Published on January 24, 2025 by

Leveraged finance asset classes continue to attract investor interest, driven by strong demand amid relatively limited supply. Riskier asset classes rallied significantly up to the US presidential election in November last year, and Donald Trump’s victory prompted a further rally in spreads as investors anticipated lower corporate taxes, deregulation and a more favourable M&A environment. Economic data supported a narrative of robust consumer spending and easing labour-market concerns. Since September 2024, the Federal Reserve (Fed) has reduced interest rates by 100bps at its last three meetings, and markets expect an additional 50bps reduction in 2025. This comes at a time when GDP growth remains strong, at 2.7%, and unemployment is relatively low. A lower cost of capital is favourable for leveraged finance issuers, especially those with floating-rate debt. M&A activity and capital expenditure are expected to increase as the new administration implements pro-growth policies.

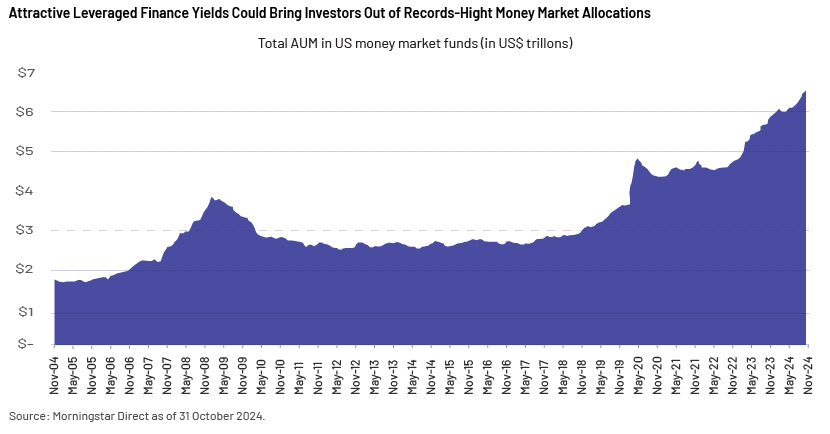

All-in yields for both high-yield bonds and bank loans remain attractive despite relatively tight spreads. High equity valuations, combined with favourable all-in yields, are expected to encourage investors to move out of money-market funds, currently at a record USD6.5tn.

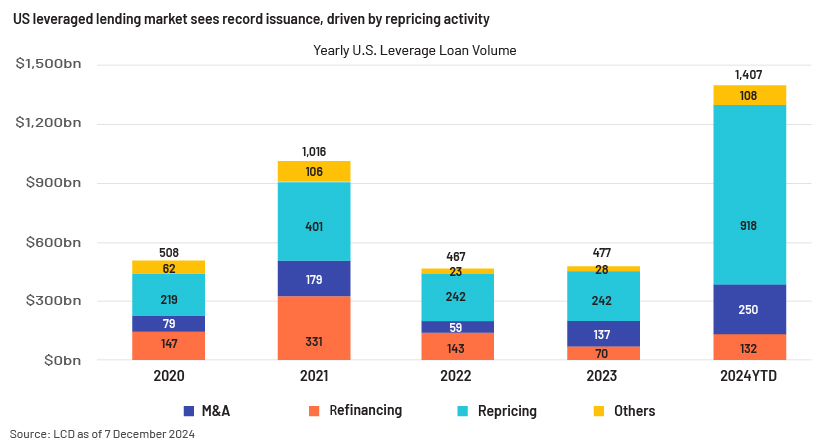

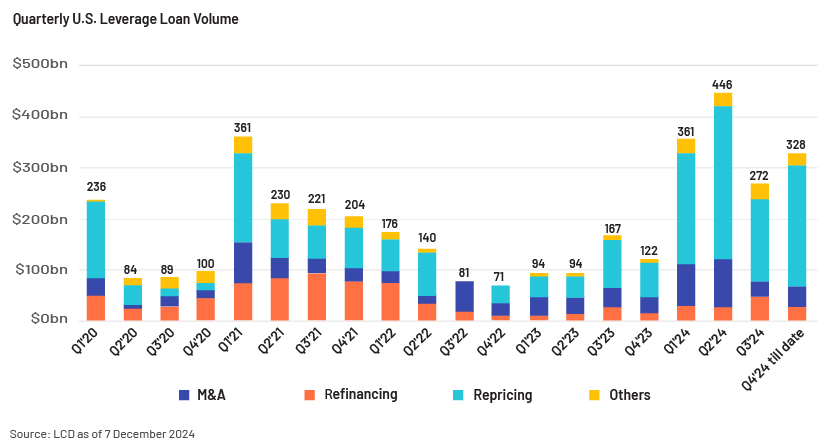

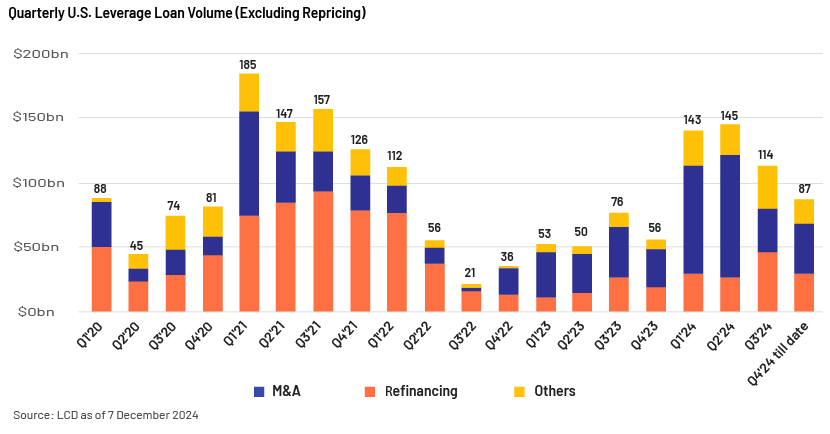

US leveraged lending market sees record issuance, driven by repricing activity

The US leveraged loan market was marked by considerable volatility and surprising developments in 2024, resulting in an atmosphere of uncertainty that has kept investors on edge. The market experienced a record level, with YTD volume of USD1,407bn (as of 7 December), 39% ahead of full-year 2021 volume and 195% above full-year 2023 volume, driven largely by refinancing and repricing efforts, with repricing activity again dominating the market and constituting 65% of overall YTD volume.

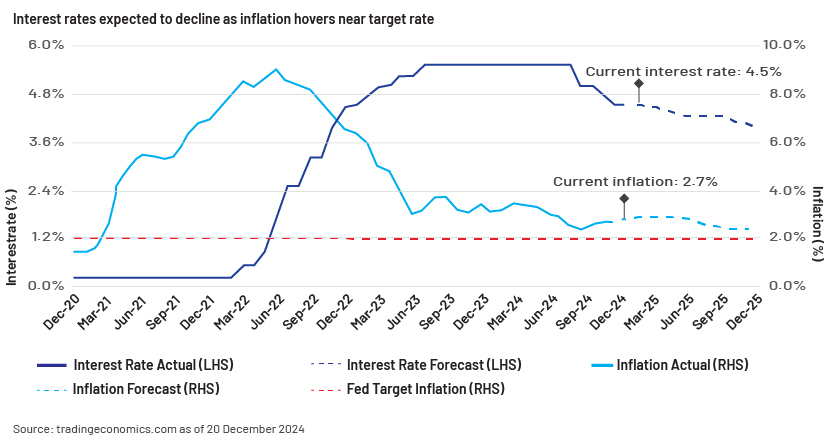

Interest rates expected to decline as inflation hovers near target rate

In June 2022, US inflation was at a 40-year high of 9.1%; it has gradually decreased over the past two years to 2.7%. The market witnessed a record-high interest rate of 5.5% for over a year in efforts to tame inflation. As inflation is now on a sustainable path, targeting 2%, the Fed started cutting the interest rate in September 2024; it is now at 4.5%. It is uncertain whether longer-term rates will follow suit, and there is uncertainty surrounding the impact of President-elect Donald Trump’s agenda on the trajectory of inflation, as some of his campaign promises could put additional pressure on inflation. However, the interest rate is expected to decrease gradually, by 50bps, in 2025.

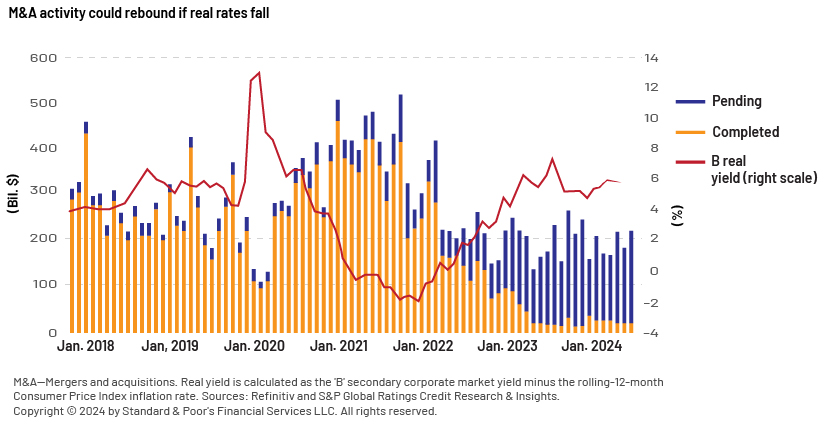

Lower rate may spur M&A

M&A activity has remained subdued in the past two years, well below the levels seen before the pandemic. Activity was expected to decline following the surge in 2021, but elevated real interest rates have also hindered progress. Most leveraged buyouts have been financed through equity rather than debt over the past two years. With inflation easing and long-awaited interest rate cuts in effect, real interest rates are likely to decline as well, helping to narrow the valuation gap between private equity buyers and sellers and normalise M&A deal-making decisions. M&A-related debt issuances are now beginning to display encouraging trends. Leveraged loan volume of M&A-related issuance was USD46n in 3Q24, surpassing refinancing volume for the first time in over two years and signalling a positive shift in market dynamics. This is the highest quarterly volume for M&A-related activity since interest rates started increasing in 1Q22.

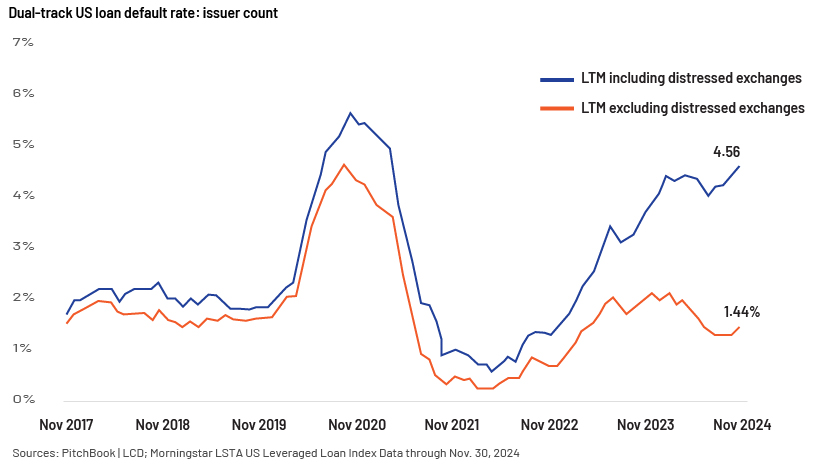

Leveraged loan default rate remains in uncertain territory

In November 2024, the Morningstar/LSTA US Leveraged Loan Index LTM default rate (by issuer count) decreased to 1.44% from over 2% at the start of the year, supported by favourable financing and macro conditions. This is well below the 10-year average of 1.65%. Over the LTM ended November 2024, 17 index issuers defaulted versus 23 during the LTM ended November 2023.

However, the default rate, including those of issuers conducting distressed liability management exercises (LMEs), rose to 4.56% over the LTM ended November 2024, driven mainly by healthcare and software companies. Over the LTM ended November 2024, 37 index issuers conducted a distressed LME versus 20 during the LTM ended November 2023.

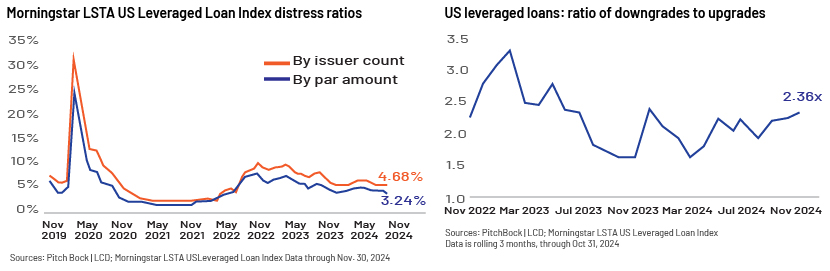

Forward indicators show a mixed direction. The price-based indicator, i.e. the distress ratio (by issuer count), was favourable and fell to 4.68%, the lowest level since August 2022. However, rating agency activity was skewed towards more downgrades, with the number of downgrades outpacing upgrades at a ratio of 2.36x on a rolling three-month basis, the highest level since December 2023.

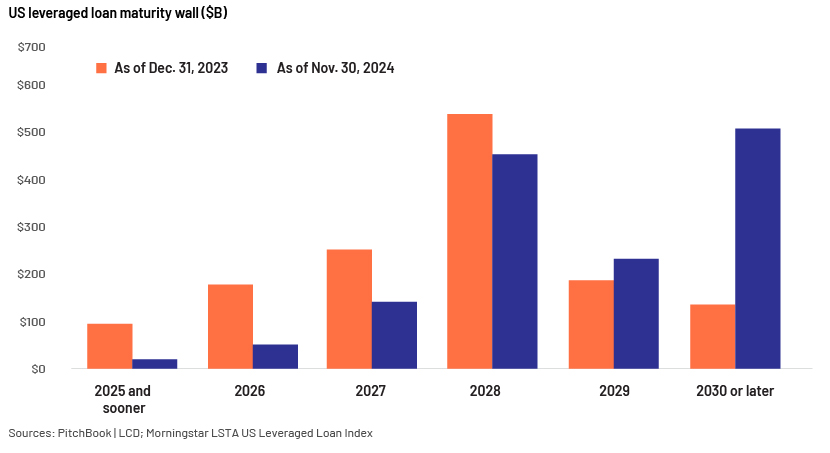

Reduction in near-term maturity wall amid heavy refinancing and extension activity

Due to a record level of refinancing, repricing and loan extension activity, nearly 77% of all outstanding loans as of 31 December 2023, are now either paid down, repriced or extended, representing the highest turnover rate in seven years. Additionally, borrowers have significantly reduced the near-term maturity wall, as currently, only USD17.8bn in loans is set to mature by the end of 2025, an 82% decrease from the start of the year. The cohort of loans maturing in 2026 has also dropped, to USD51bn, down 71%. The amount of outstanding loans due in 2027 has been reduced to USD142bn, down 44%. These developments highlight a proactive approach by borrowers to enhance their financial positions and manage their debt more effectively.

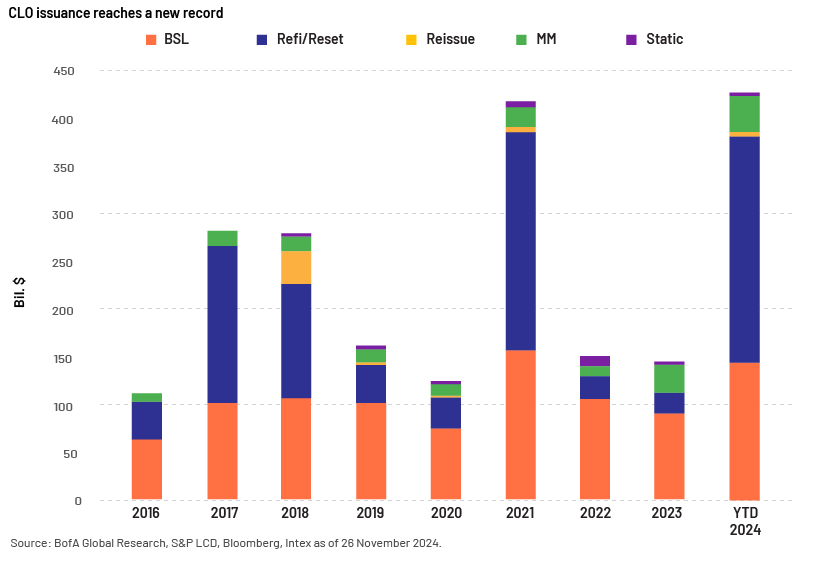

CLO issuance reaches a new record

CLO supply has remained remarkably strong despite the current market conditions. In the US, new issue volumes reached USD184bn: USD148bn in broadly syndicated loan CLOs and USD36bn in middle market/private credit direct lending CLOs. It is on track to exceed the previous record of USD185bn in 2021. Additionally, refinancing and reset volumes amounting to USD240bn have already established a new annual record. CLOs have produced positive total returns across the capital stack for 12 consecutive months and have shown overall positive returns for 19 months. Returns have been driven primarily by carry, supported by high base rates. This positive trend comes amid speculation that the Fed may take a more cautious approach to rate cuts due to the strength of the economy.

Favourable borrower conditions amid competition between public and private credit markets

The global private credit market has reached USD3tn of AuM, according to the Alternative Credit Council (ACC), becoming the fastest-growing alternative asset class over the past two decades, and provides faster execution along with flexibility in terms and payment structure. Broadly syndicated loans (BSLs) and private credit will continue to compete, leading to favourable terms and pricing for the borrower, improving overall financing conditions. While potential competition between the public and private markets is supporting tight pricing, yields have begun to decline as investors adopt a more optimistic outlook on credit due to rate cuts and a greater likelihood of a soft landing.

Outlook

As interest rates decline, loan issuers’ credit fundamentals such as interest coverage and free cashflow metrics are expected to improve in 2025, leading to a decrease in defaults. Market liquidity and deal flow are expected to increase as investors actively seek yield, and private equity funds will likely look to deploy their global dry powder of c.USD9tn. Deal activity will take place mainly in North America and EMEA, where the leveraged finance markets are larger and demand is stronger.

After a slow start to 2024, LBO activity in the US picked up in the second half of the year and is expected to increase in the coming months due to favourable market conditions for borrowers. Momentum in LBO deals will likely be bolstered in 2025 as borrowers gain confidence from easing interest rates and improving valuations. More flexible credit protections are anticipated as competition continues between direct lenders and those involved in BSLs.

Issuers of leveraged loans are expected to continue to engage in opportunistic repricing and refinancing, which dominated deal activity in 2024. Loan issuers have capitalised on favourable conditions in the capital markets to extend maturity dates and lower nominal spreads. Consequently, defaults and liability management exercises (LMEs) are expected to be concentrated among non-performing credits. Trading volatility in certain sectors and companies could also increase due to shifts in trade policy and the regulatory agenda of the incoming Trump administration.

How Acuity Knowledge Partners can help

We continue to empower our stakeholders through ongoing monitoring of leveraged debt, delivering innovative solutions to new challenges, timely delivery of alerts on the latest news and detailed projections with quality credit reports to enable them to make action-oriented decisions.

Source:

-

Finance Asset Allocation Insights: 4Q 2024 | PineBridge Investments

-

US leveraged loan default rate rises after three November bankruptcy filings – PitchBook

-

Monthly Wrap: Record demand fuels leveraged loan market – PitchBook

-

Leveraged Finance Asset Allocation Insights: 4Q 2024 | PineBridge Investments

-

Leveraged Finance Asset Allocation Insights: 4Q 2024 | PineBridge Investments

Tags:

What's your view?

Like the way we think?

Next time we post something new, we'll send it to your inbox