Published on March 11, 2021 by Rekha Narasimhan and Sumana Das

While COVID-19 vaccines raise hope for a better tomorrow, the regulators continue to evaluate and enhance regulations to protect investors and uphold the integrity of financial markets.

The US Securities and Exchange Commission's (SEC’s) Division of Examinations announced 2021 examination priorities recently, with increased focus on environmental, social and governance (ESG) and climate-related risks. For many, ESG brings to mind typical environmental issues; in a broad sense, ESG factors provide a holistic framework to understand an organisation’s environmental responsibilities, workforce practices, product sustainability, and governance matters that include compensation, ethics and compliance, and data security. Hence, an enhanced focus on ESG- and climate-related risks demonstrates a holistic approach to meeting the overall examination guidelines.

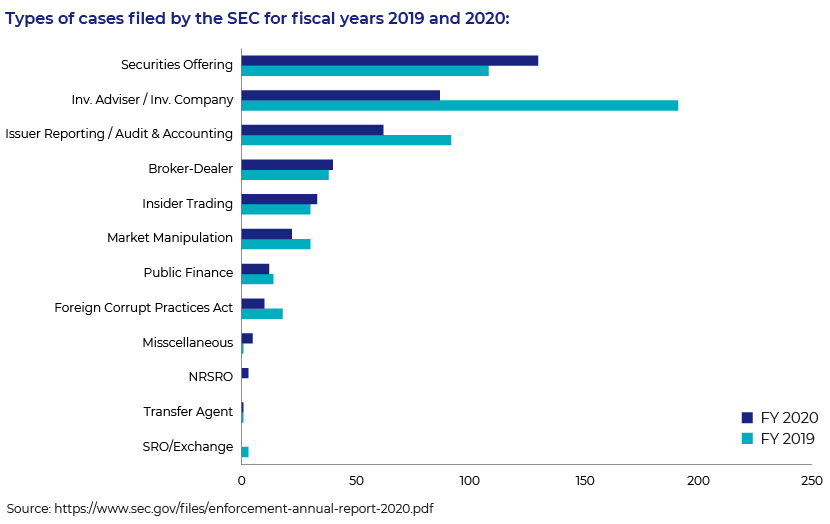

Statistics on the SEC’s enforcement actions highlight the need for every company to have a robust compliance programme in place. This was explicitly stated in the SEC’s Risk Alert in November 2020, where the Office of Compliance Inspections and Examinations (OCIE) indicated the need for sufficient compliance resources and annual internal reviews.

Source: https://www.sec.gov/files/enforcement-annual-report-2020.pdf

An overview of the 2021 examination priorities

Focus on retail Investors, those saving for retirement and senior investors:

The main purpose of this examination is to ensure registered investment advisers fulfil the duties of disclosure, loyalty, and care. This helps protect the interests of retail investors including seniors and those saving for retirement. Retail investors use certain products frequently – these include exchange-traded funds (ETFs), mutual funds, variable annuities, private placements, municipal securities, microcap securities, and other fixed income securities that the Division of Examinations would continue to prioritise. It will also continue check whether companies have disclosed conflicts, if any, and the measures they are taking to minimise conflict of interest. Timely disclosure of conflicts of interest to retail investors helps them make informed decisions

Information security and business continuity:

In the new world order, business continuity and disaster recovery plans would be integral to any business. The Division of Examinations would examine business continuity practices for their effectiveness and companies’ readiness to take appropriate measures amid any large-scale event, including a natural disaster. The Division also continues to examine data protection and information security practices to safeguard customers’ personal and sensitive information. The registered firms must demonstrate they have adequate measures in place to prevent account intrusions, customer authentication protocols to prevent unauthorised account access, oversee vendors and service providers, and address malicious email activity such as phishing and measures to prevent ransomware attacks. Due to the pandemic, the work-from-home format continues to be a new normal; hence, managing operational risk due to highly dispersed workforces would still require attention.

Financial technology (fintech) and innovation, including digital assets:

Here, the Division focuses on a registered company’s consistent adherence to stated representation and whether its operations are in accordance with customer instructions. Firms handling digital assets will be assessed to check whether investments are made in the best interest of investors, and their trading practices and the efficacy of their portfolio management services would also be examined. The safety of client assets, effectiveness of risk and compliance programmes, and monitoring outside business activities remain integral to the overall examination.

Anti-money-laundering (AML) programmes:

Financial institutions, including broker-dealers are required to establish AML programmes, in line with Section 352 of the USA Patriot Act. The Division will examine whether the registered firms have sufficient AML policies in place and are adhering to them. This helps identify and control suspicious and illegal activities related to money laundering.

The London Inter-bank Offered Rate (LIBOR) transition:

Registered firms using LIBOR will be in focus this year. The Division will assess these firms on their overall preparedness to adapt to using the alternative reference rate after the scheduled discontinuation of LIBOR due to rates decreasing significantly in recent years and interest rate manipulation.

Focus on investment advisers, broker-dealers and municipal advisers:

-

Fiduciary duties, Rule 606 and SCI: The potential impact of the pandemic on municipal advisers and their clients would also be examined, as would the ability of these advisers to fulfil their fiduciary duties. Broker-dealer reviews would assess whether firms are following the recently amended Rule 606 on order-routing disclosure. The Division will examine clearing agencies on governance, compliance and legal matters, and on back-testing, the effect of LIBOR transition and cybersecurity. These reviews would determine whether firms are following the policies and protocols mentioned by the Systems Compliance and Integrity (SCI) regulation. Focus areas would be IT governance, IT asset management, and cyber threat management/incident response including usage of cloud services.

-

Transfer agencies: The Division will assess whether the transfer agents are able to perform their core functions properly – these included the timely turnaround of items and transfers, recordkeeping and record retention, and safeguarding funds and securities. It would check whether they follow the respective exchange’s rules and federal securities laws or the guidelines set by FINRA. It would also check the effectiveness of the policies, procedures and controls of the Municipal Securities Rulemaking Board (MSRB).

What should you do next?

The following is a list of activities that would prepare your organisation for an examination by the regulators:

-

Maintain reasonably established written policies and procedures

-

Ensure the adequacy of resources and technology investment to strengthen compliance functions

-

Correct the review deficiencies observed either by the internal audit function or by the regulator, to demonstrate the organisation’s commitment to compliance practices

-

Evaluate the effectiveness of information and cybersecurity policies

-

Monitor customer on boarding and AML programmes

-

Assess the impact of any foreign regulations governing your organisation

-

Seek expert advice if you see the need to re-evaluate your organisation’s practices in line with the examination

Acuity Knowledge Partners’ perspective:

Acuity Knowledge Partners’ solution is to create an approach that cultivates an ecosystem of controls that are dynamic, robust and proficient. Through this, we aim to address risk at all levels of your company. We review and identify gaps in compliance programmes, address requirements of regulators and create unique solutions with our state-of-the-art technology teams. With our focused set of offerings in the areas of corporate compliance, forensic analysis, compliance testing, monitoring programmes, risk trend analysis and risk mitigation, we customise and design reviews dedicated to mitigating your company’s risks, keeping the latest regulatory expectations in mind. A well-thought-through approach – from initial analysis to end documentation and recommendation – will provide you with a holistic view of your business’s risks and build its resilience to any threat.

Source: SEC.gov | SEC Division of Examinations Announces 2021 Examination Priorities

Tags:

What's your view?

About the Authors

Rekha Narasimhan has over 14 years of industry experience in the area of Risk and Compliance. Her expertise spans across Anti Money Laundering compliance and Electronic Communication Surveillance. She is associated with Acuity for the last six years. Prior to joining Acuity, she was associated with Goldman Sachs and HCL Capital Market Services. She holds a Master’s degree in Business Administration, specializing in finance. At Acuity Knowledge Partners, she is part of Corporate and Forensic Compliance team and specializes in Electronic Communication Surveillance and Code Of Ethics.

Sumana is a corporate compliance professional with 2+ years of experience in code of ethics, monitoring and surveillance, AML-KYC. She holds PGDM in Operation and Marketing from Ramaiah Institute of Management.

Like the way we think?

Next time we post something new, we'll send it to your inbox