Published on April 5, 2023 by Ravisha Saparamadu

Climate change has a direct impact on fuel supply, energy production and the physical resilience of current and future energy infrastructure. The World Meteorological Department states that natural resource reduction is putting global energy security at risk; it says that water, which accounts for 87% of global electricity generation through thermal, nuclear and hydroelectric systems, is at risk of becoming a scarce resource.

With energy projects becoming increasingly vulnerable to climate change, climate risk assessment (CRA) has become an integral element in evaluating the long-term viability of energy infrastructure projects. CRA offers a systematic approach to capturing the character and scale of different risks (estimation of the magnitude and frequency of natural hazards, exposed assets and people, and the vulnerability of assets and people under certain natural hazards) to make informed decisions (source: Masum, 2019). CRA is an increasingly important consideration for lenders, as it helps them make more informed decisions on their investments by analysing the potential financial effects of climate risks while protecting their portfolios from potential loan losses.

Transition and physical risks: inevitable hazards for energy projects

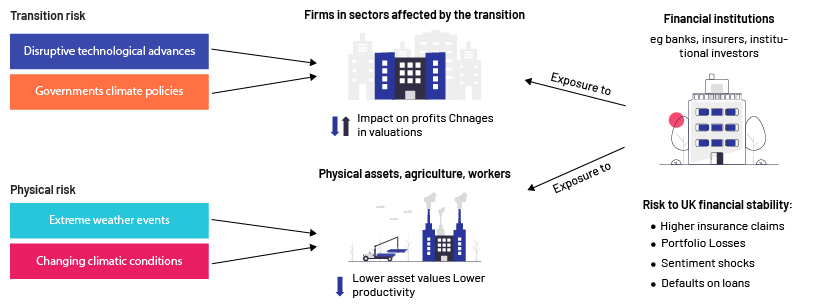

Climate risks and events can lead to uncertainty in returns while threatening the energy security of an economy. While climate risk can take many forms, the Taskforce on Climate-related Financial Disclosures (TCFD) offers a general classification of climate risks as physical risks and transition risks.

Physical risks arise directly from the changes in climatic conditions or as a consequence of climatic events such as floods and storms. One example of physical risk is the loss to petroleum platforms located in the Gulf of Mexico and the US West Coast due to rising sea levels.

Transition risks arise as a result of strategic and policy changes, accompanied by a societal and economic shift towards a low-carbon economy. Examples of transition risks affecting fossil fuel business include the transition to renewable energy and hefty carbon taxes.

While transition risks are considered to be a separate category of climate risks, physical risks are a precursor for most of the transition risks energy businesses will face. The European Environment Agency states that around two-thirds of global greenhouse gas emissions are linked to burning fossil fuel for energy production. Consequently, major political and environmental organisations have pushed to impose hefty rules and taxes on businesses engaged in fossil fuel extraction and fossil fuel-based energy production.

The following illustBanks’ lending exposure to climate risks ration from the Bank of England shows how banks and the financial stability of a country are exposed to the physical and transition risks of climate change.

Source: https://www.unepfi.org/psi/wp-content/uploads/2017/06/BANKOFENGLAND_response_climatechange.pdf (2017)

Facing the future with CRA

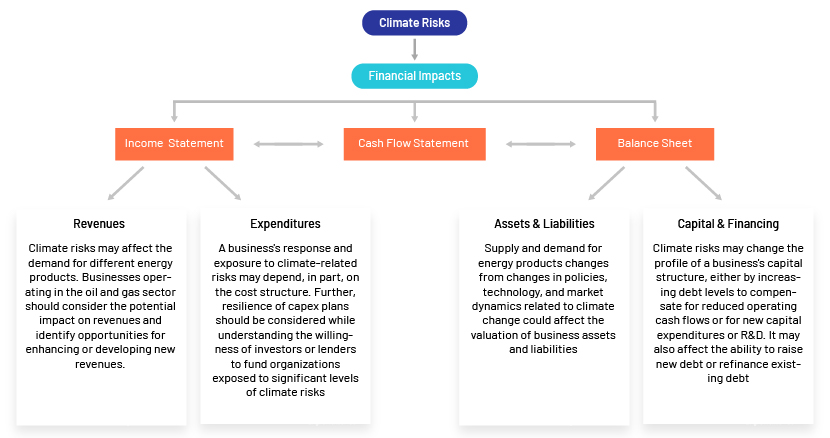

Limited knowledge of climate risks makes quantifying climate risks difficult for energy businesses. However, the TCFD identifies revenue, expenditure, assets and liabilities, capital and financing as the four major categories vulnerable to climate risks, as shown below.

Source: https://assets.bbhub.io/company/sites/60/2020/10/FINAL-2017-TCFD-Report-11052018.pdf (2017)

Understanding the fundamental impact of climate change through CRA, with a greater focus on forward-looking analysis, will help businesses in the energy sector mitigate and adapt to climate change even without historical precedent. Furthermore, CRA enhances the accuracy of decisions made in terms of capital allocation, corporate governance and operations, and helps formulate long-term strategies by identifying areas of exposure to climate risks.

Banks’ lending exposure to climate risks

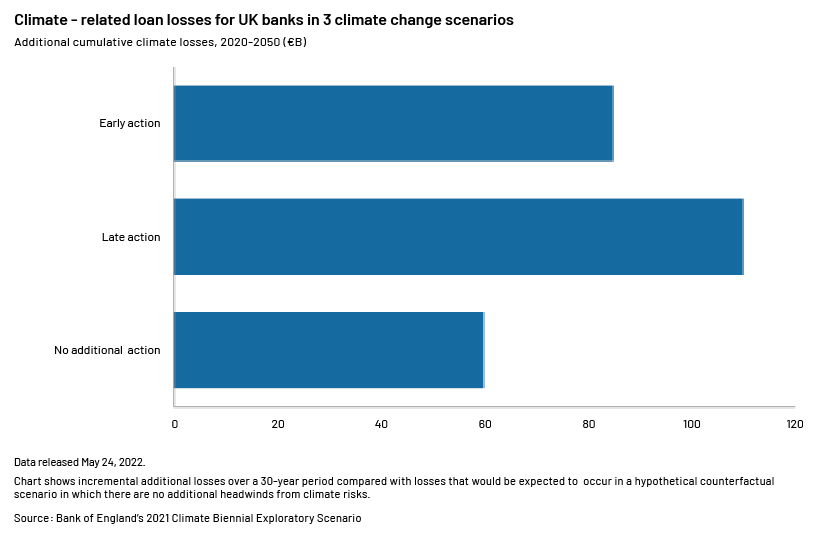

The Bank of England simulated three plausible scenarios in 2021 to estimate the potential loan losses from climate risk to UK banks’ lending portfolios. The results revealed that under the “late action” scenario, which addressed the transition risks of policy implementation to drive the transition to a net-zero economy, the banks would have to bear GBP110bn in additional cumulative loan losses over the estimated period of 30 years until 2050; this is 30% more than the losses predicted in the “early action” scenario. Despite the “no additional action” scenario, which largely addressed the physical risks, showing fewer loan losses, it was found that a “no additional action” scenario would be detrimental to banks beyond the 30-year horizon.

A climate stress test conducted by the European Central Bank showed that banks face USD71bn in loan losses from climate risks, with approximately 60% of the European banks that participated in the stress test having no integrated climate risk stress testing framework to assess vulnerability to climate risks.

Need for CRA in energy project financing

The energy sector faces a severe threat from climate risks, as these would directly impact energy production and the physical resilience of energy infrastructure. Banks backing energy projects are in turn exposed to these climate risks, as borrowers could default due to increased operating risks stemming from physical risks or increased regulatory pressures that could hinder debt-servicing capacity. Two major factors highlighting the importance of CRA for energy project financing are the downside of stranded assets and the impact of physical climate risks on efficiency, output and performance.

A) Creation of stranded assets

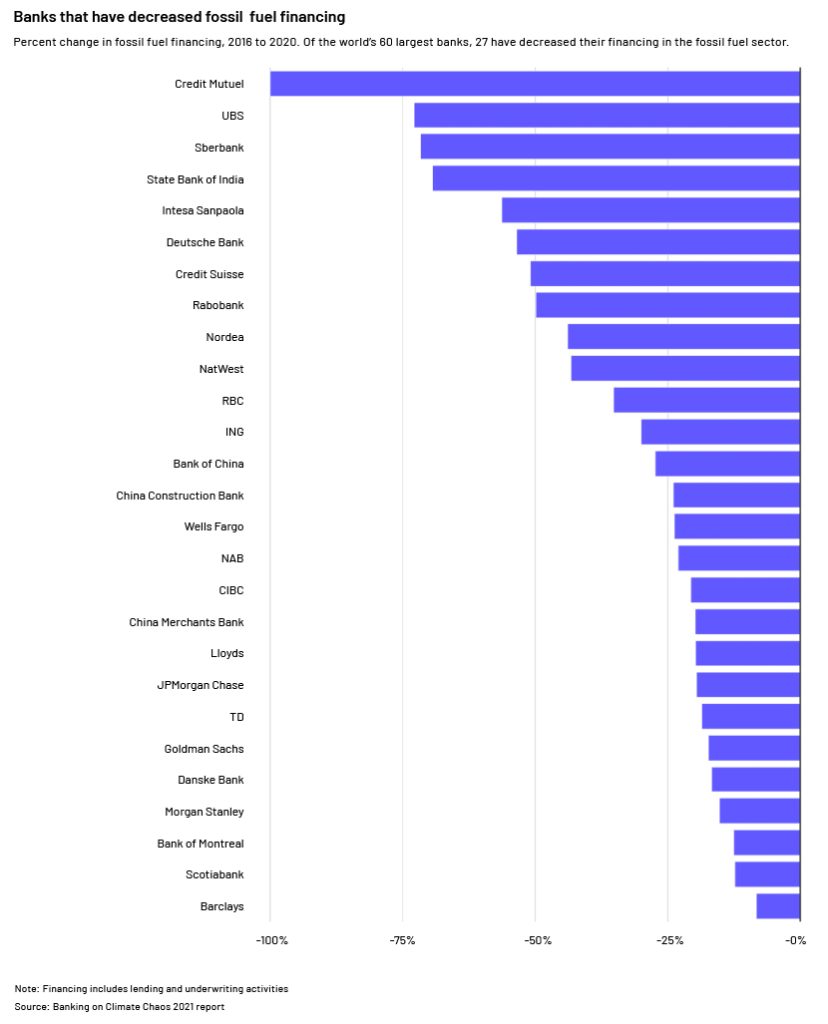

With the world gradually transitioning to a zero-carbon economy, fossil fuel businesses are being phased out by major economies; as a result, the physical and financial assets of these fossil fuel businesses are increasingly at risk of becoming stranded assets, exposing banks to credit risk due to not being able to recover capital over the operating lifetime of the assets, led by reduced demand and reduced prices. The Carbon Tracker Initiative (2022) estimates that over USD1tn of oil and gas assets are at risk of becoming stranded as a result of climate policy action and the increase in alternative renewable energy sources. Therefore, many banks have reduced funding to fossil fuel businesses, as illustrated below.

Source: https://www.cnbc.com/2021/04/22/which-banks-are-increasing-decreasing-fossil-fuel-financing-.html (2021)

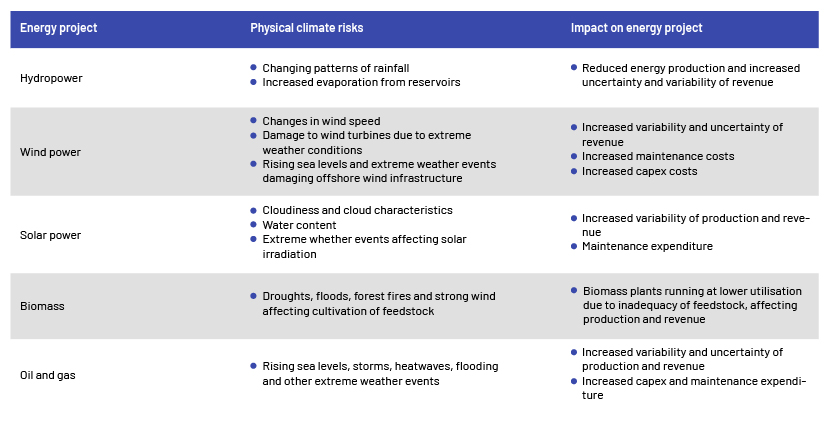

B) Efficiency, output and performance affected by physical risks

Physical risks increase uncertainty and fluctuation in production, reducing predictability of borrowers’ debt-servicing capacity. Despite increasing emphasis on funding renewable-energy projects to hedge against transition risks, banks are exposed to physical risks, as detailed below.

Regulatory and supervisory authorities’ scrutiny of banks’ vulnerability to climate risks

In light of the need to address the impact of climate risks, several authorities such as the European Central Bank (ECB) and the Federal Reserve Board have launched programmes to assess the impact of climate risks on banks, implying a likely increase in climate-related disclosures and requirements for banks.

-

In January 2022, the ECB initiated its first round of climate risk stress tests to assess the preparedness of banks to face financial and economical downside due to climate-related risks. Although the stress tests aim to identify vulnerabilities, best practices and the challenges banks face when managing climate-related risk, the ECB has indicated that it will continue to monitor banks' progress in CRA and increase its efforts in identifying best practices while setting a deadline for banks to meet all supervisory expectations by the end of 2024.

-

In the latter part of 2022, the Federal Reserve Board identified the need to assess exposure to climate risks by studying the six largest banks in the US (Bank of America, Citigroup, Goldman Sachs, JPMorgan Chase, Morgan Stanley and Wells Fargo). Fitch Ratings believes this assessment will benefit banks’ credit profiles by identifying gaps in data collection and risk governance while improving US regulatory competence on systemic climate risks.

How to limit banks’ exposure to climate risks

A) Re-evaluate business strategy and products

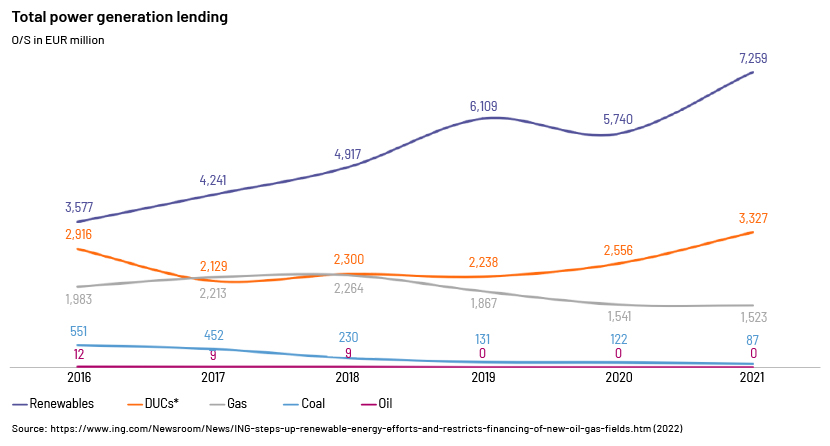

As banks become more knowledgeable about climate risks and their impact on the balance sheet and profits, they are taking measures to decarbonise their portfolios and reduce funding for fossil fuel businesses to align financing with the goals and timelines set in the Paris Agreement. ING Bank, a major European bank, has doubled its exposure to renewable energy and reduced exposure to fossil fuel businesses, as illustrated below.

B) Integrate CRA into the standard credit rating process

Lenders must take a long-term view of the need to integrate CRA into standard credit rating processes. Rating models would need to be expanded to incorporate physical risks arising from the geographical locations of assets and transition risk arising from the policies and regulatory changes due to the transition to a low-carbon economy. Banks would need to find the right granularity and time horizon to assess the impact of climate risks on the borrower’s credit risk. The first step would be conducting a sensitivity analysis to the different climate scenarios.

C) Put a price on integrating climate risks into project financing

Generally, energy project financing has a high leveraged structure of 70-80%. It is imperative, therefore, that lenders consider the project owners’ ability to service debt at each interest period rather than assess cashflow at the end of the project through NPV. Lenders should consider cashflow available for debt service (CFADS) when pricing energy project financing while assessing how different climate scenarios impact revenue, opex, capex and working capital adjustments used in calculating this CFADS.

D). Portfolio monitoring

Due to the uncertainty of climate risk, banks would need to constantly monitor their portfolio of borrowers by developing new methodologies and quantifying the impact of climate risks, so as to identify and take precautions against future anomalies. Deloitte (2022) proposed that banks can conduct portfolio monitoring by following a top-down or bottom-up methodology as follows.

-

A top-down methodology assesses the borrower’s probability of default through a fundamental analysis of the impact of climate risk on the borrower’s balance sheet and income statement.

-

A bottom-up methodology follows a forecast approach to produce scenario-adjusted financial statements of borrowers from which an individual borrower’s data is extrapolated to measure the impact of climate risk across the portfolio.

How Acuity Knowledge Partners can help

Measuring lending risks and losses by identifying potential climate risks and monitoring them continuously can help lending institutions limit downside and exposure to climate-related loan losses. We help lending institutions identify and monitor climate risks and their impact on projects through credit risk ratings and portfolio reviews while leveraging our in-house expertise and technology to provide clients with research and advisory services.

References:

-

https://www.adaptationcommunity.net/climate-risk-assessment-management/

-

https://www.adb.org/sites/default/files/publication/29889/climate-risks-adaptation-power-sector.pdf

-

Dong, J., Asif, Z., Shi, Y., Zhu, Y. and Chen, Z., 2022. Climate change impacts on coastal and offshore petroleum infrastructure and the associated oil spill risk: a review. Journal of Marine Science and Engineering, 10(7), p.849.

-

https://www.bankingsupervision.europa.eu/press/pr/date/2022/html/ssm.pr220127~bd20df4d3a.en.html

-

Carbon Tracker (2022) Unburnable Carbon: Ten Years Available at: https://carbontracker.org/reports/unburnable-carbon-ten-years-on/ (Accessed: November 15, 2022).

-

Blondeel, M., & Bradshaw, M. (2022). Managing transition risk: toward an interdisciplinary understanding of strategies in the oil industry. Energy Research & Social Science, 91, 102696.

-

Masum, Syed. (2019). Climate Risk Assessment Review. 10.13140/RG.2.2.36454.34881.

-

https://assets.bbhub.io/company/sites/60/2020/10/FINAL-2017-TCFD-Report-11052018.pdf

-

https://www.unepfi.org/psi/wpcontent/uploads/2017/06/BANKOFENGLAND_response_climatechange.pdf

What's your view?

About the Author

Ravisha is an Associate attached to the Commercial Lending Division at Acuity Knowledge Partners. She is currently part of the Energy team, undertaking credit/portfolio reviews, risk raters, covenant monitoring, annual reviews and other credit workflows for a leading European Bank. She is a CIMA passed finalist, holding a first class bachelor’s degree in finance from University of Colombo and a MBA (Finance) from University of Bedfordshire.

Like the way we think?

Next time we post something new, we'll send it to your inbox