Published on April 17, 2025 by Amit Bansal

Executive summary

Investment banks (IBs), independent research houses (IRHs) and mid-market brokers are striving to stay ahead by being more reliable, accessible and budget-friendly to their clients. Besides, there are strict regulations that call for a wider span of transparency and accountability, which re-develop sell-side research and operations. Firms can now deliver detailed analyses and actionable advice more quickly by leveraging advanced analytics techniques and tools, supporting clients to make informed investment decisions more efficiently. Most sell-side firms are now exploring niche areas that typically have little coverage in research, creating opportunities to fill the resulting knowledge gaps and enabling them to produce differentiated research that drives innovation and growth in the sector.

Importance of research coverage

Research coverage can enhance the functioning of financial markets by disseminating essential information about companies, enabling investors to make well-informed decisions based on comprehensive analysis. Having insights that shed light on a company’s true potential enhances investor confidence and builds trust by way of transparency and thorough performance evaluations.

Increased research coverage of a security has a ripple effect. The more analysts research a company, the more investor attention will be attracted, increasing its trading volumes. This increased activity would result in liquidity for the investors to trade the security without facing significant price movements. In brief, broader research coverage both informs and activates the market, creating a dynamic environment in which investors can thrive.

Balancing: expanding coverage, consistency, time to market and budget

Sell-side firms face several key challenges in expanding their research coverage and broadening their services. Expanding research coverage requires the availability of considerable resources, including potential new hires of analysts and technology systems, which can strain existing capabilities. Maintaining consistency and quality of research is another challenge, compounded by the reality that rapid expansion will dilute the depth and accuracy of reports, compromising client trust and credibility. Timely delivery of initiation reports is another significant aspect, as they need to maintain their relevance and attractiveness to clients who use such information for their investment decisions. Striking a balance between expanding research coverage, reaching the market and budget constraints is becoming a pain point for sell-side firms.

Building research capacity across disciplines and sectors is time-consuming, as it requires recruiting and training analysts in particular skills. In addition, internal compliance vetting imposes stricter guidelines on companies; such challenges often lead to legal and reputational damage. Finally, it blocks onshore analysts' schedules, restricting them from meeting with end clients, answering their queries and building stronger client relationships. This necessitates efficient delegation and support systems to handle routine tasks, freeing analysts to focus on high-value client interactions. Navigating these challenges skilfully is crucial not only for expanding coverage but also for ensuring that research remains of high-quality and relevant.

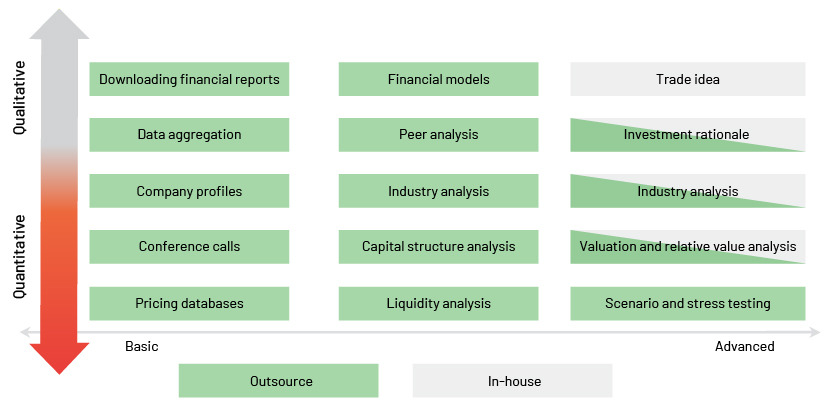

Leveraging specialised firms for low-hanging tasks

Sell-side research outsourcing can be an effective strategy to navigate some of the challenges described above. Sell-side research outsourcing allows sell-side firms to access specialised skills while easing the workload of in-house analysts. This approach enables them to retain or expand the scale of research efforts without the full costs associated with increasing internal headcount to offset outsourcing. Moreover, outsourcing enables onshore analysts to focus on crucial client-facing engagements and more strategic analyses. Through these strategic considerations, sell-side firms can enhance their coverage while controlling costs and delivering consistent, timely and high-quality research to their clients.

The wide range of research coverage activities (conducted in-house or outsourced)

How Acuity Knowledge Partners can help

Acuity Knowledge Partners bring more than two decades of industry experience as a committed collaborator in capital markets research, serving investment banks, independent research companies and mid-market brokers. Our team comprises highly experienced equity and credit analysts, supported by research publishing and operations teams in India, Sri Lanka, China and Costa Rica, helping firms effortlessly expand their coverage.

Through deep industry insights, domain knowledge and advanced analytical capabilities, we help traders and analysts quickly meet research requirements, ranging from the basic to advanced levels. The team sits for comprehensive Level 3 and Level 4 certifications in-house and follows a continued education programme to ensure they remain up to date on developments in different sectors and domains. Committed to excellence, the team provides customised services that keep track of and help clients adapt to changes in the regulatory environment for sell-side research.

Sources:

-

https://www.tandfonline.com/doi/pdf/10.1080/23322039.2019.1625480

-

Trading desk: Behind the Scenes of a Sellside Trading Desk update –FasterCapital

-

Trading: Best practices for the sell-side desk – The DESK – The leading source of information for bond traders

What's your view?

About the Author

Amit is part of Acuity Knowledge Partners’ (Acuity’s) Credit Research team, covering high yield, crossovers, distressed debt and leveraged loan credits across non-financial sectors for a leading European bank. He holds a master’s degree in business administration (specialisation: Finance) and a diploma in data science and business analytics, and is a certified Financial Risk Analyst (FRM).

Like the way we think?

Next time we post something new, we'll send it to your inbox