Published on July 30, 2024 by Prasanna Kumar

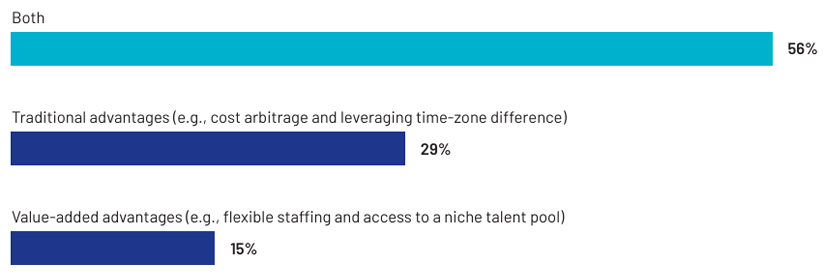

More than half of the respondents acknowledge that leveraging offshoring services will be pivotal. 65% of them seek either traditional and/or value-added advantages by engaging with an offshoring partner.

There is a systematic shift from just availing traditional advantages of offshoring to an evolved combination of both traditional and value-added advantages

Offshoring offers unparalleled benefits and is reshaping the global investment banking and advisory industry. Offshoring services can be leveraged across the deal lifecycle, with varying complexities. Investment banks and advisory firms are moving away from the traditional tactical offshoring support towards a more strategic partnership for assistance across live deals and strategic tasks.

Our survey captured the increased interest of the top leaders of the investment banking industry in offshoring. While traditional advantages continue to generate proven value propositions, value added advantages are increasingly catching attention. Over and above the cost arbitrage advantage, offshoring offers savings in terms of lower supervision time, ready access to a skilled talent pool and operational flexibility.

The survey results outlined the following core offshoring support and services already being used by investment banking teams

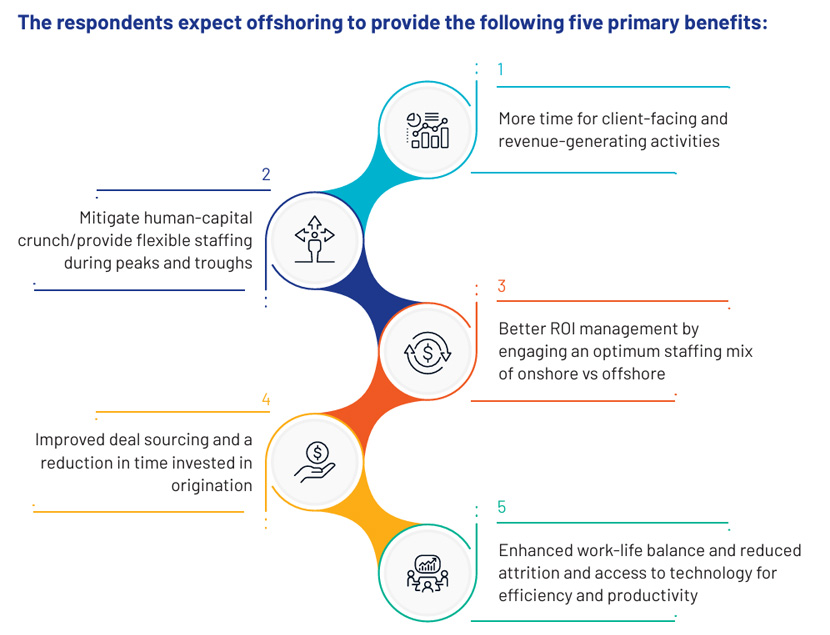

Offshoring to enable additional client-facing time, achieve higher ROI and mitigate operational challenges Investment banking offshoring partners are also evolving and innovating with a view to enhancing business agility and value propositions.

Technology development has been a prime focus to further support investment banking and advisory clients’ growth journeys.

Tags:

What's your view?

About the Author

Prasanna Kumar has over 16 years of experience in global capital markets –Investment Banking and Investment Research. His responsibilities include managing one of the IB engagements and relationship, coordinating with staffers and bankers on new initiatives and services, soliciting feedback, working with teams to identify and improve efficiencies and productivity, training team members on complex and value-added analysis, and implementing industry best practices in the Acuity team for IB Analytics.

Prior to taking up the dedicated role with the account in 2014, Prasanna was working as part of Projects and Transition team gained experience in business development and equity research (financial modeling, report writing, relative..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox