Published on December 20, 2023 by Darshit Pachori

Since the 1950s, investors around the globe have wanted their capital to earn returns while supporting causes that matter to them. From the selective disinvestment by South Africa during the height of apartheid in the country to the push for diversity in the workforce in recent years, having responsible organisations as part of one’s portfolio has been at the top of the agendas of many investors and managers. In view of this, there is a growing need to adopt a new vision for asset management and investing in general.

A study by Morgan Stanley on sustainable brands suggests that millennials are more likely to include sustainability in their consumer behaviour, with 86% of millennials interested in sustainable investing. Deloitte predicts that the value of ESG assets in the US will reach USD35tn by 2025.

The market for ESG investing is growing rapidly, with investor interest increasing due to its focus on objectives other than profitability.

The concept of ESG was introduced when awareness of global sustainability challenges such as climate change, social discrimination and problems with corporate governance was heightened. It gained in importance due to the various climate crises and financial crises such as that of 2007-08 and the OPEC oil price shock in 1973. These events highlighted the importance of a company’s strong governance, transparency and responsible behaviour. Social and human rights crises such as labour rights violations and supply-chain violations have led to demand for more accountability. Social movements such as those for racial justice and workers’ rights have forced companies to adopt more sustainable practices and practise diversity and inclusion.

Apart from ESG reporting being mandatory for certain companies, it also acts as a bridge between stakeholders and businesses. It ensures that businesses follow ethical practices, are trustworthy and pay back to society, which ultimately attracts more stakeholders.

ESG reporting, frameworks and aggregators

Companies have been adopting different approaches to ESG reporting in recent decades, but the globally accepted metrics are as follows:

1. Environmental – This category focuses on the environmental impact of a company, such as in terms of air quality, greenhouse gas (GHG) emissions, energy management and water waste management

2. Social – This category focuses on the impact of a company on social factors, such as human rights, community relations and product safety and quality

3. Governance – This category focuses on management of a company’s legal and regulatory aspects, such as business ethics, competitive behaviour and risk-management practices

4. Human capital – This category focuses on a company’s practices in relation to its employees, such as labour practices, employee health and safety, and diversity

5. Business innovation – This category focuses on how a company plans to manage factors such as product design, product lifecycle, resilience of the business model and supply-chain management

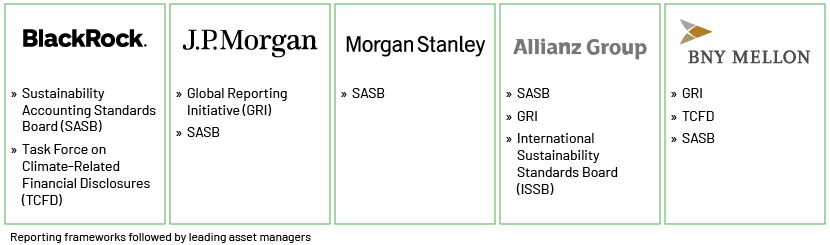

The aforementioned factors can be assessed in greater measure by choosing the right ESG framework. More popular frameworks within the ESG space include the following:

1. Sustainability Accounting Standards Board (SASB) standards: This is a standards-setting organisation that develops industry-specific standards for disclosing sustainability risks and opportunities. The framework focuses on the financial consequences and material impact on companies. The standards were formulated using a transparent standard-setting process that included evidence-based research; open participation of companies, investors and subject-matter experts; and oversight and approval of the SASB.

The SASB categorises the standards as follows:

-

The environment

-

Human capital

-

Social capital

-

Business model and innovation

-

Leadership and governance

2. Framework of the Task Force on Climate-Related Financial Disclosures (TCFD): This keeps investors updated on the steps companies are taking to mitigate climate change and ensure their methods of governance are transparent. The TCFD framework breaks down a company's climate-related risks into two major categories:

-

Physical risks – These relate to the real effects of climate change. Different types of physical risks could be caused by different factors – some are caused by harsh weather conditions such as hurricanes, flooding, wildfire or drought. Other risks are chronic and related to long-term climate changes such as rising temperatures, rising sea levels and longer and more frequent heat waves. Physical risks may have a significant impact if they affect a company’s operations, transport, supply chains or employee or customer safety.

-

Transitional risks – These relate to developing climate-related policies, regulations and disclosure requirements around issues such as GHG emissions; net-zero carbon emission initiatives; carbon tax policies; energy and fuel costs; and national or global energy policies.

3. Framework of the Climate Disclosure Standards Board (CDSB): This enables investors to evaluate the correlation between a company’s strategy and planning with specific environmental and social matters. The CDSB has three member bodies:

-

The Board of Directors is responsible for core governance and strategic direction. It includes representatives from business and environmental groups.

-

The Advisory Committee provides advice and guidance to the Board of Directors. It includes representatives from industrial companies, non-governmental organisations and law firms.

-

The Technical Working Group coordinates the CDSB’s work programme and the development of the CDSB structure. It includes representatives from major accounting firms and professional accounting bodies, professional consultants and academia.

4. Global Reporting Initiative (GRI) Standards: These comprise three categories: Universal Standards, Sector Standards and Topic Standards. They cover a wide range of ESG topics and are used by companies to report their sustainability performance and impact. They enable private companies to assess their economic, environmental and social impacts in a comparable and transparent manner. They can be used in sustainability reports in line with stakeholders’ requirements and specifications.

5. Greenhouse Gas (GHG) Protocol Corporate Accounting and Reporting Standard: This establishes an international framework for measuring and controlling GHG emissions from private and public sectors, value chains and mitigations. It ensures the accuracy, precision, completeness, consistency, transparency, stability, stability and comparability of GHG accounting principles.

There are six types of GHG:

-

Carbon dioxide (CO2)

-

Methane (CH4)

-

Nitrous oxide (N2O)

-

Industrial gases: hydrofluorocarbons (HFCs), perfluorocarbons (PFCs), sulphur hexafluoride (SF6) and nitrogen trifluoride (NF3)

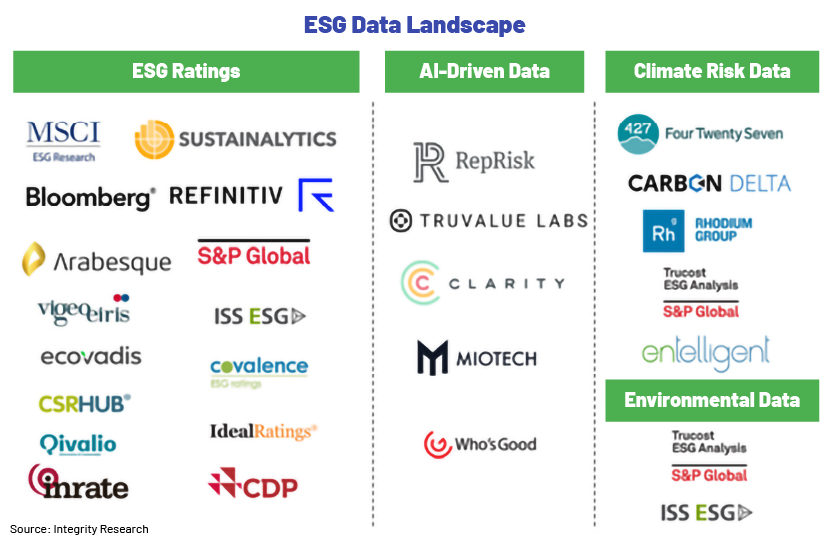

Common ESG aggregators include the following:

What’s ahead?

Global ESG assets are expected to exceed USD53tn by 2025, accounting for more than a third of the total projected assets under management of USD140.5tn, and by 2021, more than USD500bn is expected to flow into ESG-integrated funds, representing 55% of the total. This would be driven by factors such as technological advancements that help reduce carbon footprints, growing concern for human resources and corporate social responsibility. ESG guards stakeholders’ interests by ensuring that a company’s business practices are clear and transparent.

How Acuity Knowledge Partners can help

We provide customised ESG support solutions for private equity clients, covering sector- and country-specific reporting, marketing support, ESG risk analysis and opportunities. We support client teams and advisory through a top-down, bottom-up or combined approach. Our ESG support solutions include building a reporting process, developing frameworks, pitching new ideas to integrate developments, writing reports and preparing marketing collateral. We support asset managers, investment banks, commercial and regional banks, venture capital firms, think tanks and specialist advisory firms.

Sources:

-

https://www.oecd.org/finance/ESG-Investing-Practices-Progress-Challenges.pdf

-

https://www.bnymellon.com/content/dam/bnymellon/documents/pdf/2021-enterprise-esg-report.pdf

-

https://www.allianz.com/content/dam/onemarketing/azcom/Allianz_Report_2021-web.pdf

What's your view?

About the Author

: Darshit Pachori has over 4 years of experience in financial services. As an associate with Acuity, Darshit works with a range of different teams providing research and marketing production support for a range of clientele. His skills have helped him to collaboratively work with various professionals, streamline the content development process and add value by integrating unique perspectives.

Like the way we think?

Next time we post something new, we'll send it to your inbox