Published on June 18, 2024 by Treenoy Das and Asha Jagadishwaran

Form PF is a regulatory filing requirement for investment advisors [registered/required to register with the US Securities and Exchange Commission (SEC)] or certain Commodity Pool Operators (CPOs) and Commodity Trading Advisors (CTAs) [registered/required to register with the Commodity Futures Trading Commission (CFTC)] who manage one or more private funds and collectively (entities and related persons) have at least USD150m of assets under management (AUM) as of the last day of the most recently completed fiscal year. The form has been updated several times recently. The latest regulation, effective from 12 March 2024, aims to strengthen the Financial Stability Oversight Council’s (FSOC’s) ability to monitor systemic risk and reinforce the SEC’s surveillance of private fund advisors and investor protection.

Information reported: Details of entities, private funds advised, types of private funds, hedge funds advised, related persons, AUM, fund structure (parallel, parallel managed and master-feeder arrangements), liquidity funds advised, qualifying criteria and quarterly events reporting.

The first set of amendments came as part of the May release last year. The essentials of this are covered in our blog The SEC’s amendments to Form PF. These include the following:

-

Advisors to large hedge funds to report events indicating significant stress that could harm investors or the broader financial system

-

Enhanced reporting for large private equity fund advisors to improve the SEC’s and the FSOC’s ability to check systemic risk and identify/assess changes in market trends

-

Quarterly events reporting by all private equity fund advisors for investor protection

-

Annual filing by advisors to large equity funds on information relating to general and limited partners

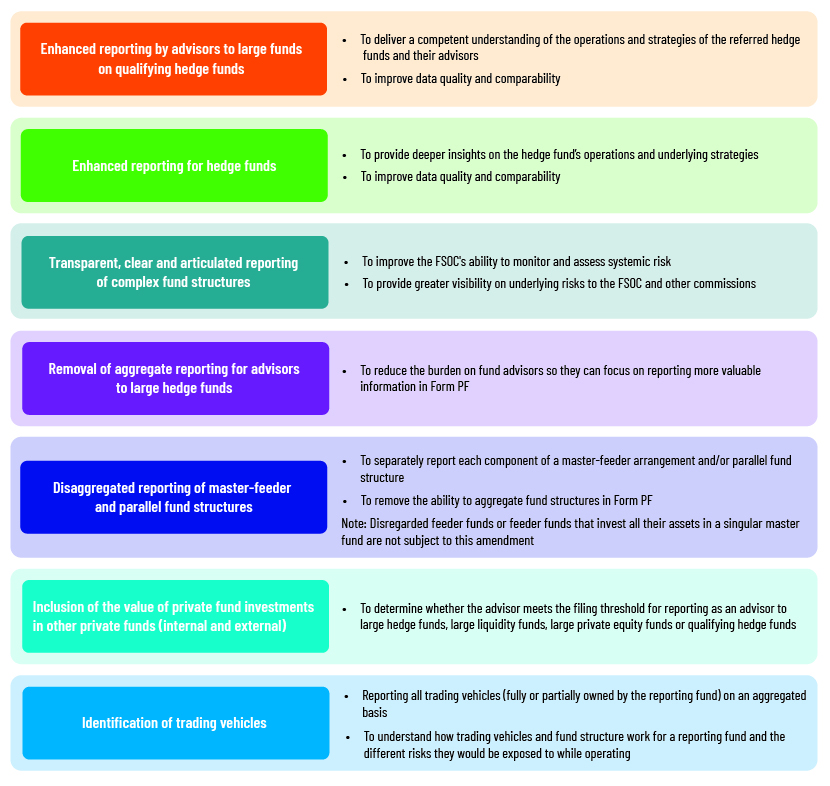

On 8 February 2024, the SEC and the CFTC adopted a new set of amendments to Form PF:

Source: SEC Adopts Amendments to Enhance Private Fund Reporting, 8 February 2024 (https://www.sec.gov/news/press-release/2024-17)

This additional set of amendments was implemented in less than a year due to the constantly developing and growing private fund market amid changing business practices, newer and more complex fund structures, contemporary investment strategies, market exposures and overall changes in operational themes in the sector. The FSOC requires more data to bridge gaps in information, enhance understanding of the private fund sector and potential systemic risks and further protect investors.

The latest set of amendments requires a substantial increase in reporting effort – hedge fund investment strategies (including digital assets), borrowing and financing arrangements, trading and clearing mechanisms, investment, borrowing and counterparty exposures, open and large position reporting, market factor and component reporting and disclosure of trading vehicles. Firms are also required to file quarterly, based on the calendar quarter and not the fiscal quarter. This increases the cost of compliance and calls for firms to be ready with the requisite data within the prescribed time limits.

Private fund markets are evolving rapidly and have more complex fund structures and strategies, and risks and exposures are likely to increase. Hence, it is vital to report the essentials and trust in the system’s ability to identify and combat such risks. Efforts such as these amendments are significant in ensuring that firms, regulators, investors, markets and the sector remain ahead of the curve.

How Acuity Knowledge Partners can help

Our compliance services help streamline the process of preparing regulatory reports and filing forms to ensure adherence to stringent standards and policies facilitating validation and certification requirements. Our subject-matter experts help meet regulatory requirements such as reporting and filing forms, and control overall risk by creating unique solutions for our clients using our state-of-the-art technology infrastructure.

References:

Tags:

What's your view?

About the Authors

Treenoy Das has overall above 5 years of experience in the financial services industry. Prior to joining Acuity Knowledge Partners, he worked at Price Waterhouse Coopers as an ethics and compliance analyst. His expertise spans independence compliance, risk consultancy, project management, personal account dealing and digital solutions. As part of the Compliance Operations team at Acuity, he supports his client through compliance monitoring.

Treenoy holds a Master of Business Administration in Finance and Marketing from University of Calcutta and a Master of Technology in Laser Technology from Jadavpur University, Kolkata.

Asha Jagadishwaran has 14 years of work experience, with expertise in electronic communication surveillance. Prior to joining Acuity Knowledge Partners (Acuity), she worked with the Internal Compliance and Supply Chain team at Honeywell Technology Solutions. At Acuity, she is an integral part of the Corporate and Forensic Compliance team. She holds a master’s degree in Human Resource Management, specialising in Finance, from Tilak Maharashtra Vidyapeeth - Pune

Like the way we think?

Next time we post something new, we'll send it to your inbox