Published on January 13, 2025 by G. Sridevi Poorani

Introduction

A soundstage is a specialised facility used in the entertainment industry for film and television production. It is a purpose-built construction, which means production teams can construct and develop sets specific to their requirements, for example, a bustling street in a city, an enchanting forest or a futuristic spaceship. A soundstage also offers all production facilities and equipment under one roof, making the film-making process efficient.

Sound studios have recently emerged as a profitable niche property investment due to increasing demand for high-quality production spaces, driven by shifts in media consumption, the expansion of streaming platforms and technological advancements such as 5G. Notable institutional investors that have entered the soundstage and production space market include Hudson Pacific Properties, Hackman Capital Partners, Blackstone and Silver Lake Partners. Hudson Pacific Properties sold a 49% stake in its Hollywood studios to Blackstone, a private equity giant, for USD1.65bn, signalling strong institutional interest in production real estate. Investors are willing to pay a premium for these facilities, particularly in high-demand areas such as Los Angeles and New York. This competition has led to higher rental rates and longer-term leases for soundstage spaces.

We now take a deep dive into sound studios to understand why they are becoming popular among investors.

Why are sound studios booming?

The movie and video production industry has been in decline for the past five years as the pandemic rattled movie production. With the major shift in the way audiences absorb and view content, demand for online streaming options has increased significantly. The expansion of 5G technology is expected to accelerate this growth. Major studios such as Netflix, Amazon, Hulu, Buzzfeed, Facebook and Apple are catching on to the rapidly expanding digital distribution channel, with many investing in their own streaming platforms. Media giants are also entering the streaming war, as evidenced by the launch of Disney+, ESPN+, Peacock, Paramount Plus and HBO Max in the past two years. This substantial output has intensified demand for high-quality studio space in major media markets such as New York and Los Angeles, leading to nearly full occupancy rates and fierce competition among media companies to secure these facilities for long-term leases.

Trends driving growth of the soundstage studio market:

1. Penetration of over-the-top television (OTT):

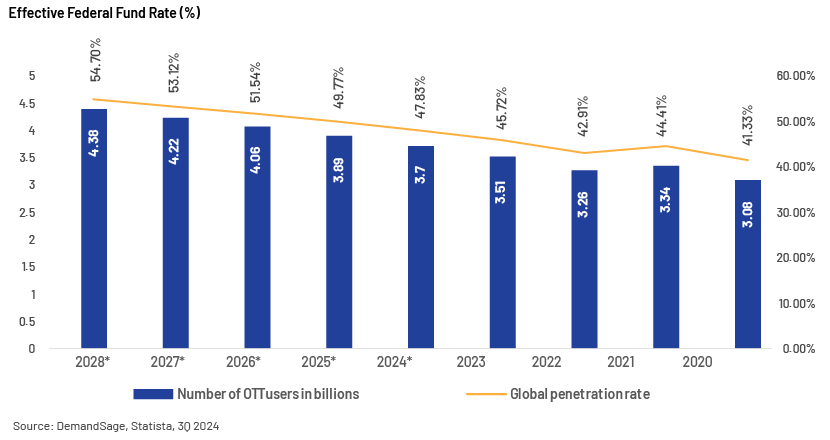

DemandSage by Statista expects the number of OTT users to reach USD3.89bn in 2025; market value of the industry is over USD316.40bn. The number of users is expected to grow to USD4.38bn by 2028 – at a CAGR of 24.75% from 2023 to 2028. The global adoption of smart devices and easier access to high-speed internet have increased penetration rates, forecast to reach 54.7% by 2028.

2. Purpose-built studios:

The structural shift in the media ecosystem to OTT has reset the level of content spending. This has created demand for studio infrastructure and, in particular, purpose-built studios. The major, established players engaged in soundstage infrastructure are Aermont, Pinewood, Blackstone and Hudson Pacific Properties; emerging players include Silver Lake, Shadowbox, East End and Studio Fund.

3. Credit tenants:

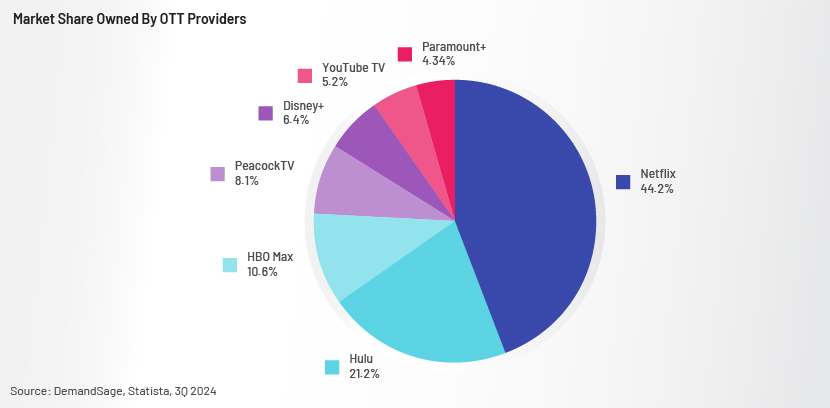

In terms of market share, credit tenants such as Netflix, Hulu and HBO Max hold 44.2%, 21.2% and 10.6%, respectively.

Tax incentives:

Tax incentives such as production tax credits, R&D tax credits and other benefits have helped reduce costs and promoted investment in the film and television industries. Such incentives encourage technological innovation and workforce development. States that provide substantial tax incentives to promote investment in studio developments include New York, New Jersey, Connecticut and Georgia. For instance, the new tax incentive programme in New Jersey and New York has raised the cap from USD420m to USD700m, significantly influencing investment decisions.

| State | 2024 tax credit amount |

| New York | USD700m |

| New Jersey | USD300m |

| Connecticut | No cap |

| Texas | USD200m |

| Georgia | No cap |

| New Mexico | USD120m |

Source: CBRE research, 4Q 2024

According to the 2023 Tri-State Film & Television Report by CBRE, those states that have no annual cap on their film tax incentives include Connecticut, Georgia, California, New Mexico and Texas. The latter three are the states currently incentivising studio investments.

Industry outlook:

IBISWorld expects the industry’s revenue to grow at a CAGR of 3.3% to USD32.8bn by 2028, with profits estimated to reach 12.9% in 2028. The global video-streaming market is projected to grow significantly, from USD473bn in 2022 to USD1.69tn by 2029, at a CAGR of 19.9%. Streaming platforms such as Amazon and Netflix are increasingly encroaching on traditional studios by offering exclusive online content. As consumer preference shifts towards streaming, movie producers would rely more on these platforms to distribute their content digitally. Smaller studios may also turn to streaming platforms for distribution to gain a competitive edge. Traditional studios are expected to invest in streaming services to remain competitive in the evolving market.

Outlook for sound studios in the US:

CBRE identified 12m square feet of soundstage in North America as of June 2023, with the largest concentrations in Los Angeles, Atlanta and New York (together known as the “Tri-state”).

Los Angeles County has more square feet of soundstage than does New York and Georgia combined, and more constructions are on the way. On a global scale, Los Angles remains the world leader in terms of overall stage space, but new-stage development is continuing. The Greater Los Angeles area has 571 certified soundstages, 102 certified production facilities and a total of 7.3m square feet of certified stage space, according to Film LA’s most recent soundstage study.

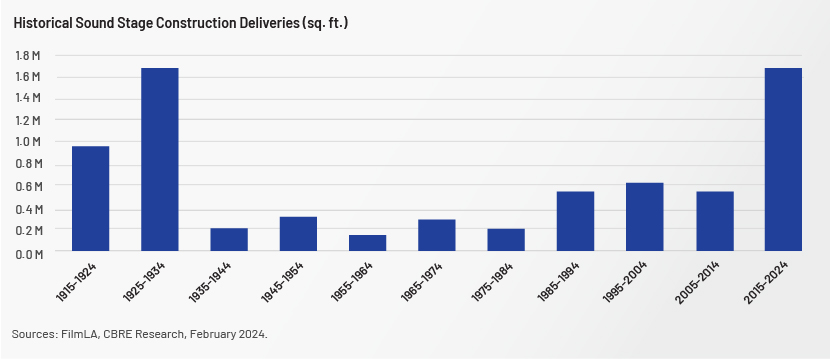

The graph below illustrates fluctuating trends in soundstage construction in Los Angeles, with significant peaks in the early 20th century and a resurgence in the most recent decade. The Tri-state film production industry continues to push forward, adding hundreds of millions in state tax incentives and constructing dozens of new soundstages. Los Angeles is the global leader in the number of both soundstage facilities and total square footage.

Opportunities for lenders:

-

Steady stream of interest income: Loans to sound studios generate interest income, offering a steady source of revenue over the life of the loan. Given that most sound studios involve much upfront capital for equipment and space, these loans can be sizeable and significant in generating interest earnings for the bank.

-

Cross-selling of financial products and services: Sound studios often need to upgrade or acquire new equipment. Banks may offer equipment leasing or financing, which would open up more income streams from these clients. Valuable equipment can act as collateral for a sound studio. Even if the resale value for such a buyer might be low in case of loan default, this is still some sort of security for the bank.

-

Portfolio diversification for balancing risk: A bank can diversify its portfolio and, thereby, its risk exposure across sectors by lending to sound studios. Although some industries may be more cyclical or driven by downturns in the economy, the creative industries and entertainment often have varied risk profiles that may offset risks in other areas.

-

Leverage industry growth: Due to the growth of content creation, streaming and the gaming industry, there is increasing demand for top-of-the-line audio production. The financing of sound studios would enable banks to capitalise on such opportunities and become part of the industry's growth. Knowing that the latest technologies are often innovated first in sound studios in audio production, the association would benefit banks by their being at the forefront of any technological innovation and potential growth.

-

Government and industry support for access to grants and incentives: In some countries, sound studios will be able to access government grants, tax incentives or loan guarantees supporting the creative industries. Banks could benefit from such programmes since they reduce their risk exposure and provide better loan terms. By knowing precisely the needs and potential of sound studios, banks would strategically benefit by lending towards such property, fostering growth in an industry that has as much of a cultural impact as its economic impact.

Current challenges:

-

Shifting consumer preferences: Audiences are shifting towards short-form content such as on Tik Tok, Instagram Reels and YouTube, moving away from traditional long-form media such as movies and TV shows/series. The industry must adapt to these evolving viewing habits and formats.

-

Sustainability and environmental concerns: The film and TV industries are under increasing scrutiny for their environmental impact – from on-location filming to set construction. Studios face increasing pressure to implement greener practices and reduce their carbon footprints.

Despite these challenges, there have been significant mergers and acquisitions in the industry. Hackman Capital Partners and Square Mile Capital have purchased Silvercup Studios, one of New York City's (NYC’s) largest full-service film and television production facilities. After Silvercup, the same investment firms acquired Kaufman Astoria Studios, another major production facility in NYC. In 2022, Crafty Apes, a California-based visual effects company, acquired an NYC-based production company, further emphasising the cross-country interest in NYC's media talent and infrastructure.

Conclusion

The sound studio industry is currently experiencing significant growth, driven by technological advancements and changing consumer preferences. Increasing demand for premium streaming content is creating significant opportunities for sound studios to grow in number, especially in key markets such as Los Angeles and New York. This expansion is boosted by attractive tax incentives, directing increased investment in studio infrastructure. For lenders, the sound studio sector offers a unique opportunity to diversify portfolios, benefit from stable revenue streams and channel the momentum of industry growth. As the ecosystem continues to evolve, lenders should position themselves to reduce the risk so that they reap the benefits of long-term growth and innovation. While challenges such as fluctuating interest rates and new technologies such as Generative AI exist, the industry's strength and continued cashflow point to a promising future for sound studios. By staying ahead of these developments, investors and financial institutions can build strong partnerships with sound studios and contribute significantly to the future of the entertainment industry.

How Acuity Knowledge Partners can help

We have multi-sector expertise in the areas of financial analytics, valuation and advisory services. The commercial real estate (CRE) sector is one of our key focus areas, and we have a large team of CRE analysts and subject-matter experts who support global financial institutions, brokers, investment firms and service providers. We provide support across the CRE deal lifecycle – from loan origination, lease analysis, loan underwriting and valuation, guarantor analysis and covenant monitoring and testing to post-closing and portfolio monitoring. Our proprietary suite of Business Excellence and Automation Tools (BEAT) gives clients leverage, and we provide them with bespoke products and services customised to their requirements.

Sources:

-

Commercial Real Estate Goes Hollywood as Investors Buy Studios, Soundstages – REBusinessOnline

-

28+ OTT Statistics For 2024 (Users, Platforms & Market Size) (demandsage.com)

-

L.A. Still Has Most Soundstage Space, But Growth Is Outpaced By Toronto, UK, NYC (deadline.com)

-

Netflix's Continues Losing Market Share In 2023 | Similarweb

Tags:

What's your view?

About the Author

Sridevi Poorani has over 8 years of experience in commercial real estate (CRE) domain. Her expertise encompasses a wide range of analysis, including CRE loan underwriting, portfolio monitoring, post-funding covenant audits and lease reviews. At Acuity Knowledge Partners, she is supporting the CRE portfolio monitoring process for one of the Midwest banks.

Like the way we think?

Next time we post something new, we'll send it to your inbox