Published on March 20, 2020 by Zahin Mohammed

While industry flows are still shifting from active management to passive indexing solutions, smart-beta funds have proliferated. Large global asset managers are at the forefront of offering smart-beta products. Investing according to factors, or smart beta, provides a halfway house between traditional active management that seeks to beat the market and a passive index-tracking strategy, which is rule-based, transparent and cost-effective. Globally, smart-beta funds have more than doubled in the past five years – from USD485bn to USD1.1tn – and there are now more than 1,300 smart-beta products1 .

Smart Beta - the new Alpha?

The current global low-yield environment, increasingly volatile markets and central-bank interventions have made it challenging for active managers to determine winning stocks or assets. As a result, active fund managers are increasingly seeking to enter the world of alternative indices, as many of their funds are losing out to external smart-beta products. The 2019 Global ETF Investor Survey, conducted by Brown Brothers Harriman (BBH) with ETF.com, showed that 92% of respondents in the US have at least one smart-beta ETF in their portfolio and that 26% of them have used it to replace an actively managed mutual fund2. The following chart summarises some key trends that indicate why smart-beta funds are preferred over actively managed ones:

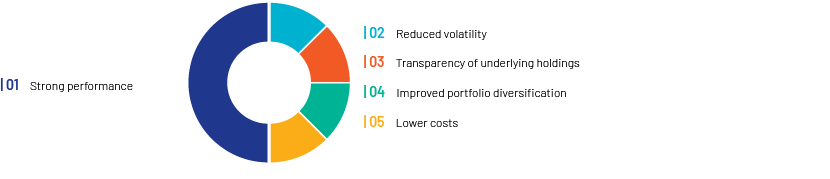

According to VanEck’s 2019 Smart Beta Survey, most advisors use smart-beta strategies to replace actively managed funds, and most of them are very or extremely satisfied with their investments, for the following reasons:

Source: VanEck Fourth Annual Smart Beta Survey, August 20193

Smart beta – proving to be popular across asset classes

Smart-beta funds could go a long way through their increased adoption in different asset classes or types of investment strategies that have traditionally been the preserve of active managers. In the equities asset class, smart beta has been well explored with common factors such as value, momentum, size, quality and low volatility.

Fixed-income smart beta remains a relatively underdeveloped part of the market, with less than 10% of global smart-beta inflows. However, it has now become a popular theme among investors and differs from equity markets in many ways. A recent study by BlackRock indicated that fixed-income ETFs may be best served by focusing on those factors that power macro risk such as real rates, inflation, credit, sovereign credit risk and liquidity. Once these factors are incorporated into a factor-based approach, studies have suggested that as much as 80-90% of the alpha outperformance from active bond fund managers can be explained away4.

Thematic ETFs are also becoming more prominent in the investment decisions of asset owners, especially those that take into account environmental, social and governance (ESG) issues. Integrating ESG with smart beta has gained momentum, with using ESG information on individual companies to shift capitalisation weights up or down depending on a quantitative score. This helps the multi-factor methodology of shifting capitalisation weights towards the desired factor exposure5 . One of the key themes that have emerged in 2019 has been the merging of two widespread trends, namely smart beta and ESG, as per the FTSE Russell smart beta survey of asset owners6 .

Although ESG has undeniably been a key theme for investors, this year’s top themes have been clearly dominated by commodities. The recent gold rally due to the global growth slowdown, lingering trade tensions and easing of monetary policy have increased the safe-haven appeal of gold. With volatility in mind, investors may consider alternative index-based gold miner ETFs more than traditional market cap-weighted ETFs that incorporate smart-beta indexing methodology. Seven of the top ETFs by net new assets in 2019 are invested in gold or precious metals, as per the latest ETFGI data.

With smart beta present across asset classes and assets under management of around USD1tn, we believe the industry seems to have widely accepted the product. Institutions are increasingly adding smart-beta ETFs to their portfolios to improve risk budgeting and liquidity. Growth in this space has been driven by new cash inflows, new launches and the entrance of new participants who often come from firms that offer active investment management. We expect smart-beta ETFs to continue to gain momentum by identifying more empirical evidence-based factors that determine the performance of a fund and that could be employed continuously in an efficient and low-cost manner.

How Acuity Knowledge Partners can help

Acuity Knowledge Partners’ Fund Marketing Services arm offers a range of services to assist clients with their marketing and investment communication efforts. As smart beta strategies grow in popularity, it is imperative that firms do not invest the lion’s share of time and effort on these ancillary support functions, ensuring their core teams focus on more value driven and strategic functions. To facilitate this, Acuity collaborates with clients to assist them on their marketing efforts across the investment universe, alleviating the team bandwidths and ensuring better synergies amongst all verticals.

Source:

1. Morningstar

4. https://www.ft.com/content/763dd2ab-694e-364b-b2ef-e0a8719f6c0e

7. https://www.ft.com/content/728384ad-73db-3d61-b1b8-58834ae5fdff

What's your view?

About the Author

Zahin Mohammed has over 6+ years of experience in the financial services industry. His expertise areas include investment banking, writing market commentaries, attribution reports and client reporting. In his current role at Acuity Knowledge Partners, he provides support in fund marketing services for the asset management industry. Zahin holds an MBA in Finance from Vellore Institute of Technology.

Like the way we think?

Next time we post something new, we'll send it to your inbox