Published on December 13, 2023 by Treenoy Das

In a rapidly evolving world marked by technological advancements, socio-economic shifts, geopolitical frictions, market disruptions and volatility, rapid transformation of financial markets and instruments and increased data-led decision making, it is essential more than ever to be vigilant.

The US Securities and Exchange Commission’s (SEC’s) Division of Examinations was established to safeguard investors, uphold market integrity and foster sound capital formation by focusing on enhanced compliance, fraud prevention, risk assessment and policy advisory. The Division conducts the SEC’s National Exam Program, the results of which are used to create rules, identify and monitor risks, improve industry practices and challenge misconduct and malpractice.

In its efforts to empower the compliance community and regulated entities, the Division communicates the deficiencies identified during the examinations through Risk Alerts, Compliance Outreach and Annual Exam Priorities. Risk Alerts are examination-specific compliance communications that address the challenges, observations, initiatives, industry practices, regulatory compliance and overall impact of identified exceptions or risks.

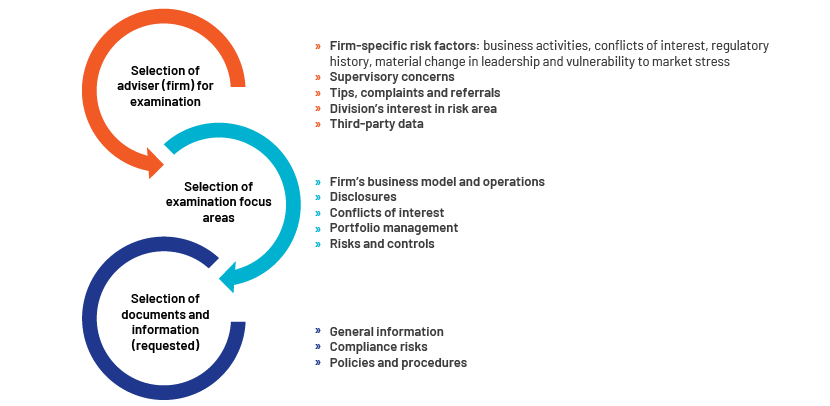

The SEC published Risk Alert – Investment Advisers: Assessing Risks, Scoping Examinations, and Requesting Documents on 6 September 2023, notifying investment advisers of the upcoming examinations. A summary of the exams process is given below.

Risk identification and assessment is a crucial step in the SEC’s Examinations Process. The SEC assesses various risks to investment advisers, including firm-specific, conflict of interest, digital assets, ESG investments, third-party, wrap fee programme, online investment advisory, fee calculation, and operational and non-operational risks. It uses technology to collect and analyse data, review disclosure documents and conduct continued risk assessment to contribute to financial market stability and effectiveness.

Recent actions by the SEC to make educated considerations on the scope for future examinations:

1. The SEC published another Risk Alert on 8 June 2023 – Examinations Focused on Additional Areas of the Adviser Marketing Rule – that informs investment advisers (including advisers to private funds) of additional areas of focus relating to the amended Marketing Rule. Other than the general prohibitions, the initial and continued areas of focus are as follows:

2. The SEC has consistently demonstrated its commitment to scrutinising hypothetical and extracted performance and implementing necessary policies and procedures.

3. Other areas of focus:

-

-

Improper or inconsistent accounting

-

Safekeeping of client assets

-

Disclosure of fees recordkeeping failures

-

Insider trading

-

Disclosure of policies and procedures

-

There are diverse types of initial information and documents that may be requested during the examination of an investment adviser:

-

Business information – An organisation's structure, business operations, client contracts, fees and payments.

-

Compliance, administrative and financial information - Administrative procedures, compliance policies, compliance training and attendance, disclosures, filings, litigations, valuation processes, conflicts of interest, insider trading, marketing and advertising material, financial records and custody.

-

Client information - Fee calculations for clients, client portfolios, investment strategies and trading information.

-

Policy information - Measures for protecting customer records and information, business continuity plans and cybersecurity measures.

The SEC’s Risk Alerts and Examinations are, hence, an effective and constructive way of adhering to established regulatory requirements and setting expectations in terms of compliance of regulators, the sector and an organisation’s stakeholders. Understanding the process of examinations, the document and information requirements and the scope of examinations keeps organisations informed and vigilant. Having a dynamic, proficient and well-equipped compliance function/advisory is crucial, as it would help an organisation keep abreast of regulatory requirements and conduct risk-based assessment across the different avenues of compliance discussed above.

How Acuity Knowledge Partners can help

We develop controls that are dynamic, robust and proficient in addressing risk at all levels of an organisation. We have expertise in identifying and reviewing gaps in compliance programmes, helping meet regulatory requirements and providing unique solutions by leveraging our state-of-the-art technologies. Our focused suite of offerings spans forensic analysis, compliance testing, monitoring programmes, risk trend analysis and risk mitigation. We customise and design reviews dedicated to mitigating company risk, keeping the latest regulatory expectations in mind. We also offer a well-thought-through approach – from initial analysis to end documentation and recommendation – to provide a holistic view of the risks an organisation may be exposed to and how to safeguard it.

References:

-

https://www.sec.gov/files/risk-alert-ia-risk-and-requesting-documents-090623.pdf

-

https://www.sec.gov/files/risk-alert-marketing-rule-announcement-phase-3-060823.pdf

What's your view?

About the Author

Treenoy Das has overall above 5 years of experience in the financial services industry. Prior to joining Acuity Knowledge Partners, he worked at Price Waterhouse Coopers as an ethics and compliance analyst. His expertise spans independence compliance, risk consultancy, project management, personal account dealing and digital solutions. As part of the Compliance Operations team at Acuity, he supports his client through compliance monitoring.

Treenoy holds a Master of Business Administration in Finance and Marketing from University of Calcutta and a Master of Technology in Laser Technology from Jadavpur University, Kolkata.

Like the way we think?

Next time we post something new, we'll send it to your inbox