Published on February 4, 2025 by Anshuman Bhawsar and Kurian K Jacob

Politically exposed persons (PEPs), due to their positions of power and authority, are delegated with important responsibilities and resources. Due to this prominence and access, they play a central role in ensuring there is accountability in governance although they are most likely to be targeted for corruption and bribery. It is, therefore, important to apply measures to reinforce ethical decision-making to eliminate any possibility of misuse of such influence.

PEPs are usually more vulnerable to criminals, as a PEP’s family and friends could be coerced and compelled to engage in criminal and unlawful practices. Due to their power and authority, any illegal activity they are involved in could be more impactful and lead to serious consequences.

As a result, financial organisations and banks should take additional measures to minimise the risks posed by PEPs. This involves conducting due diligence on PEPs and their family members and monitoring signs of illegal activity. Further measures include acquiring information about the source of customers' wealth and conducting periodic reviews of the status of PEPs.

Firms' obligations under FCA regulations

The FCA regulations require companies to have the necessary risk-management mechanism and procedures in place to assess whether a customer or the beneficial owner of a customer is a PEP and to mitigate the various risks that result from such relationships.

The FCA advises that even if a PEP does not hold a public position, they should be subject to extra scrutiny for a minimum of 12 months. Companies could continue scrutiny for longer if they believe a specific PEP remains a significant risk.

FCA guidance on treatment of PEPs

According to FCA guidance, financial firms including banks, payment firms and lenders should ensure that parliamentarians, senior public servants and their families are not treated unfairly. The regulator has issued the following guidance:

-

Ensure that the definition of PEP is restricted as recommended by law

-

Review and monitor the status of PEPs and their associates once they leave office

-

Effectively communicate with PEPs in terms of consumer duty, providing clear guidance on their action

-

Effectively consider the risks posed by PEPs and ensure that the information requested is proportionate to the risks posed

-

Improve the training of staff who directly deal with PEPs

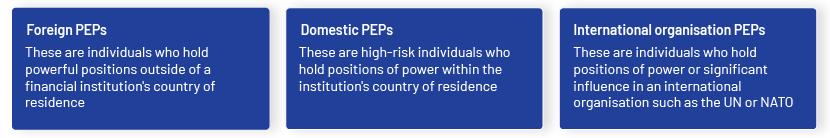

To understand FCA guidance better, we need to understand who is categorised as a PEP

A PEP is an individual in a high political role or who has been assigned an important public function or role in a government body or international organisation. Immediate family members or close associates of these individuals are also considered to be PEPs.

PEPs often have significant power over functions such as government spending, development plans and grants.

Examples of PEPs:

-

Heads of state

-

High-ranking government officials

-

Military officials

-

Central-government governors

-

Senior bureaucrats

-

Board members

-

Executives of international organisations

Categories of PEPs

PEP risk management – best practices

Companies looking to establish a robust risk-management process should consider the following practices:

-

Prioritise highly accurate and reliable data. Companies should focus on acquiring highly accurate and reliable data from all employees. This will enable quick assessment of PEP status.

-

Develop a robust screening process using checks such as adverse media screening. This provides an additional layer of scrutiny and enables assessing and addressing risks relating to corruption, bribery and drug/human trafficking.

-

Revaluate changes in PEP status. PEP status could change when an individual resigns or their tenure expires. In such instances, it is necessary to keep track on a real-time basis.

-

Ensure ongoing monitoring of PEP-related regulation.

PEPs are often subjected to more stringent regulation due to these risks associated with them.

Challenges in Screening PEPs

-

a) Be compliant: Use an extensive PEP screening tool that requires investment in terms of resources, time, and money to ensure compliance.

-

b) Updated PEP data: The PEP list is frequently updated, so companies need to stay updated, using software to safeguard against new risks.

-

c) False alerts: Screening software sometimes generates false alerts; this not only delays the process but also increases costs.

-

d) Regional regulations: Regulations relating to PEPs differ by region, making it challenging for a company to stay updated and compliant.

-

e) Data quality: Companies need to ensure that their data quality is good, as this will impact the screening process. Poor-quality data increases risk.

Controversy surrounding a PEP-related incident in the UK

This was when a prominent UK bank closed the PEP’s account, leading to media outcry.

The bank’s owners first claimed that the individual failed to meet the bank's eligibility criterion of holding GBP1,000,000 or more in his account after his mortgage expired. The individual later obtained incriminating evidence, claiming that the bank acted against him because of his political values. The scandal led to the resignation of the chief executive officer of a prominent company.

This incident prompted the FCA to encourage improvement in the treatment of PEPs. It has advised banks and lenders to take extra care to ensure parliamentarians, senior civil servants and their families are treated fairly and without discrimination.

How can compliance teams help?

The compliance team can play a major role in identifying PEPs and their sources of wealth. Through ongoing monitoring and analysis of PEPs such as via adverse media screening, sanction screening and transaction monitoring, suspicious activity can be reported to the authorities concerned.

Implementing strong internal control systems including establishing clear compliance policies, board accountability and independent oversight can help ensure compliance. This also includes maintaining records of the status of PEPs.

PEPs are often subject to a high level of scrutiny due to the associated risks. The compliance team can conduct due diligence by collecting information on the sources of funds and business relationships.

Conclusion

Ensuring compliance with regulations relating to PEPs is critical for maintaining trust in the financial world and protecting against corruption, bribery and other unlawful activity. Companies should adhere to the FCA’s regulations to reduce risk associated with PEPs even if they no longer hold public positions.

How Acuity Knowledge Partners can help

We provide expert guidance and a range of bespoke services including marketing material review and advertisement review, regulatory compliance review, distribution compliance, code of ethics monitoring, electronic communication monitoring and social media surveillance. Combined with our expertise in compliance, our subject-matter experts strive to maintain internal controls and help redesign workflow to mitigate inherent and potential risks identified under any policy or regulation.

We help implement an automated system that regularly updates PEP lists and monitors changes in an individual’s status, ensuring real-time compliance. We help document risk assessment and in enhanced due diligence as part of a wider compliance framework to ensure that FCA expectations on transparency and accountability are met.

Sources:

What's your view?

About the Authors

Anshuman has overall 5 years of experience in the financial services industry. Prior to joining Acuity Knowledge Partners, he has worked in KPMG, XL Dynamics and his expertise span across distribution compliance, project management, financial reporting and assurance.

At Acuity, he is a part of the Compliance Operations team and is responsible for compliance monitoring tasks for a client. He has completed master’s in business administration from Welingkar Institute of Management, Mumbai and Bachelor’s in financial markets from..Show More

Kurian K Jacob has overall 2+ years of experience in the financial services industry. Prior to joining Acuity Knowledge Partners, he worked for KPMG as an Audit Associate and his expertise spans across distribution compliance, risk consultancy, project management, and financial reporting and assurance. At Acuity, he is a part of the Compliance Operations team and is responsible for compliance monitoring tasks for a client. He has completed Master’s in business administration from St Joseph’s Institute of Management and Bachelor of commerce from St Joseph’s College of Commerce

Like the way we think?

Next time we post something new, we'll send it to your inbox