Published on August 22, 2016 by

A rising tide lifts all boats. In recent years, this maxim certainly holds true for the incredible increase in both corporate and sovereign debt across all major economies, driven by dovish monetary policies of global central banks. As per McKinsey, since 2007, global debt has grown by US$57trillion.

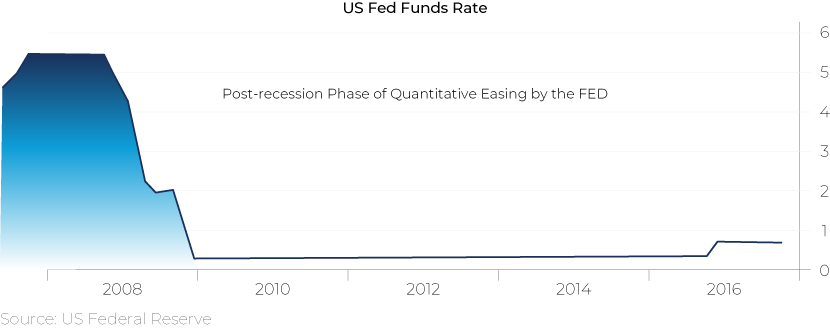

The global recession of 2008-09 and the macroeconomic turbulence in Europe have led to many years of policy initiatives by central banks, commonly known as Quantitative Easing (QE) programs. These were initiated by governments globally to bolster anemic growth in a post-recession macroeconomic world order. A key mandate of a QE program was to infuse liquidity in markets, typically leading to a low interest rate regime. During this phase, interest rates remained at record low levels for a considerable period. An analysis of the US Fed rates given below indicates that these have been at the near-zero level since 2009. The Fed left the target range for its federal funds rate unchanged at 0.25% to 0.5% at its July 2016 meeting. Similar monetary policy initiatives were undertaken by all major central banks worldwide to stimulate growth. Over the years, lower rates have led to an excess of cheap liquidity in the market in the form of debt.

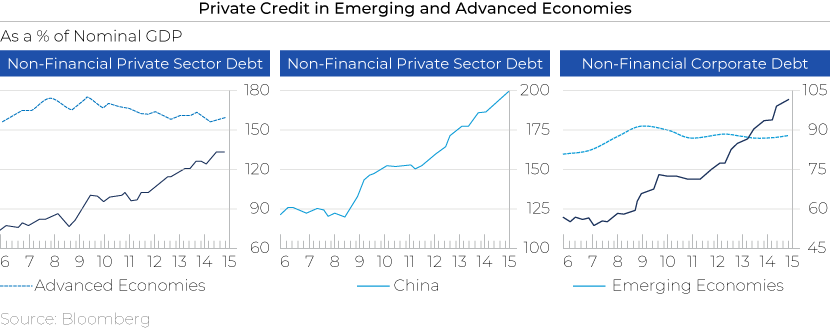

Against this backdrop, over 20 countries now have their Debt-to-GDP ratios above 200%. Business, household and government debt have all increased. This debt has largely found its way into the emerging markets led by China. Since 2007, developing economies have accounted for around half of this increase in debt. Between 2007 and 2014, China’s debt quadrupled from US$7trillion to US$28trillion.

Issuers are being rewarded with lower costs of funding and are seeking to lock-in low rates for the long term in the international markets. A sustained period of low interest rates has made investors hungry for higher yields to boost returns. The search for higher yield is driving markets – ranging from perpetual bonds in Singapore to Samurais in Japan. Sales of Samurai bonds (yen-denominated debt issued by non-Japanese entities) totaled 425.7 billion yen (US$4.07 billion) in June 2016, the most since May 2014. Investors are seeking longer tenors for higher yields. With the Fed holding rates for now, this trend is expected to continue in the near term. In the mid to long term, as global markets stabilize and rates inch north, this tide may turn.

Copal Amba is acting as a key partner to investors, offering specialized research solutions tailored towards debt markets. It provides transaction support ranging from origination, execution and distribution of bonds and syndicated loans.

What's your view?

Like the way we think?

Next time we post something new, we'll send it to your inbox