Published on September 18, 2024 by Mahati Rao

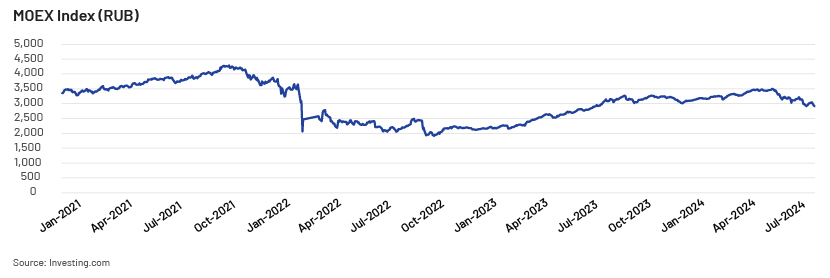

Russia’s economy has demonstrated remarkable resilience in the face of significant sanctions imposed by the EU and the US following its incursion into Ukraine in 2022. Despite facing economic upheaval, high inflation and fiscal deficits, Russia’s GDP has exhibited robust recovery in growth, outpacing that of a number of developed nations. The country's economic resilience can be attributed to factors such as high oil prices, support from allies including India and China, and stringent internal controls. The economy has recovered remarkably, with the MOEX Russia Index hitting its post-war peak in April 2024 since the start of the war.

Impact of sanctions on LNG

Several major economies have taken decisive action to support Ukraine by imposing comprehensive sanctions on Russia to restrict its revenue and block funding for the war effort. As of June 2024, the US, guided by its G7 commitments, implemented secondary sanctions to constrain Russia's allies and individuals, restricting the flow of technology and financial resources to the Russian economy. The EU has imposed 14 packages of sanctions, the most recent of which largely pertains to liquefied natural gas (LNG) exports from Russia.

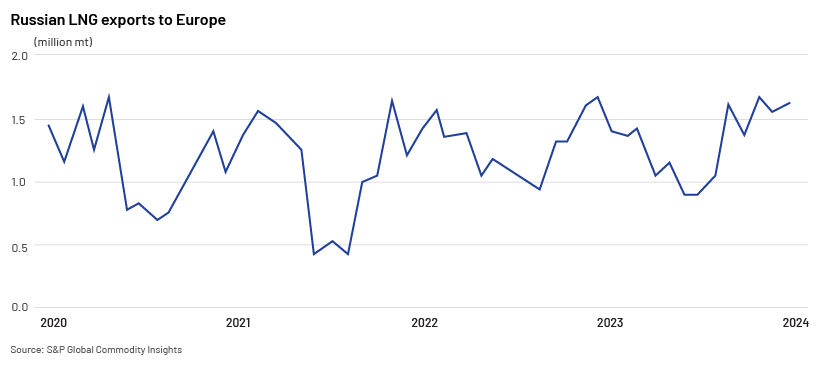

The EU sanctions that target Russia’s LNG aim to reduce Russia’s revenue from LNG exports by banning trans-shipments; additional clauses allow nations to cancel LNG contracts. However, gas-market experts believe this will have little impact, as Europe still buys Russian gas. Historically dependent on Russian gas, Europe has sought alternative sources, increasing imports from the US and other countries. However, US natural gas supply disruptions due to winter storms (Uri, Elliott and Heather) have occasionally forced Europe to revert to Russian imports. Russia supplied 4.89m MT of LNG to Europe in 1Q24, representing over 16% of the continent's total LNG supply, compared with 12.7% during January-April 2023, according to S&P Global. This highlights the complexity of global energy markets and the challenges of reducing dependence on Russian energy.

Examining Russia’s economy in light of sanctions

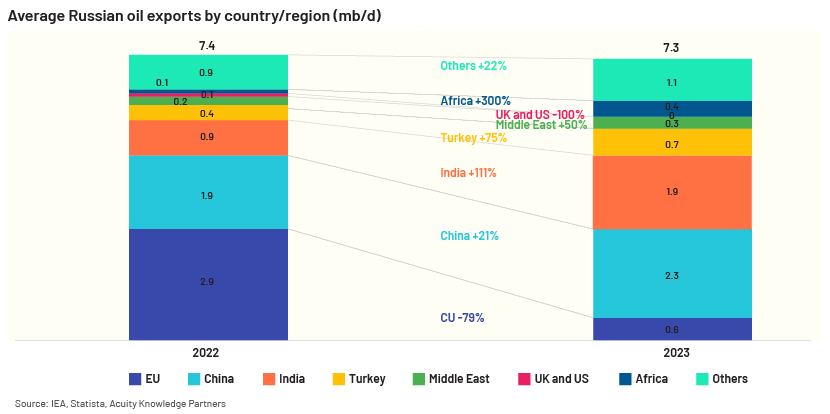

The Russian economy has been resilient despite the sanctions, driven by support from its allies, stringent internal controls and high oil prices due to the war, which have contributed to increased oil and gas revenue for the government. Since the start of the war, Russia has been diverting its oil exports to countries such as China, India and the Middle East. Russia’s refining capacity, which was damaged by Ukrainian drone strikes, also recovered sharply, resulting in a 12% m/m uptick in oil product export volumes in May 2024, according to the Centre for Research on Energy and Clean Air (CREA).

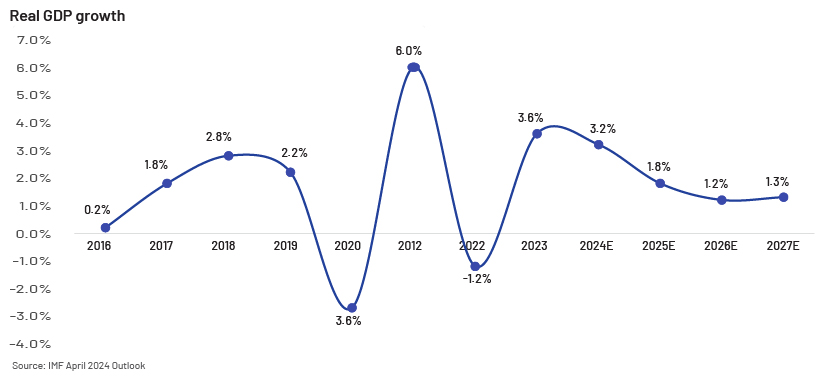

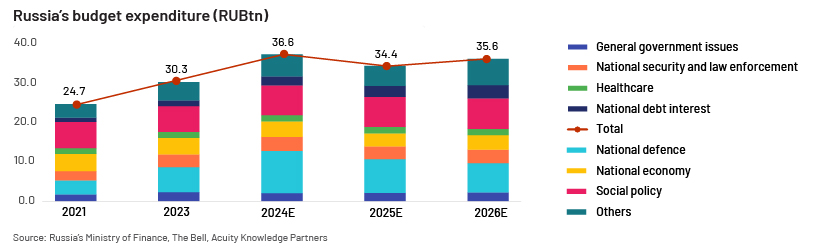

The country's resilience is visible in the recovery of its GDP, which grew by approximately 3.6% in 2023, following a 1.2% contraction in 2022. Real GDP is projected to grow by 3.2% in 2024, outperforming that of a number of developed nations. This could also be attributed to growth in oil and gas revenue and changes in monetary policy, including substantial government spending on national defence and security expected to account for a total of 39% of total spending (RUB14.3tn of budget expenditure) in 2024. Technically, military pay, ammunition and compensation for soldiers all support GDP growth. The IMF expects Russia’s GDP to continue to grow at an average annual rate of c.1.5% over 2025-27, slightly lower than its pre-war, pre-pandemic annual average of c.1.75% over 2016-19.

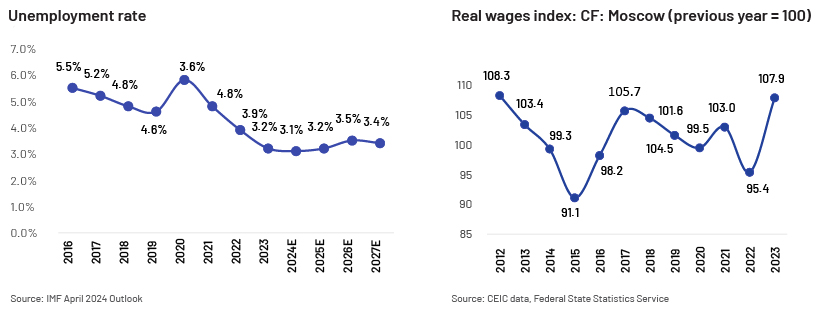

Another reason for the recovery of Russia’s GDP was private consumption, supported by increased real wages due to a tight labour market and improved consumer confidence. Government expenditure helped increase private consumption through increased labour demand from the military sector and higher payments and transfers to soldiers and their families. Russia’s private consumption grew at an annual rate of 6.5% in 2023, compared to a 1.1% y/y contraction in 2022, according to the European Commission’s Spring 2024 Economic Forecast. It is expected to continue to grow in 2024 and 2025 at 4.1% and 1.9%, respectively.

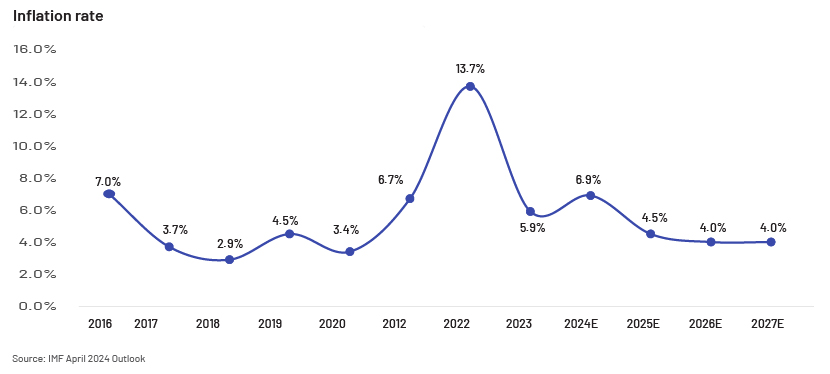

On the inflation front, Russia’s inflation spiked to a peak of 13.7% in 2022 from 3.4% in 2020 due to severe economic sanctions following its invasion of Ukraine, which disrupted supply chains, devalued the ruble and caused shortages of goods. Increased government spending and higher energy prices further fuelled inflationary pressures. The Central Bank of Russia (CBR) consistently raised its key policy interest rate, from 7.5% in September 2022 to 18% in July 2024. As a result, inflation declined substantially during 2023 to 5.9%, before inching up again to 9.1% in July 2024, prompting calls for the CBR to consider raising the key interest rate further to manage price growth. The market expects monetary policy to remain tight until substantial disinflation takes hold and inflation reaches the 4% target. The IMF predicts headline inflation to remain elevated for some time, with a forecast of around 6.9% in 2024, before reaching the target of 4% in 2026. The expected decline in inflation over the next couple of years should support growth of the Russian economy.

The fiscal deficit improved to 0.5% of GDP in 1H24 from 2% of GDP in 2023 as growth in key non-oil and gas revenue offset spending. Non-oil and gas revenue in the federal budget rose 26.6% y/y in 1H24 and receipt of sales taxes, including VAT, increased 17.6%, laying a stable foundation for further rapid revenue growth. Given the increase in economic activity, Russia’s finance ministry tweaked its budget plan for 2024 in early June, now expecting to spend more to leave a full-year deficit of 1.1% of GDP, or USD23.81bn. Military spending is expected to surge to around 6% of GDP in 2024, making up about one-third of the total budget.

In addition to spending, total revenue is expected to rise in 2024, in part owing to special taxes on energy companies and forecast growth in oil and gas revenue of 29.8% y/y in 2024, according to federal budget projections. The current account surplus in 1H24 increased to USD40.6bn, compared to USD23.3bn in 1H23, due to the increase in the trade balance and the narrower deficit in the balance of primary and secondary income.

Market outlook

Russia’s equity market has recovered most of the decline in the aftermath of the Ukraine war, with its RUB-denominated MOEX Index, which tracks the performance of the 50 largest Russian companies listed on the Moscow Stock Exchange, reaching pre-war levels. The index exceeded 3,500 in May 2024 for the first time since February 2022. Domestic investors and investors from friendly countries have been fuelling the upward trend in domestic indices. Russia’s focus on its military has helped significantly in the country's economic growth.

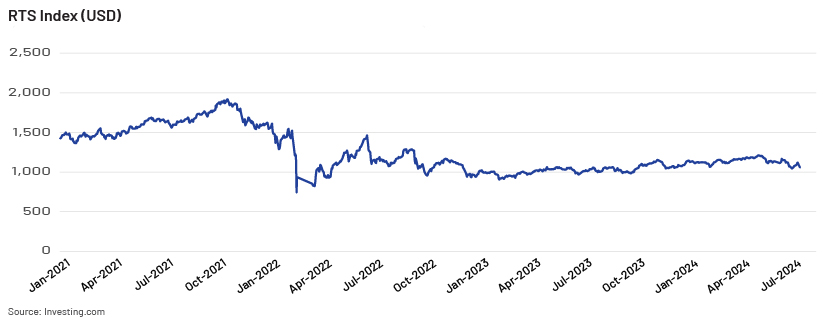

Meanwhile, the USD-denominated RTS Index, which comprises 50 of the most liquid Russian stocks listed on the Moscow Stock Exchange, has largely remained sideways after a decline in 2022 due to financial sanctions that cut off most of the foreign access to the country, effectively trapping the stocks owned by foreign investors in Russia. Foreign portfolio investors previously accounted for about 40% of equity ownership; valuations of these shares have been marked down by over 90% since the war, with little hope of foreign investors ever recovering their investments.

The RUB dropped significantly at the start of the war but has since been resilient due to recovery of the country's economic strength. Overall, economic growth is expected to show strong momentum in the near term as Russia’s government and consumer spending remain strong.

In 2023, Russia's economic expansion was bolstered by significant growth in trade (+6.8%), the financial sector (+8.7%) and construction (+6.6%). This can be attributed in large part to a substantial increase in military-related activity in 2023 and reflects the nation's remarkable economic resilience amid substantial Western sanctions and persistent military involvements. Furthermore, a low unemployment rate and corresponding strong wage growth are driving consumer spending, enabling Russia's economy to surpass expectations. The positive rally in the MOEX Index indicates the country's strong underlying fundamentals; investors may consider this as an opportunity to invest in the MOEX.

How Acuity Knowledge Partners can help

Global investment banks and asset managers leverage our sector-specific/macroeconomic experience to rapidly increase internal analyst bandwidth and expand coverage. We set up dedicated teams of analysts (CAs, MBAs, CFAs) to support our clients in a wide range of activities including idea generation, macroeconomic research, financial analysis, thematic research, building databases and providing regular sector coverage. Each output is customised, based on the client’s requirement, and made available for their exclusive use. This ensures our clients a unique, sustainable edge.

Sources:

-

https://cepr.org/voxeu/columns/russian-economy-war-footing-new-reality-financed-commodity-exports

-

Russia's war economy faces tough times ahead, says IMF's Georgieva | Reuters

-

Oil, gas, and war: The effect of sanctions on the Russian energy industry – Atlantic Council

-

Russia: Gloomy medium-term economic outlook (allianz-trade.com)

-

The Russian economy on a war footing: A new reality financed by commodity exports | CEPR

-

https://www.ceicdata.com/en/indicator/russia/private-consumption--of-nominal-gdp

-

https://ec.europa.eu/economy_finance/forecasts/2024/spring/spring_forecast-2024_ru_en.pdf

What's your view?

About the Author

Mahati has over seven years of experience spanning investment research, with expertise in writing reports, analyzing data sets and news flows to derive conclusions, and other research-related work. She has been associated with Acuity Knowledge Partners since December 2021 and currently supports a U.S.-based hedge fund with an AUM of ~$60bn. Before joining Acuity, she worked at a research firm covering stocks listed in the US.

Like the way we think?

Next time we post something new, we'll send it to your inbox