Published on January 13, 2020 by Gunjan Upadhyay

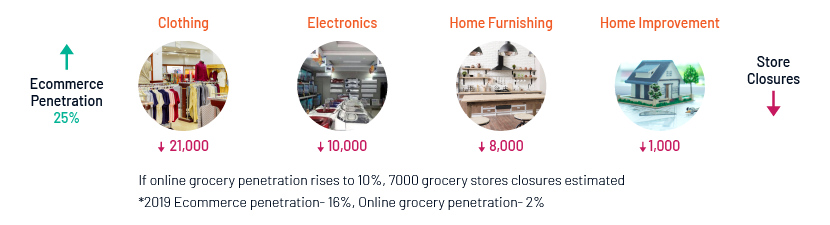

The woes of Store based retailing doesn’t seem to end anytime soon. 2019 has been an year of massive stores closures in the US with 9,000 store closures (Nov 2019) and the number might touch 12,000 by year end as per Coresight Research. Even Retail elephants aren’t unfazed with stalwarts as Nordstorm, Walmart, GAP, CVS and Forever 21 joining the spree.

The ecommerce boom has hit hard the future of brick and mortar stores. Online shopping has offered enormous convenience to time crunched on-the-go shoppers. The attraction of hassle free any time shopping, without struggling in crowed trial rooms & payment queues, access to wider product range and product reviews has brought ecommerce to the forefront of retailing landscape. Competing with these attributes is certainly not easy.

2026 Ecommerce Penetration Growth Impact on Store based Retail-UBS estimates

But what has so obnoxiously gone wrong with Store based Retail?

Change in consumer aspirations has a major role here as shoppers are buying way differently now. Look & feel of products and elaborate in-store displays are no longer the only decisive factors. Young shoppers with limited leisure time are disgruntled of long waiting time in stores, consequently they are drifting towards hassle free ecommerce.

So are the days of Retail stores over? Have consumer shopping habits changed to the level that Retail stores revival is nothing but wishful?

Perhaps not! According to retail experts, not all is lost.

Consumer assertions on Physical Store relevance

Retail stores come with their inherent advantages.

-

Shoppers can see, feel & experience the products

-

Happiness of moving out of the store with product in hand is a psychological boost

-

Sales professionals aid in apt product selection specially in electronics and technology item purchase

-

Some product categories like grocery and perishables are preferably bought in-store

These factors are bound to keep Store based retailing relevant. However, retail stores while leveraging their strengths, need to re-invent themselves and embrace technology to appear standing with time and trends. This will require retailers’ to redesign their strategies and develop stores as areas that create experiences consumers relish rather than just product display zones.

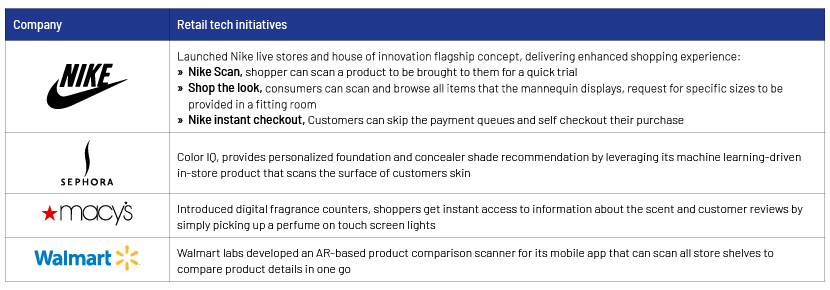

According to BRP consulting, nearly 50% of shoppers would buy from a retailer that provides AR/VR experiences1 . Technology driven experiences can hence avert a much feared Retail Apocalypse. To enable this transformation, ‘Retail Tech’ is the buzzword that is being seen as tool to drive shoppers to the stores.

Few notable examples of Retail Tech evolution:

Experiential stores concept is an upcoming trend and according to BRP consulting survey 32% of retailers plan to use virtual and augmented reality in coming three years. It is however noteworthy that Retail tech also has its share of challenges as it is hugely capital intensive. “It also comes down in large part to funding,” asserts Paul Blackburn of L'Occitane Group.

Of course, it will not be a smooth transformation. There would be capital limitations, also not all tech initiatives leave an impact and draw customers to stores. Retailers need to be mindful to what technologies they must introduce along with scale of adoption. This is critical in the times where real estate cost pressures are already eroding retail margins.

Experiments to assist retailers in selecting relevant technologies:

1. McKinsey has taken an innovative initiative in the space and recently launched its first ever retail concept store- Modern Retail Collective at the Mall of America in Minneapolis. The retail space provides ground for experimenting new technologies and enable brands provide novel experiences to customers.

McKinney intends to provide its clients a clear view on which technologies are a hit among customers, keep them engaged and shop in store. The space will also investigate which technologies have a low uptake. Shoppers can experience the following, among others:

-

-

-

Single-tap access to product information across the store through Interactive mobile hotspots

-

Virtual trial of products outside the fitting room via Smart mirrors and Fit predictor software

-

Cryptocurrency capabilities enabled payment options

-

-

Tiffany Burns, Partner at McKinsey and Retail Stores Practice Lead, North America asserts, "Retailers are experiencing many pressures as they navigate the evolving retail landscape. Modern Retail Collective will provide insights to retailers exploring opportunities to re-imagine the store through new in-store experiences and technologies that will enhance customer experience and overall store performance.”

McKinsey plans to publish perspectives on insights gained through Modern Retail Collective to help inform and shape the future retail industry2.

Prior to McKinney, some other retailers have also been upbeat on testing initiatives and technology.

2. Nordstrom, for testing new initiatives uptake with customers operates “Experience Concept Store”. Some initiatives tested here includes the feature that enables the customers reserve clothing online but try it on in stores.

3. Walmart, also invested in testing feasibility of BOPIS- Buy online, pick up in-store. Pick-up towers were created in stores to investigate how coupling with technology innovations, like driverless vehicles that increase footfalls for order pick-up, can enhance BOPIS

The challenges before brick & mortar retail are immense. The industry is searching solution in new age technology, experiential retail and personalization strategies that leave shoppers with experience they can keep coming back for. Stores can create appealing new experiences for consumers and transform the shop into an experiential destination rather than simply a place where transactions happen. A 2019 National Retail Federation (NRF) study states that customers are finding that retail technology is making the shopping experience better on mobile, in stores and online3.

Choosing the right Retail Tech thus becomes imperative.

Acuity Knowledge Partners is an influential player in the global market, offering expertise services to Consumer Retail and CPG companies navigate through emerging retailing trends, market landscape and competitive strategies. With a pool of talented professionals experienced in analyzing consumer market risks, theme-based research and trend analysis, Acuity helps businesses and corporate clients identify market opportunities, customers and competitors.

2. https://msmsolutions.com/mckinsey-opens-modern-retail-collective-in-mall-of-america/

3. https://retailwire.com/discussion/nrf-study-says-customers-dig-retail-tech/

What's your view?

About the Author

Gunjan Upadhyay has over 11 years of experience in research and consulting. She works as a subject-matter expert, specialising in the consumer products, FMCG and retail markets. Gunjan assists leading private equity firms and management consulting clients with industry analysis, opportunity assessment, portfolio strategy and identifying new avenues for growth. She holds an MBA in Finance and a master’s in Economics.

Like the way we think?

Next time we post something new, we'll send it to your inbox