Published on March 1, 2023 by Rekha Narasimhan and Madhu Reddy

SEC's 2023 Exam Priorities

The Securities and Exchange Commission (SEC) announced its 2023 examination priorities last week, primarily to safeguard investors’ interest and the integrity of capital markets.

The SEC hasn’t deviated from its focus areas compared to the previous years. Once again, the regulator has taken a stance towards broker-dealer houses/registered investment advisor (RIA), information security risk, crypto assets and risks emanating from emerging technologies. As per a press release, the watchdog may sharpen its focus on new investment advisors and investment firms.

A quick comparison of the SEC’s examination priorities between 2020 and 2023 shows the regulator is narrowing on specific themes as the markets stabilise after the lows from the COVID-19-pandemic outbreak. At the same time, it is looking at a potential recession, which seems to be long overdue.

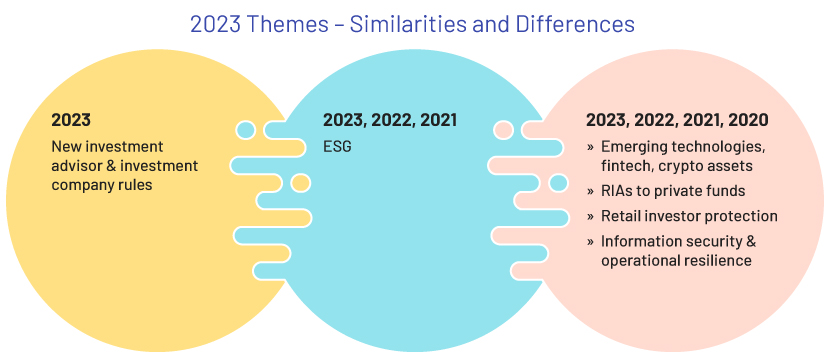

2023 Themes – Similarities and Differences

The above image shows that in all the four years, the focus was on RIAs to private funds, fintech and crypto assets, retail investor protection, and information security and operational resilience.

A new theme emerging this year is new investment advisor and investment company rules, which may demand much from the firms.

Let’s take a closer look at the priorities announced by the regulator this year.

New investment advisor and investment company rules

The examination division seeks to focus on fresh marketing rules that enforce the legitimacy of investment advice provided by advisors, minimising the potential risk of advisors’ engaging in fraudulent activities or market manipulation. This is critical to protect the interest of retail investors. The examination entails the evaluation of written policies and procedures established by investment advisors and their supervisors to thwart violations.

On investment firms, the SEC will evaluate events and occurrences that may depreciate investment value considerably. This could include the evaluation and management of conflicts of interest it believes is material and have the potential to erode valuation.

RIAs to private funds

The SEC has emphasised more on compliance programmes, new marketing rules, custody, fees and expenses, the use of alternative data and conflicts of interest, among others. Issues pertaining to the Advisers Act and advisor’s fiduciary duty will be reviewed, and the related risks assessed. Additional areas under scrutiny include disclosures and conflicts related to investment recommendations and allocations, private fund advisors’ portfolio strategies and risk management. Besides, RIAs to private funds, including funds managed by side-by-side and highly leveraged private funds, remains under focus.

Environmental, social and governance

In recent times, the popularity of environmental, social and governance (ESG)-oriented investments has gained material traction. The examination division will stay focused on ESG-related advisory services and fund offerings to ensure funds comply with disclosures. Beyond this, the examination will study the means set forth in evaluating ESG products. This will likely ensure the transparency of investment products, protecting investors’ interest.

Retail investors and working families

The protection of retail investors and working families continues to be paramount to the regulator. The objective of the SEC’s evaluation has been to ensure investors receive recommendations that are in their best interest. The assessments this year will primarily focus on investment goals and account characteristics of the consumer, compared to the recommendations offered by the intermediary/broker-dealer. Investment alternatives and management of conflict of interest will also form part of the audits.

Information security and operational resiliency

Data protection and privacy, alongside wealth protection, have the same weightage. The SEC will examine information security practices, cybersecurity controls, data management practices to protect investors’ information, records, and assets at broker-dealers/RIAs. In addition, managing third-party risk and ensuring the integrity of third-party services availed, if any, will be covered as part of the assessment

Emerging technologies and crypto assets

The new-age investment vehicles may consist of crypto assets, online lending platforms and many other alternatives. To address the emerging trends, the examination of broker-dealer/RIAs is likely to encompass financial technologies, deployment of new practices and online solutions used in managing investments, among others. The audit will also cover the life cycle of investment solutions including sale, advice and offers. This is expected to ensure the broker-dealer/RIAs adequately meet the stated standards and are in compliance with the law of the land and risk management practices are fairly reliable.

The regulations and examinations continue to evolve to meet the needs of the dynamic financial, technological and investor landscape. Staying on top of the regulatory needs is never a choice, but a need. We can help you to prepare for tomorrow.

How Acuity Knowledge Partners can help

Acuity Knowledge Partners’ solution is to cultivate an ecosystem of controls that are dynamic, robust and proficient. Through this, we aim to address risk at all levels of your company. We review and identify gaps in compliance programmes, address the requirements of regulators and create unique solutions using our state-of-the-art technology infrastructure. With our focused set of offerings in the areas of corporate compliance, forensic analysis, compliance testing, monitoring programmes, risk trend analysis and risk mitigation, we customise and design reviews dedicated to mitigating your company’s risks, keeping the latest regulatory expectations in mind. A well-thought-through approach – from initial analysis to end documentation and recommendation – will provide you a holistic view of risks to our business and build its resilience to any threat.

Source:

SEC.gov | SEC Division of Examinations Announces 2023 Priorities

Tags:

What's your view?

About the Authors

Rekha Narasimhan has over 14 years of industry experience in the area of Risk and Compliance. Her expertise spans across Anti Money Laundering compliance and Electronic Communication Surveillance. She is associated with Acuity for the last six years. Prior to joining Acuity, she was associated with Goldman Sachs and HCL Capital Market Services. She holds a Master’s degree in Business Administration, specializing in finance. At Acuity Knowledge Partners, she is part of Corporate and Forensic Compliance team and specializes in Electronic Communication Surveillance and Code Of Ethics.

Madhu Prasad Reddy has 9 years of experience in Compliance. Previously worked with Cognizant Technology Solutions. Expertise in KYC, Code of Ethics and Email Surveillance. At Acuity Knowledge Partners he is part of the central compliance team and specializes in code of ethics. Madhu is an MBA graduate from Cambridge Institute of Technology, VTU University.

Like the way we think?

Next time we post something new, we'll send it to your inbox