Published on September 24, 2024 by Bhavya P

Introduction

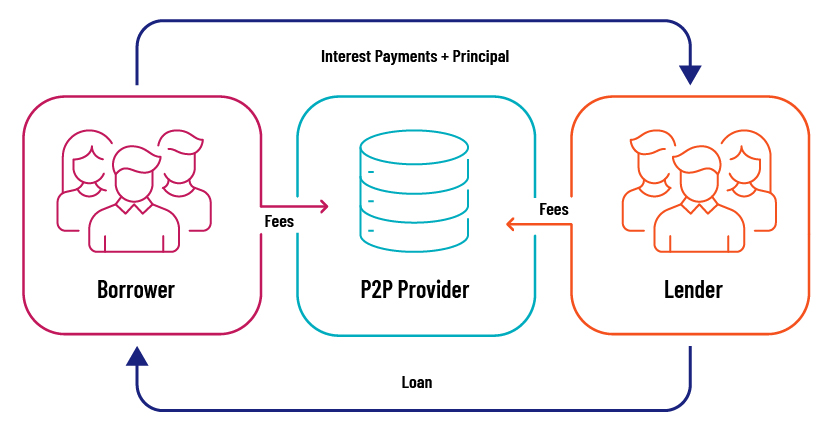

Peer-to-peer, or P2P, lending refers to social lending where the borrowers and lenders connect directly via a P2P website. P2P lending provides alternative financing to borrowers who have difficulty in qualifying for a loan from a conventional lender. Lenders offer lower interest rates to borrowers with higher credit scores.

The lending industry has experienced dramatic shifts in the banking sector over the past two decades, mainly due to the disruptive nature of P2P lending. This is because eligibility criteria are not as stringent as those stipulated by major banks and other traditional financial institutions. LendingClub and Prosper were two of the main platforms that emerged in the early 2000s, when they opted to use technology to reach a wider group of borrowers seeking loans.

Demand for P2P lending rose significantly after the Lehman Brothers collapse in 2008, which led to stringent bank operating regulations being implemented. In P2P lending, investors would communicate directly with borrowers, avoiding the additional costs involved in dealing with intermediaries in the traditional financial sector. This resulted in reduced overhead costs for lenders, increasing their return on investment.

How do borrowers qualify for P2P loans?

To be eligible for a P2P loan, a borrower needs to fill an online application with their personal and financial information. They also need to document their income, employment and credit history so the lender obtains a better understanding of their cash flow.

After assessing the applicant’s cash flow and transaction history, the platform gives them a credit score based on timely repayment of past loans with predetermined interest. Applicants with higher credit scores would, therefore, find it easier to obtain a loan.

What happens if a borrower defaults on paying back a P2P loan?

If a borrower defaults, the lender has the legal right to act. Some P2P platforms require collateral such as property or other assets to protect against defaults. In the event of default or late repayment, they would collect the debt themselves or hire a debt collector to recover the loss on their behalf. All this indicates that a P2P lending platform would set its own rules in case of default or late repayment, and a borrower would need to go through such terms before obtaining a loan.

Benefits of P2P lending

For the borrower

The platforms are used widely by different types of borrowers, ranging from small and medium-scale enterprises to real estate investors and students, primarily struggling with liquidity. In most cases, they require funds to repay debt, construct homes or for medical expenses and education. The platforms are convenient options, as they provide easy access to funds in addition to the following benefits:

-

Better access: P2P platforms offer loans to individuals or businesses that may not meet banks’ traditional criteria for assessing creditworthiness.

-

Reduced rates of interest: By circumventing banks, a borrower could get a cheaper rate of interest, as the profit would be shared by the borrower and the platform.

-

No prepayment penalties: Most P2P loans do not carry a prepayment penalty, unlike regular bank loans. A borrower could prepay the loan without incurring a penalty.

For the investor

The P2P lending platforms include investors of various of categories, from individual retail investors to institutional entities looking for alternative investment opportunities.

-

Higher potential return: P2P lending offers higher returns than do bonds and savings accounts, as the lender charges more for easy access to funds.

-

Portfolio diversification: P2P platforms help expand portfolios by contributing to a host of loans with diverse risk profiles.

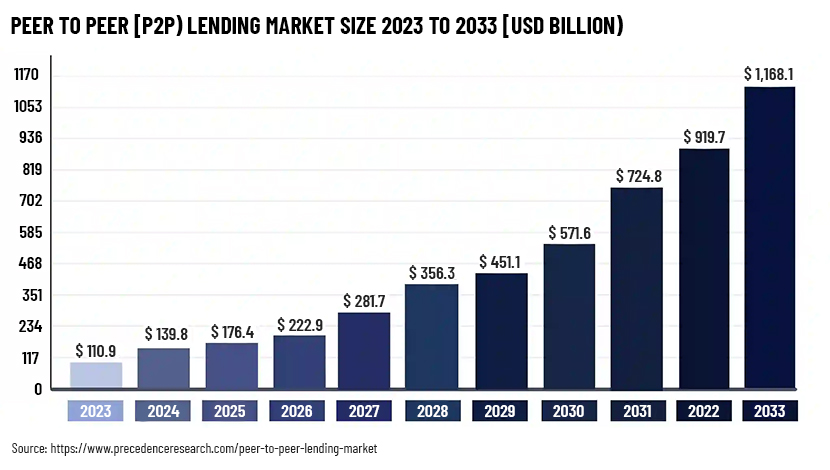

The global P2P lending market is expected to reach USD1,168.1bn by 2033, growing at a 26.6% CAGR from 2024 to 2033, according to Precedence Research, driven by increasing demand for digitalisation in the banking sector, which is accelerating development by enhancing transparency and trust between borrowers and lenders. Challenges include strict government controls and a lack of general awareness of P2P lending.

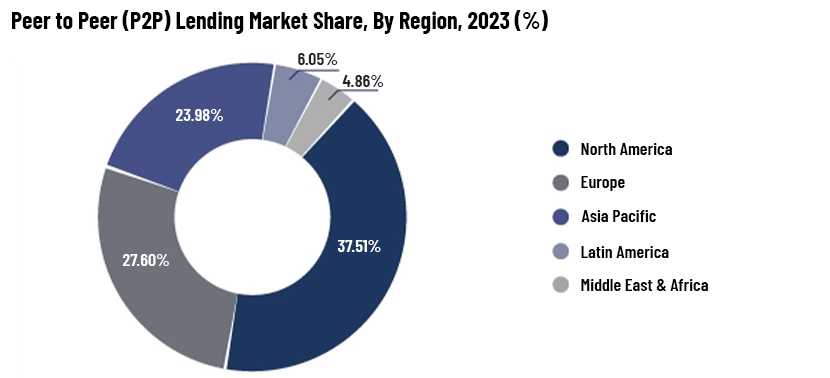

The North American P2P lending market grew significantly in 2023, driven largely by its lenient regulatory environment. However, clear regulations and frameworks boost lending activity, attracting attention of both borrowers and investors.

The P2P lending market boomed in Asia Pacific led by China, followed by Europe, the UK, Japan and France, as more small and mid-size firms emerged and as government investment in cashless tech drove economic growth.

Key factors building trust in the P2P lending space

-

Regulatory framework: Strong regulations have increased openness, consumer protection and fair market practices on P2P lending platforms. Many governments have introduced regulatory measures against risks, improving trust in P2P platforms. A number of financial watchdogs now oversee P2P lending rules, protecting investors and managing risks; these include the Financial Conduct Authority in the UK; the Securities and Exchange Commission, the Consumer Financial Protection Bureau (CFPB) and the Federal Trade Commission in the US; and the Reserve Bank of India.

-

Platform security: Safe online platforms are key to protecting user data and financial details. P2P platforms use tough security measures, such as data scrambling, access limits and ways to stop fraud, to keep user information and transactions safe.

-

Credit risk assessment: Advanced credit-assessment tools help lenders determine whether a borrower can repay a loan. Tools such as FICO and Vantage Score are common, with some platforms using models and smart computer programs. The process involves analysing spending habits and how a borrower uses websites.

-

Transparency and education: P2P lending needs to be open on every front if it is to foster confidence. This includes providing clear information on loan terms, fees and the risks involved.

-

Customer service: One of the main ways in which to ease customer concern and gain trust is by providing good customer service, solving user problems quickly and efficiently.

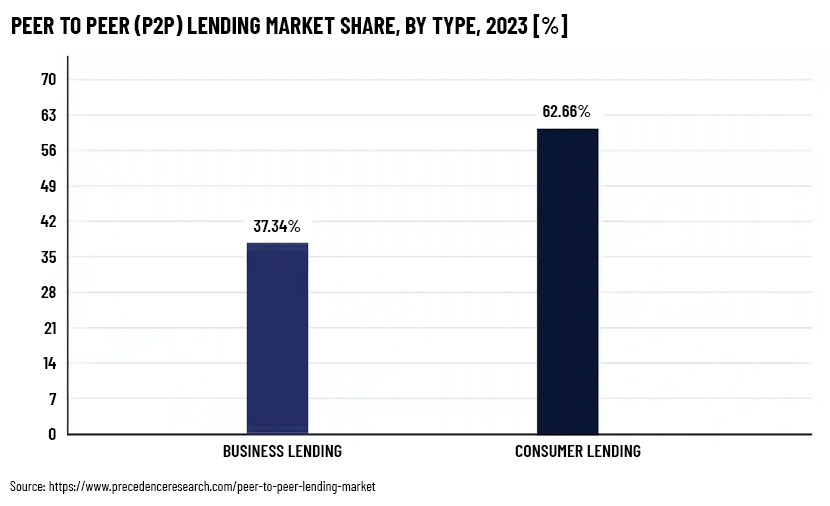

Consumer lending accounted for the largest share of the P2P lending market in 2023, according to Precedence Research. This refers to raising funds loans online without intervention of a bank. A borrower needs to list their loan requirements, including the amount they want to borrow, the interest rate they are willing to pay, and the purpose of the financing.

Opportunities in P2P lending

-

Wider access and reach: P2P platforms provide alternative financing options; this helps new companies, small firms, businesses without much banking experience and borrowers who need loans that are easily accessible.

-

Tech progress and new ideas: Fintech helps P2P lending by improving credit checks, enhancing safety with blockchain, smoothing processes and enhancing users' applications and websites.

-

Rules and regulations: These aim to protect borrowers from scams, ensure reports are clear, increase investor confidence and enable P2P platforms and traditional banks to collaborate.

Challenges in P2P lending

-

Regulatory landscape: P2P lending-related rules are still being formulated, with governments seeking to balance new concepts and protecting borrowers.

-

Cybersecurity concerns: P2P platforms need to ensure that user information and financial details are safe, in order to prevent fraud.

-

Investor education is key: Platforms need to offer clear information on risks and rewards so users can make informed investment decisions.

Conclusion

The future of P2P lending involves adapting to changing regulations and giving priority to educating users and ensuring their security. P2P platforms have the potential to establish themselves as alternatives to financial institutions, able to democratise access to credit, empower borrowers and create a complete and efficient ecosystem for all.

How Acuity Knowledge Partners can help

We have the expertise to support fintech and work with sales and marketing teams to track the development of infrastructure and technologies in the fintech and digital lending sectors. We help clients identify trends and analyse competitors, delivering results faster and driving excellence.

Sources:

-

https://corporatefinanceinstitute.com/resources/wealth-management/peer-to-peer-lending/

-

https://www.investopedia.com/terms/p/peer-to-peer-lending.asp

-

https://www.precedenceresearch.com/peer-to-peer-lending-market

Tags:

What's your view?

About the Author

Bhavya P is associated with Acuity Knowledge Partners with a year of work experience in the Financial Spreading domain as a part of Lending Services.

Bhavya is a dedicated and enthusiastic learner with strong passion for finance. Graduated MBA in Finance and Marketing at Presidency College, She have honed skills in the financial sector and awarded as the best student in the field of finance.

Like the way we think?

Next time we post something new, we'll send it to your inbox