Published on October 15, 2020 by Sreehari Tamaraparani

Winning mandates in this changing socio-economic landscape has seldom been more decisive. As more commercial banks vie for exclusive synergies with other related businesses, the request for proposal (RFP) process, which is often one of the most important processes, becomes a pivotal component in the sales cycle. However, responding to RFPs can be quite challenging and time consuming, demanding niche skill sets that many do not possess. Furthermore, identifying experts who can understand the nuances between services lines¬– such as commercial payments and treasury services –while prioritising the end goal of a well-constructed executive summary and strategic solution is not always easy. This is why most sales teams often rely on the expertise of skilled RFP teams. Building a strong and successful RFP team that can effectively guide a sales team through the RFP process and ensure opportunities are translated into wins must be the priority for commercial banks. In order to achieve this, banks need to evaluate their options across three main factors when building their RFP teams: an optimum team structure that is both efficient and cost-effective, a robust content database that forms the bedrock for curating an effective RFP response and the overall presentation of RFPs through the incorporation of powerful graphics and designs that will have the desired impact on the decision makers.

Optimum team structure

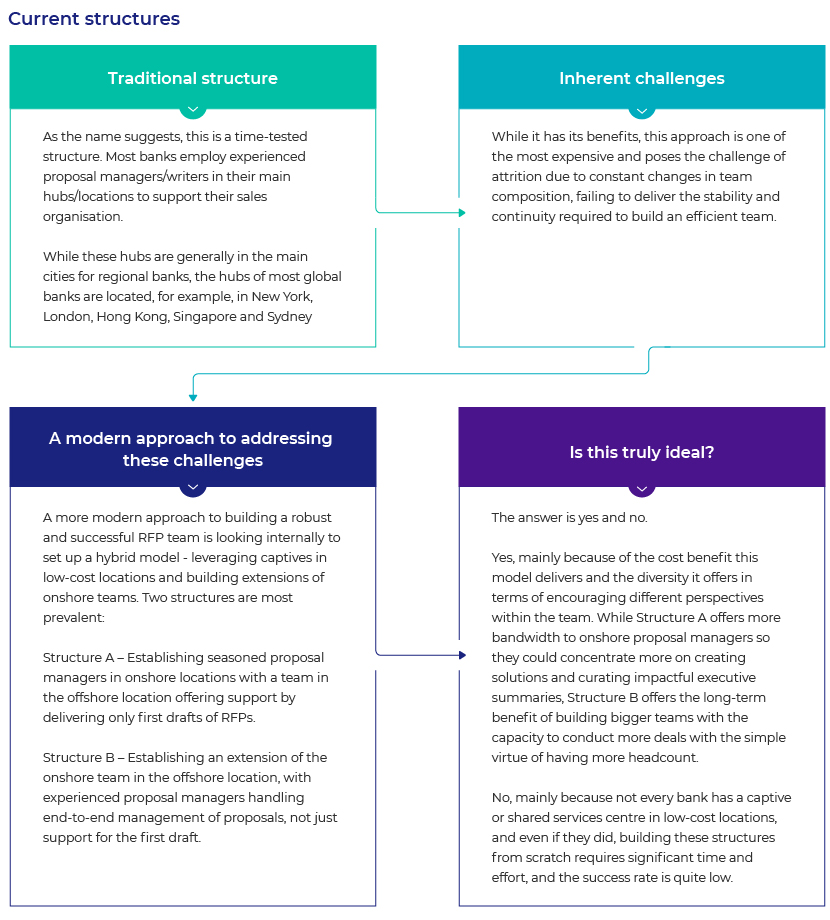

One of the important factors to consider when building a successful RFP team is team structure – one that is ideal to your organisation and both efficient and cost-effective. The ideal team is structured in a way that delivers maximum efficiency while considering the experience, expertise and diversity of its members. There are many options that banks can consider when building an optimum RFP team structure, ranging from the time-tested traditional approach to the more flexible modern approach.

Is there an alternative?

There is an alternative option for commercial banks to consider when thinking about building cost-efficient and optimally functioning RFP teams. That option is to partner with experienced third-party vendors to build an offshore team that can deliver quality work at a reasonable cost. This “best-of-both-worlds” approach offers an easy and effective option that can deliver faster results with relatively lower investment. The main advantage of outsourcing is the “plug-and0play” option offered, with vendors having established the required infrastructure and expertise, and banks only having to decide on how they want to structure their offshore team.

In addition to the obvious cost benefit, partnering with these experienced vendors allows banks to leverage the best practices these firms have to offer and enjoy the reduced impact of attrition, which is much less in offshore locations. Overall, this option offers immediate benefits to commercial banks, empowering them to be more focused on strategic goals.

Are there challenges to outsourcing?

There are always challenges, and this alternative has its fair share. The main challenges in the outsourcing model are as follows:

-

Experience/expertise: As mentioned earlier, the art of proposal writing is a niche, so finding the right partner with the required experience and expertise in the industry is an important challenge to overcome.

-

Flexibility/scalability: It is also important to partner with a vendor who can help identify the right structure for you and has the flexibility to build an effective team, while being able to scale when required to truly deliver process efficiencies.

-

Information security: Unlike insourcing, where banks can take comfort in the security of data that remains within the organisation, outsourcing poses the main challenge of data security.

Hence, it is imperative to choose the right vendor partner that has the required expertise, experience, flexibility and infrastructure to setup the most effective structure that works best for your organisation.

Robust content database

While creating an optimum team structure is the important first step in building a successful RFP team, streamlining your content database by establishing a robust content structure and management process is the next step in the overall process. Proposals are only as good as the content used to build them. As such, it is imperative to have a clearly established and strictly defined process to review and update the content library as well as a process to add content newly curated by SMEs once a particular proposal is completed.

This can be achieved first by implementing a holistic workflow management process that ensures the proposal writers can consider an RFP project “completed” only when they update existing responses in the content library and add newly curated responses. Establishing such a process will ensure the existing content is updated regularly –eliminating the risk of content becoming stale – and new content is being added to the library, resulting in better first drafts.

Second, RFP teams can leverage automation features within RFP software such as Qvidian, RocketDocs, RFPIO and Loopio to make their content-updating processes smoother and more efficient. A couple of examples of these features include the use of merge codes and the project management feature. The merge code feature is an excellent way to update your content library in one fell swoop with dynamic data that changes periodically. The project management feature in software such as Qvidian and RFPIO can be used to complete an entire RFP within the system and project manage it from start to finish. The feature also enables users to update existing content that has been modified during the course of the RFP project and add newly created responses to the library with a click of a button. RFP software offers more features that RFP teams should leverage to make their processes more robust.

Presentation

Another important, and sometimes least prioritised, aspect of proposal management is the use of design elements in a proposal. While having strong content in your proposals is crucial, it is equally important for content to be presented in a manner that connects with clients and has an impact on their psyche. Sometimes, a proposal is heavy on words and makes for a dull read, losing its impact. Therefore, it is always advised to present the message to clients using infographics, which are more impactful.

It is also a best practice to build proposals that have thematic designs from start to finish. A visually enhanced proposal can go a long way in influencing decision makers. As the saying goes, “a picture is worth a thousand words”. An optimal team structure and strong content database, along with the power of graphical elements in your proposal, can have a greater impact on the effectiveness of RFP teams in organisations.

The Acuity advantage

Acuity Knowledge Partners (Acuity) has been partnering with financial institutions, including many commercial banks globally, for over 13 years in setting up best-in-class RFP processes to deliver true efficiencies in terms of cost as well as quality. We are experienced in setting up multiple structures, as outlined above, that work best for our clients and a talent pool that includes some of the most seasoned proposal writer sand content managers who understand the art and science of proposal writing and content management and have worked at major global banks and appreciate the needs of our banking clientele. Acuity also has industry-leading information security policies as well as robust compliance policies, including strict Chinese walls, to ensure client confidentiality is never compromised.

Acuity offers a one-stop shop for our clients’ sales and marketing requirements. In addition to RFP services, we offer support that includes content management, designing, pitchbooks, presentations and brochures, digital marketing and client reporting. As such, our clients can consider a holistic approach to outsourcing and explore setting up their entire sales and marketing organisations by partnering with us. These services are supported by our proprietary suite of Business Excellence and Automation Tools (BEAT) that offer domain-specific contextual technology.

With Acuity’s unique blend of the trident approach comprising process, people and technology, our commercial banking clients can expect a partnership that offers a true “plug-and-play” service capable of delivering quicker results and a return on investment that is unmatched in the industry.

What's your view?

About the Author

Sreehari Tamaraparani is a Assistant Director within the Fund Marketing Services line of business at Acuity Knowledge Partners.

Sreehari has 10 years of sales enablement experience with team management, writing compelling business proposals and content management within the financial services industry. Prior to joining Acuity, he worked at J.P. Morgan as an RFP Writer within the Investor Services line of business. Prior to his stint at J.P. Morgan, Sreehari worked as a Proposal Manager for Bank of America Merrill Lynch within the Global Transaction Services line of business.

Sreehari holds a Bachelor of Commerce from Bangalore University, India and a Post Graduate Certificate in International Business from..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox