Published on April 23, 2025 by Yaran Li

The South Korea retail market grapples with slowing growth as economic uncertainty and subdued consumer spending weaken demand. Amid broader challenges in market South Korea retail market, convenience stores stand out as a resilient growth driver. While geopolitical risks and recessionary pressures cloud the 2025 outlook, government policy adjustments and industry adaptations aim to stabilise the sector and align with evolving consumer trends.

1. Slowing momentum: post-pandemic growth deceleration

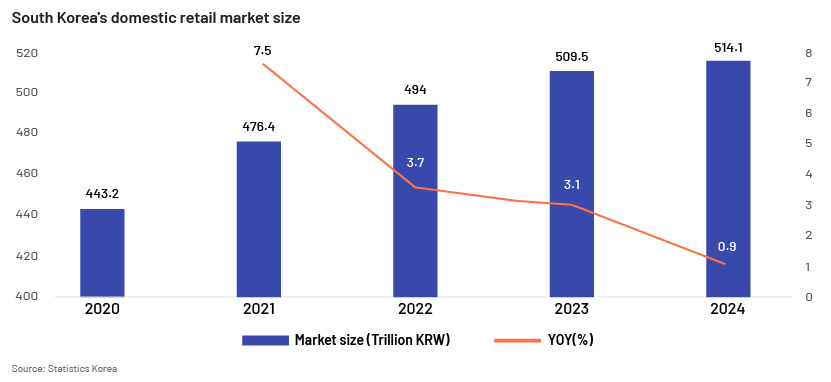

The South Korea retail market is likely to have reached approximately KRW514tn in 2024, marking an increase only of about 1% y/y, according to Statistics Korea. This limited growth reflects challenges in market South Korea retail market attributing to the ongoing recessionary consumption pattern, where consumers open their wallets only when necessary. Categories such as home appliances, clothing and cosmetics showed negative growth compared with the previous year. Prior to this, the retail market grew by 7.5% in 2021 after the pandemic but has since declined for three consecutive years, with growth rates of 3.7% in 2022 and 3.1% in 2023.

2. Convenience stores: defying the downturn with hyper-local expansion

The South Korea retail market comprises a number of sub-markets, including hypermarkets, duty-free stores, department stores, e-commerce and convenience stores. Of these, the convenience store market stands out as a promising sector. Of these, the convenience store market stands out as a promising sector, particularly amid current challenges in market South Korea retail market. A growth rate of 5.1% was forecast for this market in 2024, a rare sight in the global retail landscape. With average annual growth of 10.4% over the past decade, the number of convenience stores in South Korea has reached approximately 55,800. Brands such as CU, GS25 and 7-Eleven dominate this expansion through hyper-localised strategies: 24x7 operations cater to time-poor urbanites, while neighbourhood-specific SKUs (e.g., regional snacks, meal kits) and private-label products (costing 20-30% less than branded goods) attract price-sensitive consumers. This rapid expansion is expected to continue, making convenience stores a bright spot in the Korean retail sector.

3. Headwinds intensify: geopolitical and economic pressures

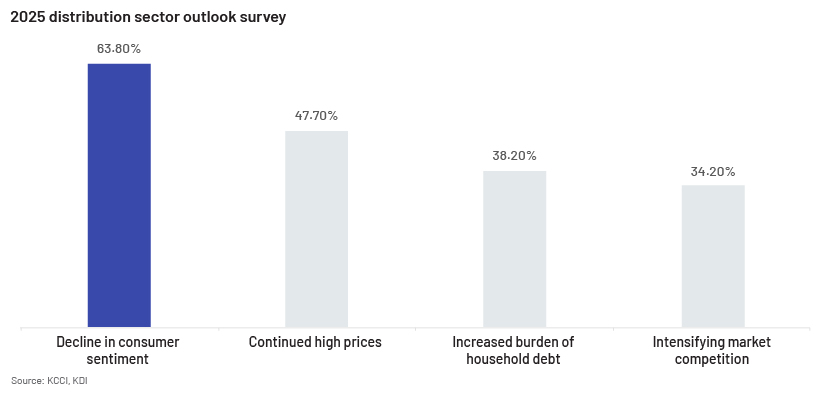

There are several challenges in market South Korea retail market in 2025. The ongoing economic recession, coupled with political instability at home and abroad, has increased uncertainty in the South Korea retail market. . According to the Korea Chamber of Commerce and Industry (KCCI), the retail market in 2025 is expected to grow by only 0.4% compared with 2024, the lowest figure since the start of the pandemic in 2020. Additionally, 66.3% of the companies responding to the survey mentioned below estimated that next year's distribution market would be more negative than this year's, citing the decline in consumer sentiment as the primary reason.

4. Policy levers in motion: duty-free reforms and liquidity backstops

To support the South Korea retail market amid rising economic challenge, the Korean government has implemented a number of measures, addressing the ongoing challenges in market South Korea retail market, such as the following:

-

Optimise duty-free industry policies: From April 2025, the patent fees of airport duty-free shops will be halved, and the two-bottle limit on imported duty-free alcoholic beverages will be removed to boost the tourism retail sector.

-

Strengthen the market-stabilisation mechanism: Through joint actions by the central bank and financial regulatory authorities, financial market fluctuations will be monitored 24 hours a day, and liquidity-support measures will be taken when necessary to reduce the financing pressure on retail enterprises.

5. Conclusion

The South Korea retail market is in a state of flux with limited growth and increasing challenges. However, the convenience store market stands out as a promising sector, driven by its rapid expansion and innovation. To navigate the uncertain retail landscape, stakeholders must adapt to changing consumer behaviours and leverage government support measures to overcome challenges in market South Korea retail market

How Acuity Knowledge Partners can help

With their Korean language capabilities, Acuity Knowledge Partner’s, analysts in Beijing provide up-to-date Korean market research analysis with industrial insights on South Korea’s local commercial activities including retail, consumer, TMT (especially semiconductor) and entertainment.

Sources:

-

Statistics Korea, Monthly Industrial Statistics, https://kostat.go.kr/board.es?mid=a20103030000&bid=11721&list_no=434597&act=view

-

KDI, 2024.12.30, 2025 유통산업 전망 조사 | 국내연구자료 | KDI 경제교육·정보센터https://eiec.kdi.re.kr/policy/domesticView.do?ac=0000190986

-

KDI,2024.09.11, 통계로 본 소매시장 변화 10년 | 국내연구자료 | KDI 경제교육·정보센터, https://eiec.kdi.re.kr/policy/domesticView.do?ac=0000187966&pg=&pp=20&issus=O

-

South Korean Ministry of Trade, Industry and Energy, https://www.motie.go.kr/kftz/en/fta/static.do

-

YNA news, 2024-01-14, 편의점 5만5천개 시대…일본 브랜드 사라지고 '대형4사 체제' | 연합뉴스https://www.yna.co.kr/view/AKR20240113033800030

-

YNA news, 2024-12-23, 내년부터 해외여행 면세 주류 '2병 제한' 폐지

Tags:

What's your view?

About the Author

Yaran Li joined Acuity as an Investment Research Analyst in November 2018 and presently supports the China consulting team as a consultant since September 2023. Prior to Acuity China consulting team, she supported Macro-economy team of top-tier global Investment bank, focusing on the Korea and Taiwan market. Her key responsibilities include data collecting and analyzing, news tracking, policy research and translating. Prior to Acuity, she worked as an Equity Data Research Analyst in Morningstar with a focus on Korea market company research.

Like the way we think?

Next time we post something new, we'll send it to your inbox