Published on May 11, 2021 by Zahin Mohammed

Since the concept of environmental, social and governance (ESG) factors was introduced at the Who Cares Wins conference in 20051 , it has gained significant traction among investors, asset managers and policy makers. In less than two decades, ESG and sustainable investing has grown more than 10-fold, with total assets under management associated with the theme now exceeding USD1.65tn2 . Growth was fuelled by both client demand and an unprecedented level of product development, with the total number of sustainable funds globally reaching 4,1533 at the end of December 2020.

With its increased popularity and acceptance, investors and asset managers have raced to integrate ESG factors into their investment processes, and many ESG-labelled securities and funds have been created. However, there is little consensus on the definition of an ESG fund, further complicating investment decisions and performance analysis, and making apples-to-apples comparison difficult. The subjectivity inherent in what ESG factors try to capture also creates a significant variation in sustainability scores or ratings across data providers, resulting in confusion among investors4 .

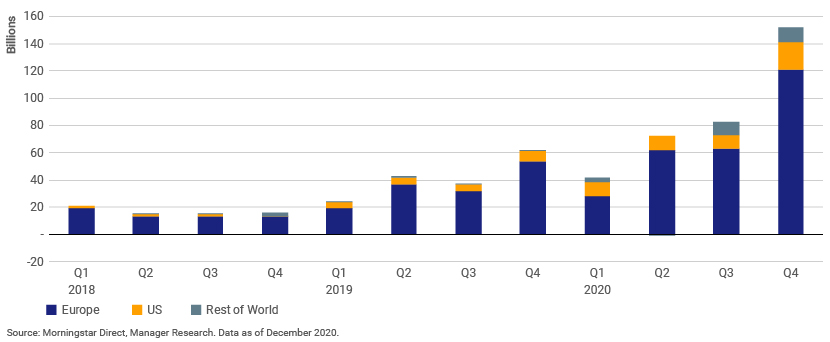

With ESG considerations playing a bigger role in investment decisions, there is a clear need for promoting rating transparency and standardising reporting. ESG funds are currently identified by relying on the fund name and prospectus. Beyond the label, to differentiate between ESG and non-ESG funds, we look at holdings data and standard risk factors. While a fund’s asset class or geographical focus is relatively easy to determine, other characteristics, such as establishing whether it qualifies as an ESG fund, are more difficult to assess. As a result, in the coming year, European and many global investors are likely to face a large influx of ESG disclosure requirements, whether they run specific ESG-labelled funds or not. With no signs of ESG inflows abating, the fourth quarter of 2020 saw a rise of 88% to USD152.3bn5 from the prior quarter, clearly indicating where investors are putting their money to work.

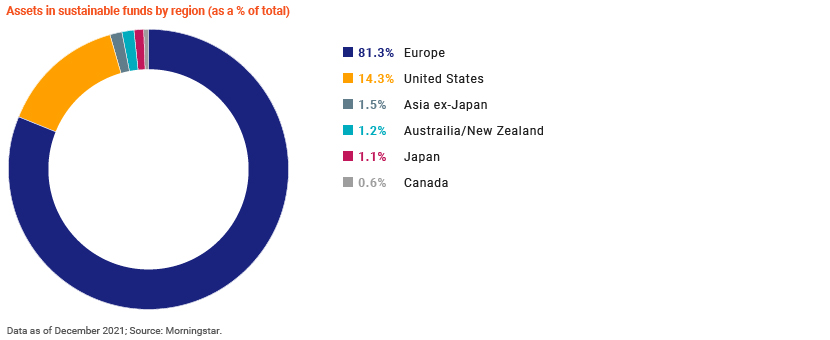

Globally, Europe continued to dominate the sustainable funds space over the last year, accounting for more than 80% of the total, followed by the US (13.4%). Subsequent to the growth of ESG investing in Europe, the EU has set out obligations for asset managers in the Sustainable Finance Disclosure Regulation (SFDR), effective from 10 March 2021. The SFDR was put in place to increase transparency and reduce risks of greenwashing (which means conveying a false impression or making something seem more environmentally friendly than it is). The policy applies only to EU asset managers and products registered and sold within the EU, and will not be part of UK law, as the SFDR became effective after Brexit. Bloomberg Intelligence estimates that by mandating greater disclosure, global ESG assets are set to exceed USD53tn by 2025, representing more than a third of the USD140.5tn in projected total AUM6 .

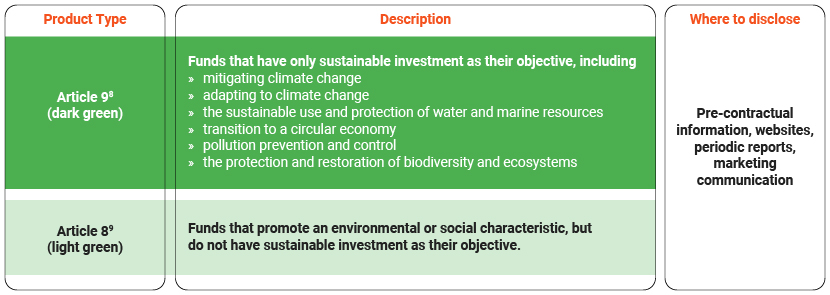

At the product level, the SFDR calls for a mandatory set of sustainability-related disclosures, requiring changes to product documentation and marketing material7 . The regulation stipulates that funds should be classified “light green” or “dark green”, and the classification added to periodic publications. Fund documents to be updated by asset managers will include fund prospectuses, website product information and key investor information documents (KIIDs). Funds that do not integrate sustainability factors into the investment process will fall under the “grey” or “Article 6” category.

The Securities and Exchange Commission (SEC) in 2020 asked for public comment10 on whether ESG products should follow existing rules that require a fund’s name to broadly match what it invests in. Besides the fund name, the SEC also asked whether there should be specific requirements to which funds must adhere in order to call their investments ESG or sustainable11 . Several asset managers have also set ESG targets and constraints at the firm level and updated ESG policies with new commitments and strategies. On the investor side, there has been a continued increase in the number of asset owners and managers signing up to high-level ESG commitments such as the United Nations Principles for Responsible Investment12 .

The adoption of ESG considerations was not derailed by the pandemic, and their importance is set to grow in the coming years due to regulatory pressures and strong demand from asset owners. As sustainability regulation ramps up, ESG reporting requirements for asset managers and their products are likely to increase sharply. Investment managers also need to be transparent about the characteristics of their products to qualify them as sustainable. Hence, it is vital that the asset-manager community augment ESG data communication and transparency, enhancing fund reporting.

How Acuity Knowledge Partners can help

Our Fund Marketing Services arm offers a suite of services in the fields of marketing and investment communication. We support prominent investment managers in preparing market collateral and writing investment commentaries. Given our extensive experience in the reporting space, we have also been able to adapt to changes to regulations that impact marketing material. To help asset managers communicate their ESG themes better, we leverage our fund management specialists’ rich and extensive experience, built over the years through collaboration with leading investment management firms.

Sources

1 https://www.forbes.com/sites/georgkell/2018/07/11/the-remarkable-rise-of-esg/?sh=79b875981695

2 Morningstar report, Global Sustainable Fund Flows: Q4 2020 in Review

3 Morningstar report, Global Sustainable Fund Flows: Q4 2020 in Review

5 Morningstar report https://www.ft.com/content/a5e02050-8ac6-11e8-bf9e-8771d5404543

6 https://www.bloomberg.com/professional/blog/esg-assets-may-hit-53-trillion-by-2025-a-third-of-global-aum/

7 https://www.intertrustgroup.com/insights/the-first-sfdr-deadline-is-fast-approaching-on-10-march-are-you-ready-to-comply/

8 https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:32020R0852

9 https://www2.deloitte.com/content/dam/Deloitte/lu/Documents/sustainable-dev/lu-sustainable-finance-disclosure-regulation.pdf

10 https://www.ft.com/content/ed4452e6-cd04-49d6-b2b7-6e098dc715a4

12 https://www.schroders.com/en/about-us/corporate-responsibility/sustainability/un-pri/

What's your view?

About the Author

Zahin Mohammed has over 6+ years of experience in the financial services industry. His expertise areas include investment banking, writing market commentaries, attribution reports and client reporting. In his current role at Acuity Knowledge Partners, he provides support in fund marketing services for the asset management industry. Zahin holds an MBA in Finance from Vellore Institute of Technology.

Like the way we think?

Next time we post something new, we'll send it to your inbox