Published on August 29, 2019 by Pramod Padhy

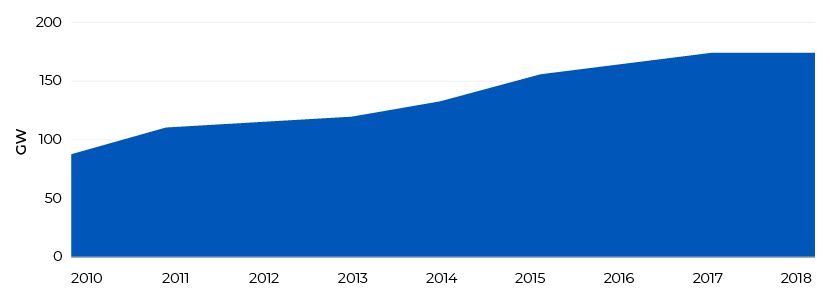

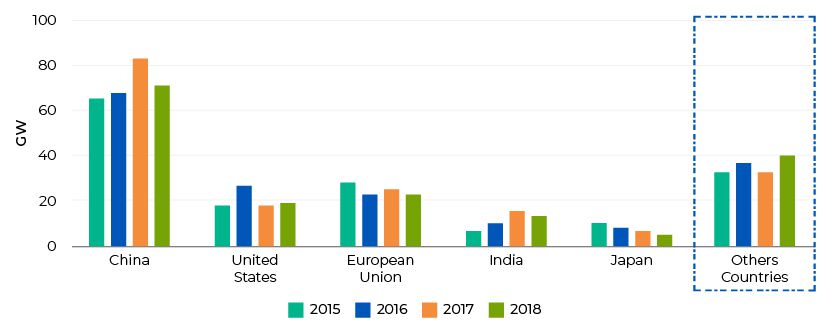

As the world’s population grows and economies develop, we expect global demand for electricity to rise, with a considerable proportion generated from renewable sources. Renewable energy has grown significantly in recent years, especially in the major markets of China, the US and Australia, adding 171 gigawatts (GW)* of installed capacity in 2018 alone.

Global renewable energy – Net capacity additions

Source: International Energy Agency

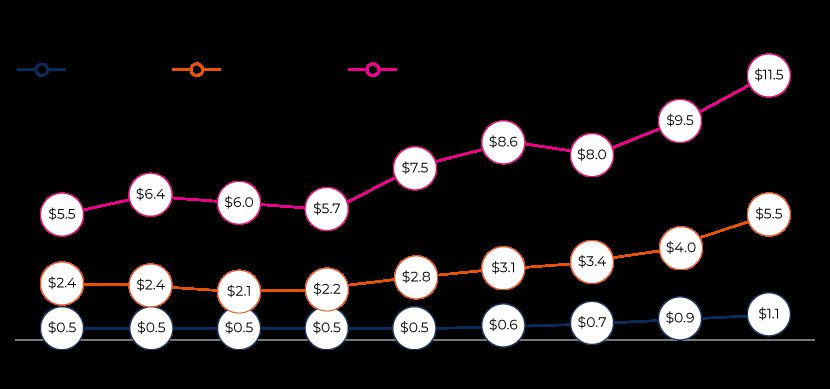

Global renewable energy – Net capacity additions by technology

Source: International Energy Agency

However, after nearly two decades of significant annual growth, renewables growth paused in 2018, adding only as much net capacity as in 2017, due to an uncertain policy environment.

Renewable energy – Net capacity additions by country and region

Source: International Energy Agency

While solar energy is thought to be heating up in many emerging markets including Saudi Arabia, Brazil and Morocco, with auction prices falling and a desire for more market-driven renewable solutions are leading offtakers, developers and suppliers to recognize solar energy as an area of growth. For example,

- Saudi Arabia has received record-breaking bids from solar developers and operators, including ACWA Power, to build its first utility-scale solar project; this has reduced tariff rates to their lowest, increasing the attractiveness of solar investment in the country.

- Brazil, which has historically had a strong wind market, solar is now said to be gaining momentum with its projects sized 5 megawatts (MW) are taking advantage of a mix of bilateral power purchase agreements (PPAs) and spot prices. Brazil has now surpassed Chile to become Latin America’s second-largest solar market after Mexico, with total installed capacity exceeding 2.5GW at end-February 2019, according to Brazilian solar association ABSOLAR. It expects solar energy generation to grow 44% in 2019, leading to 3.3GW of total solar operating capacity.

- Morocco is building the world’s largest concentrated solar power plant, the 580MW Noor-Ouarzazate complex, in the Sahara desert. Once operational, the plant could generate half of the country’s electricity by 2020, while powering more than one million homes and reducing carbon emissions by an estimated 760,000 tonnes per year. With this project, the country aims to achieve its ambitious target of generating 42% of electricity from renewable resources by 2020 and is on track to achieving this target, with 35% of its energy already derived from renewables.

The development of enabling trends including price parity, grid integration and technological innovation, combined with rising consumer demand, should continue to boost solar energy generation in the global markets in the coming years.

At Acuity Knowledge Partners, our Private Equity and Consulting team helps solar energy players including asset managers, developers and suppliers to tap the potential market and identify opportunities. We provide assistance with market studies, asset/deal screening, DDQ support, competitive landscape analyses, and post-investment research, including investor reporting, board meeting notes, and newsletters. Our team of renewable/solar market experts provides solutions for solar asset managers/developers by producing unmatched insights, including Bloomberg-driven research.

*Global additions

Sources:

3. https://www.pv-magazine.com/2019/03/28/brazils-pv-capacity-exceeds-2-5-gw/

5. https://edition.cnn.com/2019/02/06/motorsport/morocco-solar-farm-formula-e-spt-intl/index.html

What's your view?

About the Author

Pramod Padhy joined Acuity Knowledge Partners in 2015 and is a part of the company’s Private Equity and Consulting Division. His current role involves managing a fund-of-funds/alternative investment client and providing research support to a solar energy fund. He is primarily responsible to supervise all the deliverables closely including quality assurance, workflow management and client relationship and provide the technical know-how to team in case of any support. Overall, Pramod has over a decade experience in working on financial research and consulting projects that includes experience in writing various reports and case studies at industry/company level and preparing commentaries on asset classes including equity, fixed income, commodity etc. In..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox