Published on November 22, 2023 by Shobhit Agarwal

The steel sector, which has been in a state of turmoil since the breakout of COVID-19, is finally hoping for some stabilisation by the end of 2023. We can also expect steady growth for the next few years. Not all the challenges faced by the steel sector in the last few years have smoothened out, but the industry has shown immense resilience in these turbulent times and is adapting to the new geo-political order at a face pace.

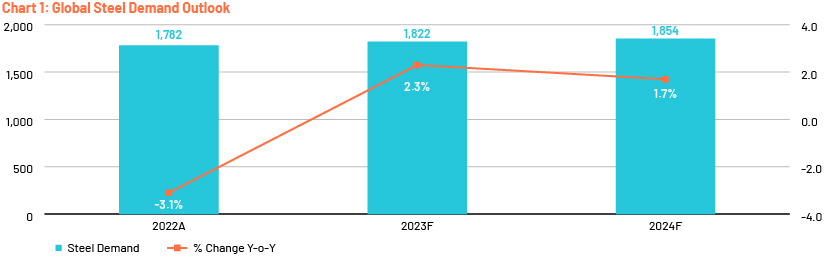

After witnessing a 3.1% contraction in global steel demand in 2022, it is expected to grow at a 2.3% and 1.7% rate in 2023 and 2024, respectively. In 2025, it is expected to maintain a steady growth rate of 1.5– 2.0%. Till July, 2023 has been a flat year in terms of crude steel production, which is ca.1100m MT, almost the same as July 2022. A more optimistic indicator is that combined crude steel production in China and India till July 2023 (which constitutes 62% of the world’s total steel production) is 3.5% higher Y-o-Y. However, steel production is not the exact indicator of steel demand.

Despite the uncertainties around the US and China economies and EU countries showing great resilience against economic challenges due to high energy prices, India is expected to exhibit robust growth in the next few years. Other small economies such as ASEAN, MENA and Non-EU European countries are poised to show strong economic recoveries and balance the negative pressure on steel demand from developed economies and China. Let us look at some key economies in detail.

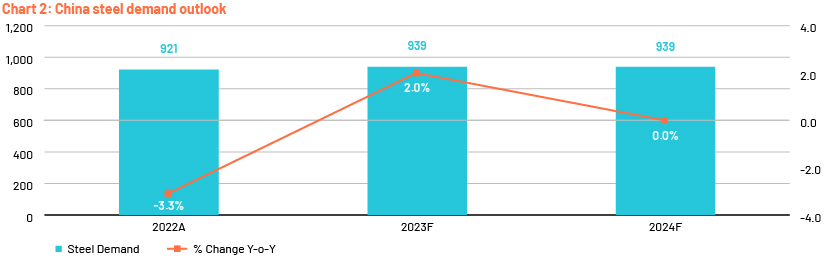

China

The negative momentum of 2022 in the infrastructure sector continued its run in the first half of 2023, but the sector also benefitted from the projects started in late 2022. The recent fall of real estate giants such as Evergrande and Country Garden, along with falling real estate investment, shows the severity of the crisis in this sector. The real estate and the manufacturing sectors, which are supported by government measures, might exhibit moderate recovery in the second half of 2023. The lack of new large-scale projects in 2023 may also affect 2024’s steel demand. Without any stimulus package, the automotive industry may also face some challenges. Overall, in 2023, steel demand may go up by 2% but is expected to remain flat in 2024.

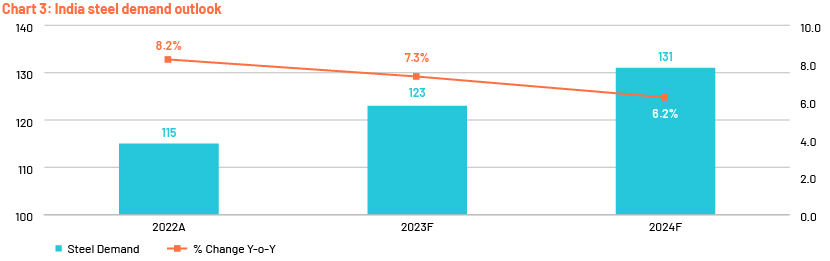

India

Like 2022, prudent inflation management and the government’s focus on infrastructure development are going to be key for 2023 and 2024. Steel-intensive sectors, including construction, real estate, capital goods, automotive and consumer durables, are expected to maintain a healthy growth momentum form 2022. Affordable housing projects, urban demand, PLI schemes, private investment, investment in renewable energy and sustained private consumption will continue to back all the sectors mentioned above. In total, steel demand is expected to continue the positive momentum of 2022 and grow at a 6–7.5% rate till 2024.

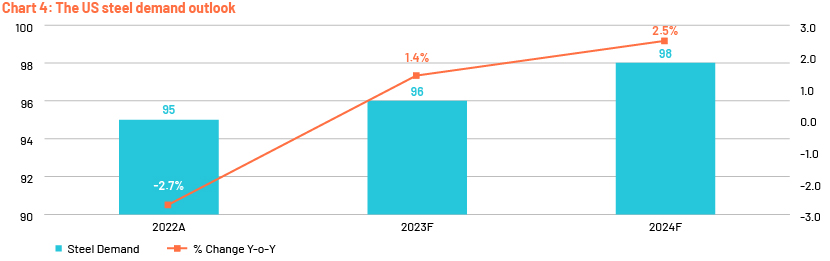

The US

As slowdown in most of sectors like manufacturing, construction, automotive etc. were induced by inflation and its counter measures hence as the inflationary pressure will ease, we can expect a rate cut and hence a boost to domestic & private consumption. Government legislation on infrastructure and inflation, along with expansion of the energy sector, is also expected to drive steel demand. Although, it is difficult to predict any timeline for visible impacts still demand growth at the rate of 1.4% and 2.5% is expected in 2023 & 2024 respectively.

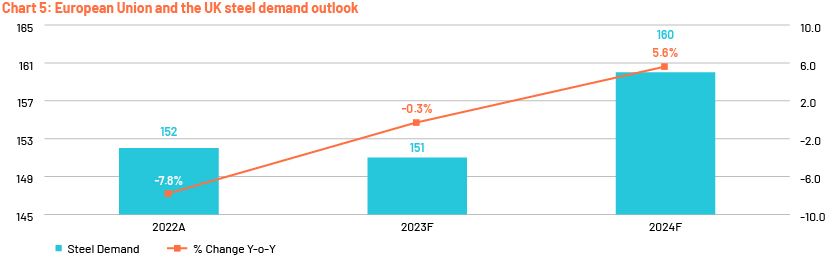

European Union and the UK

The EU economies are still experiencing pressure from geopolitical disturbances such as the Russia-Ukraine war and supply-chain issues. Monetary tightening to tackle inflation is still in place. Despite the uncertainties, we can hope for some of these impacts to dissipate by the end of 2023. Hence, although steel demand growth is expected to remain negative in 2023, a rapid recovery is very much possible in 2024. Expected growth rate in 2023 and 2024 is -0.3% and 5.6%, respectively.

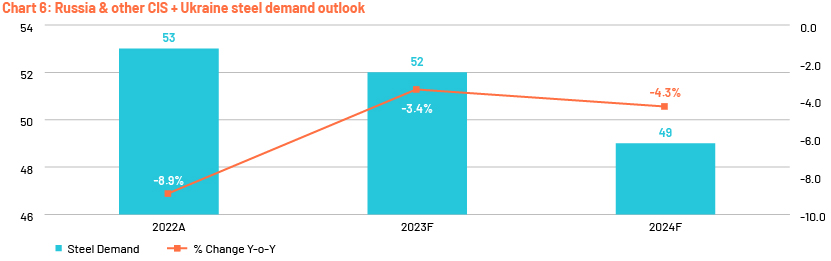

Russia, Ukraine and other CIS countries

Russia was able to avoid a large-scale economic crisis in 2022, partially because of its old infra projects and strategic business support from China and India. Nevertheless, the country is expected to face serious challenges due to western sanctions. Other consequences of the prolonged war include workforce leakage due to immigration and military mobilisation. Currently, the Ukrainian steel demand is less than 40% of its pre-war demand level, and no recovery is visible before the war comes to an end. Overall, the region is expected to witness a further slowdown in steel demand for the next two years at 2–3% rate Y-o-Y.

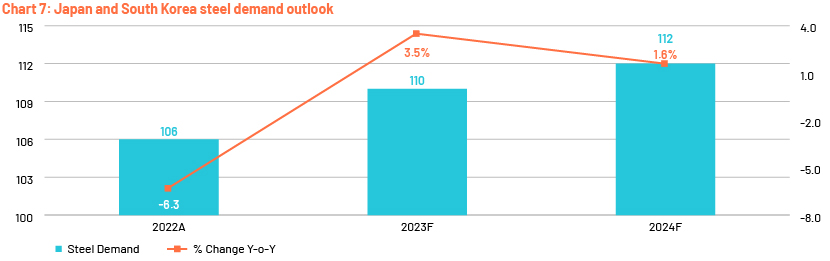

Japan and South Korea

Both the countries are among the top five steel consumers in the world and have witnessed a slowdown in steel demand in recent years. Although these countries are expected to witness a recovery in the coming years, steel demand may remain below pre-pandemic level. The manufacturing, industrial machinery and automotive sectors will play a critical role in terms of steel demand in both these countries, with these sectors showing promise amid easing supply-chain constraints. In addition, shipbuilding in Korea is expected to recover mildly, while the construction sector in Japan is expected to get a big boost from investment in warehouses and logistics projects. Overall combined steel demand is expected to grow at 3.5% and 1.6% in 2023 and 2024, respectively (See Chart 7).

Looking back: 2020–2022

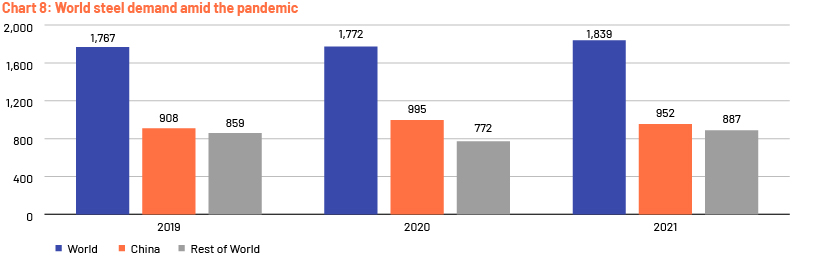

The steel sector faced massive headwinds in 2020, with most countries facing a huge demand slowdown due to the pandemic. Except China, all other major steel-consuming nations faced an 8–18% demand slowdown.

Overall, in 2020, global demand remained flat at c.1772m MT, as China alone compensated for all the demand cut in the rest of the world (See Chart 8). Strong exports, new infrastructure projects and tax reduction are expected to boost household consumption-driven steel demand in China to 995m MT (10% y-o-y).

In the beginning of 2021, rapid vaccination programmes were expected to establish normality in major steel markets by Q2. Global steel demand was projected to increase by 5.8% and 2.7% in 2021 and 2022, respectively.

However, the demand recovery witnessed in 2021 was at a much slower pace of 3.8% against earlier estimates of 5.8%. An increase in supply-side constraints, slow vaccination progress in developing countries and rise in inflation proved to be the major constraints.

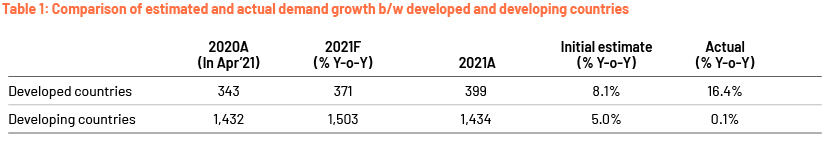

One key feature of this recovery was that developed nations performed much better versus developing nations against initial estimates (See table 1). One possible reason for this might be the slow progress of vaccination programmes in developing countries.

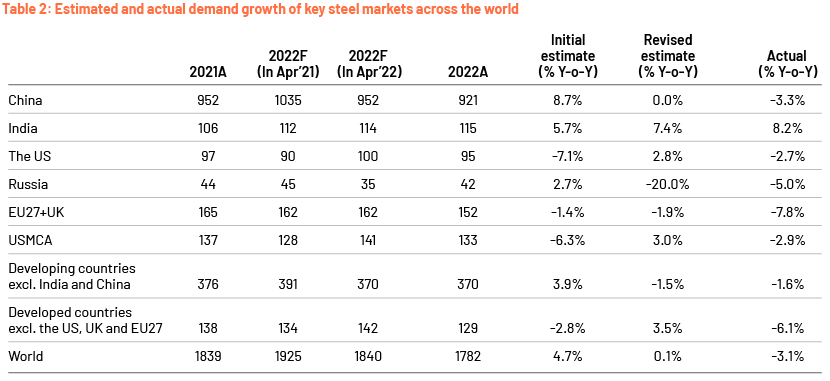

2022 brought the real disappointment for the steel industry globally. Global demand fell by 3.1% (table 2). Some of the factors responsible for the demand fall across the globe were a rise in inflation and interest rates, Russian invasion of Ukraine and China lockdown as part of the zero-COVID policy.

India was the only bright spot in the global steel industry, which witnessed an 8.2% increase in steel demand and the demand touched an all-time high of 115m MT. Increasing economic growth and rising investments played a crucial role in driving India’s steel demand despite several economic and geopolitical headwinds.

China’s steel demand contracted unexpectedly by 3% in 2022 against an estimated increase of 9% in April’ 21. Countrywide lockdown, which also set a negative momentum in the construction sector, was majorly responsible for this demand contraction. For the first time in the last 25 years, real estate investment dropped by 10%. Other real estate indicators were also in negative territory.

Among other major steel markets, Russia is another interesting case. As per April’ 21 estimates, a demand slowdown up to 20% Y-o-Y was predicted, but surprisingly, it contracted only by 5% to c.42m MT. Large-scale pipeline and residential construction projects prevented the steel demand from collapsing. However, these projects will not be able to support steel demand in the coming years.

Advanced economies such as the USMCA, UK and EU27 witnessed sudden demand contraction in Q4 2022. This was triggered by high energy cost, along with monetary tightening, which led to a contraction in industrial activities. The EU and UK, whose combined steel demand in October’ 22 was estimated at c.159m MT, were at c.152 m MT (-7.8% Y-o-Y). Similarly, the USMCA registered a 2.9% Y-o-Y contraction, while it was expected to expand by 1.1% in October’ 21.

Steel demand in all other developing economies (excluding India and China) registered a marginal fall of 2% from c.376m to c.370 m MT.

Conclusion

The steel industry is still going through a turbulent period that started late 2019 and has faced several headwinds and surprises in the last 3–4 years. The several waves of the pandemic, significant changes in the geo-political order, globally high inflation, global economic slowdown, supply-chain disruptions, etc. have impacted the industry in different ways. We can only hope for no further disruptions and the global demand to gain a steady pace in the next 12–18 months, which will navigate growth for the next 4–5 years.

Tags:

What's your view?

About the Author

Shobhit has close to 9 years of experience working across steel manufacturing value chain. He has varied experience working on various strategic research projects involving market intelligence, competitive intelligence, market sizing models, industry benchmarking and market entry strategy. At Acuity Knowledge Partners, Shobhit is leading a team to support a major steel maker in various strategic research projects. He holds an MBA degree in Banking & Finance from Jindal Global University and B.Tech in Electrical Engineering.

Like the way we think?

Next time we post something new, we'll send it to your inbox