Published on February 4, 2025 by Meghana D Prakash

Introduction

Asset-based lending (ABL) is used widely in the business world and refers to borrowing funds by using assets as collateral. The borrower monetises assets such as accounts receivable, inventory, marketable securities and property, plant and equipment (PP&E) on the balance sheet to secure loans that are structured to provide a flexible source of working capital.

Lenders generally assess the value of these assets of the borrowing company and lend a lower amount. The difference between the value of the assets and the lending amount is kept as a margin of safety for the lender.

ABL is a financing avenue that businesses resort to when they may have high leverage, erratic earnings, constant cash burn or marginal cashflow. It is primarily considered to provide a turnaround in business or facilitate recapitalisation or debtor-in-possession (DIP). Apart from fundamentally weak companies, financially sound companies (i.e. companies with constant profitability and free cashflow) also opt for ABL for greater flexibility in executing operating plans without breaching restrictive financial covenants.

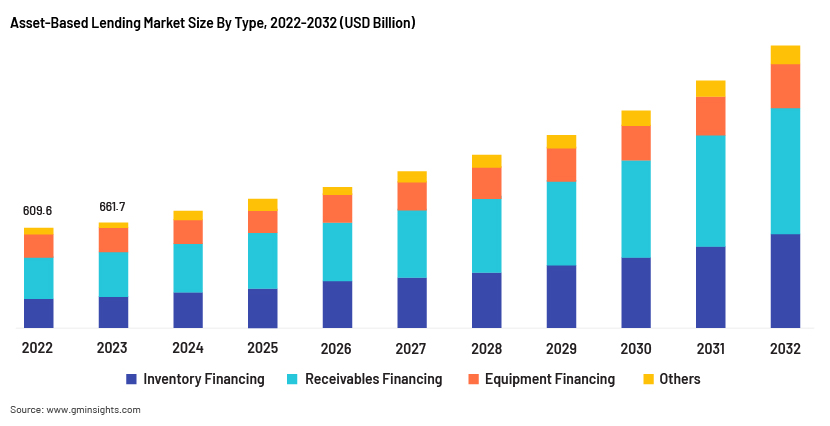

ABL offers a compelling alternative to conventional finance sources such as short-term loans, enabling businesses to use their current assets to obtain funds via faster and more flexible options. The ABL market was valued at USD661.7bn in 2023 and is expected to grow at a CAGR of over 10% from 2024 to 2032, according to Global Market Insights (see graph below).

ABL vs traditional bank lending

| Market | Bank market | |

| Capacity | Loan value is based on the company’s eligible assets – capacity, accounts receivable, inventory, machinery, real estate and equipment | Loan value is based on the company’s leverage, revenue, historical consistency of cashflow and debt levels |

| Capital structure | Revolver-heavy (maturity of three to five years) | Revolver or term loan |

| Monitoring | Through submission of borrowing base periodically such as accounts receivable ageing report and inventory summary and collateral diligence | Through maximum debt-service coverage and maximum leverage tests included in covenant package |

| Covenant structure | Flexible financial covenants are mainly on fixed charge coverage and inventory appraisals, such as a minimum coverage test, maximum leverage test and field examination and cash dominion | The financial covenant includes multiple covenants such as a maximum leverage test, minimum coverage test, and balance maintenance test |

Components of ABL

In ABL, the lender determines whether to approve a loan application based on the current and fixed assets of a company. Different types of ABL are provided based on the nature of underlying assets, such as the following:

-

Cash – The borrower can probably expect to get 100% for a letter of credit.

-

Real estate – Lenders tend to support higher loan-to-value (LTV) ratios – up to 95% for residential properties and generally upwards of 75% of appraised value for commercial properties.

-

Inventory – Frequently capped at a 50% LTV ratio.

-

Rare or customised assets –These command the lowest LTV ratios. The niche appeal and limited secondary markets for assets (e.g., fine art, wine collections and collector vehicles) limit their upside, which equates to a lower LTV ratio (approximately 25-30%).

-

Receivables – Generally at a 70% LTV ratio.

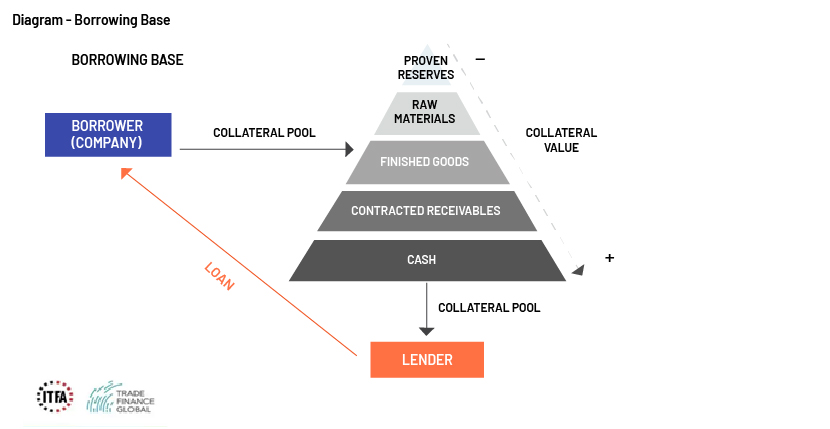

The lender appraises these assets to determine the borrowing capacity; the following are the components of ABL:

1. Borrowing base

Lenders evaluate the value of a business’s assets to determine the qualifiable advance amount, known as the borrowing base. ABL commonly refers to the LTV ratio, as it is crucial to determine the loan amount that can be borrowed based on the value of the collateral.

LTV ratio = Loan amount/asset value

For example, the lender offers the following LTV ratios for certain assets:

| Asset type | LTV ratio |

| Accounts receivable | 70% |

| Inventory | 50% |

| Machinery | 40% |

Borrower XYZ requires a USD200,000 loan and owns the following assets:

| Asset type | Value |

| Accounts receivable | USD205,000 |

| Inventory | USD220,000 |

| Machinery | USD350,000 |

Loan amount calculation:

Loan amount = Value of asset * LTV ratio

Borrowing base = (Accounts receivable × LTV ratio) + (Inventory × LTV ratio) + (Machinery × LTV ratio)

| Asset type | Value | LTV ratio | Maximum loan amount |

| Accounts receivable | USD 205,000 | 70% | USD 143,500 |

| Inventory | USD 220,000 | 50% | USD 110,000 |

| Machinery | USD 350,000 | 40% | USD 140,000 |

| Borrowing base | USD 393,500 |

2. Monitoring and reporting

The lender periodically reviews the collateral to ensure the assessed value complies with the terms of the loan through audits and regular financial reports from borrowers. The borrowing base is adjusted accordingly, depending on changes in collateral value, impacting the credit availability of the borrower.

3. Financial covenants

ABL usually has fewer and single financial covenants in the form of a “springing” fixed charge coverage ratio (FCCR), which is intended to measure whether the borrower has sufficient cashflow to cover the debt service and capital investment obligation.

Reasons for ABL increasing in popularity

ABL is increasing in popularity mainly due to the caution in the debt market after the pandemic. ABL offers flexibility and access to capital to businesses that are subjected to commodity price fluctuations, retailers with ebbs and flows in revenue, startups with limited financial history and distressed companies facing financial distress and undergoing restructuring.

The following contributed to the popularity of ABL after the pandemic:

-

Increased demand for business loans. Widespread economic disruption fuelled demand for ABL as businesses required immediate funding to manage cash buffers and operating costs. As ABL facilities are more easily accessible than other short-term loans due to fewer restrictions with covenants and flexibility in qualifying criteria, volume expanded over 15% y/y after the pandemic, according to research by the Secured Finance Network (SFNet).

-

Higher advance rates. Competition among ABL lenders has led to increased advance rates with sometimes up to 90% or more of an asset’s value, benefiting borrowers and enabling them to maximise their capital.

-

Cross-border ABL. Due to expanding globalisation of business operations post-pandemic, lenders are aggressively facilitating cross-border ABL for companies operating in multiple countries seeking financial solutions that can accommodate their international asset portfolios.

-

Risk mitigation.ABL facilities require few financial covenants for underwriting; the risk associated with lenders is mitigated by conservative advance rates against liquid collateral and frequent monitoring.

-

Seasonal opportunities. ABL provides funding for seasonal sectors by providing liquidity during periods of slow sales and inventory buildup.

-

Growth capital. As the financing line itself is tied to the value of assets such as accounts receivable and inventory, ABL provides increased credit lines as sales grow.

Conclusion

ABL stands at the forefront of innovative financial solutions, offering businesses the agility to unlock capital tied to their assets and drive growth without the rigid constraints of traditional bank loans. The ABL market continues to grow, driven by the evolving needs of businesses and the increasing value of secured lending, redefining the financial landscape.

How Acuity Knowledge Partners can help

We provide tailored financial solutions to clients to help them make informed decisions and manage risks efficiently across the lending lifecycle. Our services include the following:

-

Pre-closing: Borrowing base and financial spreading

-

Post-closing: Underwriting support, monitoring ABL, collateral analysis, financial spreading and modelling, monitoring covenants and determining periodic borrowing base

Sources:

-

What Is Asset-Based Lending? How Loans Work, Example and Types (investopedia.com)

-

ABL mythbusters: The truth about asset-based lending | U.S. Bank (usbank.com)

-

A Comprehensive Guide to Asset-Based Financing (ABF) | eCapital

-

Asset-Based Lending – Meaning, Process, Pros, and Cons (dripcapital.com)

-

Asset-based Lending – Understanding, Formula, Example (corporatefinanceinstitute.com)

-

A guide to asset-based lending for businesses (fundingoptions.com)

-

U.S. Lending Activity during COVID-19 | St. Louis Fed (stlouisfed.org)

-

Asset-based Lending Global Market Report 2024 (researchandmarkets.com)

-

Asset-Based Lending Market: Industry Analysis and Forecast 2030 (maximizemarketresearch.com)

-

Asset-based Lending Market Size, Share & Analysis Report – 2032 (gminsights.com)

-

LTV (Loan-to-Value) – Overview, Calculating, Collateral (corporatefinanceinstitute.com)

-

Asset-based Lending – Understanding, Formula, Example (corporatefinanceinstitute.com)

Tags:

What's your view?

About the Author

Meghana D Prakash is associated with Acuity Knowledge Partners for over 2 years, specializing in lending services. She has worked in collateral, financial spreading, valuation, fund administration and other lending operations projects for international banking and financial companies.

Meghana holds an MBA in Finance and Human Resources from BNMIT, under VTU University, and a BCom in Accounting from Dayananda Sagar Institution, affiliated with Bangalore University.

Like the way we think?

Next time we post something new, we'll send it to your inbox