systems and toll roads, among other projects.

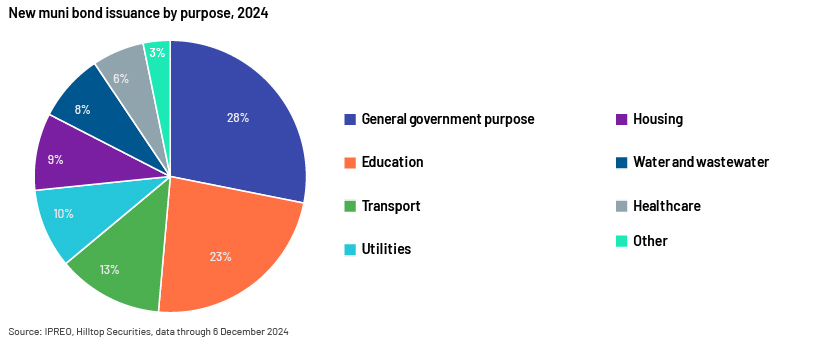

The US municipal bond market’s new issuance volume spiked to USD507.7bn in 2024, indicating a major influx of new debt and highlighting the market’s continued strength. Approximately 94% of the bonds sold in 2024 were to finance critical infrastructure, with education and general government purposes dominating the list, vital for community development and economic growth.

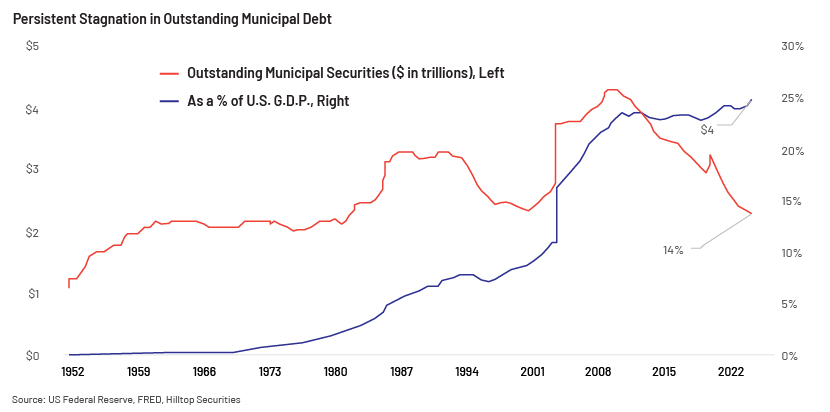

Notwithstanding the record-high issuance levels over the past 14 years, total outstanding municipal bond debt remained steady at USD4.2tn as of the start of 3Q 2024, translating into an increase of less than 10% over the decade. The slow pace of the municipal bond market’s growth reflects the fiscally conservative stance of the issuers, prioritising balanced budgets and debt reduction due to their commitment to high credit ratings and prudent financial management. This risk-averse stance enables mitigating the risk of excessive debt, safeguarding their financial ability. Such proactive monitoring of debt levels ensures long-term financial sustainability for taxpayers and residents.

municipal bonds are poised for a strong start, especially in 1Q 2025, driven by a surge in demand. As January typically experiences a wave of bond maturities and interest payments, investors are expected to reinvest their proceeds in the market. This is likely to create strong demand for new and existing municipal bonds, leading to higher prices and a favourable market environment. The supply side is expected to be healthy, as issuers are also likely to make the best use of low real interest rates.

The top trends expected to impact the US municipal bond market in 2025:

-

Anonymity of the tax-exempt status may impact municipal bond issuance

-

A reduction in federal aid could result in states issuing muni debt

-

Major sectors likely to depend on municipal bond issuance include water utilities and school districts for infrastructure development

-

Risk of disaster could result in states issuing municipal bonds

Anonymity of the tax-exempt status may impact municipal bond issuance:

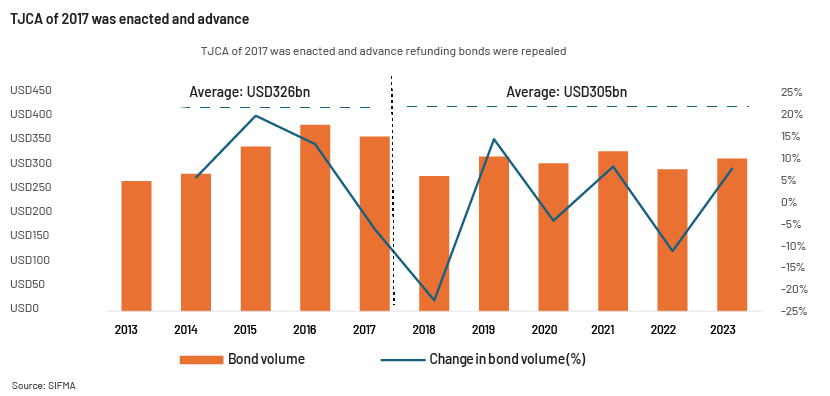

The likely expiry of the Tax Cuts and Jobs Act (TCJA) at end-2025 could result in higher tax rates, making the tax-exempt status of municipal bonds attractive to investors; this could increase demand for these bonds and lead to higher prices. Issuers would have a cost-effective way in which to finance their projects, as they could borrow at lower interest rates.

There is not much visibility on tax plans under President Trump’s second term. However, his campaign pledged to extend most provisions of the TCJA of 2017, although the state and local tax (SALT) deduction cap may be raised or eliminated.

Tax-exempt municipal bonds are a crucial source of funding for state and local governments, enabling them to finance projects essential for the nation’s economic health. municipal bonds have been tax-exempt since the inception of federal income tax in 1913, making them a reliable and attractive option for state and local government financing.

However, according to municipal bond market experts, the long-standing tax-exempt status of municipal bonds may be threatened by tax cuts and growing concern about national debt. If all tax schemes proposed during the campaign are executed, the 10-year budget deficit would balloon by USD3tn, according to Tax Foundation reports. However, curbing the tax exemption on all municipal bonds could cost the federal government about USD36bn per year in lost revenue, according to the Congressional Joint Committee on Taxation. Nevertheless, this is a meagre loss compared to the harm that would be done to financing local infrastructure. Hence, such as situation is unlikely to materialise.

Tax exemption is likely to be maintained eventually, as its removal would result in c.USD40bn in annual revenue savings, according to the Congressional Joint Committee on Taxation. This translates into just 0.6% of the USD6.5tn federal budget. Assuming issuance of c.USD500bn worth of tax-exempt bonds in 2024, withdrawing the tax exemption would significantly disrupt infrastructure financing and the economic freedom of local communities, while not improving the level of national deficit.

A reduction in federal aid could result in states issuing muni debt:

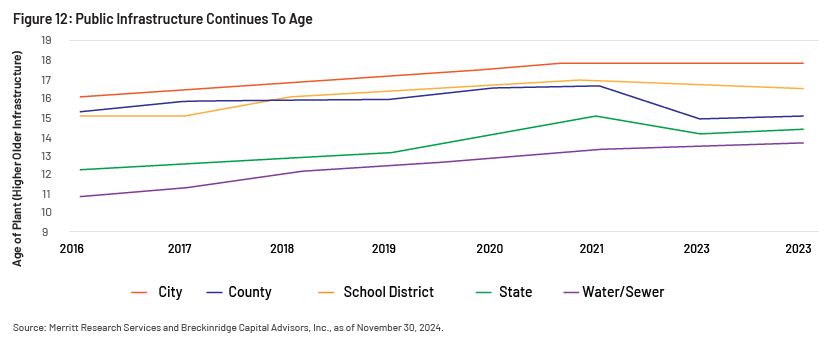

State and local governments will receive less federal aid due to cost-cutting initiatives, forcing them to issue more debt for infrastructure projects. A report by the American Society of Civil Engineers reveals a staggering infrastructure funding deficit of over USD2tn in FY24, with deteriorating roads and poor water-treatment methods posing environmental risks.

State and local governments issued c.USD4.1tn in municipal bonds from 2009 to 2018, with an annual average volume of USD412bn towards infrastructure development. Hence, states and local municipalities are likely to rely on municipal bond issuance for financing more than 75% of the US’s infrastructure.

Strong municipal bond ratings owing to stable reserve funds from major municipal bond-issuing states:

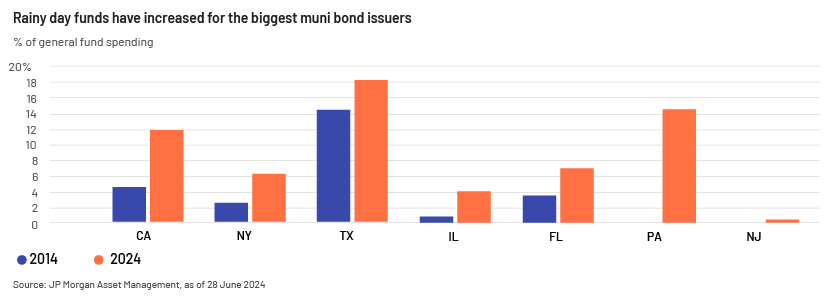

The pandemic led to an increase in states’ rainy day fund balances, with the median balance at 13% of general fund spending owing to the federal government’s fiscal stimulus efforts to promote economic growth. State and local authorities in particular have exercised restraint in the use of federal funds, opting to shore up reserve funds and not squander these on new programmes that would benefit their communities in the long term. Large tax-exempt bond issuers including California, New York and Texas have significantly bolstered their financial resilience over the past decade.

With sizeable reserves in place, most municipal bonds can continue paying the principal and interest to bondholders, indicating few cases of default. With an average credit rating of AA-, the USD4tn municipal bond market is on par with the creditworthiness of the US federal government, demonstrating the sector’s commitment to fiscal responsibility and prudent financial management. Credit ratings of the US states were at their highest as of September 2024, with every state holding an investment-grade credit rating and a remarkable 48 states with credit ratings of AA or higher.

Major sectors likely to depend on municipal bond issuance include water utilities and school districts for infrastructure development:

Federal funding is mainly targeted towards lower-income districts with the greatest need. The US Department of Education disclosed that a total of USD63bn had been spent as of mid-2024, with all federal funding to be used by the deadline of September 2024, and all unobligated funds paid back. Over 50% of the 300 Texas school districts surveyed expect to have closed out FY24 with an operating deficit and to implement cuts or spend down fund balances in FY25. There is also pending construction and renovation in many school districts that could be funded through bond issuance.

About 8% of the USD38bn in municipal bond issuance in the US in 2024 was dedicated to funding water and wastewater projects. The water crisis in several cities, including in Newark (New Jersey) and Flint (Michigan), continues, and sufficient financing is required to ensure safe drinking water and effective wastewater management.

Bond supply is estimated to continue growing in 2025, largely dominated by large bond authorisations residents voted for in November 2024. It comprises USD10bn designated for construction and modernisation of public education facilities and USD10bn for water, energy and environmental projects.

Risk of disaster could result in states issuing municipal bonds:

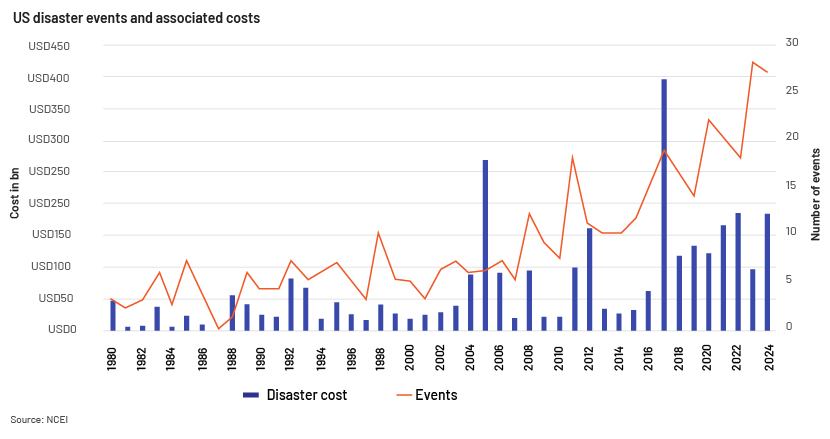

States depend on the federal government for fiscal assistance to recover from major disasters. Aid flows from Federal Emergency Management Agency (FEMA) programmes and one-time Congressional appropriations. The federal government has responded generously to major events such as the 2001 terrorist attacks, Hurricane Katrina (2005), Hurricane Sandy (2012) and the recent wildfires. However, this aid is not guaranteed, and recent trends raise concern that future disaster aid may not be as generous.

The federal deficit reached a record high of nearly USD2tn in FY24, constraining the government’s financial capacity. Simultaneously, the frequency of costly disasters increased sharply; the US now experiences 20 disasters a year that cost USD1bn or more in damages, compared to an average of just 5 disasters in the early 2000s. Increasing tension in American politics may also hamper the passage of future aid bills.

Increasing costs and the risk of reducing federal support underscore the need for resilience on the part of the states. The increased frequency and severity of natural disasters highlight the need for strong local infrastructure such as water and power that are critical for the wellbeing of communities. The federal government’s USD1.2tn infrastructure plan, introduced in 2021, may lead to a surge in municipal bond supply as issuers opt to leverage federal funds through borrowing. By providing a significant source of funding for infrastructure projects, the plan may encourage municipal bond issuers to issue more bonds to finance their share of project costs, resulting in increased supply.

Conclusion

While the pace of municipal bond issuance may have slowed in December, issuance in 2025 is estimated at USD460-745bn. The Federal Reserve’s cautious stance on interest rates in 2024 is expected to result in maintaining lower real interest rates. Considering other factors as well, including infrastructure requirements, especially in the absence of federal funds, municipal bond issuance is vital for state and local governments.

However, the impact of the tax-exempt status is currently not determinable. If the new administration attempts to repeal the tax exemption, it could result in a dual response: a rush of new issuance as issuers try to take advantage of low interest rates, resulting in a short-term increase in new bond issuance and a long-term increase in the value of the existing USD4tn outstanding bonds that would likely be safeguarded under the new rules. These trends set the stage for a strong and resilient municipal bond market, with potential for significant gains.

How Acuity Knowledge Partners can help

We help investment banking teams scale up their public finance underwriting practices and drive value for their clients. Leveraging dedicated teams of experienced analysts in our offshore delivery centres, they benefit from operational efficiency and cost optimisation. Our team of public finance experts are well versed in covering the municipal financing and public sectors and are vested with state-of-the-art modelling capabilities. Clients working with our specialised public finance investment banking teams have benefited from our integrated suite of services along the investment banking advisory value chain.

Sources:

-

https://www.msrb.org/sites/default/files/MSRB-2020-Municipal-Bond-Market-in-Review.pdf

-

https://www.irs.gov/statistics/soi-tax-stats-tax-exempt-bond-statistics

-

https://www.nuveen.com/global/insights/fixed-income/muninotes-commentary?type=us

-

https://www.gobaker.com/repercussions-of-tax-policy-changes-for-municipal-bonds/

-

https://www.breckinridge.com/insights/details/2025-municipal-market-outlook/

Tags:

What's your view?

About the Author

Anjana is a Delivery Lead at Acuity Knowledge Partners, having more than six years of experience in the financial services sector, predominantly investment banking and equity research. Currently, supports Public Finance team, with a focus on Municipal Finance for a U.S. based Investment Bank, in Bangalore. Prior to joining Acuity, she was with William O’Neil India as equity research analyst for three years. She holds a Master’s degree in Business Administration in Finance from IMT Hyderabad

Like the way we think?

Next time we post something new, we'll send it to your inbox