Published on November 4, 2020 by Sayoni Ghosh

Overview of US commercial banking

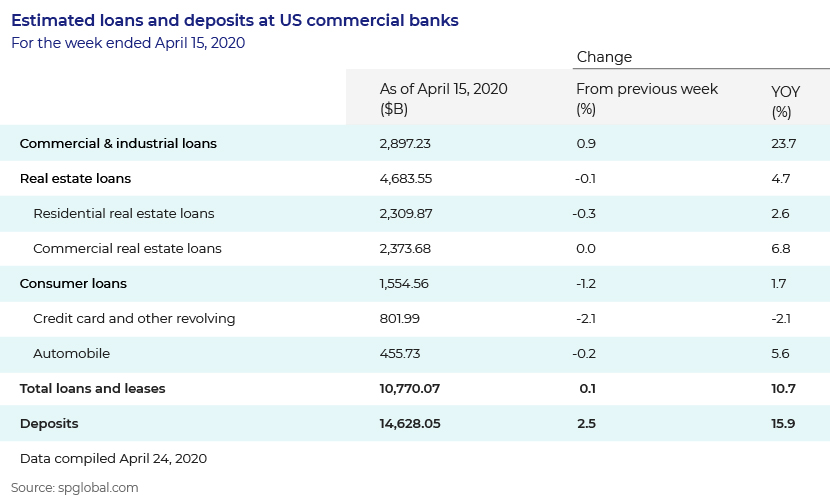

The US commercial banking system is valued at approximately USD682bn and encompasses 75k entities that employ 1.9m individuals. The sector has shown a modest improvement in most areas and remains strong, supported by a return on assets (ROA) of 1.5%. Total assets were USD16.5tn as of September 2020, up by 3.0% from 2019. The table below shows growth of US commercial banks’ loans and deposits, helping us better understand the current market scenario.

Election 2020 – what to expect

As the US presidential election approaches amid this pandemic, we anxiously await the result of the contest between Republican candidate and incumbent President Donald Trump and Ex-Vice President and Democrat candidate Joseph Biden. The first question every industrial sector faces is how the outcome will influence their future.

If the Republicans are re-voted in

In May 2018, President Trump signed a major bill to ease bank regulations in the US through the Economic Growth, Regulatory Relief and Consumer Protection Act (EGRRCPA). Among other provisions, the EGRRCPA eases requirements for banks relating to the leverage ratio, capital and liquidity, and high-quality liquid assets. Moreover, the Act exempts entities with less than USD10bn in assets from adhering to the Volcker rule, which prohibits them from engaging in proprietary trading activities. President Trump also directed the Treasury to evaluate laws, regulations and other official orders against the goal of making banking as competitive as possible while protecting consumers’ interests. In short, the Republicans are predisposed to easing restrictions on banks.

The coronavirus pandemic and related lockdowns have ravaged the US economy, with the federal and the current administration pumping a surprising USD6tn into the system since March 2020 and taking the interest rate back to a record low to keep the system on its feet. If a central bank sets its overnight deposit rate to below zero, the lender must pay its respective central bank to hold its reserves. Banks could then pass their costs on to their customers, charging fees for positive balances. This could severely impact the overall banking system, as the public may then be unwilling to maintain deposits with a bank.

If the Democrats win

Ex-Vice President Biden is closely linked to the 2010 law that enforced sweeping restrictions on banks for the purpose of increasing consumer protection. At the same time, banks may get some relief as lower rates likely trigger a refinancing wave, resulting in a benign credit environment and a low level of provisioning.

However, a Democrat win may mean a harder time for banks in the next few years as they face low earnings per share growth and concerns about tax hikes and tighter regulations. After years of positive development, there may be concern about a potential roll-back if the Democrats gain control of the presidency and/or the Senate. In a worst-case scenario, reversing tax refurbishment benefits could strip 12% from earnings per share.

However, we do not expect the election result to impact the sector in the long term. The vast majority (93%) of investors believe the presidential race will affect the stock market only in the short run, according to a survey by asset manager Hartfort Funds. Historical trends also show there is little difference in market returns in the long term based on which party is governing.

Bigger challenges facing the sector

US banks face a challenging environment in terms of the coronavirus pandemic, low interest rates, an evolving technology delivery system for banking transactions that is raising competitive pressure, and cyber threats.

-

-

The number of US banks has fallen by 20% since 2010, driven by failures, mergers and a lack of new entrants. In the current environment of technological advancement, smaller banks’ existence itself is being challenged. Growing demand for online and mobile banking products (digitalisation) is expensive for banks, especially smaller ones, to implement. This is because they require staff and infrastructure to provide these services, while they protect themselves against unauthorised access of their systems and protect confidential customer information.

-

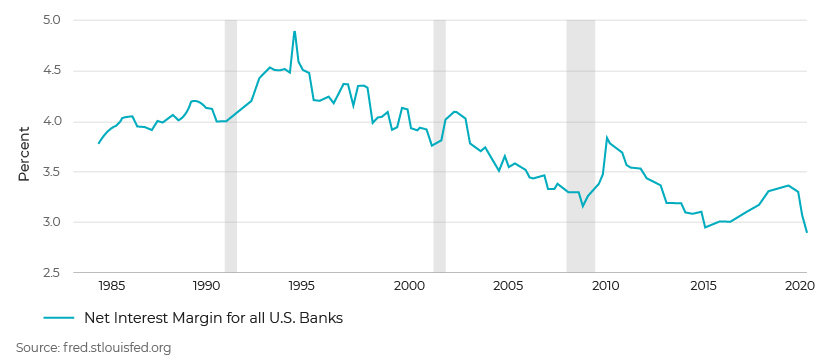

Interest rates, which have been declining since 1995, have led to a drop in operating income.

-

-

Another challenge is bringing the weakening US banking system back on track so it can cope with the surge in bitcoin and cryptocurrency adoption.

-

Banks need to familiarise themselves with the use of artificial intelligence and algorithmic/alternative credit data that is gaining popularity as a means for extending loans to more consumers, although policymakers are still to determine who bears the responsibility when algorithms result in discriminatory lending practices.

How Acuity Knowledge Partners can help

To offset falling income, banks need to keep their expenses in check, while ensuring low default rates and compliance with regulatory requirements. We support banks by analysing client financials effectively and providing solutions to help them monitor loans efficiently, keeping a close watch on potential non-performing assets.

Disclaimer: The views and opinions expressed in this blog are those of the author and do not necessarily reflect the views of Acuity Knowledge Partners.

Sources:

https://www.mordorintelligence.com

https://www2.deloitte.com/us/en

https://www.americanbanker.com

https://thehindubusinessline.com

Tags:

What's your view?

About the Author

I have over 8 years of experience in commercial lending domain having experience in credit appraisal, credit validation, real estate mortgage underwriting, asset summary report writing. I have been associated with Acuity Knowledge Partners since January’2017 and currently part of a team handling covenant monitoring of a US based bank. My responsibilities involve spreading financial statements, covenant monitoring, validation and analysis of ratios according to requirement in agreements.

Prior to joining Acuity, I have worked in commercial mortgage underwriting firm with base in US real estate markets. I hold PGDM in Finance from IAMT, Ghaziabad and..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox