Published on August 1, 2022 by Yu Yang

Background

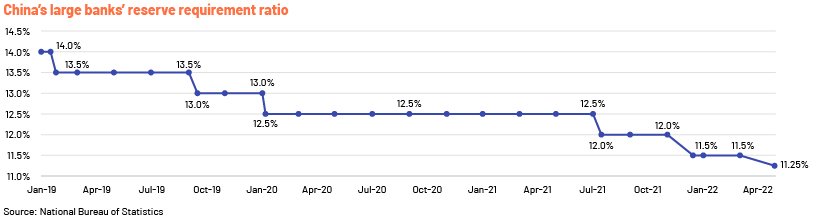

The COVID-19 pandemic had a ripple effect across global economies. Instability and uncertainties are visibly on the rise, with the pandemic hurting performance of micro, small and medium-sized enterprises as they navigate elevated financing costs. China’s central bank announced on 15 April 2022 it would lower the amount of deposits banks have to set aside – the reserve requirement ratio (RRR) – releasing RMB530bn, or c. USD 83bn, liquidity into an economy grappling with its worst COVID-19 outbreak since 2020. The People’s Bank of China (PBOC) trimmed banks’ RRR to 11.25% in April 2022 from 11.50%. One aim is to spur banks to disburse the surplus funds to industries and small businesses hit hard by the pandemic. Also, to reverse sluggish economic performance and curb the economic fallout, the RRR of large banks has been steadily pared to 11.25% from 14% in the beginning of 2019.

Reserve ratio

RRR is the portion of fund commercial banks set aside as reserve; it can neither be lent nor invested.

Governments often employ reserve requirements ratio to control money supply. A decline in RRR leaves banks with additional cash for lending and investment, potentially giving a fillip to a slowing economy.

Impact of RRR cut on Chinese economy

-

By bringing surplus funds to banks for business activities, RRR boosts liquidity. While local governments are increasingly selling infrastructure bonds, they are nudging banks to lend the fresh funds to industries and firms impacted by the COVID-19 pandemic and anchor enterprises’ long-term survival and growth.

-

The RRR cut could strengthen banks’ resolve to provide loans to entities and keep the net interest margin (NIM) steady, as well as obtain lower-cost funds. In 2021, banks offered large credits at a low cost to entities to kick-start their operations. Meanwhile, sustained high cost of deposits pressured banks’ NIM. Small and medium-sized banks, unlike their large counterparts, are unable to raise funds and have less scope to improve their NIM. Moreover, although the PBOC has adjusted the deposit interest rate self-regulatory mechanism to reduce the cost of banks’ liabilities, it may have a limited effect in the short term. Nonetheless, the RRR cut could ease banks’ NIM and fund cost to a degree.

-

Enhanced liquidity from the RRR cut should prop up the economy and the troubled property market. Overall, China’s liquidity-consolidation measures are distinct from those adopted by other major economies, currently in a tightening mode.

Limitations of RRR reduction

-

Given most current problems are the outcome of COVID-19-induced supply-side challenges, it remains to be seen whether the RRR cut can buoy the economy. More liquidity may enhance margins, but it does not address the root cause of the problem.

-

Banks’ propensity to lend will still be a function of the increasingly risky environment. Moreover, loan demand remains anaemic amid lockdown measures and a property market slump. This means a rate cut will likely have a marginal effect on economic growth.

Conclusion

Overall, the PBOC’s move to lower the RRR is key to shoring up long-term liquidity, boosting liquidity in a decelerating economy marked by a worsening property slump and pushing banks to lend to industries and firms under siege from the COVID-19 pandemic. The RRR cut could also steady banks’ NIM and help them lower their cost of funds. Monetary policy easing, however, may not remedy all the problems, many of which are the product of supply-side disruptions. Moreover, banks’ willingness to lend will still likely be influenced by the risk (currently increasing) inherent in the environment. Finally, as loan demand remains low amid lockdown measures and a property market meltdown, the rate cut may have a limited effect on economic expansion.

How Acuity Knowledge Partners can help foreign investors interested in China’s macro research

Most international investors with a keen interest in the China market may struggle to perform comprehensive research around regulatory policies and macroeconomic factors for their investment decisions because of many factors including language barrier in China.

Acuity Knowledge Partners, with a decade-plus presence in Beijing and talent pool of bilingual analysts, can assist investors in monitoring economic indicators, preparing macro databases, translating policy documents and preparing macroeconomic and sector reports, among others.

References

https://data.eastmoney.com/cjsj/ckzbj.html

https://www.investopedia.com/terms/r/reserveratio.asp

https://baike.baidu.com/item/降准/

https://www.wsj.com/articles/chinas-pboc-cuts-banks-reserve-requirement-ratio

https://www.bloomberg.com/news/articles/2022-04-15/china-s-central-bank-cuts-reserve

Tags:

What's your view?

About the Author

Yu Yang has over 7 years of experience in the financial services industry. Since joining Acuity, Yu has provided Equity Research support services for multiple global Top-tier Investment banks, focusing on China’s Banking, Property, EV, transportation, and leisure sectors. Yu holds a master’s degree in Financial Management from the University of Birmingham.

Like the way we think?

Next time we post something new, we'll send it to your inbox