Published on June 14, 2024 by Raj Kotecha

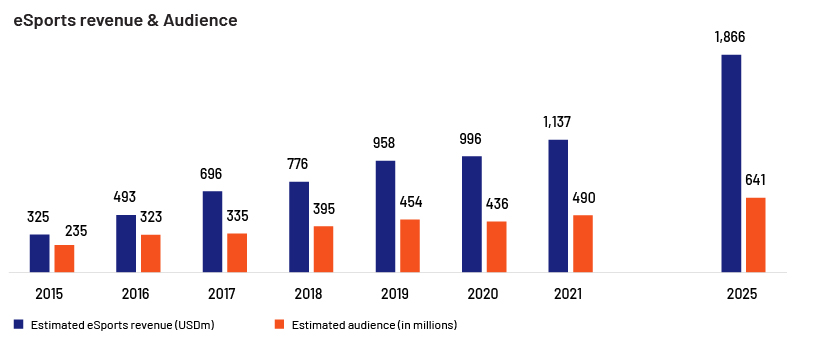

eSports, short for electronic sports, refers to competitive video gaming where professional players or teams compete against each other in organised tournaments. Once considered a niche hobby, this is now a more-than-USD2bn industry. Competitive tournaments, price money, live streaming, dedicated communities and significant audience reach have driven eSports to the mainstream, making it part of broader global gaming. Assessing its relationship with the wider interactive world signifies an expansive landscape.

Investment catalysts in interactive entertainment/gaming industry

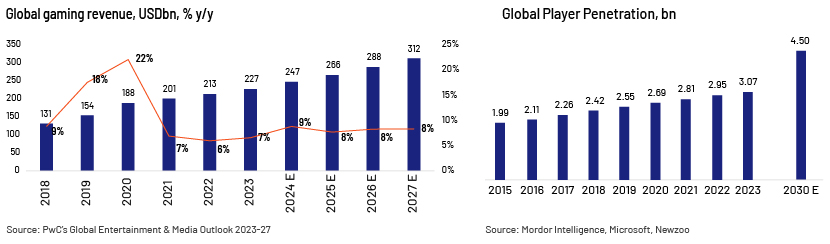

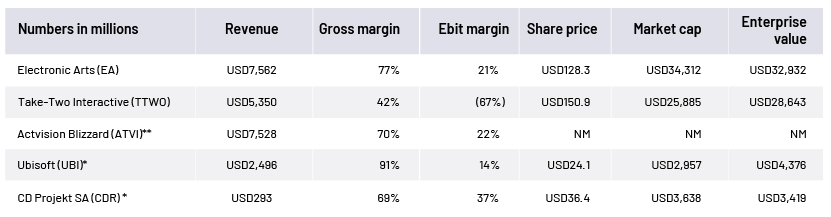

Internet infrastructure has enabled more people to access online games seamlessly. The global internet penetration rate increased to 67% as of 2023 vs 64% in 2022. Furthermore, gaming consoles have become more powerful, able to handle larger and more complex games. The original PlayStation (1995) had only 1MB of memory, while the PS5 and Xbox now offer up to 2TB of internal storage. Plus, the pandemic accelerated the adoption of gaming as a form of entertainment, leading to increased revenue. Gamers now seek diverse experiences, from casual mobile games to high-end PC or console titles. In terms of industry revenue generation, traditional media such as mobile games represent 49%, PC 22% and console 29%. Above all, the evolution of the USD4bn cloud gaming space (gaming as a service, or GaaS) and the USD2.4bn eSports segment are trailblazing investment catalysts attracting premium valuation of studios/publishers/developers such as EA, ATVI, TTWO, UBI, Embracer and CDR. Lastly, digital distribution has boosted profit margins due to lower production costs, less need for inventory management, the drop in retail distribution (fall of GameStop as consumers switched from discs to digital downloads), innovative monetisation models and faster reach, leading to higher cash realisation for game developers and publishers.

Key players

*Converted to USD

**ATVI Acquired by Microsoft in October 2023 for USD68.7bn at USD95 a share

Share price, market cap and enterprise value are as of 20 May 2024

EA, TTWO and UBI follow a March year-end. Numbers are as of FY ended March 2024

CDR and ATVI follow a December year-end. Numbers are as of FY ended December 2022 for ATVI and December 2023 for CDR

Source: Company filings, Yahoo Finance

Factors contributing to eSports market growth

Source: Newzoo

The eSports market was valued at USD1.22bn in 2019; it increased to USD1.44bn in 2023 and is projected to grow to USD5.27bn in 2029 [growing at a 20% CAGR from 2024E (USD2.11bn)]. In addition, the number of eSports enthusiasts is expected to surpass 640m by 2025, growing at an 8% CAGR from 2020 (435m), driven by multiple revenue streams: sponsorships (59%), media rights (18%), publisher fees (12%), merchandise and ticket sales (6%) and digital and streaming (5%).

Industry monetisation model

In contrast to traditional industries, eSports has multiple interconnected layers that revolve around publishers developing games that fit the ecosystem; these are marketed as leagues with prize money, along with business generation from advertisers, sponsorships, streaming rights, tickets and merchandise fees. Electronic Arts (EA), a prominent publisher, hosts Ultimate Team championships, a popular game mode that enables players to create and manage their own popular franchises of FIFA, Madden and NFL virtual teams that have weekly events/challenges/leaderboards on a local level. These concurrent live-service strategies have attracted over USD7.6bn in revenue since 2015, driven by curated premium experiences and the cultivation of vibrant gaming communities. EA continues to improve its content, based on valuable feedback from players.

Looking beyond Electronic Arts, the prize money offered by the top three games is significant: Valve’s Dota 2 has awarded USD347m in prizes, involving more than 4,800 players across 1,800 tournaments. Epic Games’s Fortnite has distributed USD180m in prizes, engaging over 9,000 players in approximately 2,000 tournaments. Valve’s Counter-Strike: Global Offensive has given out USD162m in prizes, with more than 16,000 players participating in nearly 7,000 tournaments. These figures underscore that eSports not only heightens player engagement, but also drives direct sales.

Expanding the perspective further, Twitch, a livestreaming platform focused primarily on video games (the YouTube of gaming), has seen substantial growth. It attracted 1.5m broadcasters and 100m monthly viewers in 2015. By 2018, this had risen to 2.2m broadcasters and 15m daily viewers. Average concurrent viewership climbed to over 2m in 2021. In terms of revenue, Twitch is estimated to have generated USD2.8bn in 2022, with an average of 2.58m concurrent viewers. Interestingly, the platform saw 22.4bn hours of content consumed in the same year. This data highlights the significant role of livestreaming platforms in the gaming industry.

In essence, eSports, accounting for approximately 6% of the dynamic gaming industry, holds substantial investment potential. Saudi Arabia has invested USD120m to bolster businesses. In 2023, Savvy Games Group (part of Saudi Arabia’s Public Investment Fund) made a strategic move by increasing its stake in Electronic Arts by 55% to 24.8m shares, with a market value of USD3.1bn. Growth is evident – from the early beginnings in 1972, with the first recorded video game competition at Stanford University, to 2000-10, when the industry turned from gaming arcades to an organised marketplace with the monetisation opportunities discussed above.

How Acuity Knowledge Partners can help

With our global network of over 6,000 analysts and industry experts, we are a preeminent consultancy serving the financial services sector. Our success is driven by our commitment to delivering strategic guidance, innovative solutions and expertise across sectors. Our services have enabled our clients to achieve results in areas such as mergers and acquisitions, project finance, valuation, investment research, financial modelling and business strategies. With over two decades of experience in global markets, we continue to excel in providing exceptional value to our clients.

We help financial services clients stay up to date on new investment frontiers, industry trends and evolving business models. Our offering includes deep-dive analyses, thematic research, competitive landscape analyses and company coverage. Our team of fundamental research experts and data experts provide optimal solutions by combining alternative data and technology expertise to provide differentiated research insights.

Sources:

-

Cloud Gaming Market – Industry Size, Share & Companies (mordorintelligence.com)

-

eSports Statistics In 2024 (Viewers, Growth & Forecast) (demandsage.com)

-

Esports Market Growth Analysis Forecast Year 2031 (skyquestt.com)

-

esports Market – Growth, Size & Share (mordorintelligence.com)

-

Esports Audience Will Pass Half a Billion in 2022 | Esports Market Analysis (newzoo.com)

-

20+ eSports Statistics 2024: Growth, Revenue & Viewership – EarthWeb

-

EA’s Ultimate Team raked in $3k per minute last year (engadget.com)

-

Twitch Revenue and Usage Statistics (2024) – Business of Apps

-

Saudi Arabia deploys $120 million to boost gaming, esports industry – Wamda

-

Esports revenues will reach $696M in 2017 and $1.5Bn by 2020 (newzoo.com)

-

Esports Audience Will Pass Half a Billion in 2022 | Esports Market Analysis (newzoo.com)

-

Newzoo: Global Esports Economy Will Top $1 Billion for the First Time in 2019 | Newzoo

-

Esports revenues will reach $696M in 2017 and $1.5Bn by 2020 (newzoo.com)

Tags:

What's your view?

About the Author

With more than 7 years of experience in Equity Research, Raj is currently supporting Acuity’s leading Buy-side client covering global markets along with multiple industries. On top of this, his interests lie in integration of Big Tech, AI and Media. He holds a Master’s & Bachelor’s in Business Administration Finance with CFA Level 1 certification

Like the way we think?

Next time we post something new, we'll send it to your inbox