Published on July 24, 2023 by Himanshu Mishra

Overview

Steel is a crucial component of the construction and industrial sectors and is vital for opening prospects for novel solutions in other sectors. Iron ore is converted into several products; these are sold for USD5.6tn annually by the steel sector, active in every part of the world. In 2021, 1.9bn MT of crude steel was produced by 64 countries, accounting for 98% of global steel output.

The global steel sector is currently grappling with significant overcapacity. This occurs when the production capacity of steel surpasses actual demand for the metal.

What is the problem?

Overproduction is now the largest issue facing the global steel sector due to the significant increase in production capacity over the past two decades. This has led to questions about the sector’s viability, which would have a significant impact on the financial health of steel companies. Amid the challenge of excess capacity, the steel market showed a mild improvement in 2021 but has since weakened, leading to further pressure from excess capacity. Global excess capacity has been increasing since 2022, and market conditions have not improved. Excess capacity influences the dynamics of international trade, which is a concern.

Global trends in steel capacity and utilisation

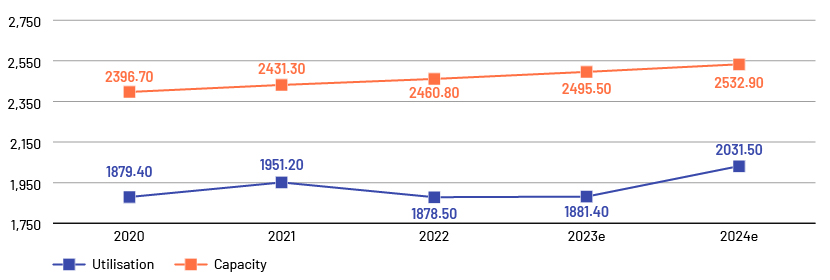

Global steelmaking capacity has increased by 34.7MT in 2023, and utilisation is expected to increase by 2.9MT. The OECD has classified 55.5MT of potential capacity additions as underway and 90.8MT as planned, which would increase the capacity by 6% over the years.

Source: World Steel, OECD

Major players that face overcapacity issues

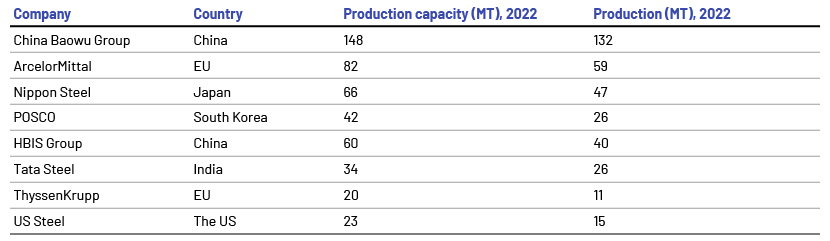

The following table lists the major companies facing problems of overcapacity. They would need to replace capacity using new technology – from basic oxygen furnace (BOF) to electric arc furnace (EAF) and hydrogen arc furnace (HAF).

Source: World Steel, OECD

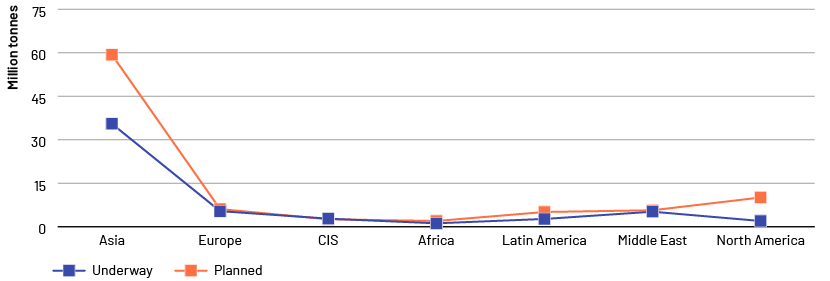

Potential gross capacity additions by region

The steel sector would continue to experience substantial increases in steelmaking capacity over the next three years if all the ongoing projects become operational.

Source: World Steel, OECD

Reasons for global excess capacity

Understanding the reasons for global excess steel capacity is vital for devising effective solutions. Economic fluctuations and uncertainty significantly impact steel demand, leading to a mismatch between capacity and production. Additionally, intense competition among steel-producing nations often triggers a race to expand production capacity, exacerbating the problem of overcapacity.

The impact of the pandemic on the steel sector: China increased its steel production by 5% amid the pandemic, but other countries such as the US, Japan and the EU experienced a dip of 20%; India alone experienced a dip of 14%. Capacity utilisation decreased by 8% in Asia and by 5.6% in the US and Europe.

Decarbonisation: The steel sector is currently dominated by carbon-intensive capacities, such as BOF and blast furnace. Major countries such as China, India and Japan use BOF processes: 90% of China’s production is through BOF processes and 50% from EAF processes, while 10% of India’s production is through BOF processes and 50% from EAF processes, and 80% of Japan’s production is through BOF processes and 20% from EAF processes. Production through BOF processes needs to be reduced so production compliant with environmental law can be increased.

Steel prices and production cuts: Global steel prices increased because of the sanctions the US and Europe imposed on imports from Russia. Due to escalating gas and energy prices in Europe, lacklustre market demand and a bleak economic outlook, ArcelorMittal, the world’s second-largest manufacturer of steel, announced the closure of one of the two blast furnaces at its steelworks plant in Bremen, Germany. A smelter owned by China Baowu Group and Nippon Steel was shut down because of rising energy costs and weak demand.

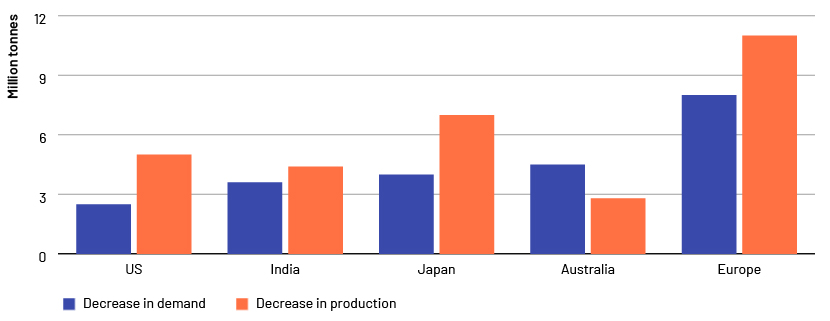

Low demand: Global demand for steel has declined because of an increase in prices of raw material and energy. Sectors such as automotive manufacturing and construction have reduced output, further reducing demand. A drop in demand is clear in the US, India, Australia, Europe and Japan due to the Russia-Ukraine war. Demand could pick up but will likely be slow.

Source: World Steel, OECD

Major steps taken to solve the problem of excess capacity

Recognising the severity of the issue, multilateral agencies and individual countries have taken significant steps to tackle the problem of excess capacity in the steel sector. Agencies such as the G20 have initiated dialogue to promote cooperation and coordination among member nations to address this problem collectively.

Government initiatives

Japan and China have introduced stricter regulations to control steel production and ensure a balance between capacity and demand. Several steel projects are at different stages of planning and execution under the “swap scheme”, helping not only to reduce the carbon footprint, but also to address the issue of overcapacity.

Companies that have cut capacity: Nippon Steel, Heyuan Deron Iron & Steel, HBIS, Zenith Steel, Sanbao Iron & Steel and Hongxing Iron & Steel.

The US and Europe have implemented subsidies to support the modernisation of steel plants and increase efficiency by using new EAF technology. ArcelorMittal and US Steel have shifted production plants to locations from which they export.

India – Jindal Steel and Tata Steel follow the three Rs of waste management: recycle, reduce and reuse and have implemented many “wealth from waste” projects to reduce carbon emissions and address the issue of excess capacity.

Significant investment in EAF and HAF

Countries such as China, India and Japan have invested a total of USD57.5bn in EAF projects to reduce carbon emissions.

It will take time to shift away from BOF to EAF and HAF, but the shift will materialise in the long term in such countries, with 25-30% of production estimated to come from EAF and about 10% from HAF by 2025.

OECD policies

Strong policy will play a major role in dealing with excess capacity, with several countries having signed the Paris Agreement and in line with suggestions of the World Steel Association.

Major policies: Targeting net zero emissions by 2050, many governments are working towards removing obstructive policies such as subsidies, eliminating trade and investment barriers and ensuring new projects comply with standards that protect the environment and uphold worker safety and environmental policies.

Major steps taken by key players

ArcelorMittal: Focusing on growing its mining activities and plans to shift its BOF smelter to EAF and HAF to become more sustainable and efficient.

US Steel: Focused on wage insurance and trade policies to limit future market distortions in the steel trade.

Nippon Steel and HBIS: Reducing the capacity of their smelters that are carbon-intensive and shifting to EAF.

How Acuity Knowledge Partners can help

Our pool of experts in the energy and mining sectors help clients develop strategies and assess base and platinum-group metal markets.

We have extensive experience in mining project due diligence, research analytics, business development and formulating strategy to accelerate the energy transition.

Sources:

Tags:

What's your view?

About the Author

Himanshu Mishra has around 6 years of experience across various sectors, including Energy, Information Technology, Finance, Consumer, Chemical, Manufacturing and others; most recently working as a Metals & Mining researcher for Acuity’s India AKP engagement for the last 1.3 years. He has worked on various business and strategic research projects, where he was involved in industry analysis, competitor benchmarking and company analysis. He is capable of end-to-end project management, including project scoping, identification and implementation of the research direction and methodology, quality check and output delivery.

In addition to the Chemical & Consumer sector, Himanshu has done competitive benchmarking: Data research on competitors, consumers and marketplace by using..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox