Published on May 16, 2024 by Shekhar Jha

In the first part of this blog, we discussed the integration of environmental, social and governance (ESG) principles in US commercial real estate (CRE) and its benefits. Stakeholders are increasingly recognising the long-term benefits of such integration. The US SIF Foundation identified USD8.4tn in total US-domiciled assets under management (AuM) using sustainable investing strategies as of year-end 2021. This represents 13% or USD1 of USD8 of total US assets under professional management.

In this part, we discuss the recent innovations in US CRE sustainability and challenges and best practices associated with the integration of ESG principles in US CRE. We also explore ideas as to how we can prepare for when ESG considerations become critical for CRE. By aligning with evolving trends, stakeholders—including those involved in real estate investment banking—can better position themselves to navigate this transformation.

Innovations in US CRE sustainability

The US CRE sector has responded to the call for integrating sustainability and ESG principles with innovative practices:

Net-zero and carbon-neutral buildings:

A notable trend in US CRE is the pursuit of net-zero energy and carbon-neutral buildings.

-

Net-zero buildings.

A net-zero building is one that, over the course of a year, produces as much renewable energy on-site or off-site as it consumes from the grid. In other words, the building's energy consumption is offset by the renewable energy it generates. This includes both operational energy (energy used for heating, cooling, lighting, appliances, etc.) and embodied energy (energy used for construction, maintenance and demolition). Developers are harnessing advanced technologies such as solar panels, energy-efficient HVAC systems and smart-building management to minimise energy consumption and emissions.

-

Carbon-neutral buildings.

A carbon-neutral building is a broader concept that extends beyond just energy consumption and production. In addition to balancing energy-related carbon emissions, carbon-neutral buildings consider emissions associated with the entire lifecycle of the building, including materials used in construction, transport of materials, building operations and end-of-life disposal. These emissions are reduced to a minimum, and any remaining emissions are offset through carbon removal or reduction activities such as planting trees, investing in renewable-energy projects or using carbon-capture technologies.

Adaptive reuse and urban regeneration:

To reduce environmental impact, developers are repurposing existing structures rather than embarking on new construction projects.

-

Adaptive reuse.

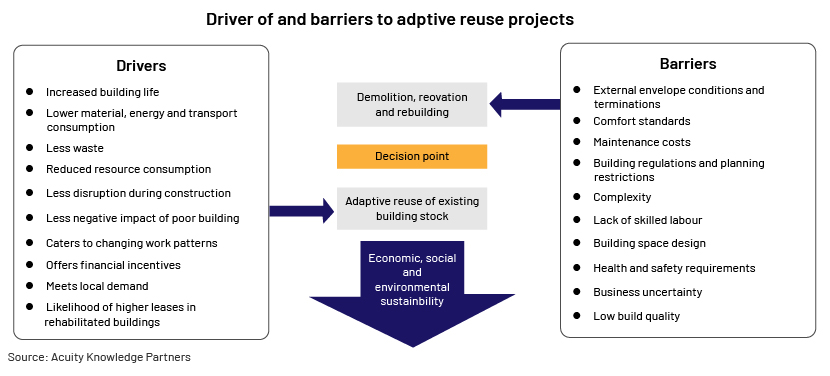

Adaptive reuse refers to the practice of repurposing existing buildings or structures for new functions that differ from their original intended use. This approach is often employed to breathe new life into older buildings that may have become obsolete or underutilised. In the context of US CRE, adaptive reuse could involve converting old factories, warehouses or office buildings into mixed-use developments, apartments, hotels, restaurants or other commercial spaces.

The following image shows drivers of and barriers to adaptive reuse projects. Investors and developers must be extremely careful when performing cost-benefit analysis for such a project.

-

Urban regeneration.

Urban regeneration is a broader concept that encompasses strategies aimed at revitalising and improving the physical, economic and social aspects of a neighbourhood or urban area. It often involves a combination of improving infrastructure, enhancing public spaces, developing affordable housing and upgrading transport and cultural amenities to create a more liveable and vibrant community. In the context of US CRE, urban regeneration could involve renovating blighted neighbourhoods, improving access to public transport, creating green spaces and attracting new businesses to stimulate economic growth.

Green buildings:

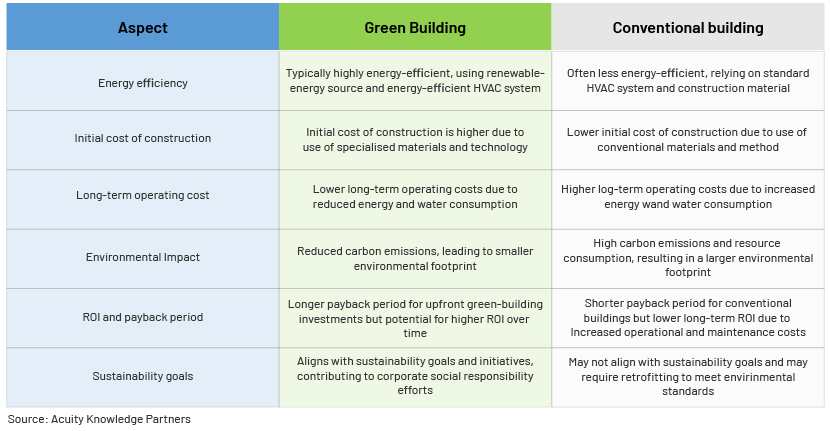

“Green building is the practice of creating structures and using processes that are environmentally responsible and resource-efficient throughout a building’s lifecycle from siting to design, construction, operation, maintenance, renovation, and deconstruction”, according to the US Environmental Protection Agency's (EPA’s) definition.

This practice expands and complements the classical building design concerns of economy, utility, durability and comfort. Green building is also known as a “sustainable or high-performance building”.

As demand for sustainable spaces continues to rise, retrofitting existing buildings to meet green standards presents a compelling opportunity for investors, developers and building owners. The US green-building market reached over USD83bn in 2021 from USD61bn in 2017.

The following table highlights the benefits of green buildings over conventional buildings:

Challenges in integrating ESG principles into the CRE sphere

Integrating ESG principles into the CRE sphere presents a number of challenges that demand attention and strategic resolution. The following are some of the major challenges faced in such integration:

Data availability and quality:

Reliable, standardised data helps investors and stakeholders assess and compare the sustainability of different properties.

Lack of standardisation and reporting frameworks:

With a number of frameworks and guidelines in use, such as the Global Real Estate Sustainability Benchmark (GRESB) and Leadership in Energy and Environmental Design (LEED), harmonising reporting practices becomes crucial for fostering transparency and comparability.

Short-term vs long-term considerations:

The nature of real estate investment often involves a balance between short-term financial returns and long-term sustainability goals. Investors may prioritise immediate financial gains over ESG factors, hindering the alignment of business strategies with long-term environmental and social objectives.

Retrofitting existing buildings:

Retrofitting existing buildings to meet modern sustainability standards is a costly and complex process. Many CRE assets have long lifecycles, and updating them to align with ESG principles requires substantial investments, presenting financial challenges for owners and investors.

Best practices

As sustainability becomes increasingly imperative, stakeholders in the US CRE sector are embracing ESG considerations to drive a positive impact while ensuring long-term profitability. The following are key points outlining best practices for integrating ESG principles into the CRE sphere:

Leadership commitment and governance:

Strong leadership commitment to ESG principles is essential for driving meaningful change in CRE organisations. Establishing dedicated ESG committees, appointing responsible executives and integrating ESG metrics into performance evaluations can signal top-level endorsement and foster accountability.

Using technology for data management:

Embracing technology solutions for data management and analysis can mitigate challenges relating to data availability and quality. Implementing advanced analytics, machine learning and internet of things (IoT) technologies can enhance the collection and interpretation of ESG data.

Integration into investment decisions:

Embedding ESG criteria into investment decision-making processes enables CRE investors to identify opportunities that align with sustainability objectives and deliver long-term value. Conducting ESG due diligence, integrating ESG factors into risk assessments and leveraging ESG-focused investment strategies can enhance portfolio performance and resilience.

Data transparency and disclosure:

CRE companies should prioritise transparency and disclosure of ESG-related information to investors, tenants and other stakeholders. Adopting recognised reporting frameworks such as the Global Reporting Initiative (GRI) or Sustainability Accounting Standards Board (SASB) can enhance credibility and facilitate comparability.

Engagement and collaboration:

Engaging with stakeholders and fostering dialogue on ESG issues can generate valuable insights, identify emerging trends and enhance relationships. Collaborating with tenants to improve energy efficiency, partnering with local communities on social initiatives and participating in industry associations can amplify the impact of ESG efforts.

Preparing for the future

While the integration of ESG principles into US CRE holds immense promise, challenges persist. The upfront costs associated with sustainable building practices, the need for standardised ESG reporting and the balance between short-term financial pressures and long-term sustainability goals are among the challenges that industry players must address.

As the urgency of climate change and social responsibility continues to shape the business landscape, stakeholders are likely to demand transparency, accountability and commitment to ESG principles. Real estate companies that embrace sustainability not only contribute to a more resilient and responsible built environment, but also position themselves for enduring success in an evolving market.

Conclusion

Sustainability and ESG have ushered in a new era of responsibility and innovation in the US CRE sector. Adopting ESG principles in the sector is imperative for several reasons. First, it aligns with growing societal expectations for businesses to operate sustainably and responsibly. By integrating ESG principles, CRE companies can enhance their reputation, attract socially conscious investors and mitigate regulatory and reputational risks. Second, it drives operational efficiency and long-term value creation.

Overall, embracing ESG principles is not only beneficial for the environment and society, but also essential for the industry’s long-term sustainability and competitiveness.

How Acuity Knowledge Partners can help

As demand for sustainable and responsible business practices continues to grow, our expertise and solutions are designed to help CRE stakeholders seamlessly incorporate ESG considerations into their operations.

We understand the significance of ESG factors in shaping the future of the CRE sector. With our team of dedicated experts well versed in sustainable practices, we are prepared to collaborate with industry leaders to foster positive change and drive value through responsible investment decisions.

Sources:

Tags:

What's your view?

About the Author

Shekhar has four years of experience in financial and investment research, with a focus on commercial real estate assets. He has worked with Private Equity, Consulting and Valuation firms on a variety of research and analysis assignments. He has gained exposure to supporting a wide spectrum of Private Market client engagements (with RE focus) at Acuity.Shekhar is a CMA Level 3 candidate and holds a bachelor’s degree in commerce.

Like the way we think?

Next time we post something new, we'll send it to your inbox