Published on June 4, 2024 by Ankit Agrawal

-

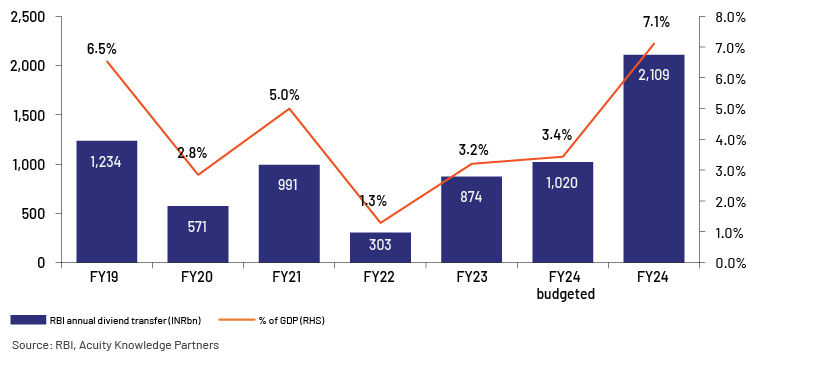

The Reserve Bank of India (RBI) is to transfer INR2.1tn (c.USD25bn) in dividends to the government for FY24, an increase of 140% y/y and 107% over the 2024 interim budget’s target

-

The dividend windfall is a positive, as the additional resources could be used towards fiscal consolidation (resulting in reduced borrowings and interest rates and boosting corporate investments) and/or towards capital spending and budgetary management

-

The market reacted positively to this, with equity indices reaching an all-time high, while the 10-year benchmark yield fell below 7%

-

The excess dividend payments are likely to have a limited impact on India’s credit rating, but policy continuity, sustained economic growth and fiscal consolidation should support a credit rating upgrade over the medium term

A year-end boost to government coffers

The RBI on 22 May 2024 approved dividend payments of INR2.1tn (c.USD25bn, +140% y/y) to the central government for FY24 (fiscal year ended 31 March 2024). This is more than 2x the amount the government had estimated in its budgetary revenue estimates (INR1tn, or USD12.2bn, in dividends from the RBI, public-sector banks and financial institutions) in the 2024 interim budget.

Annual dividend transfers and as a percentage of GDP

Surplus dividend bolsters India’s fiscal outlook

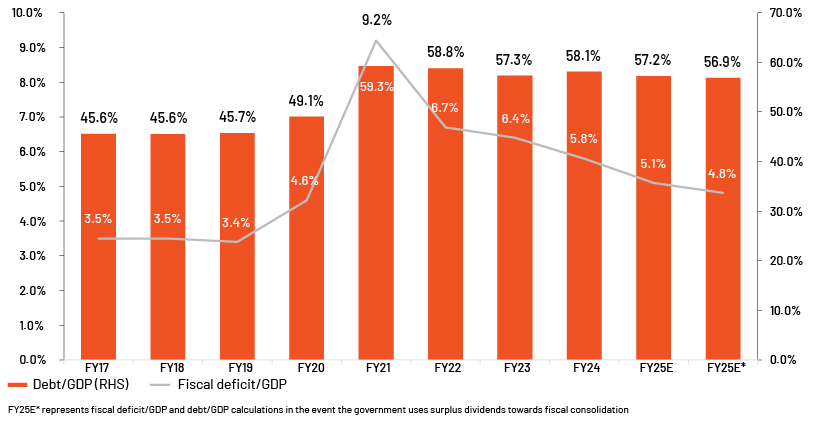

The higher-than-estimated dividend transfer is supportive of India’s fiscal profile in the near term. The government could use the surplus dividends (accounting for c.30bps of FY25 GDP) towards fiscal consolidation, bringing fiscal deficit/GDP and debt/GDP to 4.8% and 56.9%, respectively, in FY25 vs the targeted 5.1% and 57.2%, respectively, announced in the 2024 interim budget. Alternatively, the government could use the windfall to boost infrastructure spending while maintaining its fiscal deficit/GDP target of 5.1% for FY25. Either way, this windfall is positive for India’s fiscal outlook.

Deficit and debt metrics to improve on excess dividend transfer

FY25E* represents fiscal deficit/GDP and debt/GDP calculations in the event the government uses surplus dividends towards fiscal consolidation

Source: Budget documents, RBI, Acuity Knowledge Partners

The dividend bonanza had a positive impact across asset classes

The benchmark stock indices, Sensex and Nifty-50, rallied more than 1.6% to close at their all-time highs while the INR strengthened marginally.

In the bond market, the 10-year benchmark yield fell below 7% after the announcement. In addition, positive news flow such as the inclusion of Indian government bonds in international indices, reduced borrowing needs, easing inflation; a largely stable currency would keep bond yields low.

| 21-May-24 | 22-May-24 | |

| USD-INR exchange rate | 83.32 | 83.27 |

| 10-year government bond yield | 7.03% | 6.99% |

| 91-day T-bill (August 2024) | 6.99% | 6.82% |

Source: FactSet, Acuity Knowledge Partners

But this would not result in a credit rating upgrade in the near term

The dividend windfall is positive in the short term but is unlikely to be of similar scale going forward. As such, apart from being positive for short-term fiscal consolidation and perhaps marginal economic gains, we do not see this action having a broad long-term impact. Credit rating agencies would continue to review India's policy continuity, sustained economic growth and fiscal consolidation for a credit rating upgrade over the medium term.

Sources:

-

FactSet

-

Reserve Bank of India

-

Union Budget document

Tags:

What's your view?

About the Author

Ankit has close to 12 years of experience in fixed income credit research, focusing on bank, sovereign and corporate credit reviews. He has worked with three of the largest buy-side asset managers, based in Europe and the US, assisting with investment decisions. He is actively involved in discussing themes and issuer updates and is adept at writing detailed credit reviews and building in-depth financial models to present his investment case. Ankit holds a Master of Business Administration (Finance) from Symbiosis International University.

Like the way we think?

Next time we post something new, we'll send it to your inbox