Published on December 3, 2024 by Ira Dawar

The venture capital (VC) sector’s investments in artificial intelligence (AI) start-ups remain robust.

As per TechCrunch – an online newspaper, venture capitalists have invested USD26bn (1,909 deals) globally in AI start-ups in 1Q24 – an increase of 19% from the USD22bn investment (1,545 deals) in 1Q23.

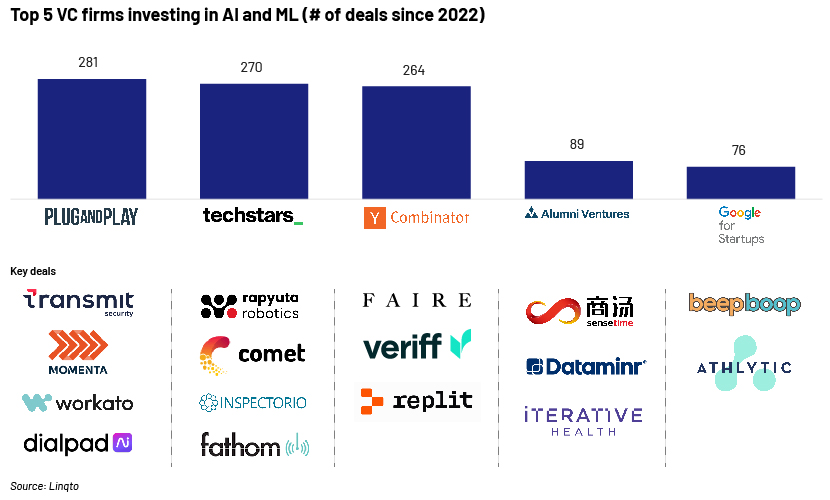

VC firms actively engaged in AI and ML sectors (including key deals)

The chart below highlights the top VC firms investing in AI and ML since 2022.

Technology-focused VC firms are increasingly adapting to the growing significance of AI and ML:

Plug and Play leads with 281 deals, underscoring its commitment to fostering innovation and unlocking new opportunities in the software and technology sectors, with a focus on AI in venture capital.

-

Techstars, with 270 deals, continues to support early-stage start-ups, driving advancements in AI and contributing to the growing ecosystem of VC investment in AI.

-

Y Combinator’s 264 deals reveal its emphasis on developing new AI technologies.

-

Alumni Ventures has made 89 deals since 2022, and its AI fund focuses on leveraging AI and ML applications.

-

Google for Startups – Google’s start-up programme – has inked 76 deals since 2022, demonstrating its dedication to integrating AI into its ecosystem and beyond.

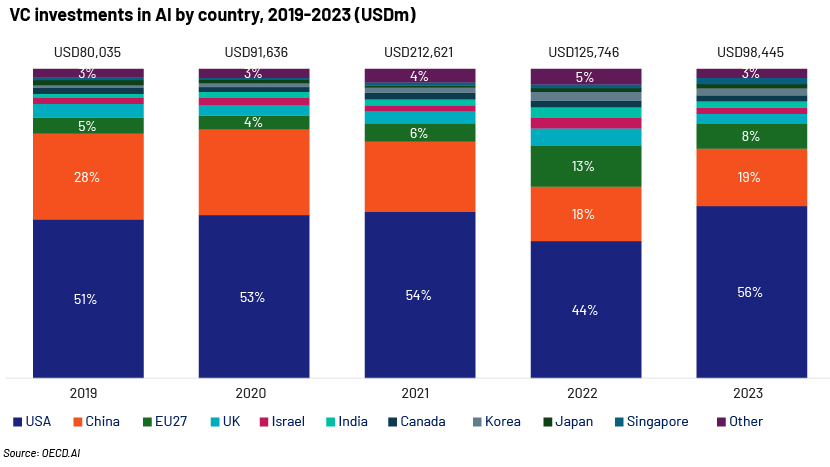

VC investments in AI by country, 2019-2023

AI has revolutionised various industries, economies and societies globally. However, VC investments in this technology vary significantly across countries, reflecting diverse strategies and priorities for AI research, development and implementation.

Overview of VC activity in key countries

1. The US: Private investments in AI have driven significant advancements in key sectors such as autonomous vehicles, healthcare and IT infrastructure. VC investments in AI have surpassed USD300bn over the last five years, with forecasts of 0.5-1.5% AI-driven annual GDP growth in the next decade. Furthermore:

-

The country saw a sharp decline in VC funding in AI in 2022, mainly driven by high interest rates, inflation and concerns about start-up valuations.

-

However, investments in AI are expected to gain momentum in the foreseeable future, and the M&A space may see heightened activities as buyers pursue lucrative deals.

2. China: The AI market is poised to almost triple to approximately USD62bn by 2025 from USD23bn in 2021. China leads globally in robotics and AI, fuelled by initiatives, such as ‘Made in China 2025’, and substantial government backing. The country dominates in industrial robots and excels in service robots for logistics, healthcare and consumers. However:

-

China is seeing a gradual decline in VC investments owing to market headwinds including lack of investment opportunities for VC firms and high interest rates.

3. Europe: The European governments are playing a crucial role, providing finances to supplement vc investment in ai. Initiatives such as European Investment Fund, European Angels Fund, and European Innovation Council Fund support breakthrough innovations in information technology, healthcare, and energy, among other sectors. Country-wise:

-

Germany: The country, which is emerging as an AI innovation hub, has attracted investments from major US technology giants. For example, Microsoft has committed USD3.2bn to German AI infrastructure. Germany also allocates EUR500m (USD536m) for AI research, emphasising on supercomputing infrastructure, skill development, women-led research groups and new professorships.

-

The UK: The region leads Europe and ranks third globally in developing AI and ML technologies, with significant ai in venture capital investments focusing on all countries and sectors. In 2012-2022, UK-based VC firms invested USD33bn in AI and ML start-ups through 4,355 deals.

4. Israel: The combination of a talented workforce, entrepreneurs’ willingness to tackle challenges and a thriving early-stage investment ecosystem is driving optimism around VC investments in AI technologies in the country. The Middle East is witnessing increased interest in AI investments (93% executives interested in investing more in 2024, per Pitchbook article in May 2024), as well as strong government aid and corporate involvement. AI21 Labs – a VC-funded large language model developer – secured USD208m in a Series C funding round in November 2023.

5. India: The AI industry is expected to grow at a CAGR of 25-35% in 2024-2027 to USD17bn. India’s burgeoning AI talent pool, increased investments and rising enterprise technology spending are expected to drive this transformation. AI, catering to 881m internet users seeking personalised experiences, is reshaping marketing strategies in India.

Conclusion

The growth in VC investments in AI start-ups mirrors the sector’s potential and transformative impact in various industries. The future of AI looks promising, with a significant increase in strategic investments in key regions such as the US, China, Europe, Israel and India. These investments may play a key role in driving innovation, addressing regulatory challenges and shaping the global technological landscape as AI develops.

How Acuity Knowledge Partners can help

We offer services, such as market intelligence, deal sourcing and screening, to private equity (PE) and VC firms operating in dynamic markets. Our expertise in evaluating AI technologies empowers these firms to make informed investment decisions, positioning them as market leaders. Acuity, with a proven record as a domain-focused knowledge partner of global financial services firm, stands out as the best technology company for all PE and VC investment needs.

Our comprehensive data and technology services are also geared towards empowering PE and VC firms with information and insights, thus delivering a competitive edge to their business.

Sources

-

Why are VC firms investing in Artificial Intelligence (AI) companies?

-

Revolutionizing Venture Capital: The Power of AI and Relationship Intelligence

-

How VC is investing in AI in the top five global economies — and shaping the AI ecosystem

What's your view?

About the Author

Ira has over 7 years of experience in business consulting & advisory and market research. She has been with Acuity Knowledge Partners (Acuity) since 2021, supporting private equity players across multiple sectors, including financial services, business services, healthcare, retail, information technology & telecommunication. Holds expertise in delivering support to clients’ corporate strategy and marketing teams and assisting them in investment opportunity assessment through in-depth secondary research & data analysis. Ira holds a Master’s in Business Administration from NIRMA University, Ahmedabad.

Like the way we think?

Next time we post something new, we'll send it to your inbox