Published on January 20, 2025 by Divyesh Sharma

Introduction to green steel

The steel industry contributes significantly (7-9%) to carbon emissions worldwide. As the world pivots towards more sustainable industrial practices, ‘green steel’ – steel produced with minimal to no carbon emissions – has emerged as a promising solution. However, a shift from traditional steel production methods to green alternatives requires substantial investment, often supported through both public and private funding.

This article provides a detailed overview of the ongoing public and private funding in green steel production worldwide, analysing major initiatives, funding allocations and the role of various stakeholders. It also highlights relevant statistics and graphical insights to illustrate trends and impacts.

1. Overview and importance of green steel production

Green steel is steel produced without the use of fossil fuels. It involves, among others:

-

Hydrogen-based direct reduction: Here green hydrogen (produced from renewable energy) is used as a reducing agent.

-

Electric arc furnaces (EAFs): This mechanism uses recycled scrap steel with renewable energy.

-

Carbon capture and storage (CCS): It captures carbon dioxide (CO2) emissions for storage rather than releasing it into the atmosphere.

With an increasing focus on sustainability, governments and corporations are driving green steel funding initiatives to help achieve emissions targets and mitigate the environmental impact of steel production.

2. Public funding in green steel production

Governments across the world are channelling funds and creating policies to promote green steel production. Key examples include:

-

The European Union (EU): The region has pledged over EUR2bn through programmes such as the Innovation Fund and Horizon Europe, focusing on green hydrogen technology for steel production.

-

The United States: The Bipartisan Infrastructure Law and the Inflation Reduction Act have allocated USD 1.2bn towards research and incentives for low-emission steel production.

-

China: The country has set ambitious carbon-neutrality goals, aiming to eliminate carbon emissions by 2030. The government supports pilot projects in green hydrogen and EAF-based steel production by proving grants and subsidies.

Regional Public Funding Commitments

| Region | Funding amount (2020-2023) | Primary initiatives |

| European Union | EUR2bn | Innovation fund, Horizon Europe for hydrogen steel projects |

| United States | $1.2bn | Inflation Reduction Act, tax credits, research grants |

| China | $900m | Subsidies for pilot projects in hydrogen and CCS |

| Japan | $700m | Green Innovation Fund, targeting hydrogen and CCS |

These initiatives illustrate the commitment of major economies to transition to cleaner steel production technologies. However, government funds are often associated with strict emission targets – a case in point is the EU’s funding to pare greenhouse gas release by 55% by 2030 (vs 2024).

3. Private funding in green steel production

In recent years, major steel producers and industrial players have invested heavily in green steel projects, often in partnership with technology providers. Three prominent examples are:

-

ArcelorMittal: It has committed over $10bn globally to achieve carbon neutrality by 2050. The company has piloted green steel plants using hydrogen in Europe.

-

SSAB and H2 Green Steel: These Swedish companies have pioneered hydrogen-based steel production, with the projects receiving substantial private funding and investments from venture capitalists and private equity firms.

-

Tata Steel: It has invested c.$2bn towards reducing emissions, focusing on decarbonising its European plants.

| Company | Investment | Focus area |

| ArcelorMittal | $10bn+ | Hydrogen-based steel production |

| H2 Green Steel | $3bn | Hydrogen-powered plant in Brazil |

| Tata Steel | c.$2bn | Decarbonisation of European plants |

| Thyssenkrupp | $1.5bn | Carbon-neutral production technologies |

Private funding has been essential in scaling up green steel projects. For instance, H2 Green Steel, backed by private equity and institutional investors, aims to become one of the first carbon-free steel producers on a large scale.

4. Green steel global project landscape

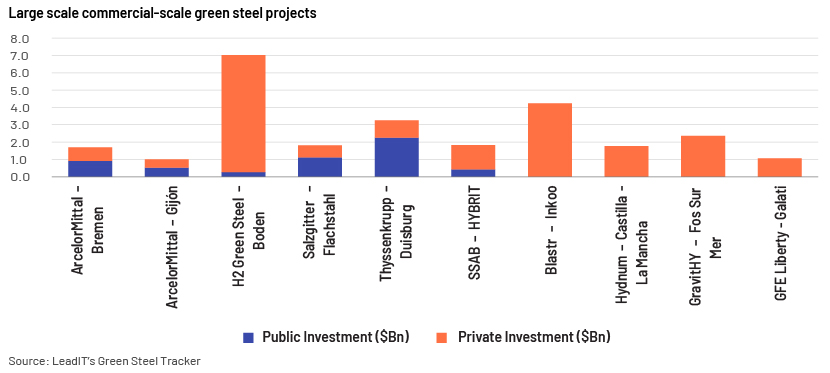

LeadIT’s Green Steel Tracker recorded 89 low-carbon investment announcements in the steel industry by 29 February 2024, underscoring the worldwide drive for cleaner steel production. Only 33 projects were employing direct electrification or hydrogen-based reduction mechanisms. Of these, just 10 were large-scale plants (0.5 million tonne per annum [Mtpa] capacity), with concrete green hydrogen production.

Overview of 10 commercial-scale green steel projects

All the 10 direct reduced iron projects are planned in Europe. Spain, and Sweden will have two projects each, Germany will have three whereas Finland, Romania and France will have one project each.

Public-private partnerships and collaborative funding

Public-private partnerships are making material contributions to green steel technologies. Governments primarily provide initial grants or subsidies to mitigate risks, whereas private companies bring in operational expertise and capital. Examples include:

-

EU and ArcelorMittal partnership: ArcelorMittal, aided by EU funding support, has launched multiple hydrogen-based pilot projects in Germany and France.

-

Collaboration between U.S. Department of Energy (DOE) and Cleveland-Cliffs: The U.S. DOE has tied up with Cleveland-Cliffs to reduce emissions from traditional steelmaking methods.

These partnerships aim to derisk initial investments, allowing companies to experiment with green steel technologies and encourage broader adoption.

5. Comparative analysis of global funding trends

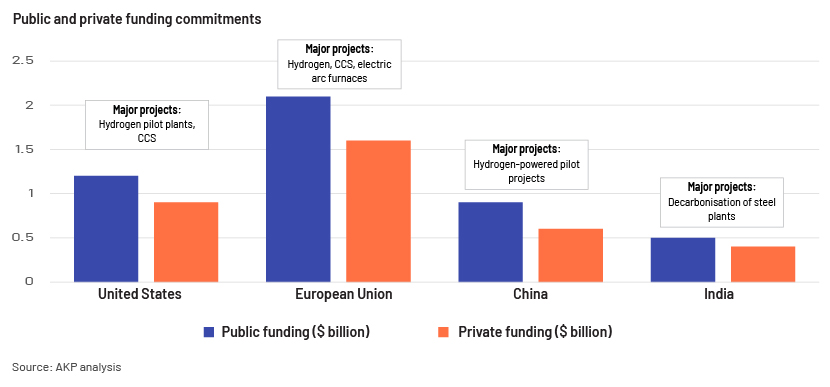

The chart below compares public and private funding commitments across countries/regions.

In the United States, public funding stands at $1.2bn, with private funding at $900m, focusing primarily on hydrogen pilot plants and CCS projects. The EU has invested more, with public funding at $2.1bn and private funding at $1.6bn, targeting hydrogen, CCS and EAF projects. China has allocated $900m in public funding and $600m in private funding, concentrating on hydrogen-focused plants. Meanwhile, India has committed $500m in public funding and $400m in private funding, with a major focus on the decarbonisation of steel plants. These examples clearly highlight the different priorities and scales of investment in clean energy and decarbonisation technologies across these regions.

Key challenges

-

High initial costs: The cost involved in green steel production is higher than that in traditional methods, creating a challenge in large-scale adoption. The cost of the technology involved and economic viability are among the primary hurdles. The higher cost of producing hydrogen and the relatively high price of renewable electricity compared to fossil fuels are also major challenges.

-

Cost of technology: Green steel is made using CCS technologies, which are currently expensive.

-

Lack of policies and regulatory support: The absence of stable policies and regulatory frameworks poses a major challenge. Besides, the lack of clear global regulations and standards for hydrogen production, handling and storage necessitates policy intervention. Also, trainings will be necessary to transition the workforce to adapt to this modern technology.

Conclusion

Both public and private funding, each bringing unique strengths, are vital to the transition towards green steel production. Government initiatives and subsidies lower initial barriers, while private investments drive technology and efficiency improvements. Together, these funding streams enable the industry to transition towards a sustainable future, but significant financial and technological challenges remain.

The road to green steel production is complex, requiring a concerted global effort in terms of public policies, private sector innovation and continued funding to ensure that steel – one of the most crucial building materials – becomes a sustainable asset in the fight against climate change.

How Acuity Knowledge Partners can help

Our pool of experts in the energy and mining sectors at Acuity Knowledge Partners help clients develop strategies and assess base and platinum-group metal markets.

We have extensive experience in mining project due diligence, research analytics, business development and strategy formulation to accelerate the energy transition.

Sources:

-

https://www.industrytransition.org/insights/g7-green-steel-production/

-

https://www.citizen.org/article/government-subsidies-for-the-green-steel-transition/

-

https://www.climatebonds.net/files/reports/cbi_steelpolicy_2022_5.pdf

-

https://climate.ec.europa.eu/news-your-voice/news/hybrit-story-unlocking-secret-green-steel

-

https://climate.ec.europa.eu/system/files/2022-07/if_pf_2022_hybrit_en.pdf

-

https://www.weforum.org/publications/green-hydrogen-in-china-a-roadmap-for-progress/

-

https://corporate.arcelormittal.com/sustainability/climate-action-reports

-

https://ieefa.org/resources/green-finance-has-begun-flow-green-steel-funding

Tags:

What's your view?

About the Author

Divyesh is a member of Acuity’s Corporate and Consulting division, responsible for devising business solutions and aiding industries in undertaking specialized and innovative projects worldwide. This encompasses fields like energy transition, decarbonization, CCUS, sustainable practices, and providing extensive knowledge support. Prior to Acuity, worked with the B A Continuum Services (a captive unit of Bank of America) where he supported investment bankers by conducted research across various sectors including Metals and mining

Like the way we think?

Next time we post something new, we'll send it to your inbox