Published on July 6, 2021 by Bhargav Patro

As general partners (GPs) start exploring alternate sources of liquidity, market acceptance of net asset value (NAV)-based lending in the private equity (PE) space is increasing more than ever before. The pandemic has accelerated fund managers’ use of NAV financing. It has impacted both short-term (within one year) and medium-term (within two to three years) growth prospects of fund portfolio companies. This in turn has delayed the exit of portfolio companies and impacted fund liquidity and distribution. Fund managers are resorting to specialty borrowing facilities such as NAV facilities to tide over this situation.

What is an NAV facility?

Like an asset-backed facility, an NAV facility provides a fund with leverage, based on its portfolio of assets and serves a number of purposes – from providing working capital to finance growth to making follow-on acquisitions to distributing profits to investors.

NAV financing market opportunity:

The NAV financing market is still in its nascent stage; therefore, data on its size and growth is scarce, but anecdotal reports from advisers, funds and banks that provide NAV facilities indicate that activity and deal flow hit record levels in 2020.

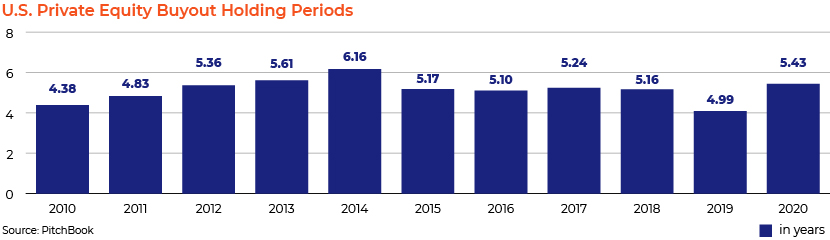

The average US PE buyout holding period shortened in 2019, according to PitchBook Data, but lengthened again in 2020. It is expected to lengthen further in 2021 as fund managers wait for asset pricing to recover. As holding periods lengthen, NAV financing as an option is likely to gain importance.

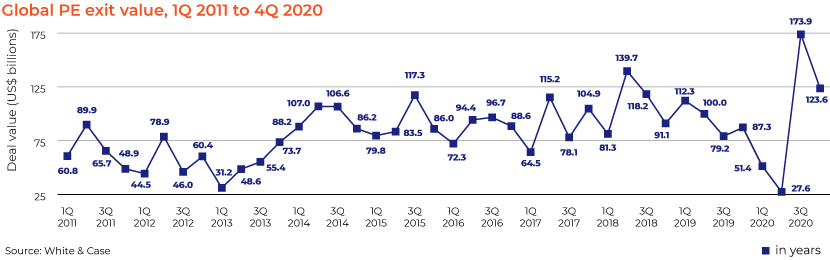

The global PE exit value for the year to end-4Q 2020 was up by 43%, with exit volumes increasing 8%. While pandemic-related uncertainty kept fund managers away from deals in the first half of 2020, the number of deals rebounded in 3Q and 4Q 2020 on the back of strong TMT, business services and pharma, medical and biotech deals. The drop in exit activity in the first half of 2020 meant that PE firms were unable to realise value when selling assets and making distributions to investors.

The analysis:

While an early-stage fund has the capacity to hold its investment, a fund nearing the end of the lifecycle may struggle to honour its liquidity and distribution commitments. Therefore, NAV facilities help fund managers support their portfolio companies that may be facing financial difficulties and covenant breaches. This trend is likely to continue in the medium to long term as GPs look for new ways to finance growth or liquidity of their portfolio companies.

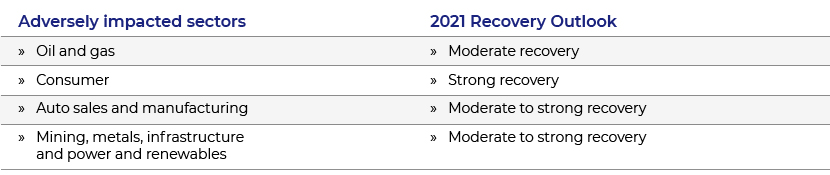

Although PE exit activity reached pre-pandemic levels in the second half of 2020, mainly due to concluding large TMT deals that were put on hold in the first half, the outlook for the next 12-24 months remains gloomy as sectors adversely impacted by pandemic take time to recover.

-

The oil and gas and consumer sectors, including auto sales and manufacturing, were impacted significantly in 2020 as economic activity declined and consumer behaviour evolved due to restrictions on mobility. The consumer sector is likely to recover strongly in 2021 on increased spending on non-essential goods.

-

The mining, metals, infrastructure and power and renewables sectors were also impacted negatively in 2020 due to disruptions to operations and delays in project planning. However, they are likely to witness a moderate to strong recovery on higher average prices.

The economy is likely to take much longer to recover, as many companies are exposed to significant corporate debt and this could create stress in the event their revenue declines or fails to recover.

However, specialty borrowing facilities such as the NAV credit facility are likely to gain in popularity and become a mainstay in the fund-financing space.

How Acuity Knowledge Partners can help

Our Commercial Lending teams provide offshore support to banks by helping in the prudent underwriting of loans to financial institutions group (FIG), large corporate, mid-corporate and SME customers. Our credit managers provide granular insight at the macro level and help banks’ credit risk teams identify potential risks in lending. Our team of experts has a good understanding of the global banking industry and lending trends, and we currently support a number of large global banks in loan appraisal and portfolio monitoring.

References:

https://mergers.whitecase.com/highlights/private-equity-ends-2020-on-a-high

PitchBook Data

Tags:

What's your view?

About the Author

Bhargav Patro has over 6 years of experience in investment banking research and commercial lending. At Acuity Knowledge Partners, he supports a leading corporate bank’s fund finance desk in quantitative and qualitative analysis of assets for NAV based lending. Bhargav holds a Post Graduate Diploma in Management in Finance from the Institute of Management & Information Science, Bhubaneswar.

Comments

07-Jul-2021 07:47:22 am

Like the way we think?

Next time we post something new, we'll send it to your inbox