Published on September 13, 2023 by Pankaj Bukalsaria and Oliva Rath

Investment banks and advisory firms have been pragmatically exploring ways to improve operational efficiency as they assess the drag from rising regulatory pressure and extended periods for deal losure on direct and indirect costs. Any amount of cost escalation would need to be checked at an early stage to prevent a large impact as investment banks walk a fine line amid dynamic conditions.

-

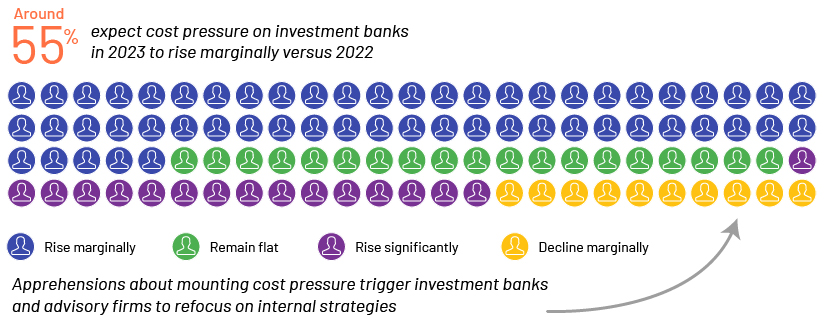

While most respondents expect cost spikes in 2023 and believe that focus on cost control is paramount, managing costs cannot be a one-off, short-term action; it requires deliberate strategy.

-

From past experience with downturns, firms have learnt to build resilience that comes from improving capital and liquidity positions as well as through exiting non-core activities and markets.

-

About 24% expect cost pressure to remain flat versus 2022. 15% expect a notable rise in 2023, and only 5% believe a marginal decline in cost pressure would provide some respite.

Investment banks and advisory firms have been agile and decisive in realigning cost structures and making transformations that can alleviate the mounting pressure on the margins

Refocusing on core businesses has been the key

Early this year, Goldman Sachs disclosed that it had accumulated USD3bn in losses in its consumer banking franchise since 2020, and signalled a partial retreat from this business.

Digital transformation infuse strength into investment banks

Building in-house collaboration platforms, entering into digital partnerships with vendors having relevant technology, and leveraging artificial intelligence (AI) platforms for better client experience are some of the key trends in the investment banking sector as firms try to strike the right balance cost optimization and improved efficiencies

There has been an uptick in consolidation activity in the investment banking and advisory space in 2023 to improve efficiencies

Firms have been looking for scale-driven efficiencies, focused on lowering operating expenses and strengthening their competitive positioning. In 2023, several financial services companies announced major acquisitions. Few notable ones are: » Mediobanca acquired TMT specialist boutique Arma Partners to become a more competitive player in the technology sector » Anglo-South African international bank and wealth manager Investec acquired UK investment research & data provider Capitalmind to enhance its footprints in major developed markets of Europe and North America

Market challenges and uncertainties have often inspired innovation and encouraged companies to take bold actions. Download the full survey report now

Tags:

What's your view?

About the Authors

Pankaj has over fifteen years of experience in investment banking. He oversees multiple client engagements on front office research and analytics support across Corporate Finance / M&A, Capital markets including Islamic products, and Restructuring & Debt advisory. He has significant experience in working on Oil & Gas, Metals & Mining, Fintech and FIG sectors. A significant aspect of his work involves white boarding client requirements, proposing solutions and onboarding and managing client relationships across the globe, with focus on the Middle East, Africa and Asia. Prior to Acuity, he worked with UBS IB offshore team in India, where he led the set up and transition of Global Energy team..Show More

Oliva joined Acuity Knowledge Partners’ investment banking team in 2020. Well-rounded professional with 12+ years of experience in Investment Banking and Financial Services firms.

She has supported investment bankers on various pitches involving company/industry research, preparation of strategic research reports, pitchbooks, pre-IPO reports and investor PDIEs, competitive landscaping, market sizing & segmentation, case studies, macro-economic studies, and in-depth industry insights.

Extensive exposure in cross-industries primarily including FinTech, Insurance, Asset Management, Oil & Gas, Real Estate, Industrials, and Utilities. She has hands-on experience with prominent databases like Dealogic, Capital IQ, Factiva, FactSet, Pitchbook, and Crunchbase, along with other key industry associations.

Like the way we think?

Next time we post something new, we'll send it to your inbox